News blog

09/03/2026

Understanding the Solana Blockchain: Architecture and Innovation

Explore the inner workings of the Solana blockchain, from its revolutionary Proof of History consensus to the SOL token ecosystem. Discover why Solana is the leading choice for scalable decentralized applications.

09/03/2026

Understanding Bid-Ask Spread and Slippage in Cryptocurrency Markets

Stop losing money to hidden trading costs! This expert guide explains how to navigate bid-ask spreads and slippage to maximize your crypto trading profits.

09/03/2026

Complete Guide to Altcoin Investment and Trading

Unlock the potential of the altcoin market. From Ethereum to hidden gems, this guide covers everything you need to know about trading, security, and building a winning crypto portfolio.

09/03/2026

Top Crypto Investment Funds: Complete Analysis of Market Leaders

Who is driving the "smart money" in the digital asset space? We analyze the top 5 crypto funds, their secretive strategies, and how they are shaping the future of blockchain finance.

09/03/2026

How to Research and Invest in ICOs: Complete Guide

Unlock the secrets of early-stage crypto investing. This comprehensive 2026 guide covers everything from technical due diligence to identifying the next 100x token before it hits the exchanges.

07/03/2026

MACD Trading Strategy: Complete Crypto Guide

Learn how to master the Moving Average Convergence Divergence (MACD) indicator to identify trend direction and momentum strength in the volatile cryptocurrency market. This guide covers essential components, signal analysis, and practical trading strategies to help you refine your entry and exit points. Gain data-driven insights to manage risk and improve your overall trading performance across various market cycles.

07/03/2026

Decentralized Applications (DApps): Complete Guide 2026

Discover how Decentralized Applications (DApps) are dismantling central authorities to build a more transparent Web3. From DeFi to SocialFi, learn everything you need to navigate the DApp ecosystem in 2026.

07/03/2026

Gemini Crypto Exchange Review 2026: Complete Analysis

Is Gemini still the safest place to trade crypto in 2026? We dive deep into its fee structure, security protocols, and professional trading tools in this expert analysis.

07/03/2026

Digital Tokens Explained: Complete Guide 2026

Master the world of digital tokens. This expert guide breaks down everything from technical smart contracts to the latest global regulations and investment strategies.

07/03/2026

Best Crypto Trading Apps 2026: Complete Guide

This comprehensive guide explores the leading crypto trading apps, providing an in-depth comparison of platforms like Binance, Coinbase, and Crypto.com. It offers essential insights into features, security, and best practices to help you choose the ideal mobile ecosystem for your investment goals.

06/03/2026

Cryptocurrency Nodes and Masternodes: Complete Guide

Discover the backbone of blockchain technology. This guide explains how nodes and masternodes secure networks and how you can earn passive income by running them.

06/03/2026

Cryptocurrency Decentralization: Complete Guide

What is decentralization in cryptocurrency? Learn about blockchain mechanics, the differences between CEX and DEX, the impact of the DeFi ecosystem, and the future of digital finance. Discover how decentralized systems are removing middlemen and creating a borderless global economy.

06/03/2026

Binance Trading Guide: Complete Platform Analysis 2026

Discover why Binance remains the top choice for crypto enthusiasts in 2026. From advanced trading bots to industry-leading liquidity, we cover everything you need to master the platform.

06/03/2026

Bitfinex Exchange Review 2026: Complete Platform Analysis

An in-depth look at Bitfinex’s liquidity, advanced API capabilities, and institutional tools. Is it still the best choice for high-volume crypto trading in 2026?

06/03/2026

Understanding Fiat and Cryptocurrency: A Complete Guide

Learn the fundamental differences between fiat money and cryptocurrency. Comprehensive analysis of traditional and digital currencies for informed financial decisions.

13/02/2026

Crypto vs Gold: Which Is Safer as Inflation Persists in 2026?

As inflation remains persistent in 2026, investors face a critical choice between traditional gold and digital assets. This article compares the safety profiles and market performance of both assets to help you build a resilient investment portfolio.

12/02/2026

Trading Bot Strategies: How to Automate Profitable Cryptocurrency Trading

Eliminate emotions and trade 24/7. Discover the most effective trading bot strategies to automate your cryptocurrency profits in any market condition.

11/02/2026

Algorithmic Trading: A Guide to Strategies and Automation Tools

Transform your trading with automation. This comprehensive guide breaks down algorithmic strategies, from HFT to retail-friendly bots, ensuring you stay ahead in the digital markets.

10/02/2026

Cryptocurrency Payment Processing: How to Accept BTC and USDT in Business 2026

Discover how modern crypto processing gateways can slash your transaction fees and open your business to 420+ million global customers. Learn to integrate Bitcoin and USDT payments with professional AML compliance and arbitrage tools.

09/02/2026

How to Profit from Cross-Exchange Cryptocurrency Arbitrage

Discover how to capitalize on price differences across crypto exchanges. This expert guide provides a step-by-step roadmap to finding profitable spreads and using automation tools safely.

28/01/2026

Uniswap (UNI): How to Use the Exchange in 2026

Uniswap crypto exchange review: how to trade, create liquidity pools, and use the DEX. A detailed guide on working with the platform's official website.

27/01/2026

The History of Bitcoin: First Appearance and Price Dynamics

Bitcoin is the primary and most popular cryptocurrency, which gained its fame not immediately, but at the moment it began to bring its investors 1,000% profit. Today, it is a rather expensive asset, with its price having already surpassed $100,000, yet the number of people wanting to buy BTC grows every day. In this article, we will delve into the history of Bitcoin: how it all began, how the main cryptocurrency was established, and what we have today.

26/01/2026

Dogecoin (DOGE): Current Price and Future Perspectives

Dogecoin (DOGE) — current price, features of the "shiba" cryptocurrency, expert predictions, and how to buy or sell DOGE.

25/01/2026

CoinEx Crypto Exchange: How to Use and Withdraw Funds

CoinEx review: cryptocurrency exchange features, registration, and official login. Learn how to withdraw money from CoinEx via P2P and manage your assets.

24/01/2026

TradingView: overview of the official website and platform features

TradingView is the official site version with live charts, online trading terminal, plan overview, and pricing for platform access.

23/01/2026

What does Donald Trump buy?

How to make money with World Liberty Financial (WLF)? Discover where Donald Trump invests, the opportunities offered by this DeFi platform, and how it strengthens the US dollar as the global reserve currency

22/01/2026

EXMO Cryptocurrency Exchange: Official Website Review and Account Login

EXMO.me (EXMO) - a comprehensive review of the cryptocurrency exchange: login, registration, and verification. Real user reviews about the EXMO exchange in 2026.

21/01/2026

What is the TRC20 Network and How to Create a TRON (TRX) Wallet for Cryptocurrency

TRC20 – A detailed overview of the TRON network, how to create a TRX wallet, and working with USDT on TRC20. Step-by-step guide for TronLink and Trust Wallet.

20/01/2026

Huobi (HTX) Crypto Exchange: Full Review and User Guide

Huobi Global (HTX) review: popular crypto exchange overview including registration, trading, fees, and mobile app. User feedback on Huobi in 2026.

19/01/2026

What is a Satoshi (SAT): Price in USD and Bitcoin Ratio

Use ArbitrageScanner on-chain analysis tools to track whales' activity and make informed decisions in the crypto market.

18/01/2026

YoBit Cryptocurrency Exchange: Official Website Login and Platform Review

YoBit.net review: login and registration on the official website. Explore trading features, no-KYC benefits, and user reviews of the YoBit exchange in 2026.

17/01/2026

What is KYC (Know Your Customer) in Crypto: A Complete Guide to Verification

KYC (Know Your Customer): what it is, how to pass verification on a crypto exchange, requirements, and the KYC check procedure. A detailed explanation in simple terms.

16/01/2026

What is Litecoin (LTC): Cryptocurrency and Network Features

A detailed review of Litecoin (LTC), blockchain features, differences from Bitcoin, price forecasts, and the coin's development prospects.

15/01/2026

What is Polkadot (DOT): Overview of the Polkadot Cryptocurrency and its Future Prospects

Use ArbitrageScanner's on-chain analysis tools to track whales' activity and make informed investment decisions in the Polkadot ecosystem.

