Jupiter (JUP) Price Prediction 2024-2030: Complete Analysis

with ArbitrageScanner!

Jupiter (JUP) Price Forecast 2024-2030: Full Analysis

Jupiter is a protocol on the Solana blockchain that acts as a liquidity aggregator that today closely competes with the segment leaders in terms of TVL (total blocked value). The platform was launched back in 2021, but actively promoted in the market only in 2023.

What this platform has attracted the attention of the market and how much the JUP token will cost in the near future - we will analyze in this article.

General information about Jupiter

Jupiter performs the function of any DEX-exchange, but on a larger scale: more than 500 tokens are available for exchange on the platform. In addition, there is an opportunity to place limit orders, average purchase of tokens in a specified period of time, and trading with leverage up to 100x is available.

The developers of the project wished to remain anonymous, which is extremely strange. Although the times of ICOs have passed, where the identity of the project team, which collected money, was not necessary to specify, but as we can see - Jupiter is popular.

Tokenomics of the project

The JUP cryptocurrency was created to support community activity and promote a platform that aims to launch a new wave of growth and innovation in decentralized finance (DeFi). The total number of tokens issued is 10 billion JUP. Currently, only 13% of this volume is in circulation. The structure of token distribution is as follows:

-

The developers of the Jupiter project received 20%;

-

The Strategic Reserves Fund holds another 20%;

-

10% of tokens are reserved for liquidity;

-

Airdrop has been allocated 40%;

-

10% is set aside for grants for the Jupiter aggregator.

According to the project founder, no more than 10% of the liquidity fund will be utilized in the first year. As for the share allocated to the development team, these funds will start flowing into their wallets only a year after the launch, and in small monthly payments over two years. In addition, the remaining 20% of the strategic reserve will be used to attract new specialists to the team and cooperate with strategic partners.

What are the reasons for the growth of the JUP token?

Three main factors can be distinguished:

-

The Jupiter exchange has implemented almost all the mechanics to monetize it, namely exchange commissions, placing a grid of limit orders, futures contracts with leverage and an hourly fee, to hold a position;

-

JUP is a token on the Solana blockchain, from the decentralized finance (DeFi) sector. This direction on Solana continues to develop actively, closely approaching, and at some points even surpassing Ethereum. In this regard, we can assume that JUP will also be in demand among market participants, because among other things, the project has a working product;

-

In the official X account, many prominent investors and funds have signed up for Jupiter, which implies large early investments, although the exchange team did not provide any information on this.

