How to Profit from Cross-Exchange Cryptocurrency Arbitrage

with ArbitrageScanner!

The cryptocurrency market is renowned for its high volatility, which creates both significant risks and unique profit-making opportunities. One of the most reliable and market-neutral strategies is cross-exchange arbitrage. Unlike classic day trading, where a trader bets on the price moving up or down, an arbitrageur profits from market inefficiencies — the difference in the cost of the same asset across various trading platforms. In this guide, we will break down how this model works, which tools allow you to automate the process, and how to minimize potential costs to ensure stable returns.

What Is Cross-Exchange Arbitrage and How Does It Work

Cross-exchange arbitrage is a strategy where a trader buys a digital asset on one exchange at a lower price and simultaneously (or almost immediately) sells it on another exchange where the rate is higher. The primary goal is to capture the positive price spread after deducting all transfer fees and trading commissions.

This mechanism exists because the crypto market is decentralized and fragmented. Unlike the traditional stock market with a unified registry, cryptocurrency exchanges (both CEX and DEX) function in silos. If a massive buy order occurs on Binance, the price of a coin might spike faster than it does on Bybit or Kraken. This lag creates a temporary window of opportunity for a trader to execute a profitable transaction.

Difference Between Cross-Exchange Arbitrage and Other Arbitrage Types

The main differentiator is the necessity of moving assets between external exchange wallets. While intra-exchange (triangular) arbitrage involves swapping three different pairs within a single platform to exploit internal price gaps, it eliminates blockchain delays but usually offers much smaller spreads. Cross-exchange arbitrage requires the trader to understand how different blockchain networks function to ensure the transfer is completed as quickly as possible before the market balances out.

Types of Cryptocurrency Arbitrage

There are several directions a trader can choose based on their available capital, risk appetite, and technical expertise.

Cross-Exchange Arbitrage

The classic "Buy on A — Transfer to B — Sell on B" scheme. It requires active accounts on multiple platforms and a rapid response to market fluctuations. It is the most common form of arbitrage for those looking for 1% to 3% profit per deal.

Intra-Exchange and Triangular Arbitrage

This method uses trading pairs within a single interface. For example: buying BTC with USDT, exchanging BTC for ETH, and then selling ETH back for USDT. Since the funds never leave the exchange, the execution is instant, though the profit margin is typically lower.

P2P Arbitrage

Transactions occur directly between users via P2P (Peer-to-Peer) platforms. This often involves using fiat currencies and bank transfers. While the spreads here can be massive (5%–10%), the risks of bank account freezes and fraud are significantly higher.

CEX to DEX Arbitrage

This involves working between centralized exchanges (like Binance or Coinbase) and decentralized protocols (like Uniswap or PancakeSwap). Often, liquidity on a DEX is lower, leading to significant price deviations that an experienced trader can exploit.

| Arbitrage Type | Complexity | Potential Profit | Primary Risks |

| Cross-Exchange | Medium | 0.5% – 3% per deal | Transaction speed, network fees |

| Intra-Exchange | High | 0.1% – 0.5% | Low spread, high competition |

| P2P Arbitrage | Low | 1% – 10% | Card blocks, counterparty fraud |

| CEX / DEX | High | 2% – 15% | Slippage, network gas fees |

How to Find Profitable Opportunities: Step-by-Step Guide

To start, you must select reputable platforms with high trading volumes and deep order books. It is crucial that the exchanges support the same blockchain networks for withdrawals (e.g., ERC-20, BEP-20, or TRC-20). After registration, completing KYC (Know Your Customer) is mandatory, as most platforms restrict withdrawal limits for unverified accounts, which can kill an arbitrage strategy.