14/01/2026

How to Create a Crypto Wallet: A Comprehensive Guide to Setting Up Your Cryptocurrency Storage

How to create a crypto wallet: a step-by-step guide to registration and setup. Learn how to choose a reliable cryptocurrency wallet and understand key usage features.

13/01/2026

Full Review of the Cifra Markets Platform: A Worthy P2P Alternative?

Traditional P2P exchange is becoming increasingly risky due to card blocks and a lack of legal protection. This article examines Cifra Markets—the first legal crypto broker in the CIS, offering secure cryptocurrency buying and selling in full compliance with the law.

13/01/2026

Crypto Market Capitalization: What It Means and How It Affects the Crypto Market

What is cryptocurrency market capitalization in simple terms? Top rankings by cap, charts, and ratings of Bitcoin and altcoins for today.

12/01/2026

Cryptocurrency for Dummies: How to Start and Earn from Scratch

Cryptocurrency for beginners: learning the basics, a step-by-step guide on how to start and make money with crypto using simple steps.

11/01/2026

What are Stablecoins: A Comprehensive Overview and List of Popular Coins

Stablecoins explained in simple terms. Learn about the types, examples, and features of the most popular stablecoins in the cryptocurrency market.

10/01/2026

Crypto Miners: A Simple Explanation of the Bitcoin and Altcoin Mining Process

What is cryptocurrency mining and how does it work in simple terms. Learn about the Bitcoin mining process, working principles, and mining hardware.

09/01/2026

SUI Cryptocurrency: Complete Review of the Blockchain Project and its Token

SUI (Sui) - what it is, a review of the blockchain project, and its features. How to create a SUI Wallet, where to buy the coin, and the token price prediction.

08/01/2026

APR vs APY in Crypto: What is it? – How it works in Staking – Difference and Yield Calculation

APR and APY are key yield metrics in cryptocurrency. We explain in simple terms what APR and APY are, how to calculate them, and the difference. Where it applies in staking, DeFi, and exchanges.

07/01/2026

AML Bitcoin Wallet Check: What It Is and How to Verify BTC Purity

Online AML verification for Bitcoin and crypto wallets. Learn how to identify dirty Bitcoins and check your BTC wallet purity using AMLbot and Crystal.

06/01/2026

P2P Arbitrage Without Cards: The Ultimate Guide

P2P arbitrage without bank cards is a way to profit from crypto price differences without being tied to bank accounts. Discover working methods (E-wallets, cash), risk management, and where to find the best spreads.

05/01/2026

What is a Crypto Airdrop: A Complete Beginner's Guide

Airdrop is a free distribution of tokens and cryptocurrency. A detailed explanation of what crypto drops are, how to receive them, and how to make money on airdrops.

04/01/2026

Futures Trading: What They Are and How to Profit from Them

A simple guide on how futures work, the main differences between spot and futures markets, and effective trading strategies for beginners.

03/01/2026

What is Solana (SOL): Project Overview and Future Prospects

Solana (SOL) is a fast and scalable cryptocurrency. Check the current SOL price, learn how to buy and where to store Solana, explore the blockchain, and get forecasts.

02/01/2026

Derivatives — What Are They and How to Profit from Them?

We break down what derivatives are, how they work, how they differ from spot trading, and how to trade them. An overview of Long and Short strategies.

01/01/2026

Crypto Fear and Greed Index: How to Understand and Use It

The Fear & Greed Index is a key indicator of crypto market sentiment. We explain how it works, where to find it, and how to apply it to Bitcoin and altcoin trading.

31/12/2025

Non-Custodial Wallet: Complete Control Over Your Cryptocurrency

A non-custodial wallet is a crypto wallet where only you control the private keys. We explain how it works, how it differs from custodial options, and how to choose the best one for your needs.

30/12/2025

Crypto Whales: How to Track the Big Players?

Whales are major crypto market players who influence prices. Learn who crypto whales are, how they manipulate the market, and which services help track their wallets and transactions.

29/12/2025

Crypto Earn: How to Generate Passive Income?

Earn (crypto earnings) is a way to get passive income through staking, deposits, and other products. We explain how Binance Earn, Simple Earn, and alternatives work, their risks, and how to choose the best option.

28/12/2025

FOMO — What is it and how to avoid the Fear of Missing Out syndrome?

FOMO (Fear Of Missing Out) is the fear of losing profit that affects traders and investors. We analyze how the FOMO effect works in trading and crypto, why it's dangerous, and how to avoid it.

27/12/2025

Crypto Technical Analysis: Where to Start?

Technical Analysis (TA) of cryptocurrencies is about forecasting prices via charts. Learn to read candlestick patterns, use indicators (RSI, MACD), and build support/resistance levels.

26/12/2025

What is an NFT in Simple Terms - How It Works and How to Profit - NFT Platforms Overview

NFTs are unique digital assets on the blockchain. We explain how NFTs work, where to sell them, and how to make money. Overview of NFT marketplaces and cryptocurrencies.

25/12/2025

Futures Arbitrage: How to Profit from Price Differences?

Futures arbitrage is a way to earn from price differences between spot and futures markets. We explore strategies (calendar, inter-exchange), risks, and tools for cryptocurrency arbitrage analysis.

24/12/2025

What is P2P Trading – Peer-to-Peer Exchange and Transfers – 2025 Overview

Learn what P2P trading, crypto exchange, and payments are. We explain in simple terms how P2P networks, exchanges, and trading work.

23/12/2025

On-Chain Analysis of Cryptocurrencies: A Complete Guide

On-chain analysis is the study of blockchain data to predict price movements. We explain which metrics to use (NVT, SOPR, address activity) and where to find data for Bitcoin and altcoin analysis.

22/12/2025

Crypto Leverage: How to Increase Profits and Not Lose Your Deposit

Crypto leverage (leverage trading) involves trading with borrowed funds. We explain what 10x, 20x, 50x leverage means, how to calculate risks, and how to trade with leverage on Binance, Bybit, and other exchanges.

21/12/2025

Crypto whale wallets: where are the millions stored?

Crypto whales store their assets in specialized wallets. Learn which wallets major players use, how to find them, and how to analyze transactions to predict market trends.

20/12/2025

Triangular Arbitrage: How to Profit from Price Differences?

Triangular arbitrage is a strategy for earning from price discrepancies between three assets. We explain the core principles, calculation formulas, and the best tools for finding opportunities in the crypto market.

19/12/2025

Who are holders (HODL) in cryptocurrency?

A holder (HODL) is a long-term cryptocurrency investor who does not sell assets despite volatility. Learn who holders are, how the HODL strategy works, and which coins are best held for years.

18/12/2025

Funding Rate in Trading: How to Earn on Positive and Negative Funding

Funding Rate consists of periodic payments between buyers and sellers of perpetual futures. We explain how funding works, why it can be negative, and how to profit from it.

17/12/2025

Cryptocurrency arbitrage in 2025: What is it, How it works, and How to Profit?

The article discusses cryptocurrency arbitrage, a method that is once again gaining popularity among traders. Despite the fact that arbitrage is not a new approach, there is not enough information about it online. With the increasing variability of arbitrage strategies and the growing number of market participants, it is important to understand how the process works. The Arbitragescanner service team shares useful information for those who want to understand cryptocurrency arbitrage and find answers to their questions.

11/12/2025

BTCC Exchange Review 2025: A Full Guide For All Crypto Traders

BTCC is one of the longest-serving crypto exchanges, offering a secure trading environment for Bitcoin and other altcoins. This review provides a close look at the platform, covering its pros and cons, features, fees, and security to give you a clear understanding of its offerings.

05/12/2025

Staking USDT and USDC — How to Earn Passive Income on Stablecoins

Staking USDT and USDC allows you to earn up to 15% APY without volatility risk. Review of the best stablecoin staking platforms (Binance, Bybit, DeFi) and yield comparison.

03/12/2025

How Does a Cryptocurrency Arbitrage Service Work?

How does a crypto arbitrage service work? In this article, we analyze: main types of arbitrage, modern service architecture, key automation functions, and the importance of interface, analytics, and mobile access for effective trading.

