P2P Arbitrage Without Cards: The Ultimate Guide

with ArbitrageScanner!

Cryptocurrency Arbitrage Without Bank Cards

When people hear the phrase “cryptocurrency arbitrage,” they immediately associate it with piles of bank cards, drops in other countries, and other factors that create an impression of extreme complexity.

However, few know that crypto arbitrage is possible without using bank cards, and in some aspects, it is even more profitable. For a person without experience, standard arbitrage is problematic: you need to find people abroad and those who will provide their bank cards. At the same time, in both cases, the risk of being “scammed” cannot be ruled out: one might transfer money to a trusted person's card, and they might disappear with all the funds.

In this article, we will explain in detail how cardless arbitrage works, what trading strategies exist, and what you must pay attention to.

Basics of Cardless Crypto Arbitrage

Inter-exchange arbitrage – is a strategy that involves buying an asset on one exchange at a lower price, then transferring it to another exchange and selling it at a higher price. The spread, or price difference, becomes the arbitrageur's profit.

Suppose a trader notices that Bitcoin costs $80,000 on one exchange and $80,300 on another: they buy Bitcoin on the first exchange, transfer it to the second, and sell. The profit in this case is $300. However, this is profit before expenses, which consist of trading commissions and the blockchain fee for transferring Bitcoin from one exchange to another.

Additionally, before a deal, you must check if deposits/withdrawals are available for the coin being used for arbitrage (in our example, Bitcoin). Sometimes an exchange suspends operations with a cryptocurrency for technical reasons. If this is missed, you may incur losses because the coin cannot be moved, and by the time the technical issues are fixed, the arbitrage opportunity might have vanished.

