KuCoin Exchange Review: Features, Fees & Trading Tools

with ArbitrageScanner!

KuCoin Exchange Overview: Features, Commissions and Trading Tools

The cryptocurrency industry does not need to be in a place, offering market participants the most advanced tools in order to extract income. Today there are a large number of cryptocurrency exchanges, which, according to their essence, are similar, but have several differences from each other. Some work in specific jurisdictions, others offer rare trading instruments.

Among the many new platforms KuCoin is emphasized as a serious competitor. Since its launch in 2017, the exchange has quickly attracted the world's interest in the cryptocurrency sector, offering a wide range of services and features specialized for traders as well as investors. Today KuCoin takes the 6th place in the ranking of cryptocurrency exchanges.

In this article I will tell you about KuCoin's trading capabilities, security, provided instruments and much more.

Platform analysis

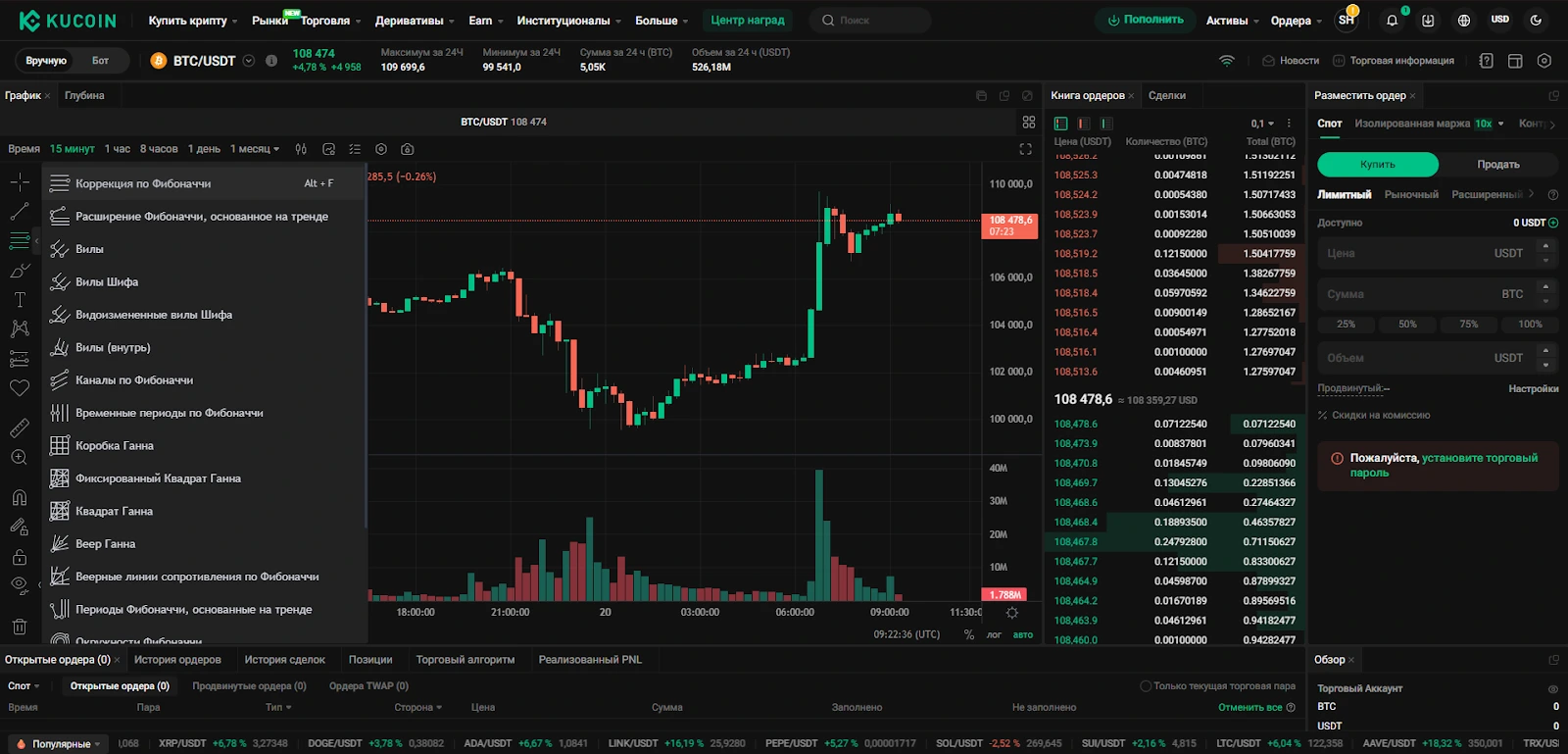

Features of the user interface

KuCoin's interface is intuitive for those who are new to crypto trading, which makes the exchange very tempting for newcomers to the industry. Here you will find informative charts along with a lot of indicators, which will allow you to notice all the necessary information to open a deal:

All the necessary information is concentrated in the “header” of the site:

-

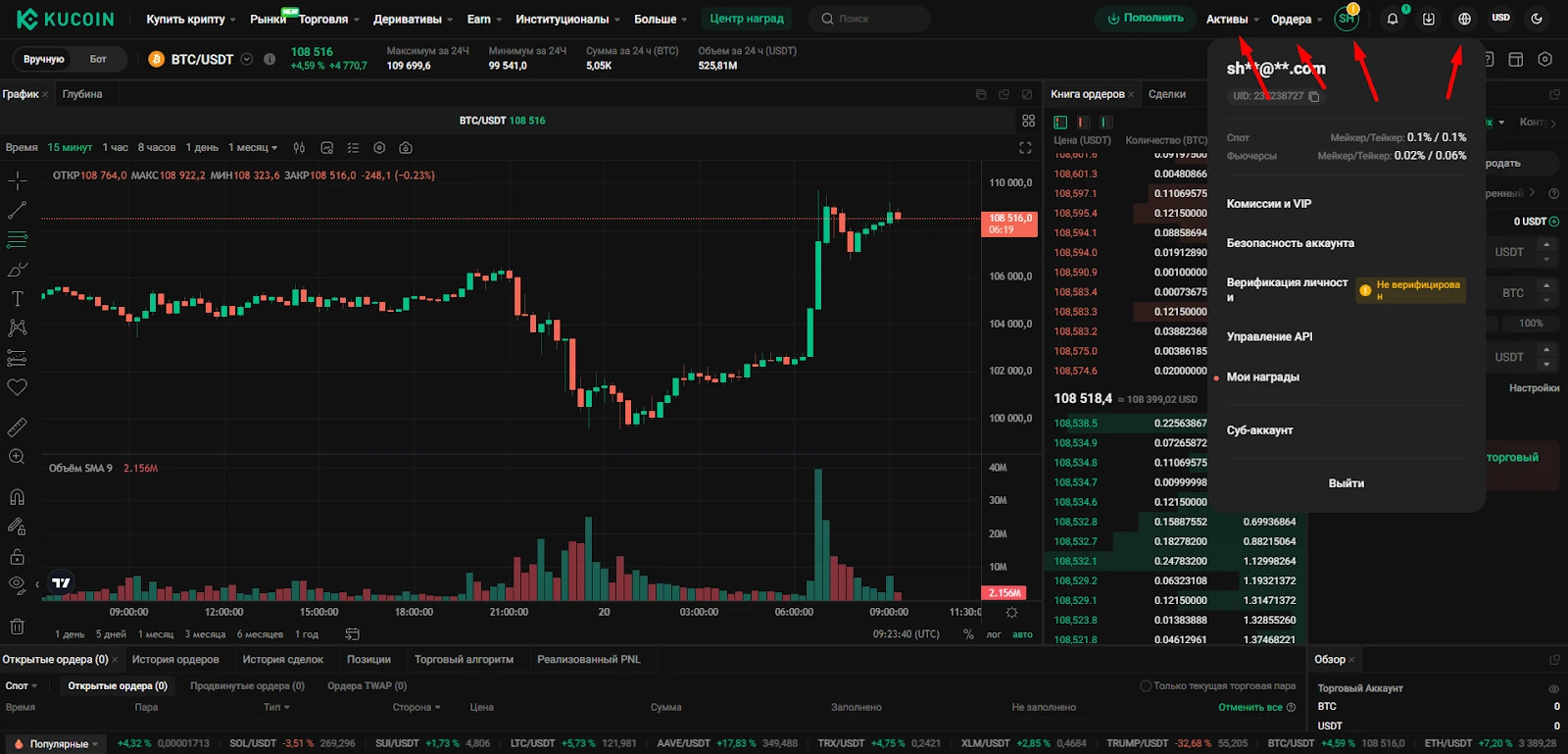

By hovering the cursor over your personal cabinet you can go to commissions, verification, security, API and so on;

-

You can also immediately check your assets and open orders;

-

By clicking on the globe you can change the language to any of the 23 offered.

Trading Environment

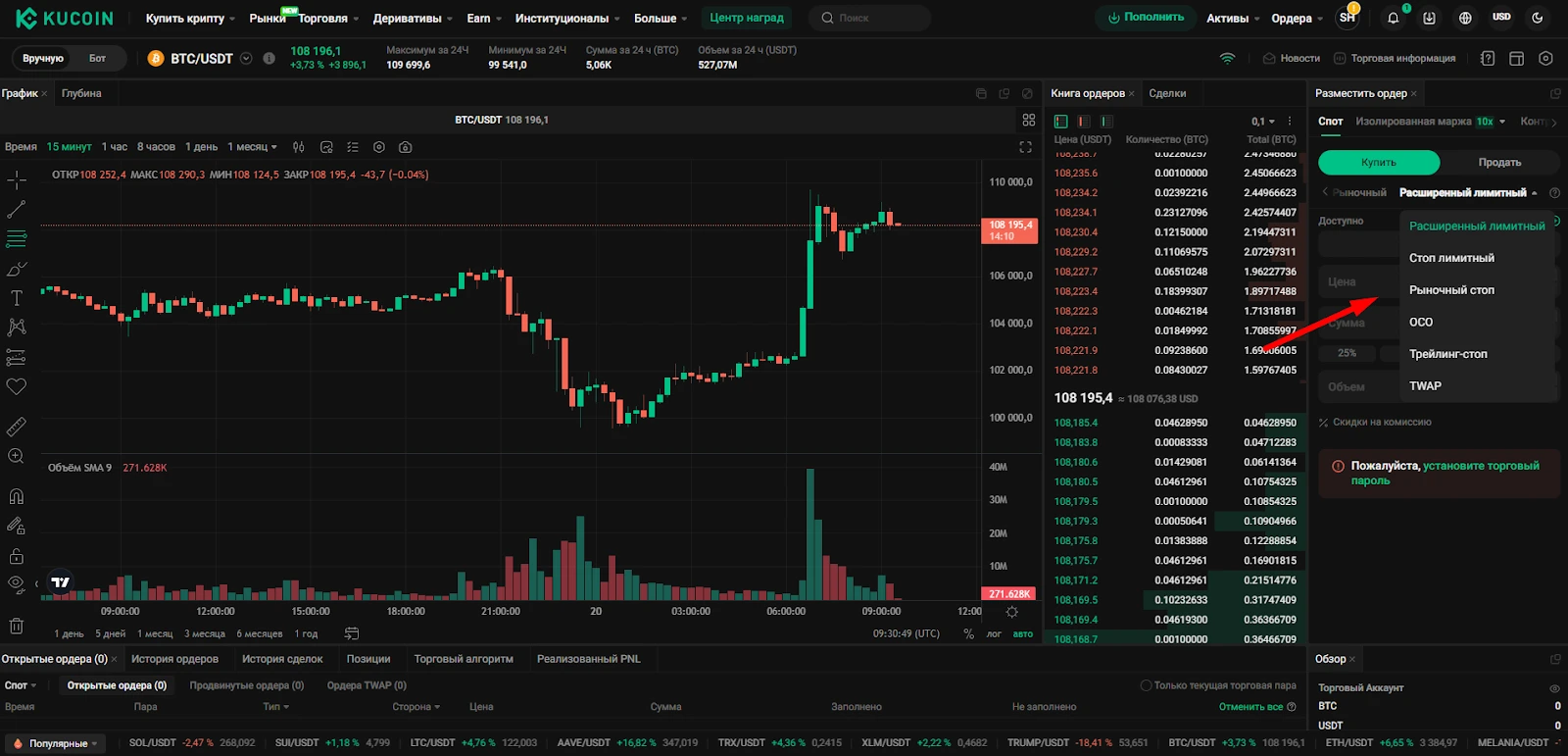

For comfortable trading, the exchange has implemented many orders, among which we can highlight:

-

Market - buy cryptocurrency at the average market price;

-

Limit - to set a price at which the cryptocurrency will be bought automatically;

-

Advanced limit orders offer additional execution conditions compared to regular limit orders, including Post Only, Fill or Kill (FOK) and Immediate or Cancel (IOC). A Post Only order, also known as a maker's order, is designed to ensure that a commission is charged at the maker's commission rate and to prevent instant execution in the market. If there is a corresponding opposite order in the market, it will be canceled;

-

A stop loss order involves pre-setting the trigger price and the order price. When the last price reaches the trigger price, the order is automatically placed based on the previously set price and quantity;

-

A market stop-loss order means that you do not set a specific order price, but only specify the trigger price and the quantity or amount of the order. When the last price reaches the trigger price, the order is quickly executed at the best available market price;

-

OCO orders include a limit order and a stop-loss order. When one of the orders triggers, the other is automatically canceled. If you manually cancel one of the orders, the second order will also be canceled;

-

You can set both an activation price and a trailing delta. When the market price fulfills both conditions, the limit order is triggered. By tracking a buy order, you will be able to buy at the right time, for example, when a downtrend ends and an uptrend begins. By tracking a sell order, you will be able to sell at the right time, for example, when a downtrend ends and a downtrend begins.