01/12/2025

Divergence in Trading: How to Find and Trade It Correctly

Divergence is a discrepancy between price and indicator signaling a trend reversal. We explain how to identify bullish, bearish, and hidden divergence, and how to use them in crypto and forex trading

20/11/2025

Ranking the Best Cross-Chain Bridges in 2026

Choosing the right crypto bridge is crucial for maximizing profitability. This article examines the key criteria for selecting a bridge, reviews the safest and most cost-efficient options for 2026, and provides practical tips for transferring your assets securely.

17/11/2025

What is Margin? Using Leverage to Increase Profits

Discover how margin trading and leverage can amplify your profits, but also your risks. This essential guide breaks down everything you need to know to start safely.

12/11/2025

Defiway Review: The Best DeFi Solution for Arbitrage?

Defiway is a crypto payment ecosystem featuring a cross-chain bridge with fixed fees, a secure DeFi wallet, and staking. It solves a primary problem for arbitrage traders: enabling fast and inexpensive asset transfers between different networks.

05/11/2025

Algorithmic Trading: How to Trade with Rules, Not Emotions

Discover algorithmic trading, the rule-based approach to financial markets. Learn how to build strategies, launch a trading bot, and trade without emotion.

31/10/2025

Exponential Moving Average (EMA)

A complete guide to the Exponential Moving Average (EMA) indicator. Learn how to use this powerful tool to analyze market trends and improve your crypto trading strategy.

27/10/2025

What Are Crypto Bots and How Do They Work?

Explore the world of automated crypto trading. This guide explains what crypto bots are, how they work, and how you can use them to trade more efficiently.

22/10/2025

Algorithmic Trading: How to Create a Trading Bot and Not Lose Money

Build your own trading bot without the common pitfalls. This guide covers everything from strategy and backtesting to risk management for automated trading.

20/10/2025

Crypto Trading for Beginners: A Complete Guide to Trading Cryptocurrency

Dive into the world of crypto trading with our complete beginner's guide. Learn how to profit from the 24/7 market, master key strategies, and manage risks to trade confidently from day one.

16/10/2025

AI Trading: How Artificial Intelligence Trades on the Stock Market and Why It's Smarter Than a Regular Bot

Explore how artificial intelligence is revolutionizing financial markets. This guide covers everything from AI bots to the risks and benefits for investors.

01/10/2025

Crypto Earning Strategies: From Beginner to Pro in 2025

Explore proven strategies to earn with cryptocurrency in 2025. This guide covers everything from long-term investing and active trading to passive income and risk management.

25/09/2025

What Are Take-Profit and Stop-Loss Orders and How Do They Work?

Take-Profit (TP) and Stop-Loss (SL) orders are essential risk management tools that allow traders to set predetermined conditions for closing a trade. Learn how they work and why they are vital for effective risk control.

19/09/2025

What Is the Bitcoin Halving? A Complete Guide

Dive deep into the Bitcoin halving event with our comprehensive guide. Understand its impact on price, miners, and the future of the crypto market.

17/09/2025

What is TRON (TRX) and How Does It Work?

A comprehensive guide to the TRON blockchain ecosystem. Learn about its history, how it works, its real-world applications, the advantages and disadvantages of TRX, the TRON ecosystem with TRC-20 tokens and USDT, and how to buy and store this popular cryptocurrency.

10/09/2025

Crypto Processing for Business: All You Need to Know About Accepting Cryptocurrency Payments

Dive deep into the Bitcoin halving event with our comprehensive guide. Understand its impact on price, miners, and the future of the crypto market.

12/06/2025

When to Sell Bitcoin: Strategic Guide for Traders

Learn to identify optimal Bitcoin selling opportunities, understand market timing strategies, and implement effective risk management tools for cryptocurrency trading

10/06/2025

Bitcoin Lightning Network Guide

Master Bitcoin's Lightning Network - learn how this Layer 2 solution works, its benefits and challenges, and its role in Bitcoin's evolution.

08/06/2025

Understanding Cryptocurrency Liquidation and Risk Management

Master cryptocurrency liquidation concepts. Learn how leveraged trading works, understand liquidation risks, and discover strategies to protect your positions.

05/06/2025

Essential Rules for Cryptocurrency Chart Pattern Analysis

Master cryptocurrency chart pattern analysis with three essential rules. Learn to identify high-probability setups through candlestick analysis, price range evaluation, and market context.

04/06/2025

Understanding Trading Volume in Cryptocurrency Markets

Master cryptocurrency trading volume analysis. Learn how to use volume indicators, interpret market signals, and make informed trading decisions in crypto markets.

03/06/2025

Understanding and Trading Falling Knives in Cryptocurrency

Master the art of trading falling cryptocurrencies safely. Learn to identify opportunities, understand risks, and implement effective strategies for buying market dips

03/06/2025

Understanding Fibonacci Trading in Cryptocurrency

Master Fibonacci trading in cryptocurrency markets. Learn how to effectively use retracement levels, identify key price points, and implement profitable trading strategies.

02/06/2025

Shorting Cryptocurrency: A Complete Trading Guide

Master cryptocurrency shorting with our comprehensive guide. Learn strategies, tools, and risk management for profitable short trading in volatile markets.

01/06/2025

Understanding Profit-Taking in Cryptocurrency Trading

Learn effective cryptocurrency profit-taking strategies. Understand when and how to secure gains, manage risk, and build sustainable trading practices in volatile markets.

31/05/2025

Understanding Limit Orders in Cryptocurrency Trading

Master limit orders in cryptocurrency trading. Learn how they work, when to use them, and how to implement effective trading strategies using limit orders.

29/05/2025

Understanding and Overcoming FOMO in Cryptocurrency

Master your emotions and overcome the Fear of Missing Out (FOMO) in crypto trading. Learn proven strategies for making rational investment decisions in volatile markets.

28/04/2025

Most Viral Crypto Memes of 2025: Year in Review

Explore the funniest crypto moments of 2025 through viral memes. From Bitcoin ETF approval to halving disappointments - complete collection of year's best crypto humor.

21/04/2025

Jupiter (JUP) Price Prediction 2024-2030: Complete Analysis

Comprehensive analysis of Jupiter (JUP) cryptocurrency. Price predictions, technical analysis, market potential and investment opportunities for 2024-2030.

19/04/2025

RSI Trading Strategy Guide: Crypto Technical Analysis

Master the Relative Strength Index (RSI) indicator for cryptocurrency trading. Learn how to use RSI signals, strategies, and best practices for better trading decisions.

07/04/2025

Crypto Coins vs Tokens: Complete Comparison Guide

Learn the key differences between cryptocurrency coins and tokens. Comprehensive guide to types, use cases, and trading opportunities.

05/04/2025

Understanding Crypto Support and Resistance Level

Learn how to identify and use support and resistance levels in cryptocurrency trading. Master technical analysis techniques for better trading decisions.

01/04/2025

Crypto Pump and Dump Schemes: Complete Protection Guide

Learn how to identify and avoid cryptocurrency pump and dump schemes. Expert guide to protecting your investments from market manipulation tactics.

26/03/2025

Crypto Bull Market Guide: How to Spot and Trade the Bulls

Learn how to identify and capitalize on cryptocurrency bull markets. Expert strategies for trading during market uptrends and maximizing profits.

24/03/2025

Bid and Ask in Crypto Trading: Complete Guide

Master the concepts of bid and ask prices in crypto trading. Learn how spreads work, their impact on trading decisions, and strategies for better execution.

22/03/2025

Cryptocurrency Trading Pairs: Complete Guide 2025

Master cryptocurrency trading pairs with our comprehensive guide. Learn about base and quote currencies, pair selection strategies, and effective trading approaches.

21/03/2025

Multiple Time Frame Analysis in Cryptocurrency Trading

Master multiple time frame analysis in cryptocurrency trading. Learn how to combine different time frames for better trading decisions, with detailed examples and practical strategies.

