Ranking the Best Cross-Chain Bridges in 2026

with ArbitrageScanner!

Ranking the Best Cross-Chain Bridges in 2026

Before you start using a bridge, it’s important to conduct research and review factors such as security, fees, transaction speed, and network compatibility.

In today’s article, we’ll examine the criteria for choosing crypto bridges, review the safest and most cost-efficient options that cover most popular networks, and share practical tips for using them. Let’s go!

Criteria for Choosing a Crypto Bridge

When selecting a bridge, you should rely on the following criteria:

-

Available networks and assets. Check which networks and coins the bridge supports. Choose bridges that support the assets and networks you frequently use. If you’re unsure what you’ll be transferring, opt for bridges with the highest number of supported networks and assets for universal flexibility.

-

Platform fees. Review the fees charged by the bridge and what they depend on. Fixed rates are generally preferable because they allow you to always know the fee upfront. Fixed fees work especially well with large amounts, helping you save significantly compared to variable fees.

-

On-chain metrics. Check bridge metrics like TVL and transferred volume. You can do this via DefiLlama — simply visit the site, enter the bridge name, and open the detailed analytics page.

-

Bridge usability. Evaluate the interface, transaction execution time, and whether the bridge allows sending assets directly to a CEX wallet. Identify which parameters are critical for you. For example, arbitrage traders need maximum transaction speed.

Using these criteria, we compiled a list of the top crypto bridges for 2026.