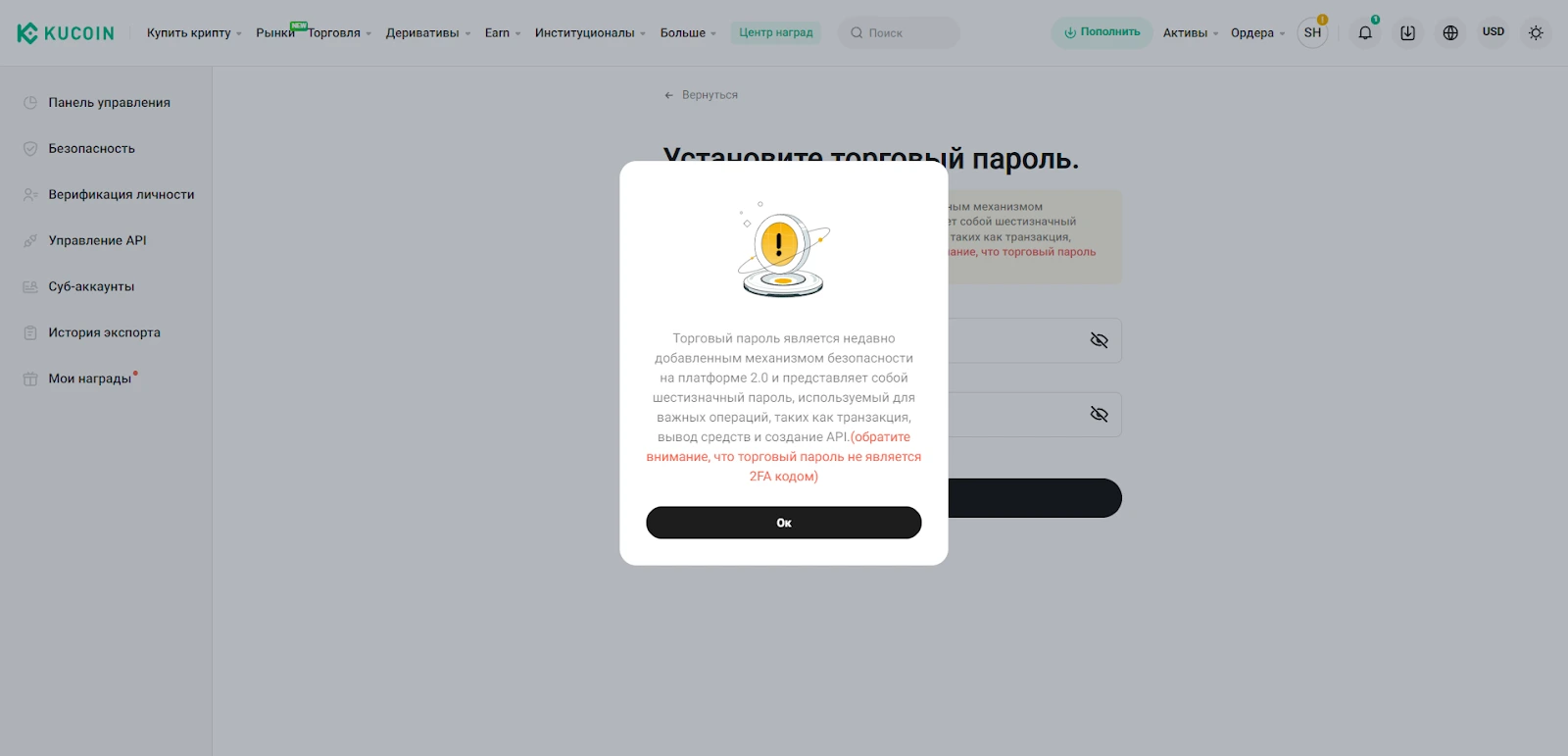

In order to use advanced orders, you will need to set up a trading password.

According to the assurance of the representatives of the exchange, this was done to increase security.

Customization options

KuCoin allows customizing the trading interface to suit individual needs. Users can choose between light and dark themes, change chart reflection characteristics, customize trading pair filters and select favorites.

Accessibility on mobile devices

The exchange has a mobile app, allowing its users to start trading at any time.

As for the mobile application: it is impossible to distinguish it from other exchanges, as nowadays all cryptocurrency platforms make similar applications. KuCoin has an ordinary, stable application with full functionality - there is nothing more to say about it.

Trading performance

-

The exchange offers 894 cryptocurrencies and more than 1,500 trading pairs;

-

KuCoin tries to keep up with its competitors, so it always adds new cryptocurrencies that are interesting to users in a timely manner;

-

The trading volume on the exchange exceeds $4.5 billion per day;

-

As of the beginning of 2025, the exchange has a reliability index of 10/10, and the exchange reserves are 100% confirmed and amount to $3.167 billion.

