Uniswap (UNI): How to Use the Exchange in 2026

with ArbitrageScanner!

How to Use Uniswap: A Complete Guide

With the introduction of mandatory identity verification on centralized exchanges (CEX), it became clear that anonymity in the crypto market would soon be a distant memory. However, in early 2018, Hayden Adams, with the assistance of Vitalik Buterin, introduced the new Uniswap protocol to the public – a decentralized exchange where users can connect crypto wallets and trade directly with each other.

In this article, we will analyze the Uniswap platform in detail, explain how to use it, discuss the UNI token, and much more.

What is Uniswap

Uniswap is a protocol that functions as a decentralized token exchanger. On the surface, the project resembles a standard cryptocurrency exchange, but it lacks a crucial component – an order book. The protocol allows users to exchange ERC-20 standard tokens, which do not go into an order book but are instead locked into special smart contracts, ensuring maximum security for exchange participants. Tokens used for transfer are pooled into smart contracts, creating liquidity pools within which participants can trade. You can also swap tokens, provide them for use to earn commissions, and create new trading pairs.

ERC-20 standard tokens were not chosen by chance: they are the most common type of coins used on the Ethereum blockchain and in the crypto market. Moreover, they are fungible, meaning that technically, two different cryptocurrencies functioning on the ERC-20 standard are no different from each other. Let’s take a simple example: if I have ten 100-dollar bills, it doesn't matter which specific one I give away. ERC-20 tokens are widely used in all crypto industry processes: as a unit of account, points, collateral for lending, bonds with further interest accrual, and more. Also, they have no restrictions on divisibility, so they can be sent in any desired quantities.

How Do Uniswap Smart Contracts Work?

As previously mentioned, Uniswap uses special smart contracts that differ slightly from traditional ones but still provide a high level of security to those who use them. In this case, modernized smart contracts help optimize the process of token exchange between participants. A Uniswap client can create a user interface through which one can connect to a smart contract and exchange tokens with other users.

There are two types of smart contracts in Uniswap: Exchange and Factory. The Exchange smart contract takes on the role of a pool holder, within which tokens are located and users can perform swaps. The Factory smart contract is responsible for creating new Exchange contracts and linking tokens to their exchange contract address; it is rightfully called a factory.

No fee is charged for listing a new token on the Uniswap protocol, and this is accomplished by calling the Factory contract in the interface.

History and Evolution of Uniswap

As of January 2025, there are several versions of the Uniswap protocol, with one under development:

-

Uniswap v1. The first version was launched in 2018 and was a basic implementation of the AMM protocol;

-

Uniswap v2. The second version, released in 2020, added support for new features such as direct token pairs and an improved interface;

-

Uniswap v3. The third version, released in 2021, introduced more efficient capital utilization by allowing users to set price ranges for liquidity;

-

Uniswap v4. The fourth version is under development and promises even more improvements, including new routing mechanisms and gas fee optimization.

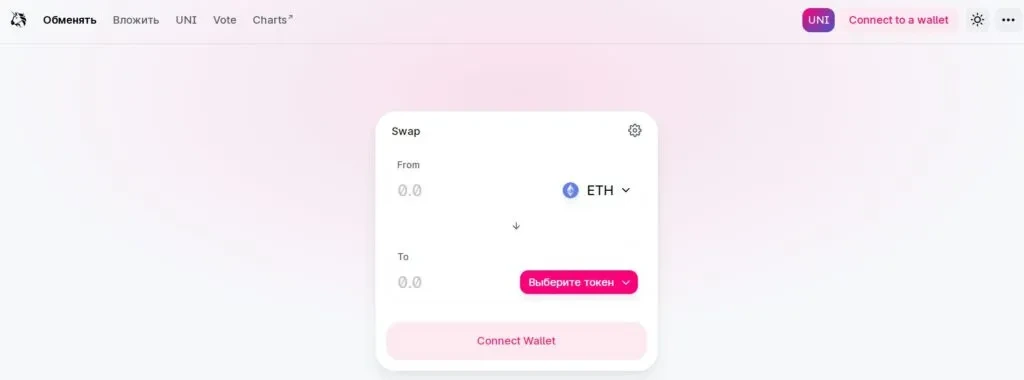

How to Start Using Uniswap

-

Connecting a Wallet to Uniswap. Go to the official Uniswap website and connect a compatible cryptocurrency wallet, such as MetaMask;

-

Setting up the Uniswap Interface. After connecting the wallet, configure the interface to your preferences by choosing the desired token pairs and setting transaction parameters;

-

Disconnecting the Wallet. After finishing your work with Uniswap, it is recommended to disconnect the wallet for security purposes.