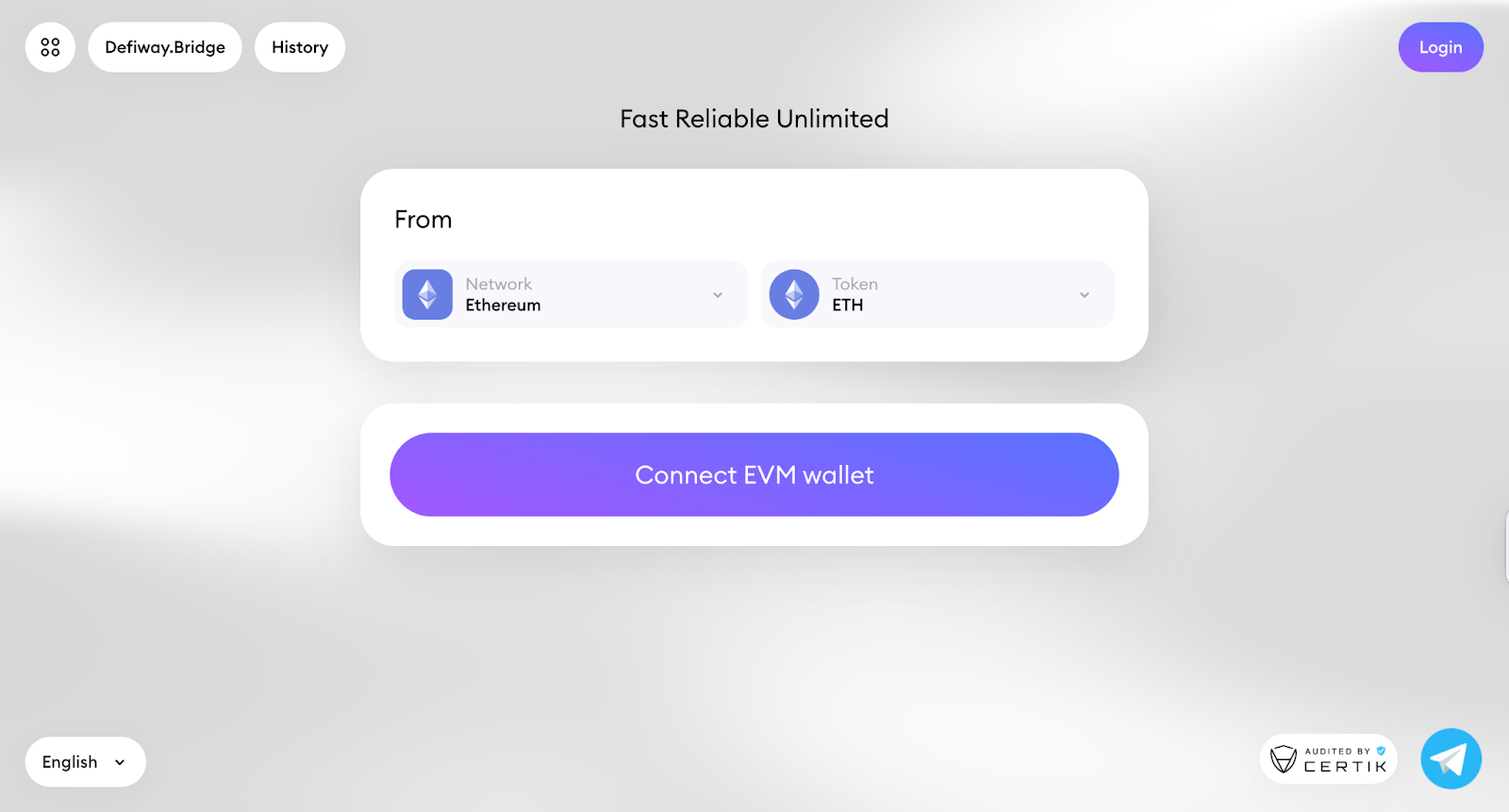

#1 Defiway

Defiway is a cross-chain bridge with fixed fees that supports 13 of the most popular blockchains, including ETH, BTC, TRON, SOL, BASE, Arbitrum, and others. Transfers can be made both through the web interface and via the official Telegram bot @Defiway_bot.

In addition, the project has a developed ecosystem that includes a DeFi wallet, a staking system, and business tools that allow accepting crypto payments and sending mass wallet distributions in one click.

The platform has existed for more than 3 years, its smart contracts have been audited by CertiK, and daily trading volume exceeds $4 million.

The Defiway bridge has become a must-have for arbitrage traders, as it allows fast and cheap token transfers between networks with a minimal fixed fee of 0.2%.

Most arbitrage opportunities lose profitability within minutes or even seconds, so the final earnings of an arbitrageur depend heavily on the inter-chain transfer speed. Many bridges take several minutes to complete a transfer, while Defiway sends assets within seconds, saving time and increasing profitability. The bridge also allows using a CEX wallet as the receiving address, saving an extra step.

In many bridges, transferring between networks requires multiple wallets because a single wallet may not support all required networks. With Defiway, you can use one wallet, making the process much simpler.

The fixed 0.2% fee is often more profitable than fees at other bridges. For example, Stargate charges 0.06% + gas, while LayerZero fees can reach 1%, especially during peak load.

Defiway’s fee does not depend on volume. It is easy to calculate and helps estimate arbitrage profitability. This is practically the only platform that provides fixed fees. The cost advantage becomes obvious when transferring large amounts, like $10,000 — savings can reach tens or even hundreds of dollars compared to other bridges.