Cost analysis

Trading fees

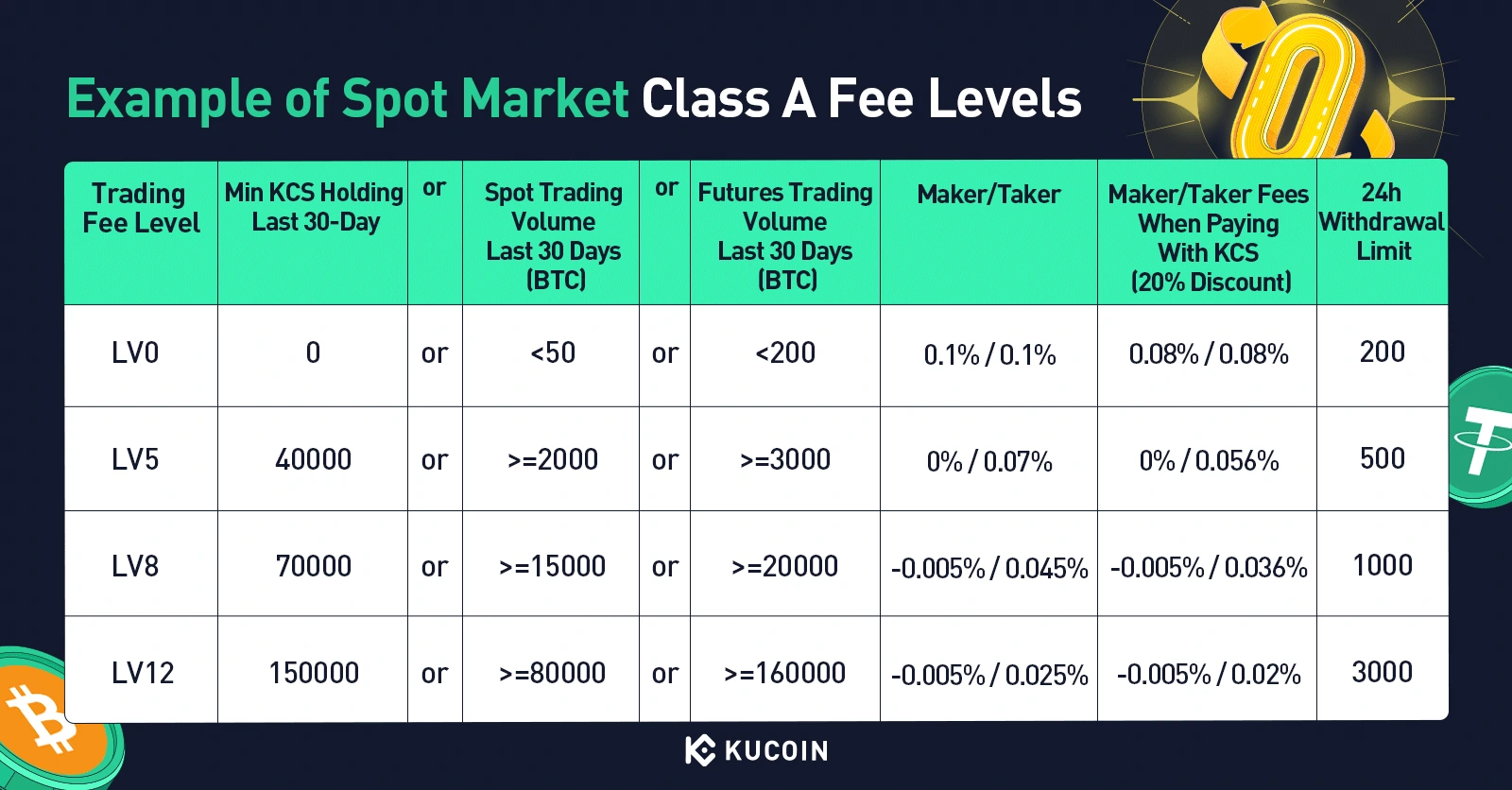

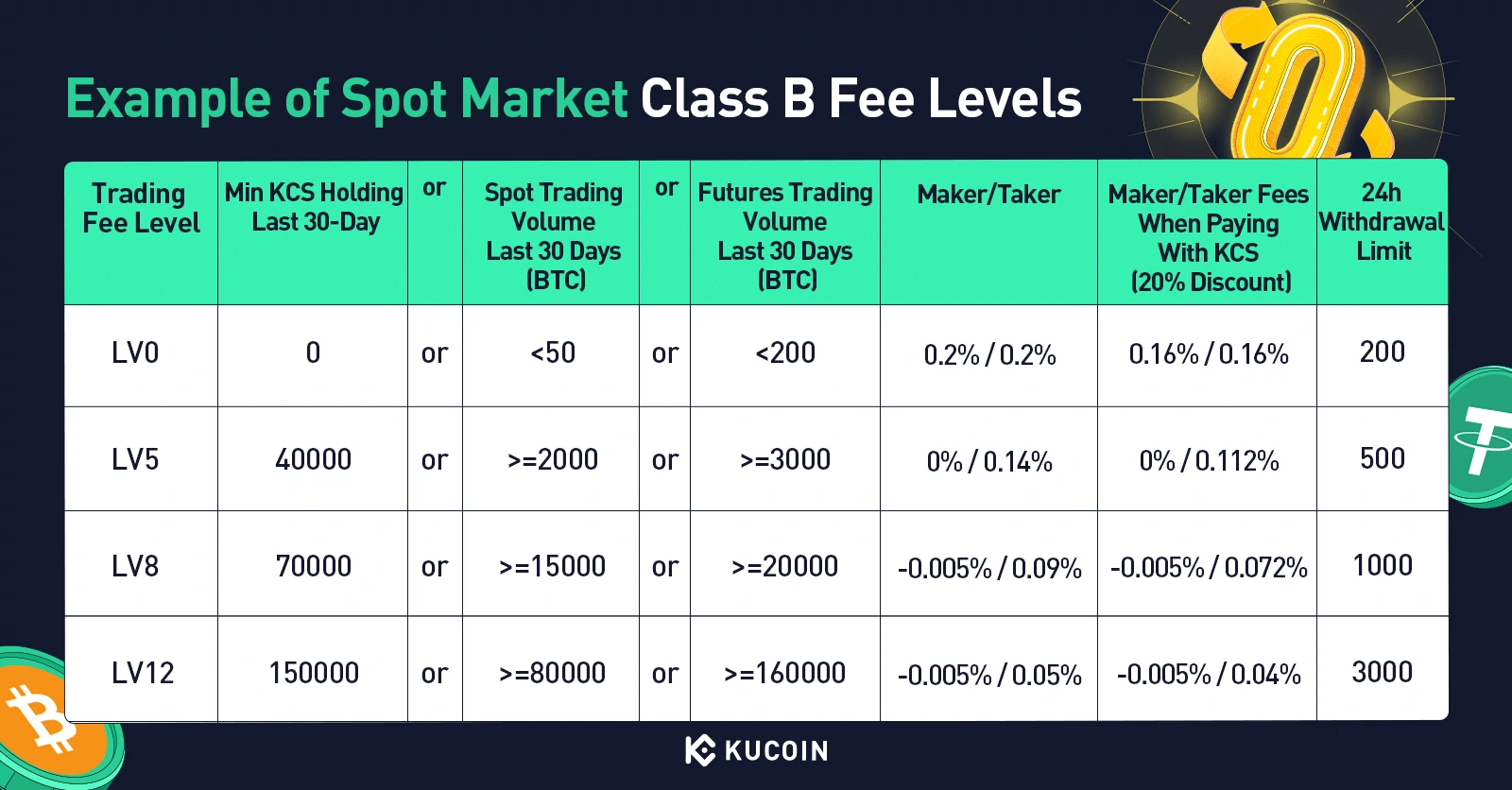

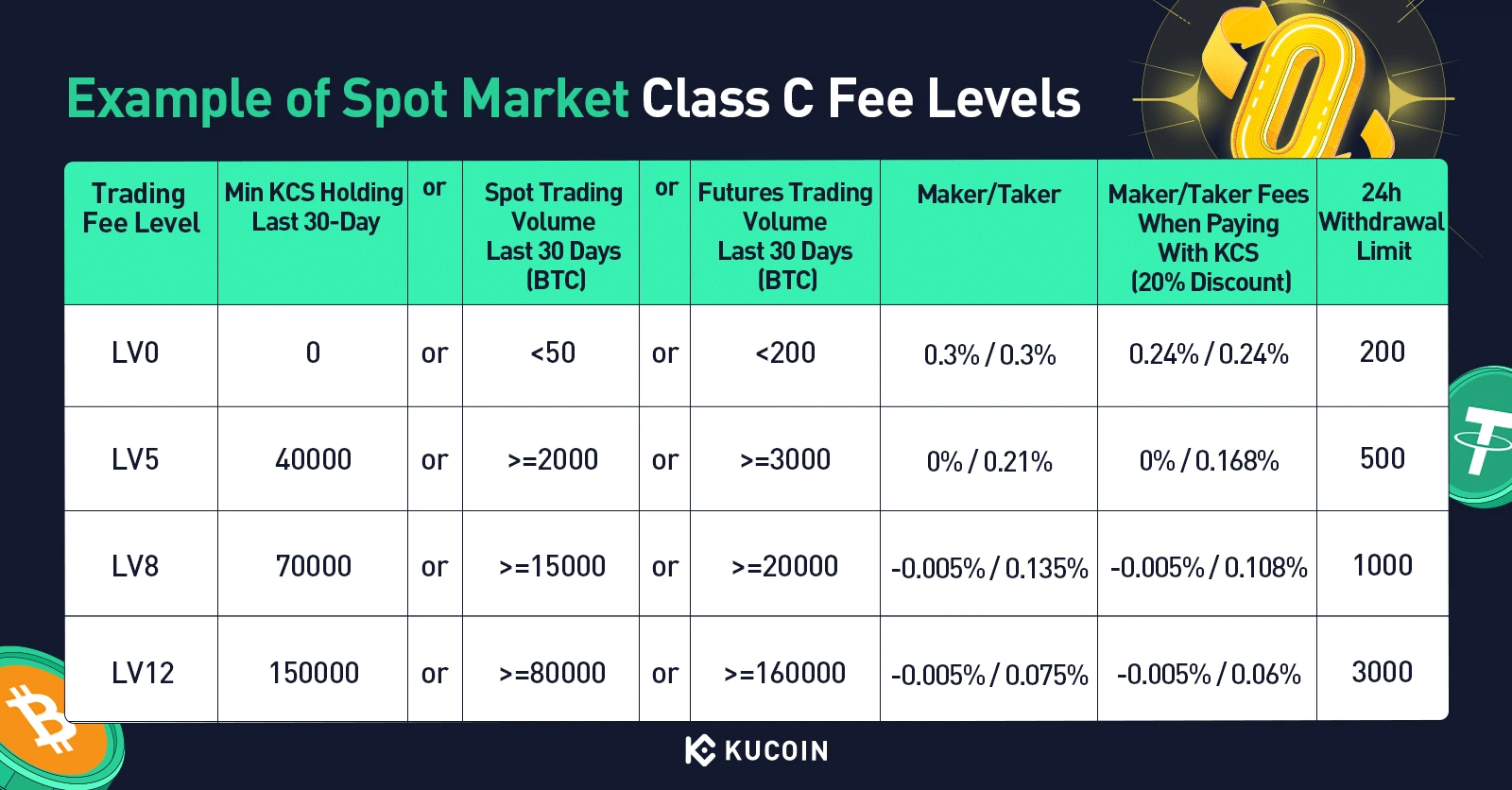

Cryptocurrencies are categorized into three classes (Class A, Class B and Group C) due to trading volume as well as some other factors. Compared to the more trading volume, along with the lesser commission and also vice versa.