Token Swapping on Uniswap

Slippage Tolerance

Slippage tolerance in Uniswap is necessary to increase the probability of rapid transaction processing and reduce the chance of failure.

Slippage occurs when the price at which the order is ultimately executed does not match the price at the time of transaction confirmation. If a cryptocurrency rises in price, high competition can arise during transaction processing. In this case, increasing the slippage tolerance will raise the likelihood that the transaction will be processed faster.

To configure slippage tolerance, you need to click on the gear icon in the upper right corner of the Uniswap browser. This will lower the minimum amount guaranteed to be sent but will increase the chance that the transaction will be executed, though in return, the user may receive less of the desired cryptocurrency.

Router API

The Uniswap Router API is needed to find the most efficient way to exchange tokens. With its help, you can enter the tokens for trading and their quantity, and in response, receive the best route, quote, and other data.

Expert Mode

Expert mode on the Uniswap exchange is intended for advanced users. It allows for trades with high slippage without displaying the transaction confirmation window.

Adding Assets to a Liquidity Pool

Adding a token to Uniswap occurs in several stages:

-

Go to the "Pool" section on the Uniswap website;

-

Click “Add Liquidity”;

-

Choose the pair of tokens you want to add to the pool;

-

Specify the number of tokens and confirm the transaction.

Adding a Token to Uniswap

To add a token to Uniswap, you need to unlock your wallet, connect to Uniswap, and check if the token is available. If the token you want to add has already been added by someone, you will be able to exchange it. In this case, you do not need to add it again. If the token is not yet listed or no one has provided sufficient liquidity for this pair, you will be the first liquidity provider.

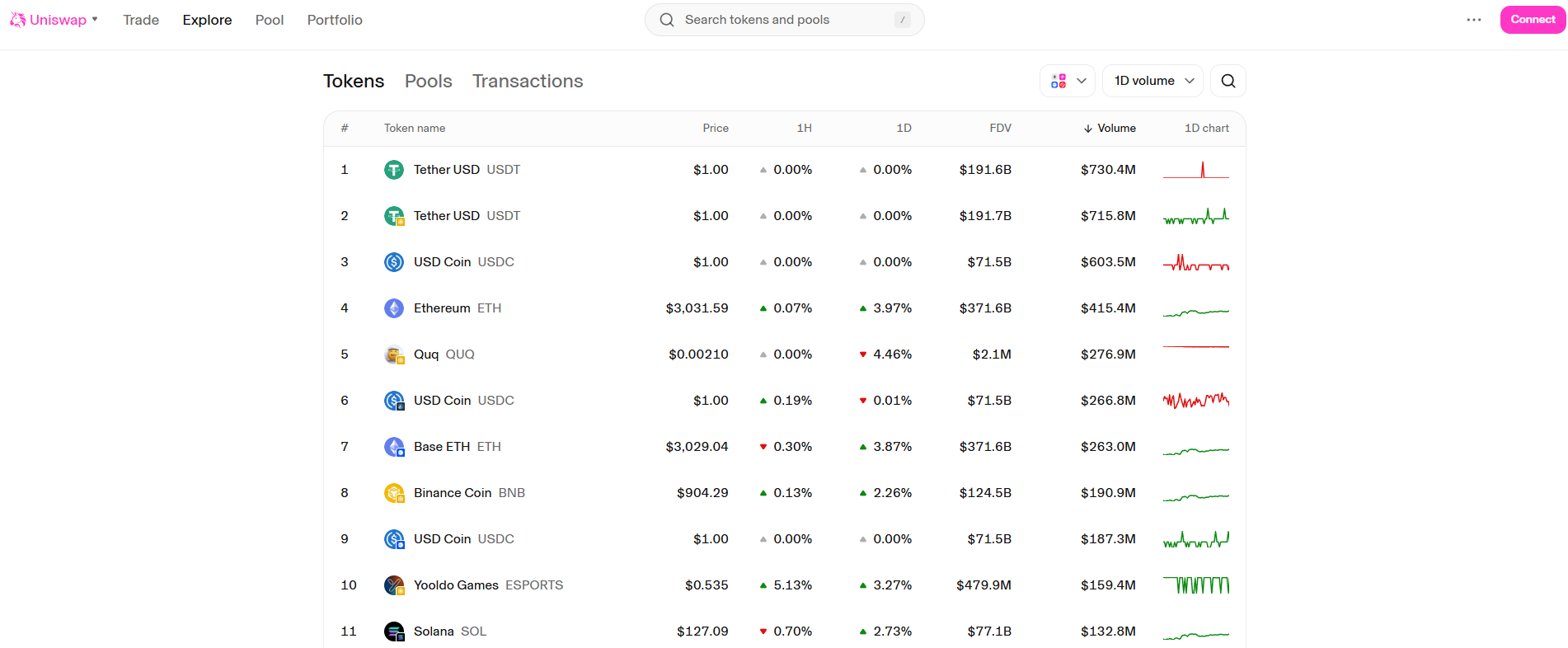

Uniswap Features

Among the features of the decentralized exchange, the following can be highlighted:

-

Token Swapping. Fast and decentralized exchange of various ERC-20 tokens;

-

Liquidity Pools. The ability to provide liquidity and earn from transaction fees;

-

NFT Marketplace. Support for trading non-fungible tokens (NFTs).