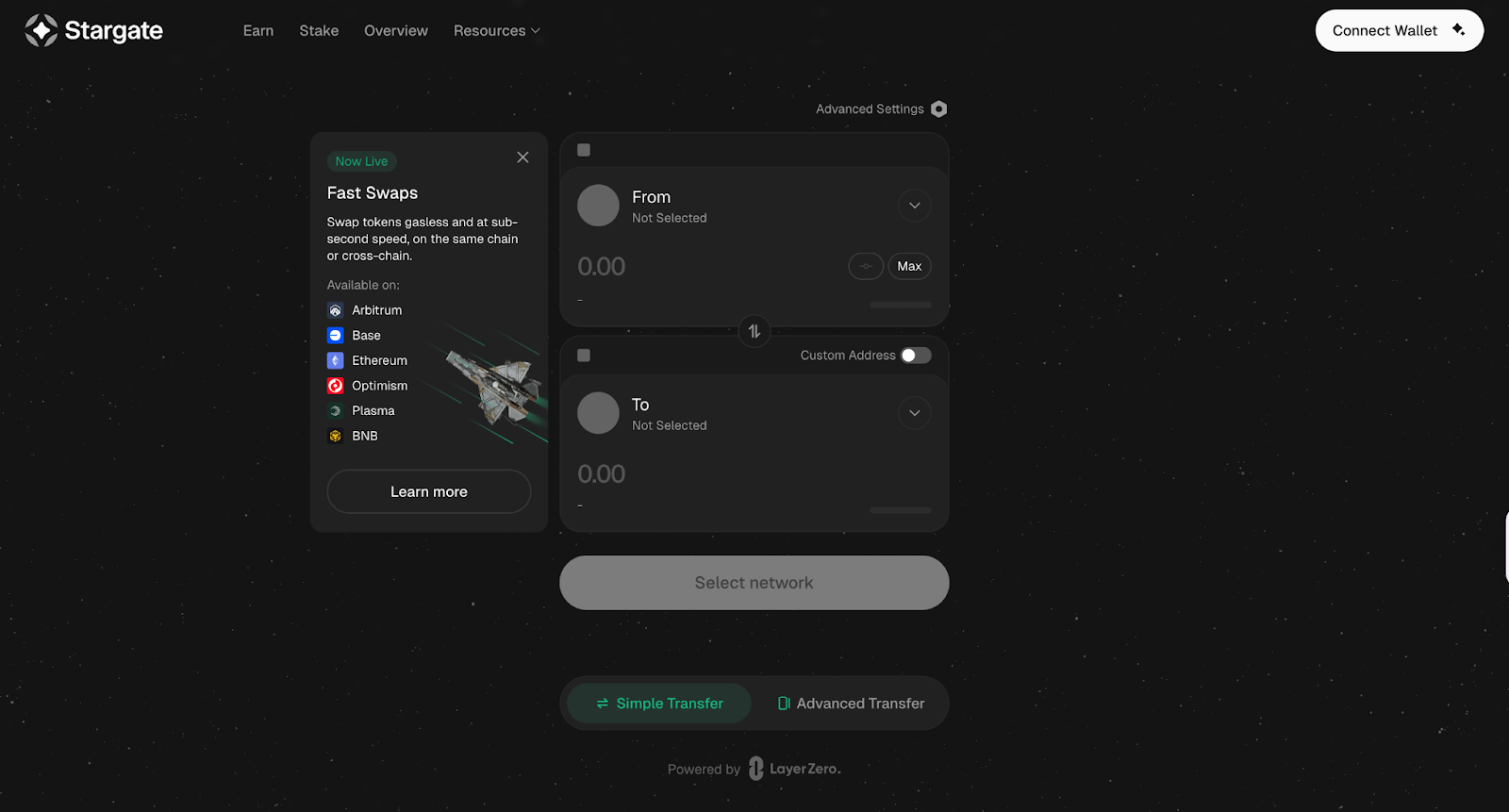

#2 Stargate

Stargate is a crypto bridge from the LayerZero ecosystem that supports more than 20 EVM-compatible networks. Its TVL exceeds $300 million, enabling users to receive native assets without having to swap wrapped tokens on DEXs.

Although the number of networks is large, routes can only be built between EVM networks. If you need to transfer tokens to a non-EVM chain like Solana or Aptos, you’ll need another bridge offering broader infrastructure. Also, due to flexible fees, it’s difficult to calculate the final cost in advance, which means you can’t pre-estimate arbitrage profitability.

Nevertheless, the bridge has gained popularity and a loyal user base, allowing it to maintain high volume and TVL.