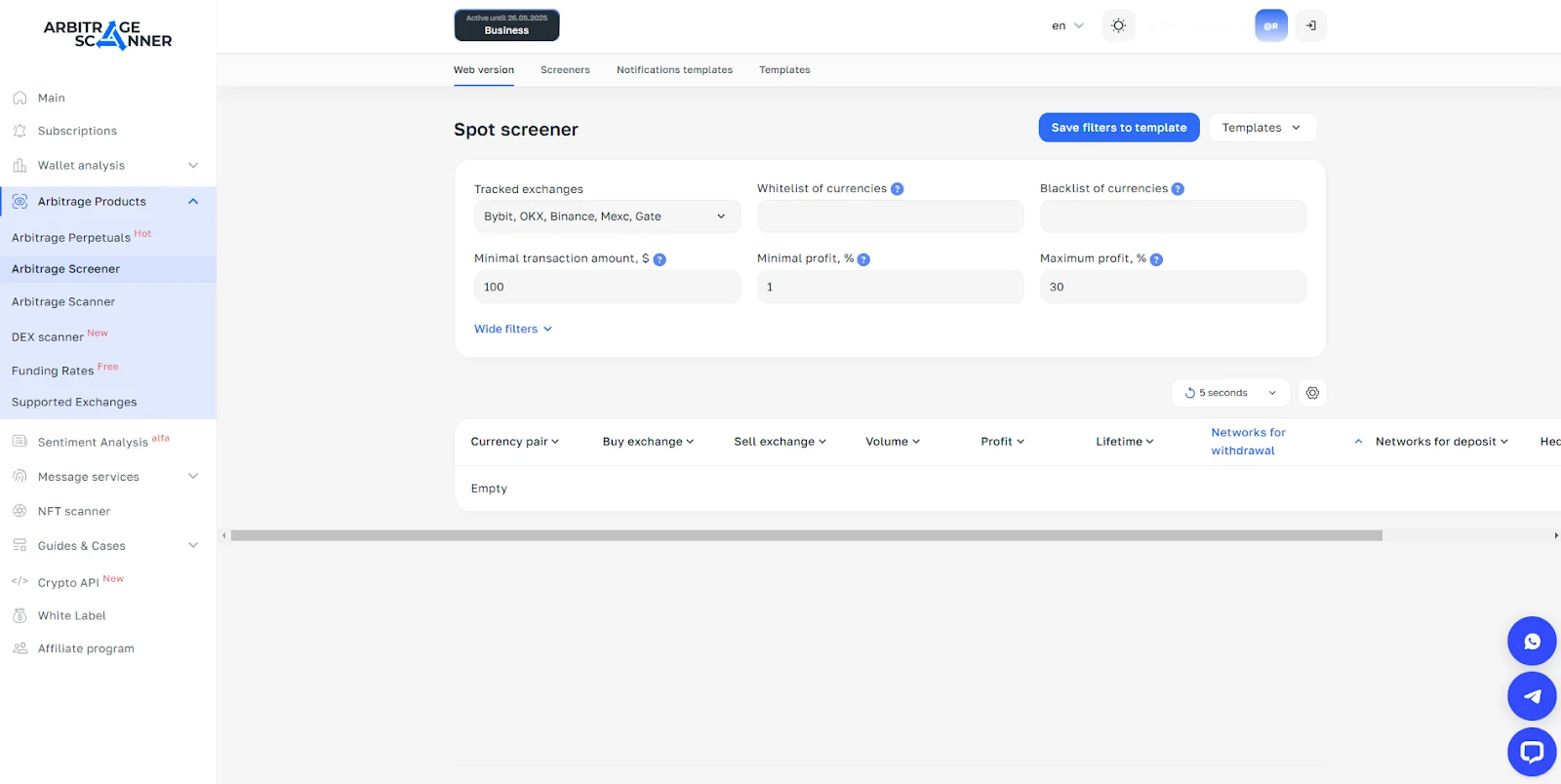

While deposits and withdrawals must be monitored manually, trading fees, spreads, funding rates, and arbitrage loops can be tracked through specialized services – Arbitrage Scanner or Arbitrage Screener.

Arbitrage Scanner Capabilities

Arbitrage scanners significantly simplify the process of crypto arbitrage by performing all the routine work that takes a lot of time. For example, an arbitrageur can search for spreads manually: just visit an analytical service like CoinMarketCap or CoinGecko and compare prices on different exchanges. This can work, but only in rare cases: arbitrage loops usually don't last long. There are many cryptocurrencies listed today. Even if you take the top 100 assets, by the time you check them all for spreads across various exchanges, you'll waste a lot of time. If you manage to complete a trade this way, it's more luck than a system, because the trader might have found the loop right at its end.

As for arbitrage scanners – they check for spreads, trading fees, and funding rates across numerous centralized and decentralized exchanges. The entire process is automated: the user only needs to input the platforms they want to track and receive notifications every time a loop appears. If a trader doesn't have specific coins they want to arbitrage, they can receive dozens of options in just one minute and choose the most suitable one.

Among the most popular crypto scanners is Arbitragescanner: here you will get loops from most top crypto exchanges and can use on-chain analysis tools that suggest which coin might soon develop a spread. The search tools have many filters for precise results. Most importantly, Arbitragescanner provides new users with a trial day so they can personally verify the service's utility.

Choosing Crypto Exchanges

After deciding how to search for spreads, you need to choose exchanges to work with. See the full list of available platforms in the Supported Exchanges section. Since today all crypto exchanges strive to know their customers (KYC) and counter money laundering, you must undergo identity verification on your chosen platforms. If you don't, you will face several restrictions:

-

A withdrawal limit will be set, which can hinder profit if you arbitrage with large sums;

-

Many exchange features will be unavailable, which isn't critical for standard arbitrage but still adds inconvenience;

-

Support is more loyal to KYC-verified users. Sometimes problems arise that only support can solve, and it's much faster with a confirmed identity.

It is also worth pre-funding your balances on the exchanges you plan to use. This isn't mandatory, but when a spread appears, you must act fast, and depositing funds can waste precious time.

Finding Spreads

As mentioned earlier, searching for spreads manually today is a problematic task that can deprive you of potential profit. It is better to use a scanner for this, which saves you from constant market monitoring as it checks thousands of quotes on exchanges. The resulting loops can be sorted by spread to immediately pick the most profitable one and start trading.

Always consider all fees when calculating estimated profit: if the spread is small, all profit might go toward commissions. Also, pay attention to the network load of the cryptocurrency: the higher it is, the higher the transfer fee. Remember that a good arbitrage loop doesn't last long: there are plenty of people wanting to profit from price differences, so once you find a spread, start working immediately; otherwise, you might miss the window.

Trading Strategies

After finding a suitable spread, you need to decide on an arbitrage strategy. Since we are talking about cardless arbitrage, there are three main strategies we will cover in detail.

“Inter-exchange Transfer” Strategy

This strategy was reflected in the example at the beginning: an arbitrageur buys cheaper on one exchange, transfers to another, and sells higher. This is considered the riskiest type of arbitrage because the price could move against you during the transfer time. Let's look at a detailed example:

Suppose a loop appears: on MEXC, ETH is 1,300 USDT, and on Bybit, it's 1,275 USDT. The spread is 2%. The available volume is 4,000 USDT. The trader subtracts 2% from 4,000 USDT – resulting in 3,920 USDT needed to buy ETH on Bybit. Also, consider the trading fee: 0.1% on Bybit (3.92 USDT). After buying, the coins are transferred to the other exchange, costing an Ethereum network fee (avg. 1.5 USDT). Total fees: 5.42 USDT. Initial profit was 80 USDT, but after fees, 74.58 USDT remains.

However, such profit is possible in an ideal scenario where one order sells everything. In reality, there might not be enough buyers at the high price. Then the trader must lower their price, reducing profit until it matches the buy price.