Example of commission levels in the spot market for Class A:

An example of spot market commission levels for Class B:

An example of spot market commission levels for Class C:

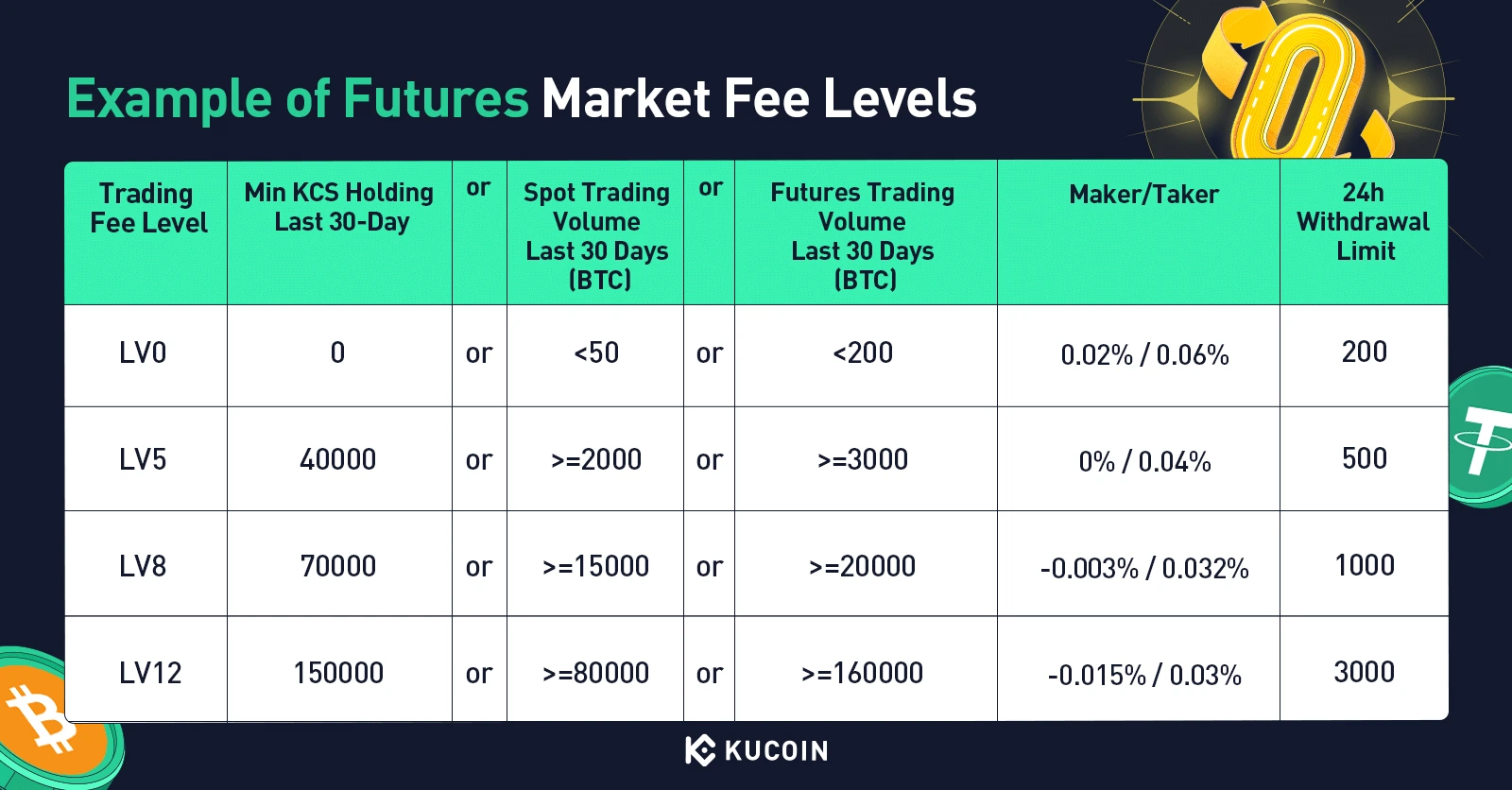

If you trade futures, however, this is where all cryptocurrencies are categorized as Class A:

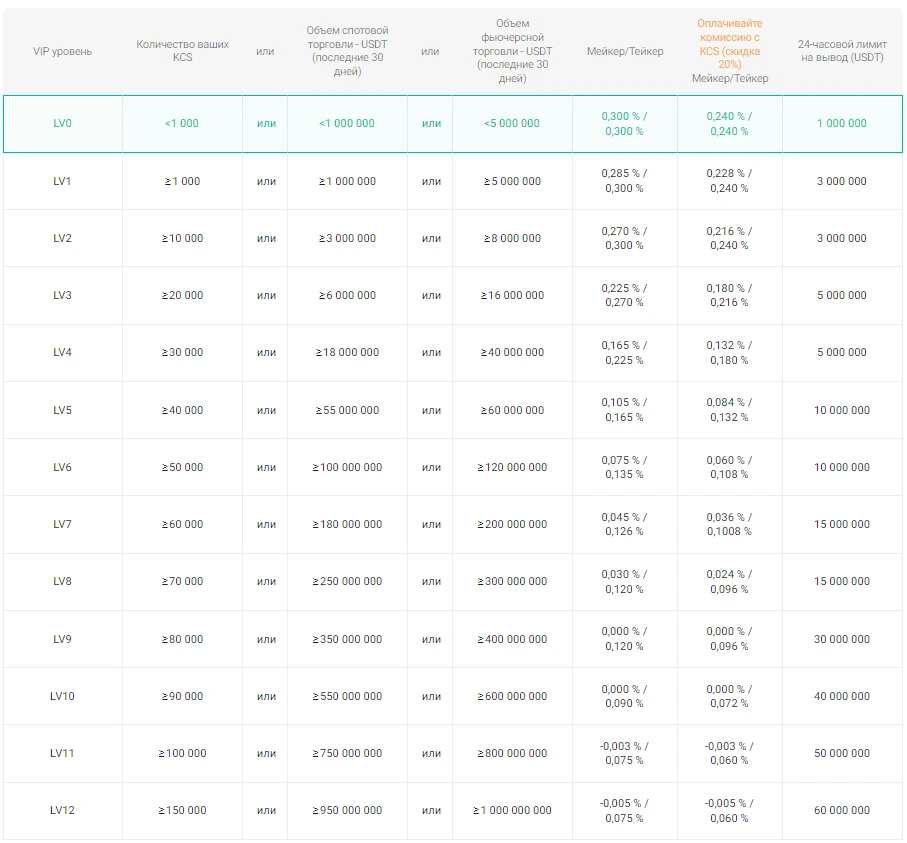

VIP levels

There are VIP levels on KuCoin, which can be opened when all regular levels are reached. You can increase VIP by one of three indicators:

-

Number of KCS (native exchange token) in your account;

-

Spot trading volume;

-

Futures trading volume.

The table below shows which metrics are required for VIP levels:

Withdrawal fees

KuCoin does not charge a deposit fee, which makes it extremely convenient to start trading. On the other hand, the withdrawal fees are different for different cryptocurrencies. The reason for this is that with different cryptocurrencies different commissions due to withdrawal of money, is the special commission required in order to send the transaction to the right address.

For example, KuCoin charges a 0.0005 BTC fee for withdrawing BTC from KuCoin. Before making a withdrawal, be sure to review these fees together to ensure the best cost management.

Benefits of KCS Token

KuCoin Token (KCS) is a native token of the KuCoin exchange launched in 2017. It serves as a profit-sharing tool, allowing traders to benefit from the exchange's activities.

Benefits of owning KCS:

-

Earnings from steaking. Users can steak KCS on the KuCoin Earn platform without having to use an onchain wallet or pay gas commissions. Earnings are collectively distributed;

-

Participation in new tokens. KCS holders benefit from KuCoin Spotlight events and can use KCS to purchase new coins. In addition, KCS can be used to participate in BurningDrop staking events, where burned KCS accelerate mining;

-

VIP benefits and commission discounts. The VIP level depends on the amount of KCS stored and staked. Each level provides different benefits including special discounts on trading commissions;

-

Cashback on KCS redemption. Regular KuCard users receive 1.2% cashback on KCS redemption, while holders of more than 100 KCS receive 1.7% cashback.

Security infrastructure

Security measures

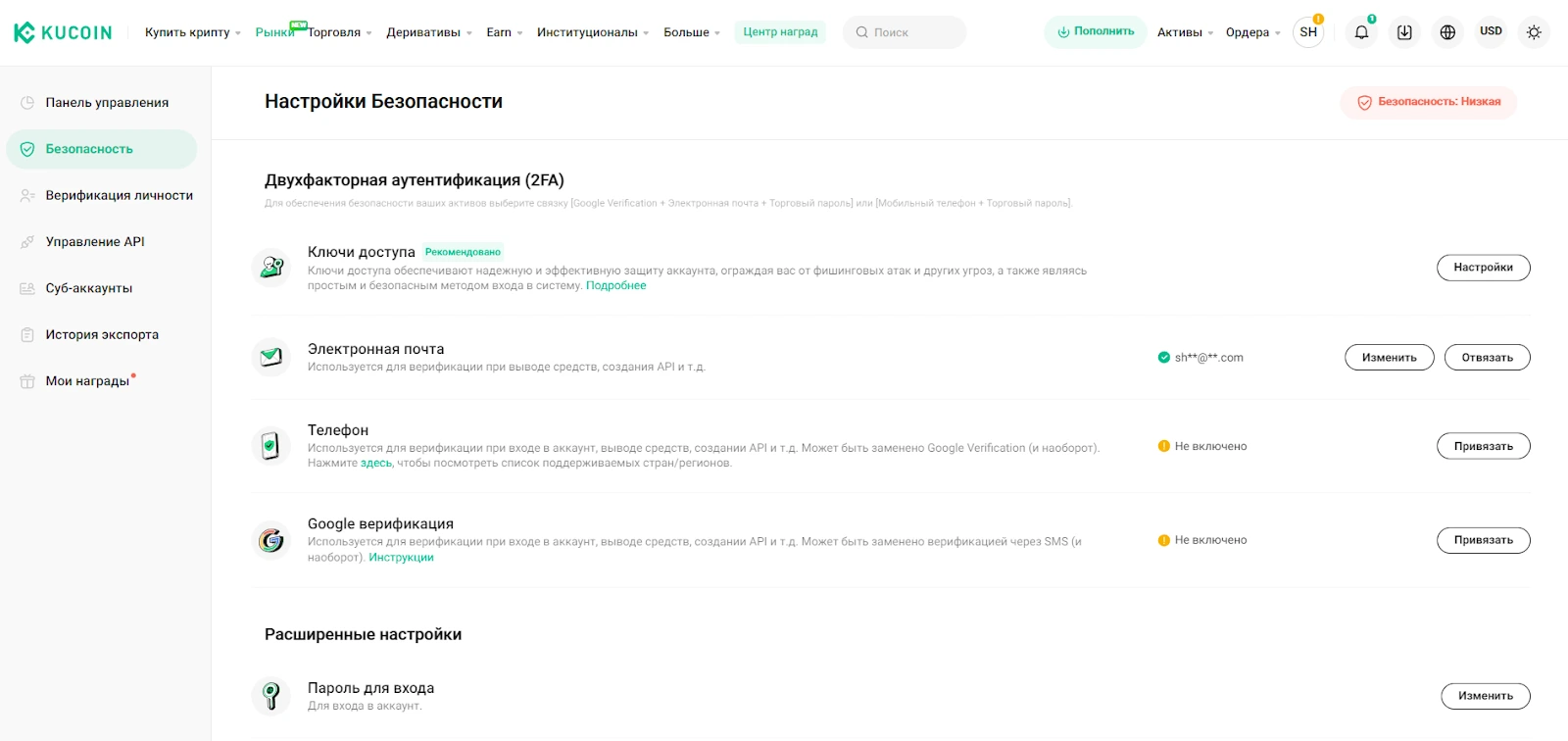

KuCoin users can take the following security measures on their own:

-

Access keys. Provide reliable and effective protection of the account, shielding you from phishing attacks and other threats, as well as being a simple and secure method of logging in;

-

Email confirmation is used to log in to the account, withdraw funds, create APIs, and you can also connect your phone;

-

Google verification. It can be replaced by SMS confirmation, but it is better to include both solutions;

-

There is also a possibility to set up a trading password, which will also be needed when making a lot of transactions on KuCoin;

-

White list of withdrawal addresses - you can withdraw funds only from approved addresses.

