How does BTC dominance work?

with ArbitrageScanner!

INTRODUCTION

You might have heard about "Bitcoin dominance" in some forums or Telegram channels. However, the question of what it actually is remains open.

Often, in market analysis, many analytical publications refer to this indicator to justify a particular action. In this article, we will explain how this indicator can be used and, of course, discuss how it is calculated.

WHAT IS BITCOIN DOMINANCE

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the capitalization of all other assets in the cryptocurrency market. Investors and traders track this indicator to adjust their trading strategies.

The Bitcoin dominance indicator appeared back in 2017 and has been widely used due to its usefulness and informativeness.

!!! NOTE: the Bitcoin dominance indicator is not a buy signal. It allows you to expand your planning horizons from another perspective.

There are situations where Bitcoin gradually grows while most altcoins either decline or remain stagnant.

This is due to the flow of liquidity from altcoins to Bitcoin. This is the reason for the weakness of the altcoin market.

HOW BITCOIN DOMINANCE IS CALCULATED

To find this ratio, you need to compare:

- The market capitalization of BTC (numerator)

- And the market capitalization of all other assets (denominator)

For example, if Bitcoin's capitalization is $1.23T, and the entire crypto market's capitalization is $2.31T, then the dominance would be:

- $1.23T / $2.31T ~ 0.53 or 53%

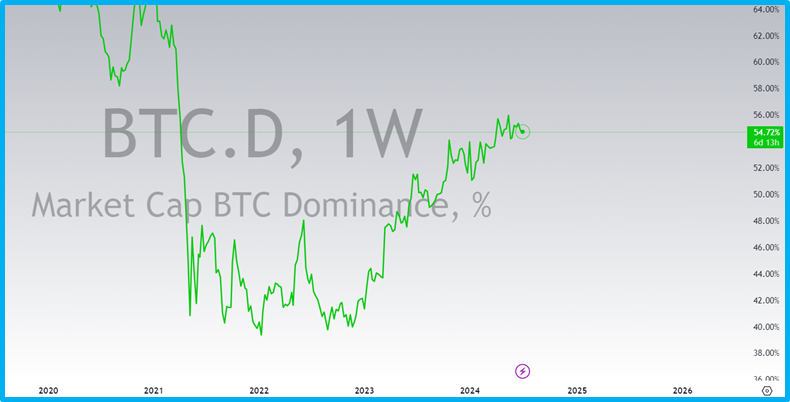

You can also refer to the ready metric on Tradingview

Fig. 1 – "Bitcoin Dominance Chart 1W"

FACTORS AFFECTING BITCOIN DOMINANCE

Several factors influence the cryptocurrency market and Bitcoin dominance, with some playing a more significant role.

Understanding the key factors can give you an advantage in making trading decisions. These include:

TREND CHANGE

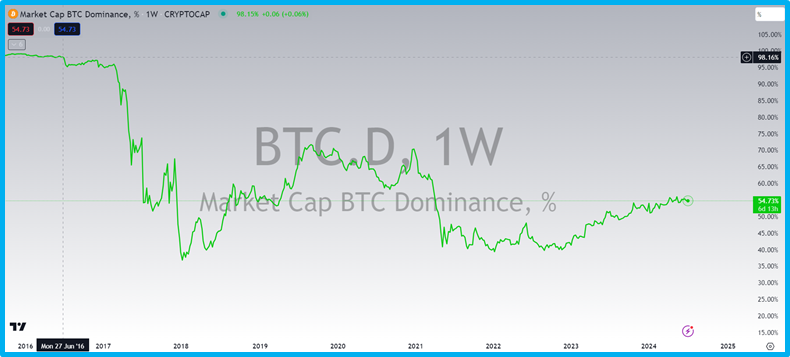

If we look again at the Bitcoin dominance chart (Fig. 2), we see how dramatically the market share of digital gold decreased.

Fig. 2 – "Bitcoin Dominance Chart since 2016"

This was due to the entry of other players into the market, such as Ethereum, which, unlike Bitcoin, could boast the deployment of smart contracts on its network, which could later create decentralized applications.

It is generally believed that when Bitcoin dominance rises:

- Market participants invest more in BTC, bypassing all other crypto assets

MARKET SENTIMENT

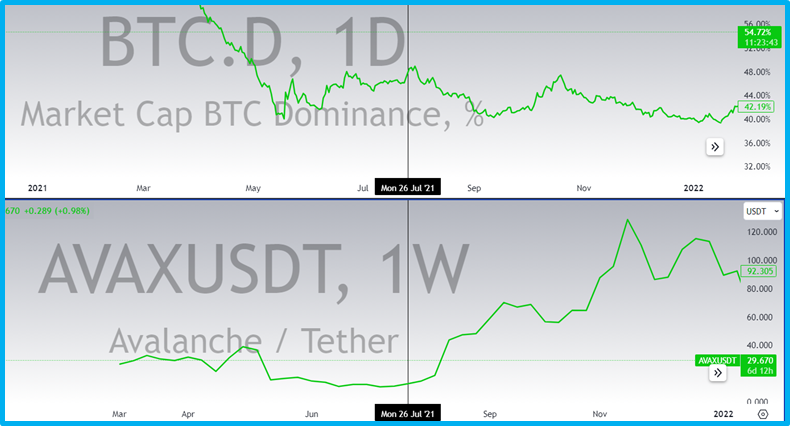

In a bull market, the popularity of altcoins reaches its peak. This happens due to the rebalancing[1] of assets from Bitcoin to altcoins. During this time, Bitcoin dominance decreases, and the altcoin market grows accordingly.

