The Arbitrage Scanner is a product that helps you find arbitrage opportunities using the tokens already in your investment portfolio.

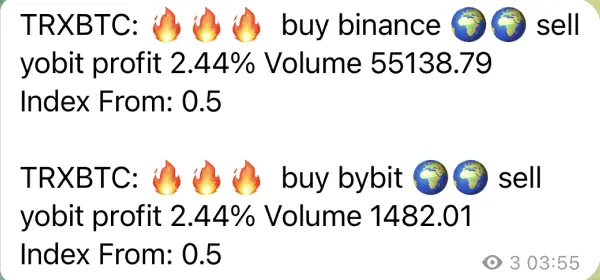

It automatically detects arbitrage setups based on your tokens, helping you buy low on one exchange and sell high on another — allowing you to recover your initial investment in the project.

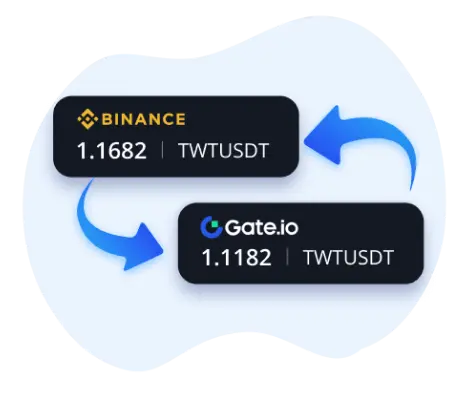

Let’s say you’re holding 1,000 ARB tokens and using them for arbitrage. Your 1,000 ARB are on Bybit, and your USDT are on Binance. Suppose the price suddenly jumps by 10%, creating a price lag — the price on Bybit is now $1.10 while on Binance it’s still $1.00. During this spike, you sell 1,000 ARB on Bybit for $1.10, receiving 1,100 USDT. At the same time, you buy 1,000 ARB on Binance at $1.00, spending 1,000 USDT. That’s $100 in pure profit (minus ~0.2% spot fees).

Then you wait for the price to equalize, or reverse the trade at a small acceptable loss. You can sell ARB on Binance and buy it back on Bybit — or wait for an arbitrage opportunity in the opposite direction. Or simply transfer assets to your preferred balance — whatever works best for you.