-

Anti-phishing code can be set up for logging in and withdrawing funds.

The KuCoin exchange offers all possible methods of personal account protection, which the user can activate independently.

Encryption protocols

All user data and transactions on the KuCoin platform are carefully encrypted using modern SSL (Secure Sockets Layer) protocols, which ensures the highest level of information protection. SSL encryption creates a secure communication channel between the user and the exchange servers, preventing the possibility of interception or unauthorized access to transmitted data. This is especially important when dealing with financial transactions, as it guarantees the confidentiality of personal information such as logins, passwords, account details and transaction details.

With growing cyber threats and increasing hacker attacks, the use of SSL encryption is a critical element of KuCoin's security infrastructure. This allows the exchange to maintain a high level of trust from users and meet international data protection standards. Thanks to such measures, KuCoin continues to be one of the most reliable and secure cryptocurrency trading platforms.

Asset protection

The Exchange assures that the majority of users' funds are on multisig wallets: in order to withdraw funds from such wallets, at least 2 access keys are required. When creating a multisig wallet, you can set up as many as 10 access keys; if you lack at least 1, it will be impossible to withdraw funds.

This approach multiplies the protection of user funds, so if KuCoin has really implemented such measures, it significantly reduces the risk of hacking.

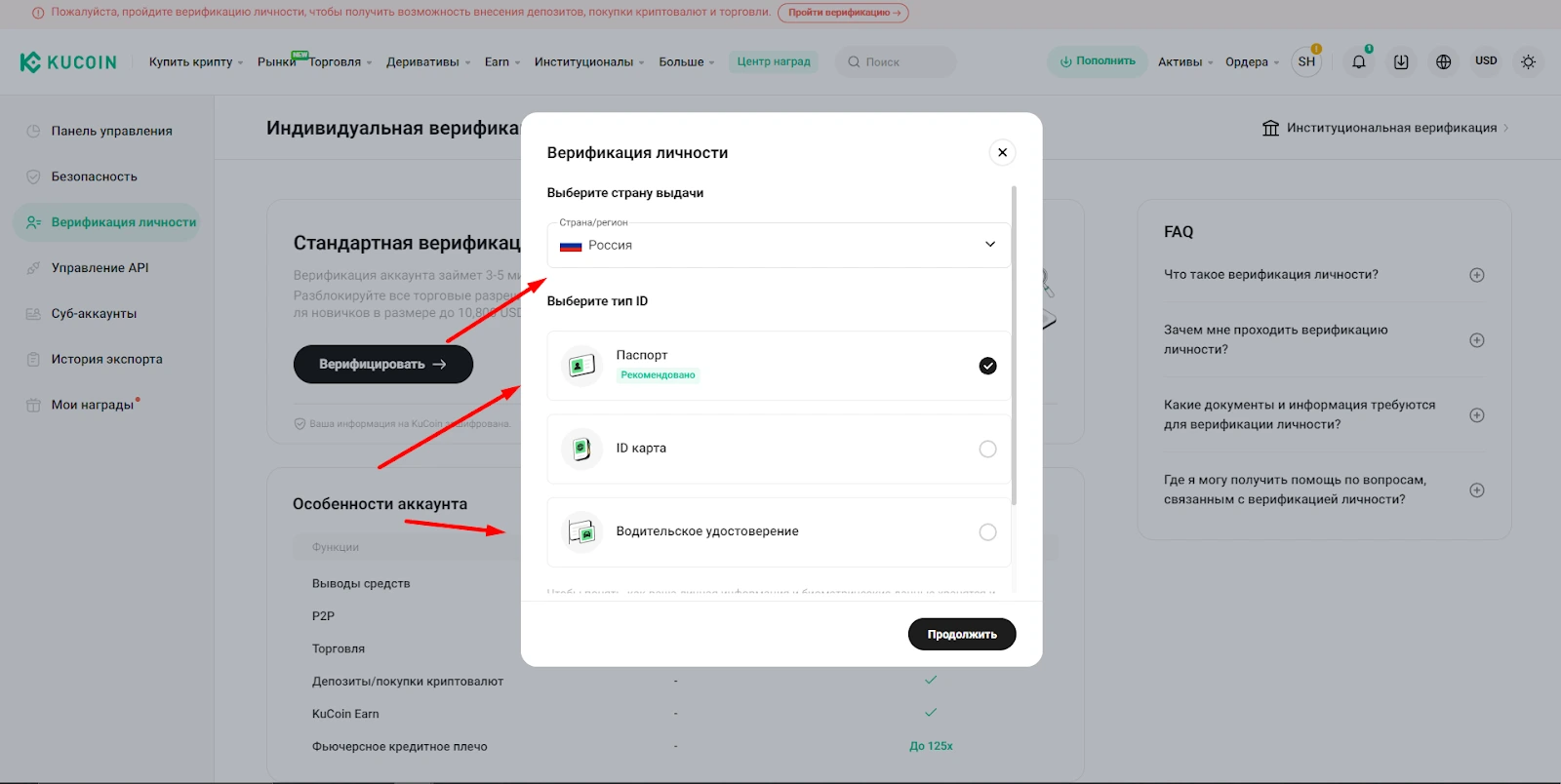

KYC requirements

KuCoin does not provide its services to non-verified users, i.e. you will be able to register on the exchange, but you will not be able to trade or make a deposit in fiat without verifying your identity.