Fig. 3 – "Example of Decreasing Bitcoin Dominance and Rising Altcoin AVAX"

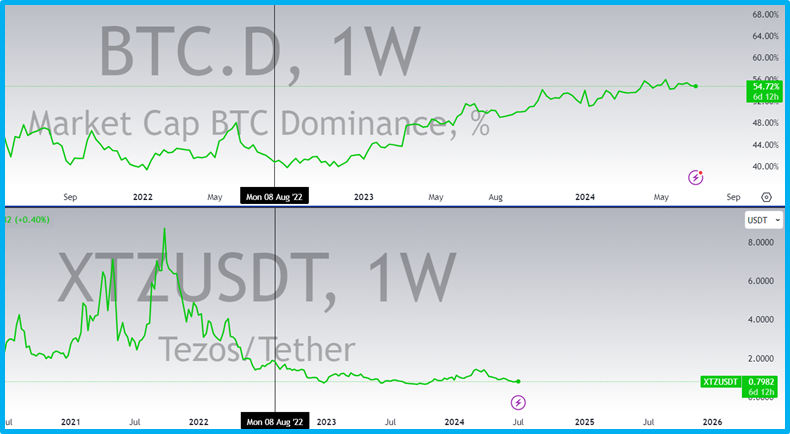

In a bear market, the opposite happens. The value of altcoins decreases along with the rise in Bitcoin dominance.

Fig. 4 – "Example of Rising Bitcoin Dominance and Decreasing Altcoin XTZ"

The behavior of traders who hold their assets in Bitcoin during a declining market is quite simple to explain. BTC is subject to less volatility, and it is better to weather uncertainty in a stable asset than in an altcoin.

IMPACT OF STABLECOINS

Stablecoins, as we know, are pegged to fiat currency.

With their appearance, they significantly reduced Bitcoin dominance. Many investors aim to diversify their portfolio, including through stablecoins.

RECOMMENDATION: do not keep all your money in stablecoins. There have been cases where many market participants lost a lot of money due to the de-pegging from the dollar.

HOW ALTCOINS REACT TO CHANGES IN DOMINANCE

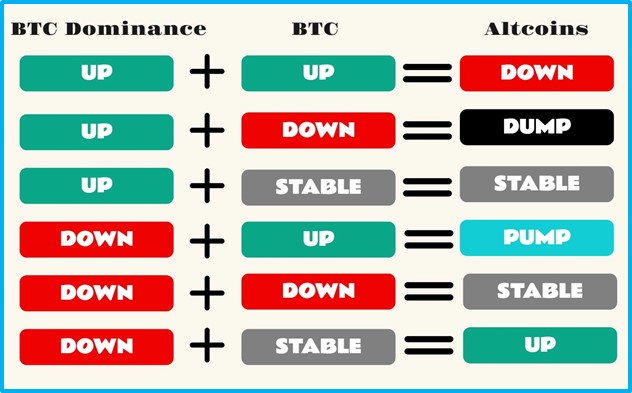

Altcoins significantly react to fluctuations in Bitcoin dominance. Analyzing the dynamics of the BTC dominance index can be used to make buying or selling decisions.

Below are the interrelations that occur in the market when Bitcoin dominance changes:

Fig. 5 – "Impact of Dominance and BTC Price on Altcoins"

Using the interrelation from Fig. 5, one can have a clear idea of how the altcoin market will react.

IMPORTANCE OF TRACKING BITCOIN DOMINANCE

The main engine of the digital financial market is undoubtedly Bitcoin. By predicting its price, you are essentially analyzing the entire cryptocurrency market.

When BTC dominance reaches its maximum, many altcoins appear undervalued compared to it.

Below are two charts of a single altcoin

Fig. 6 – "Price Charts of ARB to BTC and ARB to USDT"

- On the left, the ratio of ARB to BTC;

- On the right, the ratio of ARB to USDT.

As can be seen, Arbitrum to Bitcoin is confidently breaking through its previous lows. Meanwhile, ARB to USDT is only approaching its global liquidity block from below.

!!! NOTE: this asset is not an investment recommendation. It is an example of analysis.

Interestingly, Bitcoin dominance is currently just under 55%. And it has been growing in metrics since September 2022.

SUMMARY

Bitcoin dominance is a useful and important metric for investors or traders.

With its help, you can:

- Manage risks;

- Invest in altcoins in a timely manner.

Additionally, the BTC dominance index can help you determine the current market phase, predict the start of alt-season, and observe the reaction of altcoins to local declines in dominance.

!!! NOTE: please observe risk and money management.

________________________________________________________________________________________

[1] Rebalancing – the process of changing an investment portfolio by altering the proportions of certain assets.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.