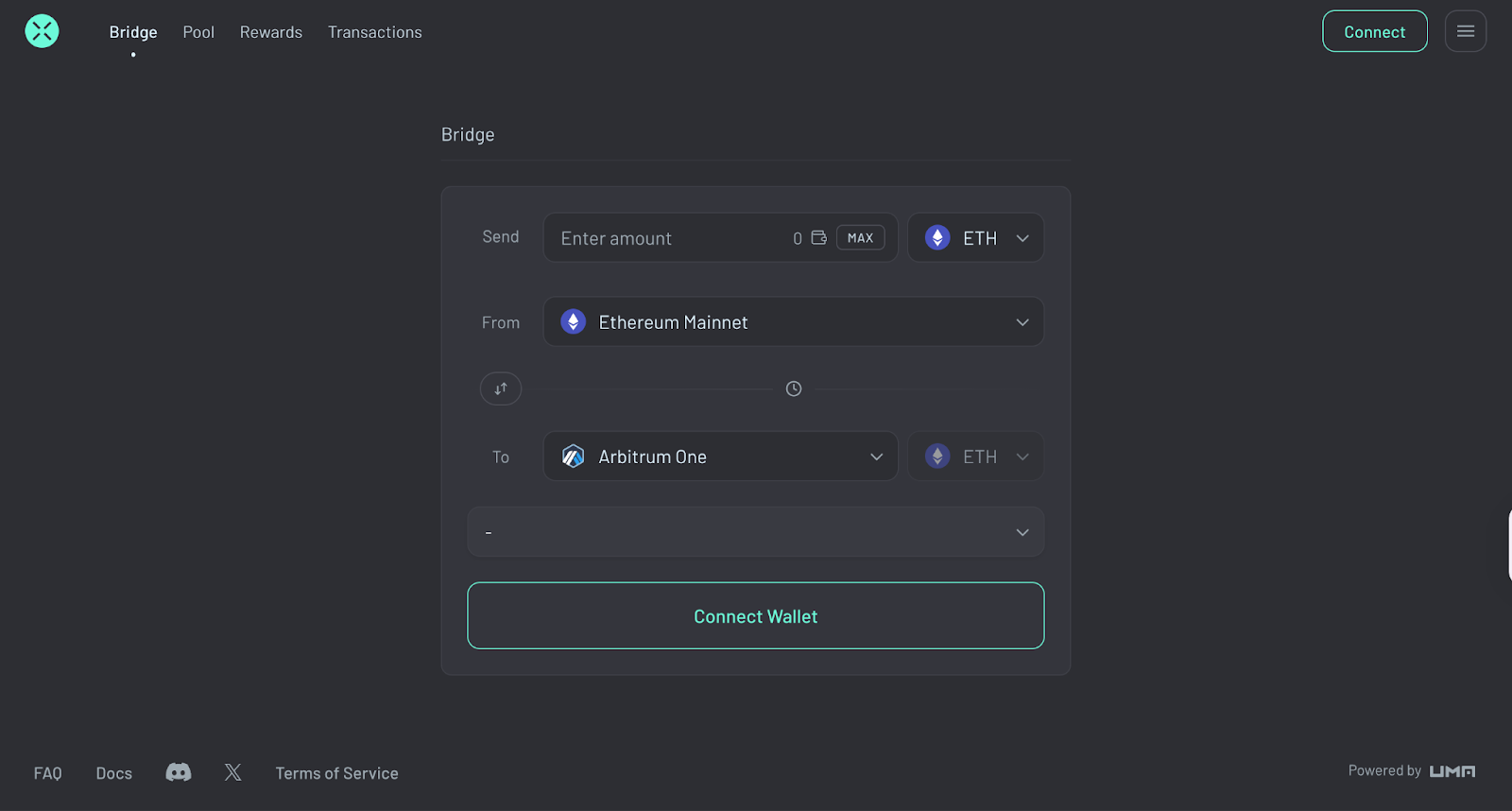

#3 Across Protocol

Across Protocol is the best bridge for transferring between Layer-2 blockchains. It offers fast transfer speeds, with typical transactions taking less than a minute.

Unlike outdated bridges that rely on closed liquidity pools, Across uses relayers that ensure instant execution, enabling seamless, uninterrupted transfers between networks.

In addition to relayers, the service provides secure escrow calculation and reduces slippage, which often occurs in traditional bridges.

The bridge is used by major DeFi applications such as Uniswap, OKX, MetaMask, and others.

Across Protocol supports transfers across 10+ blockchains, including Arbitrum, Base, HyperLiquid, and more. Over 50 tokens are available for swapping. Its fees are flexible and depend on network load. These variable fees can significantly affect profitability, especially with large volumes. And while relayers improve speed, insufficient liquidity may cause transaction delays.