Finding Opportunities Manually and Using Scanners

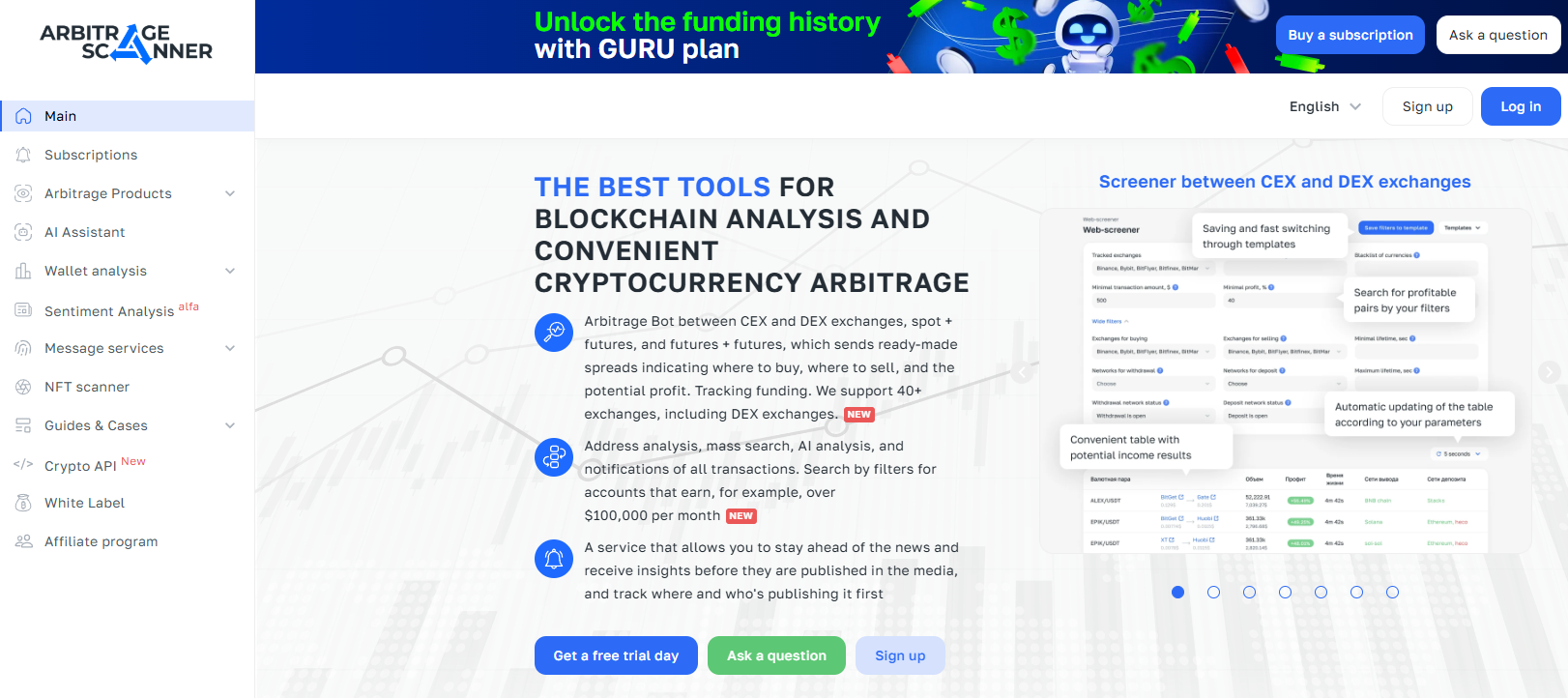

Searching for profitable pairs manually is nearly impossible in today's high-speed market. Modern traders use specialized screeners and software like ArbitrageScanner. This program compares quotes across hundreds of exchanges in real-time and sends an immediate notification when a profitable asset is detected. This allows the trader to focus on execution rather than searching.

Calculating Spread and Potential Profit

Before committing funds, you must perform a precise calculation. The formula is:

Net Profit = (Selling Price - Buying Price) - (Trading Fee A + Trading Fee B + Network Withdrawal Fee).

If the calculated profit is less than 0.3–0.5%, the deal is often considered too risky due to potential price slippage during the transfer.

Executing the Trade: Buy, Transfer, Sell

-

Buy the coin on the first exchange at the lower price.

-

Copy the deposit wallet address from the second exchange.

-

Execute the transfer using the fastest available network (e.g., Solana or Polygon).