21/03/2025

Cryptocurrency Private Keys: Security Guide

Master the essentials of cryptocurrency private keys. Learn about security, storage, and best practices for protecting your digital assets

21/03/2025

The Complete Guide to Cryptocurrency FUD: Analysis and Strategy

Master the impact of Fear, Uncertainty, and Doubt (FUD) in crypto markets. Learn to identify FUD, analyze its effects, and develop strategies to protect your investments.

21/03/2025

Effective Application of Stochastics and Stochastic index RSI in Crypto Trading

Master Stochastic and Stoch RSI indicators for cryptocurrency trading. Learn implementation strategies, differences between indicators, and practical trading applications with real examples.

20/03/2025

Crypto Candle Analysis: Complete Trading Guide

Master cryptocurrency candlestick analysis to predict price movements with confidence. Learn essential patterns and strategies for effective crypto chart reading and profitable trading decisions.

20/03/2025

Understanding Crypto Alt Season: Complete Trading Guide 2025

Master cryptocurrency alt season dynamics with our comprehensive guide. Learn about market indicators, historical patterns, and effective trading strategies for altcoin cycles.

20/03/2025

Application and Sentiment Analysis in Cryptocurrency Trading

Master cryptocurrency sentiment analysis with our comprehensive guide. Learn manual tracking techniques, automated tools, and effective trading strategies based on market sentiment.

20/03/2025

Coinbase Advanced Trade Review: Complete Platform Analysis 2025

Comprehensive review of Coinbase Advanced Trade platform, examining trading features, fees, security measures, and automated trading capabilities. Essential guide for crypto traders.

20/03/2025

Best P2P Crypto Exchanges 2025: Complete Platform Comparison

In-depth comparison of leading peer-to-peer crypto exchanges. Explore features, security measures, and trading options on Binance P2P, KuCoin, Bybit, and other major platforms.

20/03/2025

Complete Guide to Stop Orders in Cryptocurrency Trading 2025

Master cryptocurrency stop orders with our comprehensive guide. Learn about stop-loss, stop-limit, and trailing stops. Essential risk management strategies for crypto trading.

19/03/2025

Most Influential Cryptocurrency Quotes of All Time

Explore the most memorable cryptocurrency quotes from industry pioneers, tech visionaries, and market leaders. From Satoshi Nakamoto to modern influencers - wisdom that shaped the crypto world.

16/03/2025

Essential Technical Indicators for Crypto Day Trading: 2025 Guide

Master the most effective technical indicators for cryptocurrency day trading. Learn how to combine Moving Averages, RSI, MACD, VWAP, Bollinger Bands, and more for optimal trading results.

16/03/2025

Crypto Arbitrage Trading: Complete Strategy Guide

Explore cryptocurrency arbitrage trading strategies, opportunities, and limitations. Learn how to profit from price differences across crypto exchanges.

15/03/2025

Trading cryptocurrencies on spot and futures: a complete guide and comparison

Comprehensive comparison of spot and futures crypto trading. Learn about leverage, risks, benefits, and advanced trading strategies for both trading types.

15/03/2025

Poloniex Exchange in 2025: A Complete Review and Analysis

Detailed review of Poloniex cryptocurrency exchange in 2025. Analysis of trading features, fees, security measures, and automated trading options. Find out if it's the right choice for you.

14/03/2025

Blockchain Consensus Mechanisms: Complete Guide 2025

Comprehensive guide to blockchain consensus mechanisms. Compare Proof of Work, Proof of Stake, and other protocols to understand how blockchain networks achieve agreement.

13/03/2025

Hash Ribbons Indicator: Complete Bitcoin Trading Guide

Learn how to use the Hash Ribbons indicator for Bitcoin trading. Complete guide to understanding mining capitulation signals and market entry points.

12/03/2025

Fear vs Greed Index in Crypto Trading

Master the Crypto Fear and Greed Index for better trading decisions. Learn how market sentiment analysis can improve your cryptocurrency trading strategy.

08/03/2025

Bitcoin and Institutional Investors 2025: Market Analysis

Explore how institutional investors are shaping the cryptocurrency market. Analysis of current trends, major players, and future prospects in institutional crypto adoption.

04/03/2025

Best Volatility Indicators for Crypto Trading: Complete Guide

Master cryptocurrency volatility with essential technical indicators. Learn how to measure and predict market movements for better trading decisions.

02/03/2025

Best Cryptocurrency Books 2025: Ultimate Reading Guide

Discover the most comprehensive cryptocurrency books for all levels. Expert-selected guides covering Bitcoin basics, blockchain technology, and trading strategies.

26/02/2025

Best Algorithmic Trading Books 2025: Expert Selection

Discover the top books on algorithmic trading for all skill levels. From beginner guides to advanced machine learning strategies - comprehensive review for 2025.

24/02/2025

Crypto Market Makers: The Hidden Forces Behind Price Movement

Discover how cryptocurrency market makers influence prices and maintain market liquidity. Learn about their strategies, roles, and impact on crypto trading.

22/02/2025

KuCoin Exchange Review: Features, Fees & Trading Tools

In-depth review of KuCoin cryptocurrency exchange. Explore trading features, fee structure, security measures, and bot trading capabilities

16/02/2025

AI Crypto Trading: Complete Guide to Smart Trading Strategies

Explore how artificial intelligence is revolutionizing crypto trading. Learn about AI vs algorithmic trading, best strategies, and future trends in automated trading.

15/02/2025

100+ Crypto Slang Terms You Need to Know: Complete Guide

Master 100+ crucial cryptocurrency terms and slang expressions. From trading basics to DeFi jargon - comprehensive guide for both beginners and pros.

14/02/2025

Bitcoin's Black Swan: Market Impact and Recovery

Analyze Bitcoin's unprecedented reaction to COVID-19, from the 64% price crash to full recovery. Discover key market insights and future implications for crypto investors.

07/02/2025

A Comprehensive Guide to Choosing a Cryptocurrency Exchange

Discover how to choose the perfect cryptocurrency exchange. Compare fees, security features, trading pairs, and user experience. Expert tips for both beginners and pros.

01/02/2025

What is a scam in cryptocurrency and how to avoid becoming a victim of fraud in 2025

Detailed guide on how to check smart contracts and tokens for scams. Fake wallets, exchanges, and exchangers. Cloud mining, bots, pump and dump schemes. Tools for checking and signs of fraudulent tokens.

21/01/2025

Top memcoins for 2025

Memecoins have taken center stage in the latest crypto bull run, with public interest reaching unprecedented levels. New tokens and trading platforms have fueled the frenzy, while key market forces shape the trend. Although Ethereum and Solana dominate the spotlight with their ongoing rivalry, other major players have also emerged as significant contributors in recent months

28/12/2024

What AI agents are in cryptocurrency

Discover the best AI-powered crypto trading bots of 2025. Learn how artificial intelligence and blockchain technologies are transforming crypto trading, from automating transactions to building a stable token economy. A detailed guide on benefits, risks, and top solutions awaits you!

27/11/2024

Which meme coins does Murad invest in?

Learn everything about Murad Mahmudov — a crypto enthusiast who earned millions from meme coins. Discover the details of ZachXBT's exposé, hidden wallets, and how AI helps track his financial activity. We also explore why meme coins have outpaced traditional venture capital in the current bull market.