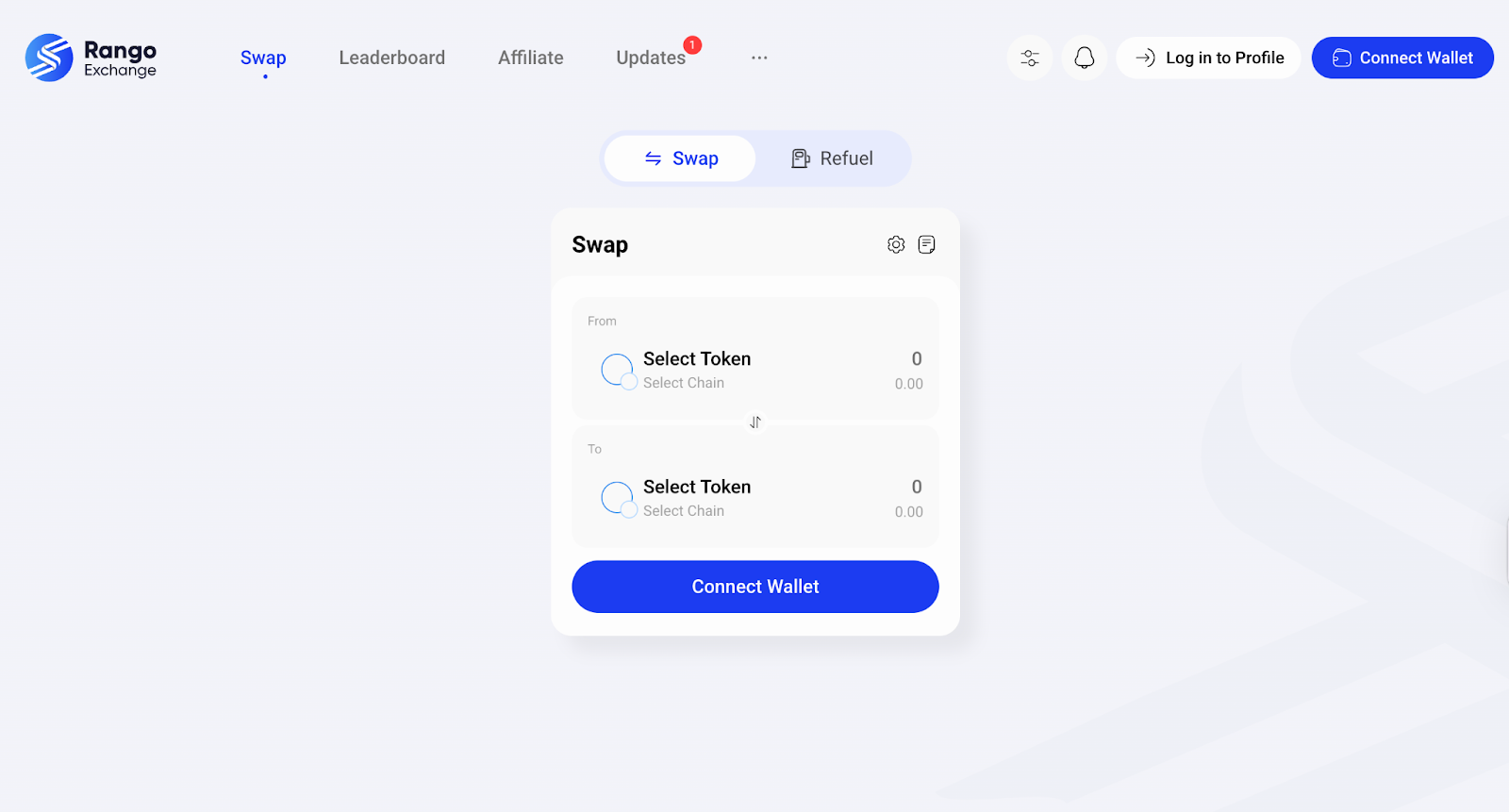

#4 Rango Exchange

Rango Exchange is an aggregator of bridges and DEXs that builds a route across multiple networks and protocols, finding the safest, fastest, and most cost-efficient path.

The platform supports more than 70 blockchains, including EVM chains, Solana, Bitcoin, StarkNet, and others; over 100 DEXs; and 24 bridges. Monthly trading volume exceeds $3.7 billion.

Its path-finding mechanism eliminates slippage and increases transfer efficiency. This technology is used by major wallets like Trust Wallet, Binance Web3 Wallet, and others.

Rango Exchange has audited smart contracts and adheres to strict security standards.

However, during high activity periods, transfer times may increase substantially, reaching several minutes. For arbitrageurs, such delays can be critical. And if the route is long with multiple network and asset changes, you may need to complete additional steps manually, requiring extra time and fees.

It’s important to understand that this is an aggregator, not a standalone bridge. Therefore, fees and risks depend on the chosen bridge. Sometimes these routes end up more expensive than a direct bridge.

Comparison Table

|

Defiway |

Stargate |

Across Protocol |

Rango Exchange |

|

|

Fees |

Fixed, 0.2% |

Flexible 0.06% + gas |

Flexible 0.1% per swap, may increase under load |

Depends on route and bridge |

|

Daily volume |

$4М |

$3.1М |

$650М (high due to integrated DeFi apps) |

$124М |

|

Supported networks |

13 |

20 |

19 |

77 (bridge aggregator) |

|

Transaction speed |

Under 1 minute |

2-6 minutes |

1-2 minutes |

Depends on route and bridge |

|

Our rating |

9.5/10 |

8.5/10 |

8/10 |

8/10 |

Summary

Your choice of bridge depends on your goals: which networks you use most often and how important transfer speed is for you. All listed bridges perform the same basic function — transferring tokens between blockchains — but each does it differently.

Defiway is suitable as a universal bridge and the best choice for arbitrage traders thanks to its fixed fees and good speed. You can always calculate costs and potential profit in advance. If you make transfers frequently, the speed and low fee of this bridge will give you an edge over other traders.

Stargate is a good option if you transfer tokens within the EVM ecosystem. The platform has high TVL and good liquidity, but the fee is hard to predict, and speed may suffer during high load. Since predictable fees are essential in arbitrage, fixed-fee solutions may be better.

Across Protocol is an excellent bridge if you're transferring tokens between L2 blockchains. For this purpose, it’s the fastest option.

Rango Exchange can be used for complex routes and non-standard transfers. However, due to the large number of bridges, networks, and DEXs involved, transfers become less predictable. You may not always know which bridges your transaction will pass through or what the fees and speeds will be.

Always compare different bridges and choose the ones you like best — including by interface and personal convenience. Save your favorite tools to bookmarks for quick access. And we wish you fast and cost-efficient swaps!

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.