Setup and usage

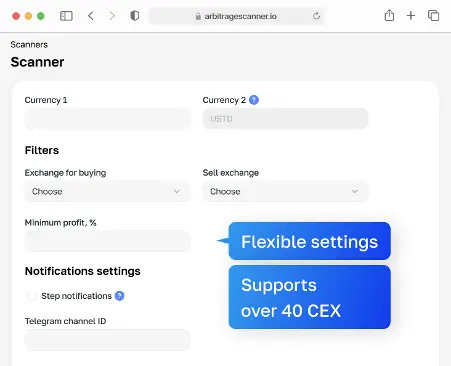

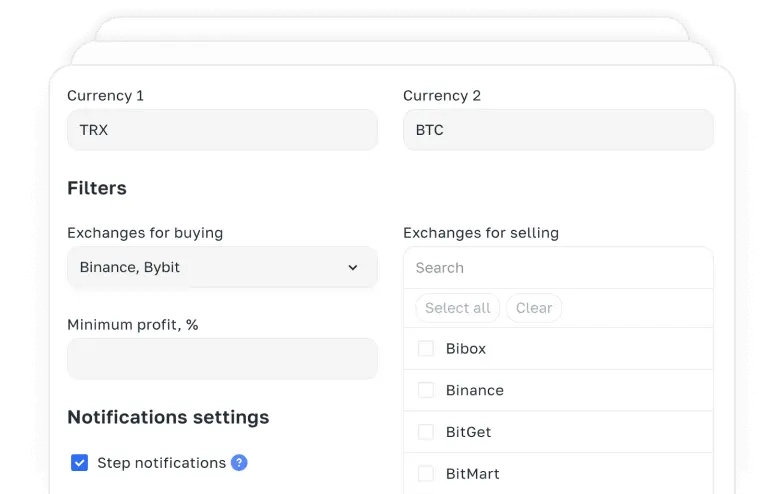

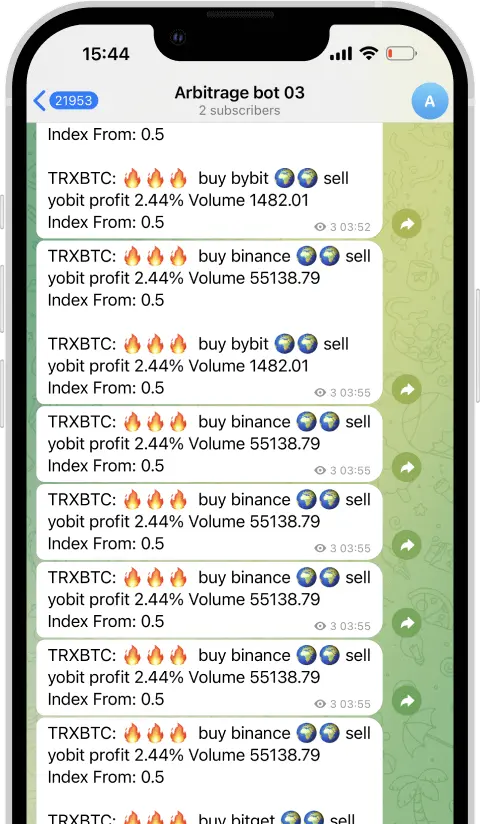

Investors configure the scanner to track tokens in their portfolio and wait for alerts. For example, if the price difference reaches 1–2%, they go to the exchanges, make the trade, and wait for their chosen exit point.

Time-saving

Investors can go about their day while receiving alerts only when action is needed. Arbitrage becomes a passive bonus while waiting for token exit points.

How to earn $6000 on arbitrage Notcoin in 2 hours

We'd like to remind you that arbitrage is just one of the functions of our service. In this example, a person managed to capture 5 types of arbitrage in 4 hours. They actively worked for an hour and a half, making over $6000.

How to earn 25% in 1 round?

This is a case study on the $SPA coin, our user also entered a small capital trade on a spot + futures strategy. He entered for a total of $4k $USDT and hedged for $3k $USDT. He waited for the price to equalize and exited. As a result, his profit amounted to $1000 for one round. And all this with minimal risk.