20/11/2024

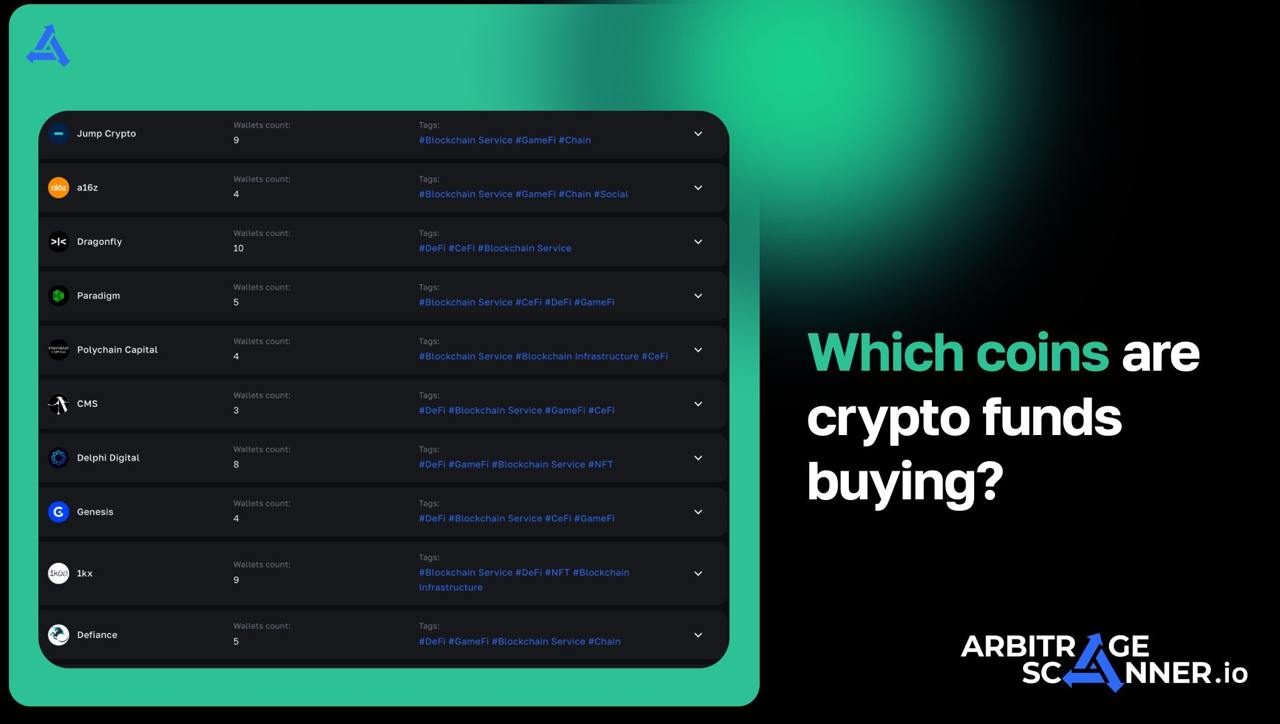

Which coins are crypto funds buying?

Discover which tokens venture capital firms are actively investing in this week. A detailed analysis of PEPE, OM, and POL investments, their market significance, growth rates, and holding volumes. Explore key crypto assets and the impact of VCs on the blockchain industry

15/11/2024

What is the Spread in cryptocurrency arbitrage and how to calculate it?

In this article, we will explain what the spread is and its importance in cryptocurrency trading. We will look at the origin of the term, which came from traditional markets, and explain why understanding the spread is essential for successful trading and arbitrage. You will understand how knowledge of these concepts can help crypto market participants avoid losses and effectively utilize the experience of traditional trading.

13/11/2024

Cryptocurrency screener: what is it and how to use it?

In this article, we discuss the youth of the cryptocurrency market and the unique opportunities it offers compared to traditional assets. We take a detailed look at cryptocurrency arbitrage strategy based on buying and reselling coins with the difference in price. You will learn how automated cryptocurrency screeners simplify the process of finding spreads and what advantages they offer traders.

12/11/2024

Why cryptocurrency memcoins are on the rise

Find out how NEIRO, KLAUS and Shiba Inu tokens are booming thanks to the activity of large investors. Learn about successful smart money strategies, their impact on the market and key examples of profitable investments. Follow the latest trends in the cryptocurrency market and learn how to capitalize on the movement of major players.

11/11/2024

Statistical Arbitrage in Cryptocurrencies: Detailed Guide

This article is dedicated to statistical arbitrage in cryptocurrency markets, which attracts attention due to its volatility. We explain in detail how this method allows you to exploit price imbalances on different platforms and instruments based on mathematical and algorithmic approaches. Learn about traders' working strategies and useful tools that simplify the arbitrage process in the world of cryptocurrencies.

09/11/2024

Cryptocurrency arbitrage in 2025 - Relevance, Prospects and Risks

In this article, we will look at cryptocurrency arbitrage, its true nature and perception in society. We will explain in detail why this process is often misinterpreted by bloggers advertising easy earnings. Arbitrage requires significant effort and time, but it can generate a stable income. Learn about its relevance in 2025, promising opportunities and associated risks.

07/11/2024

What is DEX Arbitrage?

This article examines the evolution of anonymity in the world of cryptocurrencies, starting with their initial vision as an alternative to traditional banking systems. The changes brought about by the attention of government regulators who require user verification on centralized exchanges, which undermines anonymity, are discussed. Vitalik Buterin's concept of decentralized cryptocurrency exchanges (DEX) and their role in today's crypto market is also presented. Readers will learn how DEXs can become a solution for those who value privacy and are interested in cryptocurrency arbitrage.

06/11/2024

How a trader made millions on memcoin

Ethereum traders are making big profits thanks to NEIRO and DOGE. A breakdown of their trades and the growth of the NEIRO token after listing on Binance. Find out what's behind their success and how the market is growing

03/11/2024

Why do stablecoins lose their peg and how can you profit from it?

Stablecoins are stable coins in the world of cryptocurrencies that simplify exchanges and transactions while maintaining the benefits of cryptocurrencies, such as anonymity and low fees. However, in 2024, questions about decentralization arise as issuers such as Tether can block assets at the request of authorities. This article discusses the risks of holding savings in stablecoins, their linkage to underlying assets and why they may lose stability.

01/11/2024

What is crypto scalping and how to profit from it?

The crypto market is actively borrowing trading techniques and strategies from more mature markets such as equities and forex. Scalping, which is popular in the forex market, allows traders to capitalize on small price fluctuations. Unlike forex, where high leverage is often used, in the cryptocurrency market, the volatility of assets allows scalping to be applied on the spot market, which reduces risk. In this article, we will examine the essence of scalping, its advantages and disadvantages, and learn how profitable this approach can be for traders.

31/10/2024

What are stablecoins?

This article discusses stablecoins, digital assets that provide price stability by linking to trusted assets such as fiat currencies or precious metals. It discusses the advantages of stablecoins, including their decentralized nature and high speed of payments, as well as the disadvantages of traditional cryptocurrencies, such as high volatility. Learn how stablecoins can solve the problems associated with everyday payments in a volatile market.

30/10/2024

How to make money from AI in cryptocurrency

Discover promising investment opportunities in cryptocurrencies and AI in 2024! Learn how projects like VIRTUAL, GOAT, and other tokenized AI agents are transforming the crypto market, driving up valuations, and creating new monetization opportunities. Explore how artificial intelligence and blockchain projects on the TAO and Base networks are fueling explosive growth in meme coins, gaming NPCs, tokens, and DePin. Forecasts, insights, and tips for crypto investors — everything you need to know to profit from this emerging trend.

28/10/2024

Cryptocurrencies and stocks: what is the difference?

In this article, we will look at the cryptocurrency market capitalization, which already exceeds $2.3 trillion, and analyze the reasons why digital assets attract new investors. We will discuss the advantages of cryptocurrencies such as low entry threshold, high profit potential and anonymity. We will also compare cryptocurrencies with traditional markets, especially the stock market, and review the pros and cons of each asset, which will help you better understand the peculiarities of investing in digital assets.

25/10/2024

What is staking in cryptocurrency?

Cryptocurrency staking is the process of locking coins into a wallet to support the operation of a blockchain network. This article discusses the main aspects of staking, including its role in securing the network and different variants such as staking pools and cold staking. It also discusses the factors affecting the percentage of rewards and how new initiatives are seeking to attract retail investors with small amounts of coins.

22/10/2024

How to find insiders on Binance

The article examines suspicious trading activities on wallets potentially linked to frontrunning on Binance. It analyzes transactions and profits to identify abnormal behavior before token listings. A list of wallets has been presented and added to monitoring for further tracking. Discover how insider information can impact the market and how analyzing wallets could help you profit.

15/10/2024

The unmasking of MrBeast

Learn why you should not blindly trust investments promoted by bloggers and influencers in cryptocurrency projects. In this article, we explore examples involving MrBeast, KSI, and others, discussing the risks and the importance of conducting your own research before investing in cryptocurrencies.

15/10/2024

Who are cryptowhales and how to follow them?