Uniswap Token (UNI)

UNI is the native token of the Uniswap platform, launched in September 2020. It is through this token that users manage the exchanger. Its holders have the right to:

-

Govern the platform, meaning adding new tokens for exchange;

-

Distribute the platform's finances. This refers to allocating funds for purposes that will promote the development of the exchanger;

-

Set commissions for token exchange;

-

Adjust the list of tokens considered default.

Today, UNI is listed on almost any centralized exchange, where it can be purchased without any problems. Any wallet that supports the ERC-20 standard is suitable for its storage.

How to Earn on Uniswap

Those who provide liquidity, or market makers, can earn on Uniswap. For every dollar provided to the exchange (cryptocurrency equivalent), a market maker receives $0.0004 in rewards. However, there is an unpleasant aspect to providing liquidity: the risk of impermanent loss.

For example, a liquidity provider on Uniswap deposited 1 ETH and 100 USDT into a pool to receive exchange commissions. If the price of ETH rises from 100 USDT to 400 USDT, arbitrage traders will adjust the pool balance, and the liquidity provider, upon withdrawing their 10% share (0.5 ETH and 200 USDT), will receive 400 USDT instead of the 500 USDT they would have had if they had simply held the assets.

This loss arises due to the change in the ratio of tokens in the pool and is called impermanent because it can decrease if the price returns to the initial level. However, thanks to commissions, liquidity providers can compensate for these losses over time. It is important to consider that impermanent losses occur both when asset prices rise and fall, so liquidity providers must carefully assess risks before depositing funds into a pool.

Pros and Cons of Uniswap

Pros

-

No mandatory verification or registration. To use Uniswap services, it is sufficient to link a crypto wallet;

-

Token exchange happens almost instantly. Unlike on exchanges, you don't have to wait for an order execution. If the required pool exists, the exchange will be completed immediately;

-

New ERC-20 tokens appear much faster than on centralized exchanges – this provides earning opportunities through arbitrage. A token of a promising or hyped project is often listed on major exchanges (Binance, HTX, Bitget, etc.) later, which often positively affects its price;

-

The interface is simple and easy to master.

Cons

-

Average trading fee is 0.30% of the transaction amount. This is higher than on most centralized exchanges;

-

Presence of many scammers. As mentioned in the pros, new tokens appear on Uniswap faster, which gives scammers more freedom. There have been cases where a scam token, looking like a real one that was soon to be listed on a CEX, was listed on the protocol. People bought the fake out of inattentiveness, and attackers received money as if for a real token. This can be avoided by comparing the token contract with the original, which can be found on services like Coingecko or CoinMarketCap;

-

Liquidity on a DEX largely depends on the number of market makers ensuring token availability. Therefore, the liquidity of less popular tokens on a DEX may be lower than on a CEX.

Uniswap Security

Uniswap is considered a safe platform thanks to the use of smart contracts and the lack of need to trust centralized intermediaries. However, users should be careful and check contract addresses to avoid scams.

Many traders prefer to use Uniswap or other decentralized platforms because they don't have to trust anyone with their money or reveal their identity – this is good for security. However, on a DEX, one can encounter scammers with fake tokens who are not found on a CEX, so be vigilant when choosing an asset for trading or investment.

Conclusion

Uniswap and other decentralized exchanges serve as an alternative to centralized exchanges. The main advantage of the protocol is decentralization and the absence of mandatory identity verification. Also among the pros is the earlier appearance of hyped tokens on a DEX than on a CEX, but the main thing is not to fall for scammers.

On one hand, protocol users are maximally protected and anonymous, meaning everything works as the original concept of cryptocurrencies intended. On the other hand, there are drawbacks regarding commissions, the possibility of unfair arbitrage, and the presence of scammers. However, Uniswap belongs to the decentralized finance sector, so its popularity is rapidly gaining momentum, along with the entire crypto sector in early 2025.

Arbitrage Scanner supports a large number of exchanges for cryptocurrency arbitrage; you can find more details at this link.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.