Jupiter Airdrop

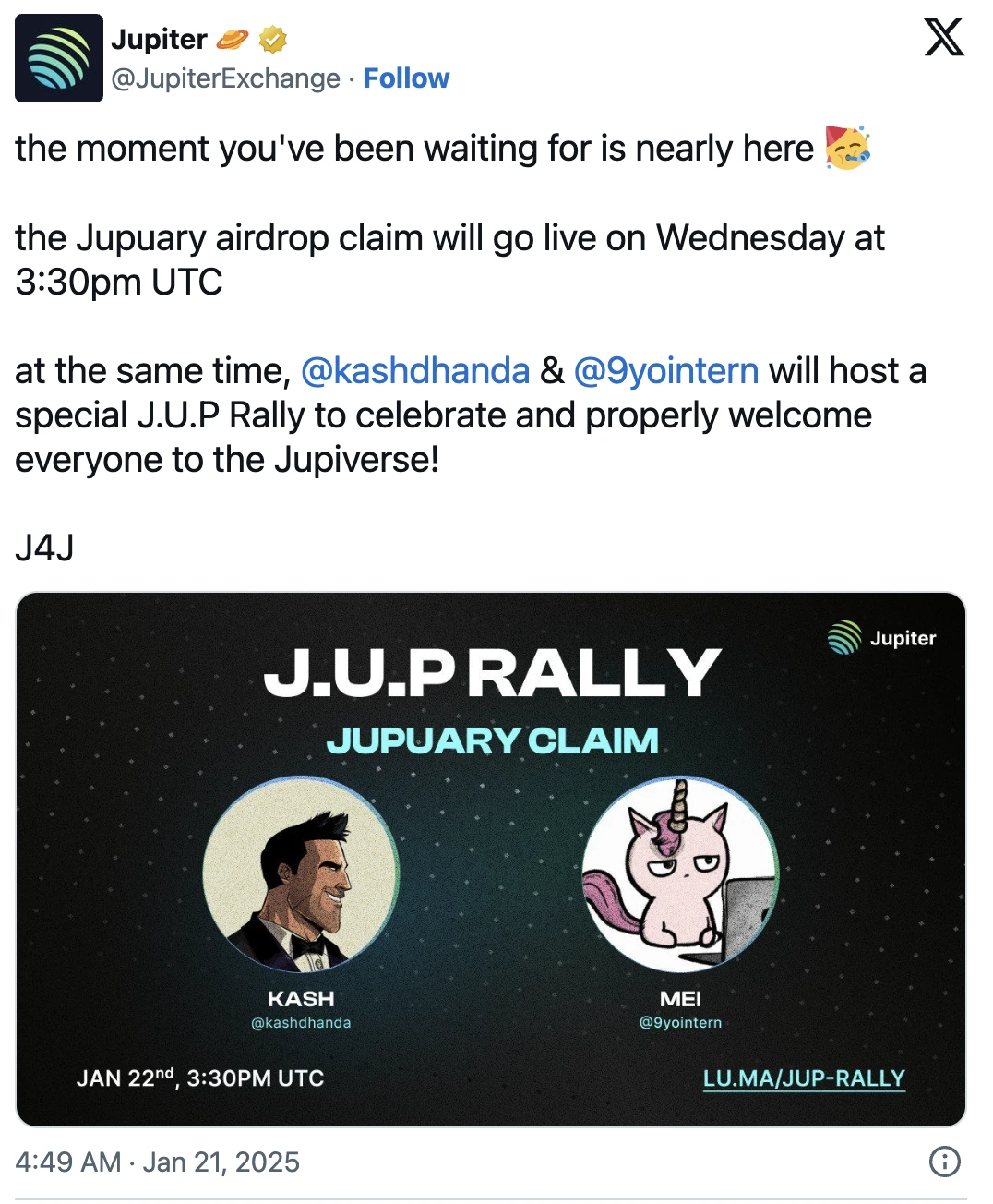

On January 22, 2025, the long-awaited JUP airdrop took place, during which the project team distributed tokens worth over $616 million. This milestone event was a key part of the annual Jupuary celebration organized by the Jupiter project.