In this article, we will look at the peculiarities of cryptokits, their impact on asset rates and methods of tracking their actions with the help of onchain analysis. We will also discuss tools that will help in finding and monitoring cryptokit wallets. Learn how to use this data to better understand the cryptocurrency market.

11/10/2024

Copy trading in cryptocurrency: how to earn by following others

The cryptocurrency market continues to attract more people looking to profit. One option for beginners is copy trading, which allows them to replicate the trades of successful traders. However, this method comes with its own pros and cons. Learn how copy trading works on exchanges and platforms, what risks it involves, and how to avoid common mistakes. The article also highlights the benefits of using Arbitragescanner tools for blockchain analysis and finding successful trades, significantly increasing your chances of profitable trading. Real cases and tips will help you better understand how to earn with copy trading and analytics.

08/10/2024

How to earn on memcoins

Elon Musk and Donald Trump got the scoop at a rally in Pennsylvania, causing the PAC America and DMAGA tokens to surge. Musk announced PAC America on Twitter, causing a 70,000% rise in the America PAC token. Simultaneously, Vitalik Buterin mentioned MOODENG and EBULL in his tweet, causing EBULL to soar 1,000%. Learn how key figures in the crypto industry are influencing the market and how traders are capitalizing on it by reacting to social activity and real-time events

08/10/2024

What is the pre-market in the crypto market?

Pre-market in cryptocurrencies is the period when a token can be traded before its official listing. This allows early investors to buy tokens at a favorable price. Learn how the pre-market helps gauge liquidity and market sentiment, as well as how to use arbitrage in the pre-market to profit. Examples of successful strategies, case analysis, and recommendations on using Arbitragescanner tools will help you make money in the crypto market.

04/10/2024

How to Profit from Cryptocurrency Volatility

Learn how to effectively use the "Anomaly Detection" tool for analyzing wallets and trading cryptocurrencies. By following the actions of a successful blogger, a user detected anomalies in their transactions, which allowed them to replicate the strategy and profit from market volatility.

03/10/2024

What are funding rates in cryptocurrency?

The crypto market, although still relatively young compared to traditional markets, already has unique features that might surprise those new to cryptocurrencies. This includes perpetual futures and funding rates (funding).

You won’t find these concepts in other markets, so in this article, we’ll dive into these two terms and how you can profit from funding.

27/09/2024

Exsploring Cross-Exchange Cryptocurrency Arbitrage

Explore the world of cryptocurrency arbitrage, a strategy that allows traders to profit from price differences in the same coin on different exchanges. In this article, we will look at how to effectively apply arbitrage strategies in a volatile market and what tools will help in optimizing this process, including working with small capitalization assets.

25/09/2024

Who hacked the Bingx exchange

In this article, we describe how user funds were stolen in the BingX exchange hack. The amount of damage in the BingX hack is $43M

24/09/2024

The Art of Cryptocurrency Arbitrage: Strategies and Tips

In this article, we will go into detail about arbitrage principles, types and strategies, as well as tools for successful trading. You will get all the necessary knowledge and answers to your questions to confidently start your way in the world of cryptocurrency arbitrage.

20/09/2024

Unveiling statistical arbitrage: Algorithmic trading ideas and methods

Algorithmic trading and statistical arbitrage are two complementary methods for making profits in financial markets. In this article, we will look at how the right setup of expensive software can automate trades and reveal arbitrage opportunities not available to ordinary traders. Learn how a deep knowledge of market processes lays the foundation for successful trading!

Let's get into more detail.

17/09/2024

Which Cryptocurrencies Are Venture Funds Investing In?

Learn about Dragonfly Capital — one of the leading venture capital firms in the cryptocurrency and blockchain space. In this article, we explore their key investments and profits, including projects like Avalanche, Near Protocol, Aptos, Cosmos Hub, and Maker

17/09/2024

Demystifying cryptocurrency arbitrage: Understanding advanced algorithms

Cryptocurrency arbitrage is a time-tested and relevant method of making money that continues to evolve in 2024. Learn about new strategies and approaches to arbitrage that open the door to profitable digital asset transactions. Dive into the world of algorithmic trading and understand how to minimize risk and increase returns by eliminating the human factor. Get acquainted with the latest trends and prospects of arbitrage in cryptocurrencies!

13/09/2024

Top cryptocurrencies with growth potential

In this article, we discuss the top cryptocurrencies with growth potential. How to make money with cryptocurrency by investing in altcoins and how to find altcoins with growth potential is explained by the best on-chain analysis service – ArbitrageScanner.

13/09/2024

Where to look for crypto arbitrage opportunities?

The crypto market features over 2,400 million cryptocurrencies, and this number is steadily growing. Differences in supply and demand across exchanges create opportunities for arbitrage, generating profit. Learn how to leverage crypto arbitrage strategies and discover profitable opportunities. We’ll guide you on how to analyze the market and configure tools for successful arbitrage. Get tips on finding effective opportunities and avoiding common pitfalls. Use our service at Arbitragescanner.io.

11/09/2024

How to make money from venture capital investments in cryptocurrency

Pantera Capital is one of the first U.S. venture funds focused on digital assets and Web3 technologies. Learn how to profit from venture capital investments and understand the importance of on-chain analysis for tracking investment strategies.

11/09/2024

Best exchanges for crypto arbitrage in 2025

Сrypto arbitrage is a hot topic right now, but there's just not enough solid info out there. we're here to change that. we'll break down how to pick the right exchange for arbitrage, share some solid options, and dive into the strategies that are trending for 2025.

07/09/2024

How to make money from insights in cryptocurrency

Discover how to leverage insider information in the cryptocurrency market to maximize profits. Explore strategies for finding key insights through on-chain analysis, filters, and AI on platforms like ArbitrageScanner. Track the actions of wallets belonging to developers, large investors, and venture funds, and analyze their strategies for successful trading. Learn from case studies of profitable trades and tips on risk management when using insider data for long-term gains.

02/09/2024

How to make 1000x by analyzing Smart Traders wallets

In this article, we will share a case study of how a Smart Trader, with a modest capital, turned it into millions of dollars. How to make 1000x by analyzing cryptocurrency wallets is explained by the best on-chain analysis service – ArbitrageScanner.

30/08/2024

Pavel Durov Arrest What Will Happen to TON

Pavel Durov Arrest. Impact on TON and Market Reaction. Learn how the freezing of the Telegram founder's assets and the concentration of validators in France have affected the TON blockchain and who profited from this news

27/08/2024

Crypto Whales Manipulate the Market

Discover how large crypto investors, known as "whales," manipulate the market and impact cryptocurrency prices. We explore recent examples, such as the sharp rise in $FET and the actions of major token holders. Learn how to profit from tracking large transactions using analytical tools and stay ahead in the world of crypto investing.

26/08/2024

What the Market Maker is buying

In this article, we will show how to use wallet analysis to find out what the Market Maker is buying. Our product line will help recognize when significant capital is preparing for a substantial price movement in assets. The best on-chain analysis service, ArbitrageScanner, explains how to identify the wallets of influential players, analyze their actions, and profit from such movements.

19/08/2024

Play-to-earn in cryptocurrency

The Play-to-earn industry in cryptocurrency has come a long way, from trading NFTs to becoming a full-fledged way to earn money. The future growth in cryptocurrency could significantly impact GameFi. Play-to-earn (P2E) is a concept in blockchain games built on play-and-earn mechanics. Most Play-to-earn games are designed as special tools with a financial incentive for gaming and progressing within it. You can earn in Play-to-earn games in various ways: from completing daily quests, collecting in-game currency, to staking. To start playing Play-to-earn games, all you need is a crypto wallet and to choose an interesting genre. Despite market volatility, large capital shows interest in certain coins from this industry. Using on-chain tools, we've compiled a top Play-to-earn coins list for 2024 that could delight their holders in the future.

16/08/2024

How does Arthur Hayes make his money

Arthur Hayes, an influential figure in the crypto world and former CEO of BitMEX, recently purchased $ATH tokens worth $3 million USD. The purchases were made through the exchanges OKX, HTX, Bybit, and KuCoin

14/08/2024

What is Bitcoin ETF and Ethereum ETF

The article explains: what is Bitcoin ETF and Ethereum ETF.