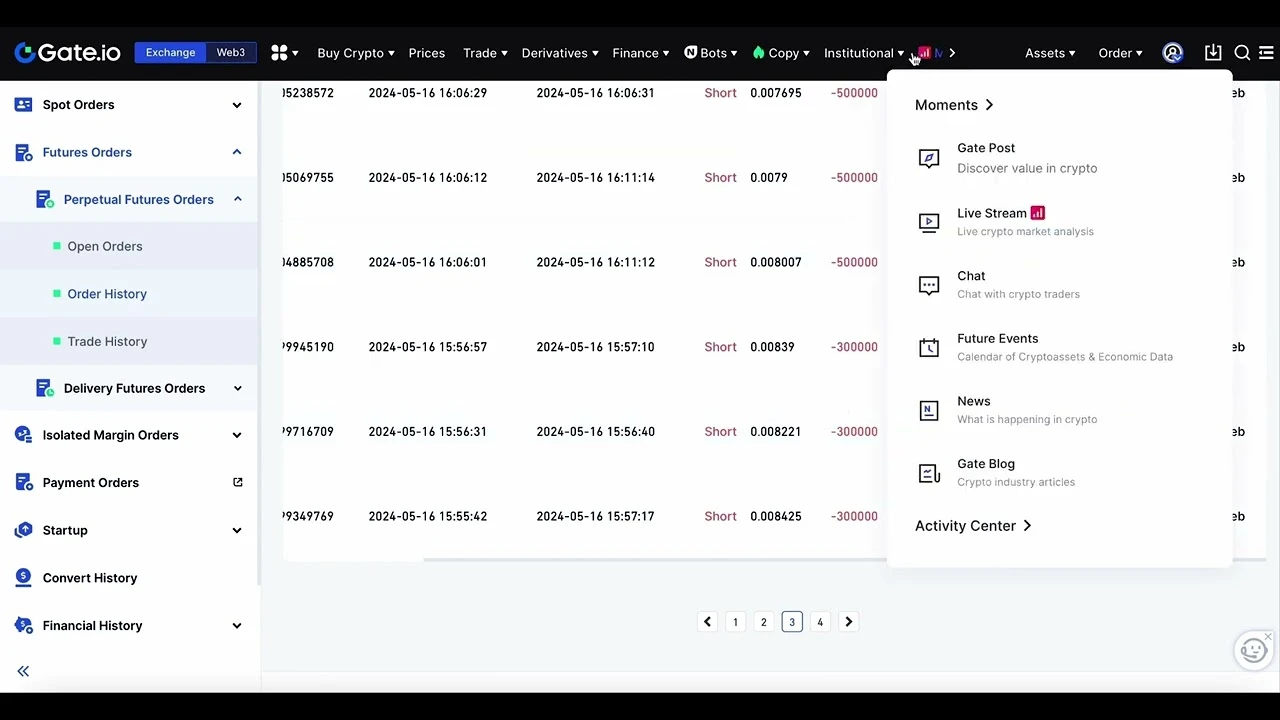

+12% Net Profit in 5 Days on $BLOCK Coin

After spotting an arbitrage opportunity between two exchanges using a spot + futures strategy on ArbitrageScanner's website, our user entered into the trade. When the price difference narrowed to 2%, they exited the trade upon receiving a notification, thereby earning $300 with minimal risks.

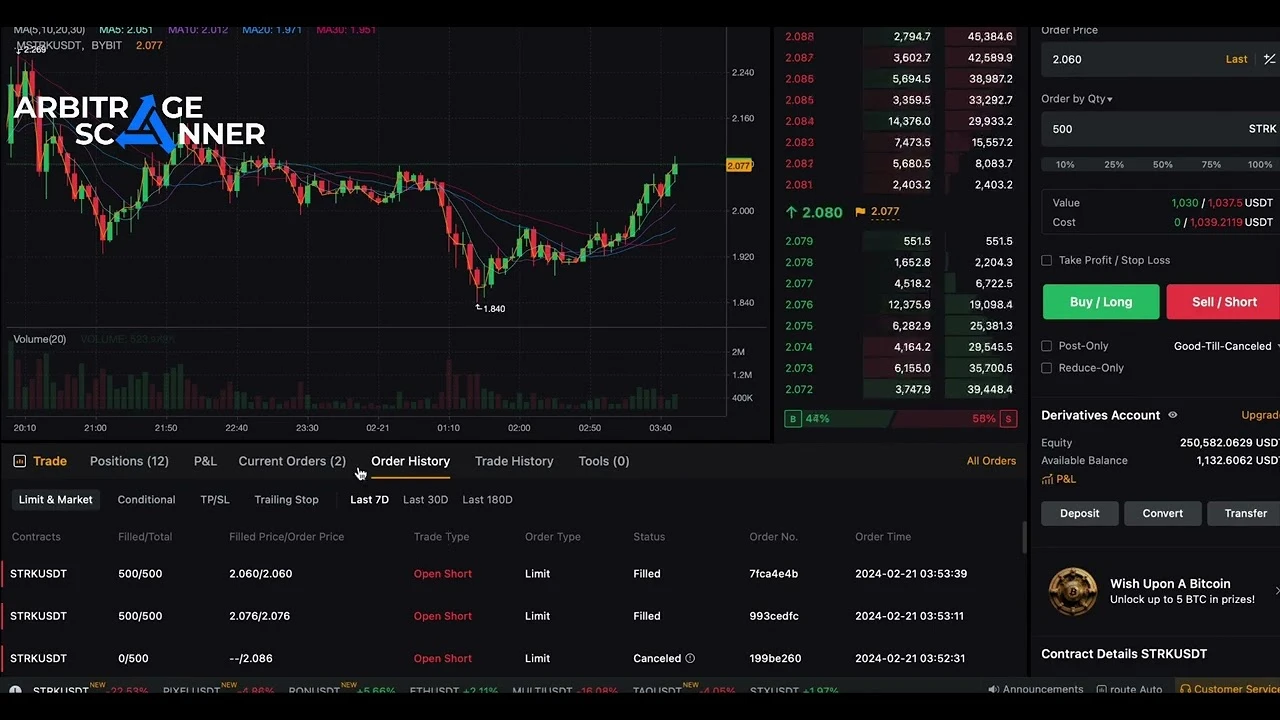

$1700 in 40 minutes based on STRK (Starknet) arbitrage signal

This is a simple example of how you can make profit using our service, Arbitrage Perpetuals. Many of our clients earn this way, and we share the most current opportunities with them in our private chat, where we build the strongest community in crypto.

Answers to your questions

IMPORTANT!

We are the developers of a product ecosystem and do not provide investment advice or income guarantees. Our core principle is not to work with clients’ money. This means our service is completely “manual”: all your funds remain under your personal control, and you are solely responsible for the decisions you make.

We may share success stories from our users, but we do not recommend copying their strategies exactly, as results may vary depending on many market factors. The ArbitrageScanner team is not responsible for your outcomes.