Again, if the arbitrageur wants to test the loop with small volume first, they'll pay fees twice on the next round, further lowering profit. In the end, the profit in the example can be halved for a more realistic figure. But you can earn this within an hour, and multiple loops a day add up to a good income.

The main risk of this strategy is the time required for the transfer. If the network is clear, it takes under 5 minutes, but if there's heavy congestion, it could take hours.

“Hedging” Strategy

This strategy involves hedging with derivatives – perpetual futures. To find optimal futures contracts, use the Futures Screener. The process works as follows:

The arbitrageur finds a spread. As soon as they buy it cheaper, they immediately open a short futures position on the same coin. You don't have to open the futures on the same exchange where you'll sell the spot; just find an exchange where the short entry price matches your spot purchase price. Then transfer the coin, sell it, and close the short futures simultaneously, regardless of its profit/loss. The hedge protects you: if the price drops, the spot loss is offset by the short futures profit.

When using futures, consider a few points:

-

There is an additional fee for opening the short futures position, which must be included in your calculations;

-

Watch the funding rate and the countdown. You might end up in a situation where shorts pay longs, which can eat your profit or lead to a loss.

Essentially, if funding isn't due soon, you pay a small fee for the futures opening to eliminate risks from sudden price movements.

“Parallel Trades” Strategy

This strategy requires preparation: the arbitrageur finds a coin that regularly develops a spread between two exchanges. When the signal comes, they buy the coin on the exchange where it's usually more expensive. When the spread appears, they open both exchanges, enter the order amounts, and simultaneously buy on the first and sell on the second. Effectively, they use less USDT to buy on one and get more USDT by selling on the other.

This is the safest type of arbitrage since trades happen in seconds. However, there's a downside: historical data doesn't guarantee future performance. A trader could hold a coin waiting for a spread that never comes. Check practical examples in the Tutorials/Case Studies section to minimize risks. While the chance of no spread is low, it's not zero. Spend time confirming the theory first: if the gap appears regularly, it's likely to continue.

Recommendations for Cardless Crypto Arbitrage

Here are a few tips to help you in crypto arbitrage:

-

Regularly monitor network status using blockchain explorers. If you know the network state, you'll know immediately if a loop is worth starting;

-

Don't chase massive percentages. A 15-20% spread is usually a red flag. It's likely the coin is being manipulated, which could lead to losses;

-

Analyze order books. If the sell-side order book is empty except for one large wall, that wall might be removed or filled, forcing you to sell at a much worse price;

-

Check contracts on decentralized exchanges (DEX) against official sites. On DEXs, you often find "scam" coins mimicking real ones using the same ticker. Buying these will result in a total loss;

-

Always keep a liquidity reserve. Having free funds on exchange balances allows you to react instantly to profitable loops. If you have no USDT or other liquid assets ready, you'll miss the window. Liquidity must always be at hand.

Conclusion

Crypto arbitrage without bank cards is not only possible but often safer and more convenient than classical P2P involving third parties. With proper preparation and tools like arbitrage scanners, it can become a stable source of income.

The key is to stay calm, act quickly, analyze risks, and never rely solely on luck.

When it comes to cryptocurrency arbitrage, Arbitrage Scanner gives you the edge in speed and accuracy, eliminating chance. Your success depends on technological superiority. Modern tools are here – start using them!

FAQ — Frequently Asked Questions

How does cardless arbitrage work?

This type of arbitrage involves working only with cryptocurrency: buying an asset on one exchange, transferring it to another, and selling it higher. All settlements occur within the crypto ecosystem, without fiat or bank cards, which simplifies the process and reduces risks.

What is the difference between arbitrage and P2P?

Arbitrage is speculating on price differences between exchanges. P2P is direct trading between people, often involving fiat. Arbitrage is a technical process based on platform prices, while P2P is more "manual" and involves counterparty risks.

What do I need for P2P arbitrage?

For P2P arbitrage, you need:

-

Exchange accounts with access to P2P sections;

-

Completed KYC (identity verification);

-

Bank cards or e-wallets for fiat on/off-ramps;

-

Understanding of price fluctuations and quick reaction time;

-

Platform reputation (higher reputation builds trust with other traders).

Where to get cards for P2P arbitrage?

Traders usually use personal cards or work with trusted parties. However, buying/renting others' cards is illegal and dangerous. The alternative is arbitrage without fiat, as described in this article: it is safer and requires no banking tools.

How to start in P2P arbitrage?

-

Register on popular exchanges with P2P functions (Binance, Bybit, OKX, etc.);

-

Complete verification (KYC);

-

Study current buy/sell rates for USDT/fiat;

-

Try a few small manual trades;

-

Scale up as you gain experience.

Important: Do not invest large sums at the start and avoid suspicious counterparties.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.