Bitcoin ETF and Ethereum ETF are a big step in the crypto industry, aimed at bringing digital assets closer to traditional finance. Having gone through a long process of fighting with the SEC, the Spot Bitcoin ETF was launched in early 2024. In the summer of 2024, after the success of the first cryptocurrency, the Ethereum ETF was launched.

12/08/2024

How funds and market makers profited from the market downturn

How large funds and market makers profited from the sharp market decline by taking advantage of the panic and strategically buying assets at the bottom

08/08/2024

What cryptocurrencies are celebrities investing in

Find out how celebrities like MrBeast, Jay-Z, Snoop Dogg and Justin Bieber are investing in cryptocurrencies. Explore what tokens they hold in their portfolios and how they use cryptocurrencies to make money

07/08/2024

What is LAYER 2

What is Layer 2. It's a protocols operate on top of the base network layer, enhancing its speed and scalability. Layer 1 and Layer 2 blockchains are often compared. While the base layer connects nodes and constructs the architecture, Layer 2 functions on top of Layer 1, improving it. The advantages of Layer 2 include increased throughput and reduced gas fees. However, there are also disadvantages: potential vulnerabilities and decreased liquidity of the main blockchain. Layer 2 solutions have been applied to both Bitcoin and Ethereum. Each has its own features and protocols. Nonetheless, their main goal is to achieve blockchain scalability, meaning finding an approach to process more transactions while offering low fees.

01/08/2024

What is a node in cryptocurrency

What is a node in cryptocurrency

In the crypto community, this term is often encountered

A node is a network of computers connected to the blockchain

Thanks to the technical features of nodes, it is possible to store and retrieve decentralized information

There are various types of blockchain nodes: full nodes, light nodes, mining nodes, staking nodes, masternodes, lightning nodes, as well as oracles and validators

Forks often occur in cryptocurrency networks

A soft fork is compatible with the previous version

A hard fork occurs when protocol changes cannot be compatible with the previous version

30/07/2024

What is liquidity in cryptocurrency

Get acquainted with a crucial concept in cryptocurrency

High liquidity allows for minimizing losses in trading

At the same time, low liquidity values can cause high volatility, making altcoin transactions difficult

Regulation, trading volume, cryptocurrency adoption, and the number of exchanges significantly affect liquidity

The main methods for measuring liquidity are analyzing trading volume and the spread between prices.

17/07/2024

Donald Trump-related tokens | How to make money on the news

The recent 8000% increase in the $FIGHT (Fight to MAGA) coin has caused a frenzy among traders. Learn how you could have profited from this using on-chain analysis from ArbitrageScanner. How can you analyze successful traders and replicate their strategies?

12/07/2024

What is a cryptocurrency airdrop

The number of cryptocurrencies is growing rapidly, making it difficult for many to track new projects

To attract an audience and promote themselves, many startups conduct airdrops

Many people want to receive free cryptocurrency, but is it safe

You will learn what an airdrop is and how to protect your capital from fraudulent schemes

10/07/2024

What is altseason in cryptocurrency

What is altseason and how it is related to the movement of large capital are key questions many market participants ask

Historically, altseason occurs after Bitcoin's rise, then the liquidity flow triggers growth in Ethereum and other cryptocurrencies

By analyzing key metrics such as Bitcoin dominance, the altseason index, market capitalization, and the fear and greed index, you can accurately predict the beginning and end of altseason

Our article will help you understand this event well, which crypto enthusiasts have been waiting for the last few years, to make the most of this movement and adjust their trading strategy

09/07/2024

Growth of Mantra DAO token

We conducted our own investigation into the growth of the MANTRA DAO token.

An early holder made transactions with an address that transferred funds to the GSR Markets and DWF Labs wallets.

The market makers' transactions showed a large volume of controlled issuance.

Using the extensive functionality of the service, we identified a chain of wallets that was preparing for an altcoin pump, which showed a growth of over 2000%.

05/07/2024

What is staking

In this article, we will discuss staking as a method of earning cryptocurrencies, which has gained significant popularity among investors. Staking provides an opportunity to earn passive income by optimizing the returns on your holdings. We will cover what staking is, its benefits and risks, types of staking, as well as where and how to stake your assets.

03/07/2024

How does BTC dominance work?

In this article, we will take an in-depth look at the concept of Bitcoin dominance, explaining what it is and how it is calculated. This metric is crucial for understanding the dynamics of the cryptocurrency market. Additionally, we will analyze how changes in Bitcoin dominance affect altcoins, highlighting typical reactions and market shifts. Finally, we will discuss the importance of monitoring Bitcoin dominance for making well-informed investment decisions.

28/06/2024

Hot wallets: advantages and disadvantages

Hot cryptocurrency wallets are digital wallets connected to the internet, providing quick and convenient access to cryptocurrencies. This article examines the key advantages and disadvantages of hot wallets, helping you make an informed decision when choosing a wallet type.

27/06/2024

Finding the Best Cryptocurrency Exchange for Triangle Arbitrage

Discover the top cryptocurrency exchanges ideal for triangle arbitrage. Learn how to choose the best platform based on liquidity, trading pairs, fees, and speed to maximize your trading profits.

24/06/2024

The best indicators for cryptocurrency trading in 2024

After studying this article, you will learn about the best indicators for cryptocurrency trading in 2024, such as RSI, MACD, trend lines, Aroon, Fibonacci levels, and others. The article explains how these indicators help analyze the market, identify trends, and make informed decisions. Using multiple indicators simultaneously enhances the accuracy of analysis and minimizes risks. It is important to adapt the best indicators to your trading strategy.

21/06/2024

Is it possible to earn money from cryptocurrency arbitrage?

Learn the fundamentals of cryptocurrency arbitrage, a strategy to profit from price differences across exchanges. Explore essential strategies, potential returns, and risks involved in this lucrative trading practice.

19/06/2024

Custodial wallet VS non-custodial wallet: advantages and disadvantages

This article covers the main aspects of custodial and non-custodial crypto wallets. You will learn the differences between them, as well as the advantages and disadvantages of each type. Custodial wallets are convenient for beginners, offering extensive functionality and support, but they require trust in a third party. Non-custodial wallets provide a high level of security and control over private keys, but they may require technical skills. The article also describes wallet compatibility with various cryptocurrencies and provides recommendations for choosing the right wallet based on your needs and preferences.

14/06/2024

What is the Fear and Greed Index?

In this article, you will get acquainted with a very important indicator of the cryptocurrency market's state – the Fear and Greed Index. The Fear and Greed Index is a sentiment indicator that shows which emotion is currently prevailing in the market.

11/06/2024

What is a cold wallet?

A cold wallet is the best choice for securely storing cryptocurrency. There are several types of cold wallets: hardware, software, paper, thick, and thin. This article will introduce you to the detailed features of each type. By studying their pros and cons, you will understand which storage option is right for you.

07/06/2024

Beginner's Guide to Basic Technical Patterns

Technical analysis examines price charts. For investors and traders, they reveal past and current trends, helping to understand asset behavior. Key patterns in technical analysis play a crucial role in this interpretation. This article will introduce you to classic technical analysis patterns. You will learn which shapes belong to trend continuation patterns, trend reversal patterns, as well as patterns of uncertainty.

31/05/2024

What is DeFi and how does it work?

DeFi, or decentralized finance, is an innovative financial services system based on blockchain and smart contracts. This article will introduce you to the main aspects of DeFi, its application in various fields, and its advantages and disadvantages compared to traditional financial systems.

30/05/2024

Crafting an Effective Crypto Arbitrage Strategy: A Step-by-Step Guide

Digital money emerged back in the late 90s. And now they are part of the modern economy. This type of asset has resonated with a large number of investors. The most popular way to make profit is crypto arbitrage. With the help of this strategy, traders extract "interest" thanks to the difference in the price of assets on different exchanges. Below we will break down a strategy on how to trade effectively in arbitrage.