-

Wait for the blockchain confirmations and sell the asset at the market price on the second exchange.

Tools for Arbitrage Automation

Cloud-based solutions allow you to track thousands of directions simultaneously. ArbitrageScanner is a market leader because it tracks price differences across CEX and DEX platforms without requiring your API keys, which significantly enhances security. The scanner notifies the user via Telegram the moment a profitable gap appears.

Trading Bots for Automation

For those looking to eliminate the human factor, trading bots can be programmed to execute deals automatically once certain price triggers are met. However, configuring these systems requires a deep understanding of market mechanics and API management.

Telegram Channels and Arbitrage Communities

The community is a vital source of information. Closed groups often share insights on "live" spreads, withdrawal issues on specific exchanges, or the emergence of new liquid tokens. Networking with other traders helps in staying ahead of the curve.

How Much Can You Earn from Cross-Exchange Arbitrage

Earnings in arbitrage depend directly on your working capital and the time invested. On average, a professional trader can generate 1% to 3% profit on their deposit per working day. With a $1,000 bankroll, this could mean $10-30 daily. When using automation and larger volumes, monthly profits can reach thousands of dollars. However, one must account for market stability; there are days with low volatility where opportunities are scarce.

Risks of Cross-Exchange Arbitrage and How to Minimize Them

While your asset is moving between exchanges, its price could drop. To mitigate this, choose fast networks (like Solana, Avalanche, or Polygon) and arbitrage stablecoin pairs whenever possible.

Exchange Fees and Network Fees

High gas fees (especially on the Ethereum network) can consume all expected profits. Always check the current transaction cost on the blockchain before initiating a deal.

Transfer Delays and Liquidity Issues

An exchange might suddenly put a wallet into "maintenance" or delay a transaction for manual review. Furthermore, check the liquidity in the order book: if you buy a large amount of a coin and there aren't enough buyers on the second exchange, you won't be able to sell it at the desired price.

Fraud Risks and Account Blocks

Working with obscure or suspicious platforms can lead to a total loss of funds. Stick to verified exchanges. Additionally, frequent large transfers may trigger AML (Anti-Money Laundering) flags. Always keep records of your source of funds to provide to compliance departments if requested.

Practical Tips for Beginner Arbitrageurs

It is recommended to start with $200-500. This is enough to cover commissions and understand the mechanics without risking significant capital. For your first deals, choose top-tier pairs with high liquidity like BTC/USDT, ETH/USDT, or SOL/USDT.

How to Verify Token Contracts and Avoid Scams

If you plan to work on a DEX, always verify the contract address via services like DEXTools or Etherscan. This prevents you from buying "honeypot" tokens — fraudulent coins that can be bought but never sold.

Risk Management and Diversification

Never keep your entire capital on one exchange. Distribute your funds across 3–5 top-tier platforms. This allows you to react faster to spreads and protects your capital if one exchange faces technical issues.

Taxation and Legal Aspects of Arbitrage

In most jurisdictions (US, UK, EU), cryptocurrency is treated as property or a capital asset. Profits from arbitrage are typically subject to Capital Gains Tax. For legal peace of mind, it is highly recommended to maintain a detailed log of all trades and exchange statements. While cross-exchange arbitrage is entirely legal, traders must be prepared to prove the legitimacy of their transactions to banks under AML regulations.

FAQ Section

Do I need to complete KYC for cross-exchange arbitrage?

Yes. Most reputable exchanges require verification for withdrawals, which is a critical step in the arbitrage process.

What is the minimum deposit needed to start?

To comfortably cover fees and see a meaningful return, starting with $300-500 is advisable.

How quickly can I withdraw profits?

Withdrawing to a bank card usually takes from a few minutes to an hour via the P2P sections of major exchanges.

Is cross-exchange arbitrage legal?

Yes, in most countries, crypto trading is legal, but you must declare your income and comply with local tax laws.

Can the entire process be automated?

While it is difficult to remove the human element entirely, tools like ArbitrageScanner automate 90% of the search and calculation process, leaving only the final execution to the trader.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.