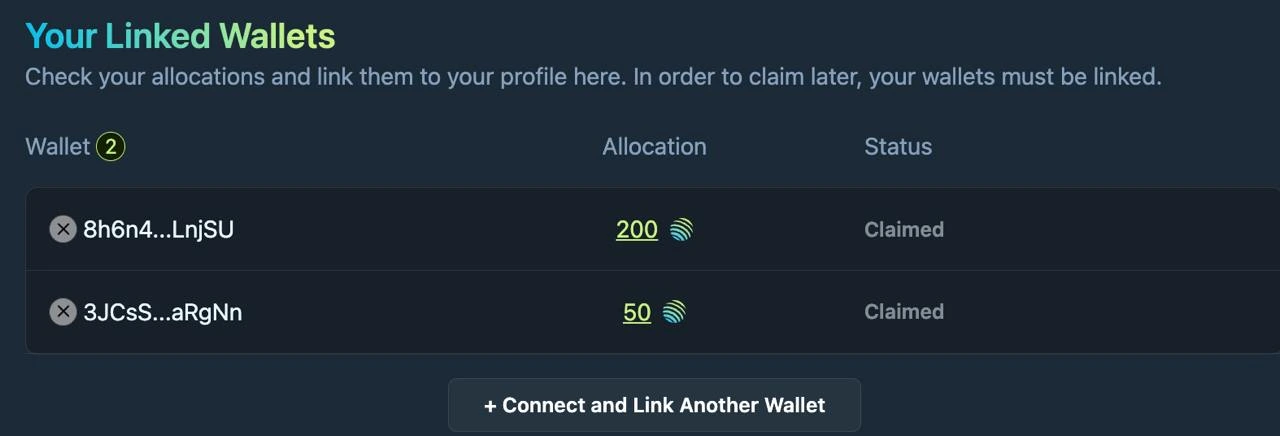

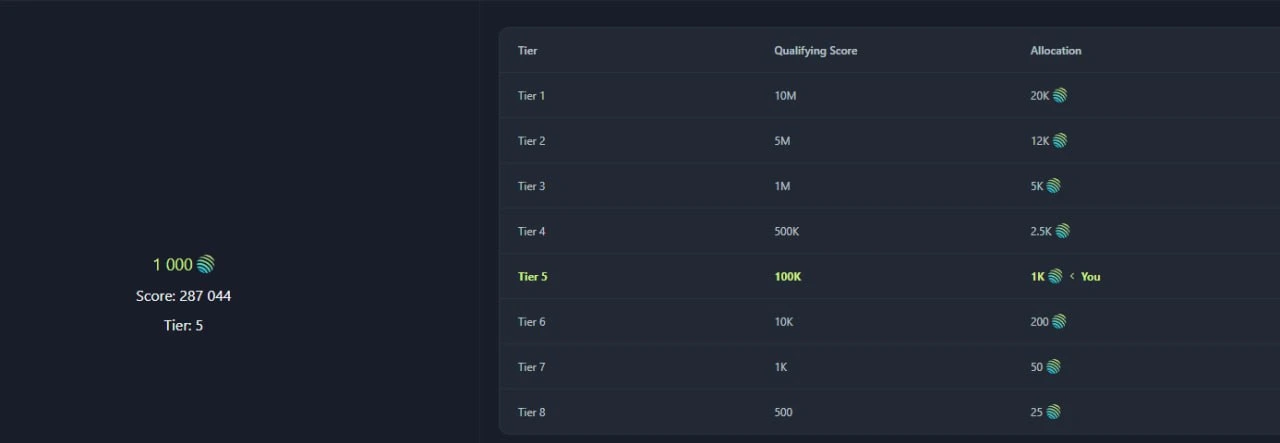

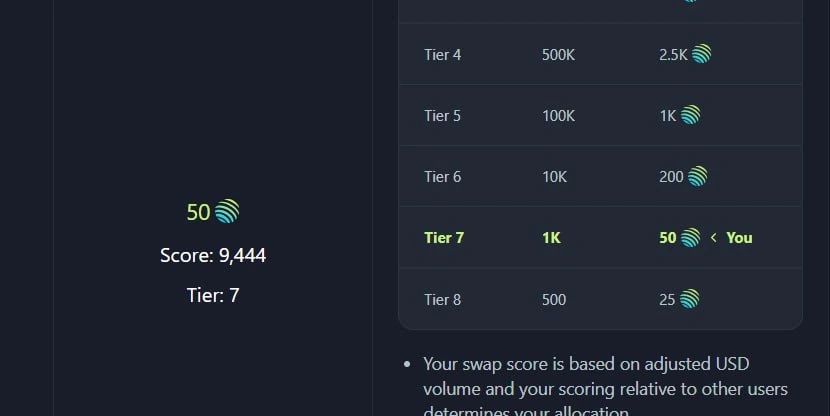

Our clients who arbitrage on DEX exchanges earned extra money on Jupiter airdrop. You can see the screenshots below:

Jupuary is an annual event organized by the Jupiter project to encourage community participants and boost their engagement with the ecosystem. The first event took place in January 2024, when 1 billion JUP tokens were distributed to over 1 million wallets. Jupuary celebrations will be held annually, with dates already confirmed for future years.

These airdrops are aimed at expanding the community and strengthening governance through the Jupiter DAO. Jupuary 2025 plans to distribute 700 million JUP tokens that will be sent to 2 million qualified wallets, demonstrating the project's commitment to its users and support for the DeFi sector.

The initiative aims to actively engage community participants and support the platform's growth through 2026, following the decisions made at the management vote in December.

JUP Price Forecast

The Jupiter (JUP) cryptocurrency price forecast for the period 2024-2030 is based on an analysis of current market trends, industry pointers as well as public expectations. The following shows the unfolding study along with the probable value spectra for each year.

2024

According to the monitors, in 2024 the price of JUP is able to change in a spectrum from $0.6759 to $1.32, with a median value of approximately $0.7268. This increase is determined by the projected increase in the number of users as well as the functionality of the platform.

2025

In 2025, a further increase in the value of JUP is expected. According to monitoring, the value is able to reach an estimate of $1.57 due to the increased interest of traders and the formation of the ecosystem of the project.

2026

Forecasts in 2026 imply that the value of JUP is able to reach a maximum of $1.75. But there are likely to be fluctuations due to bazaar circumstances as well as the unified state of the cryptocurrency market.

2027

In 2027, according to monitoring experts, the value of JUP is able to increase up to $13 by December. This kind of significant increase can be determined by the effective realization of the road game of cards plan as well as the expansion of partnerships.

2028

Projections for 2028 indicate a possible $20 price level. This could be due to further technology development and increased utilization of the Jupiter platform in various sectors.

2029

In 2029, the price is expected to correct to $15. This may be due to profit taking by investors after significant growth in previous years.

2030

By 2030, the JUP price is projected to recover and rise to $27.50. This may be due to further development of the project and its integration into new markets.

Conclusion

Jupiter (JUP) price forecasts in the period of 2024-2030 years indicate a possible increase in the value of the token. But the cryptocurrency market is known for its own volatility, and the practical values have all chances to differ significantly from the predicted ones. Traders are advised to carry out a thorough analysis and also take into account the possible dangers before making investment decisions. Also, do not forget that arbitrage can bring additional tokens to your portfolio.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.