24/05/2024

Market Makers: Who They Are and How They Make Money

A market maker is a key player in the financial market, providing activity and liquidity. He is always ready to make a deal with any other participant of trade. As a rule, the activities of market makers are strictly regulated at the legislative level, although in the field of cryptocurrencies this has not yet been achieved. In this article, we will consider who market makers are, what functions they perform and what advantages they have over other market participants.

24/05/2024

Experienced investor vs Beginner. What is the difference?

You will understand the psychology of investing, we will show you a comparison between the approaches of beginners and professional investors. You will learn how emotions and lack of a plan can lead to failure, while clear analysis and a long-term perspective help professionals achieve success. Learn the key principles that distinguish experienced investors from those just starting out in the financial markets.

17/05/2024

Japanese Candlestick - How It Works, Patterns, Overview

In this article, you will learn the history and techniques of candlestick analysis. How Japanese candlesticks became the basis for technical analysis in the rice market, and how this technique spread around the world thanks to the work of Homma Munehis and Steve Neeson. You will also learn how each candlestick tells its own story of price movement, reflecting the struggle between bulls and bears. Learn how to interpret various candlestick patterns and use them to make informed trading decisions.

10/05/2024

Discovering the Best Cryptocurrency for Arbitrage Opportunities

Arbitrage operations in the cryptocurrency market are becoming increasingly popular among traders and investors. This strategy allows you to profit from the difference in prices of the same cryptocurrency on different exchanges. However, in order to successfully perform arbitrage, it is necessary to choose the right cryptocurrency for operations.

03/05/2024

The basics of risk management and money management in cryptocurrency trading

The translation of the text into English is: “Money Management is the strategies for managing funds. Risk Management is the understanding of how much money you can lose in the process of trading or investing. Today, we will look at the basics and differences between these two concepts

22/04/2024

The Ultimate Crypto Arbitrage Guide: Getting Started and Beyond

Cryptocurrency arbitrage presents an intriguing opportunity for investors worldwide. By capitalizing on price discrepancies across different exchanges and platforms, traders can generate low-risk profits. In this comprehensive guide, we’ll explore various crypto arbitrage techniques, including geographic, exchange, and triangular arbitrage. Let’s dive in!

19/04/2024

The Ultimate Crypto Arbitrage Guide: Mastering Strategies for Success

Cryptocurrency arbitrage attracts the attention of beginners and experienced traders due to the potential profits that can be made on the difference in the prices of digital assets. However, it is a tedious and time-consuming task to manually track transactions suitable for arbitrage trading. That is why useful trading tools are created. It is possible to keep track of token price changes, even in Telegram.

22/03/2024

New product - NFT Scanner!

NFT Scanner is a product that will allow you to be the first to know about the appearance of rare NFTs for a small price. By immediately finding out about the listing of an interesting item on the marketplace, you will have the opportunity to buy it right away and list it for a higher price!

02/11/2023

P2P Arbitrage opportunities on Binance

Learn how to arbitrage cryptocurrencies on Binance using P2P pairs. The article covers the features of arbitrage on one of the largest cryptocurrency exchanges in the world, examines permanent and momentary P2P pairs, and provides tips on how to find and use them for trading. Discover strategies, tools, and methods that will help you successfully conduct arbitrage operations on Binance and profit from the difference in cryptocurrency prices.

15/09/2023

Cryptocurrency Arbitrage: How to earn in 2023? Ready-made cases how to make money

In this webinar, we will be discussing what is arbitrage, what is inter-exchange arbitrage, how to arbitrage on CEX and DEX exchanges and how to profit from cryptocurrency arbitrage. Additionally, we will go over all the products of the arbitragescanner.io ecosystem, including a new tool that allows you to catch insights from chats before they reach the media and make long, short, or token purchases ahead of the crowd.

06/09/2023

A Comprehensive Guide to Stablecoin Arbitrage in 2023

Unlock the secrets of stablecoin arbitrage in 2023 with our comprehensive guide, maximizing your profits in the ever-changing crypto market.

02/09/2023

Starter Guide to Spot Futures Crypto Arbitrage

Discover the lucrative world of spot futures crypto arbitrage with our beginner's guide, harnessing the power of volatility for maximum gains!

31/08/2023

Earning through cryptocurrency P2P arbitrage in 2023

Earning through P2P cryptocurrency arbitrage in 2023: methods and profitability in the world of digital assets. How to maximize your profits?

27/08/2023

P2P Arbitrage opportunities on Binance: What They Are and How to Find Them

P2P Arbitrage opportunities on Binance provide possibilities to profit from differences in cryptocurrency prices. Learn how to find and use them for trading.

21/08/2023

New product - Telegram Scanner!

Be the first to access breaking news and deep insights in the cryptocurrency market with our Telegram Scanner. Choose between the Live version, monitoring and forwarding real-time information based on keywords, and the History version, automatically analyzing chat history and presenting matching messages in an Excel table. Request a trial period from our support. Join us on social media, and let's build the largest cryptocurrency arbitrage community together!

18/08/2023

ArbitrageScanner Speaks Five Languages!

Our support team now offers voice assistance in English, Spanish, Arabic, Persian, and Russian, ensuring a personalized experience. Explore the advantages of our service — contact our Telegram manager and join the expanding crypto community today!

15/08/2023

Arbitragescanner.io ecosystem is a platform of several crypto-tools

Unlock the potential of cryptocurrency trading with Arbitrage Scanner's cutting-edge tools! From the acclaimed Arbitrage Scanner to the user-friendly Cryptocurrency Arbitrage Screener and the exclusive ArbitrageScanner Message service, our products empower traders worldwide. Stay ahead with real-time news and reviews, join our private community, and gain exclusive access to our offline meet-ups.

14/08/2023

Turn Market Downturns into Opportunities: Cryptocurrency Arbitrage to Offset Token Price Decreases

Hesitant to sell your token at a loss? Explore the power of cryptocurrency arbitrage to actively generate profits during market declines. Join our bot, add your token, and discover how investors have successfully recouped losses within 2-3 months. In challenging market conditions, cryptocurrency arbitrage emerges as a resilient strategy, offering a chance to earn even when prices are falling. Seize the opportunity to navigate market downturns with confidence!

12/08/2023

Multiply Your Crypto Holdings: A Guide how to use your own project and earn additional profit on crypto arbitrage

Explore the world of self-project cryptocurrency arbitrage and discover how as a coin owner, you can maximize profits through strategic trading. Learn how our arbitrage bot can automate the process, identifying and capitalizing on price gaps between platforms like Pancake and Gate. With the potential to recoup fees after just a few successful trades, this method offers a lucrative opportunity to boost your funds.

11/08/2023

Automated bots and risks: how $20,000 was stolen from a Binance account via APIs

Dangers of Using Automated Bots: Learn Why Your Deposit Can Turn to Zero. A Real Example When an Automated Trading Bot Was Hacked. Why Manual Cryptocurrency Arbitrage Bots Can Ensure the Safety of Your Funds.

10/08/2023

Coin-to-Coin arbitrage strategies: BTC, ETH, etc.

Dive into the world of altcoin arbitrage with our latest insights. Discover how pairing larger exchanges like Binance with smaller ones such as YOBIT can yield significant results. Explore real cases, like the impact of a KuCoin scandal, creating both positive and negative arbitrage opportunities. From TRX to BTC, ETH, XRP, and BNB, find lucrative pairs beyond the dollar.

08/08/2023

Case Study of Arbitrage for P2P Traders: Local Exchange + Major Exchange

Discover the secrets of successful P2P trading with ArbitrageScanner's international platform. Learn from real case studies, connect with traders worldwide, and leverage local exchange advantages for profitable crypto arbitrage. Seize the opportunity to access exclusive insights. Unleash your crypto potential today!

08/07/2023

Arbitrage Transactions with Crypto Tokens: Effective Strategies for Maximizing Profits

Discover effective strategies for conducting arbitrage transactions with tokens and optimizing profits. Explore two approaches – withdrawal-based and non-withdrawal – each with its own merits and considerations. Assess the risk and reward factors, understanding when to withdraw tokens and when to wait for favorable market conditions. Whether you prefer minimizing risks or maximizing opportunities, this guide provides insights into making informed decisions in the dynamic world of token trading.