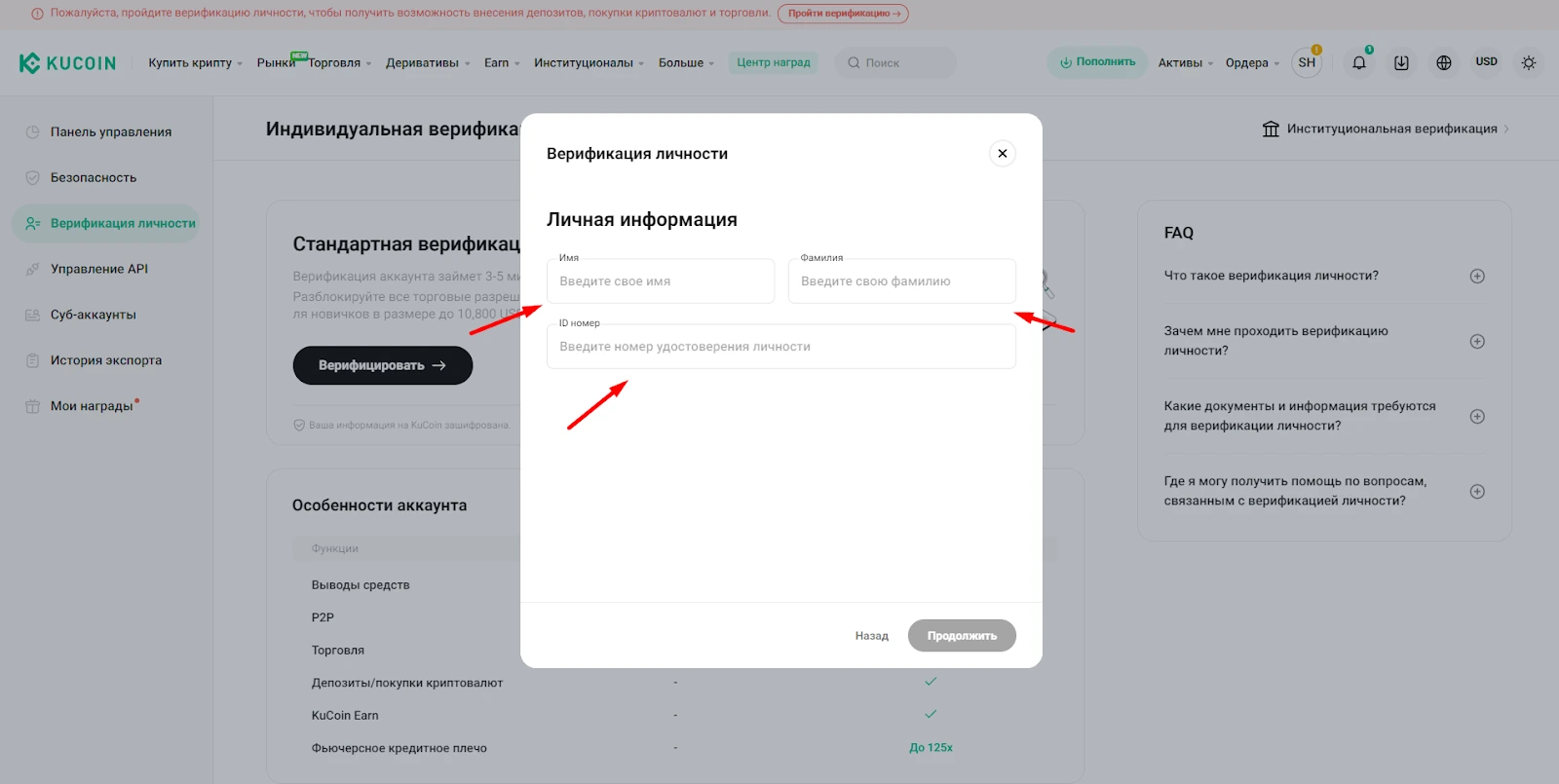

To confirm your identity, you need to click on “Identity Verification” in your personal cabinet, after which you will see the following window:

Select:

-

Country of residence;

-

Identity document. By default it is a passport, but you can also use a driver's license.

Click “Continue” and fill in the required data - first name, last name, document number:

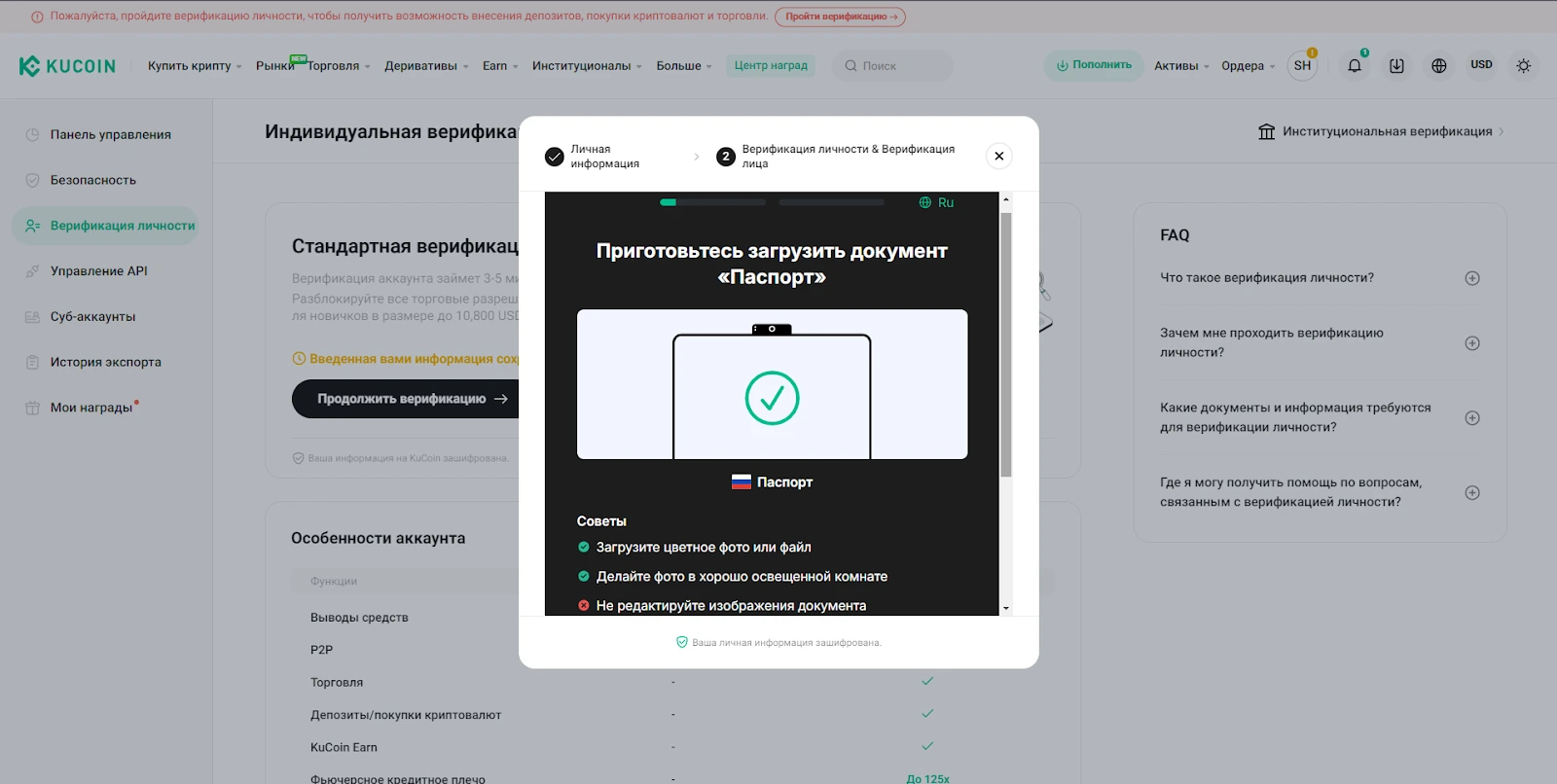

Next, the system will ask you to upload a “Passport” document - a photo or scan of your passport.

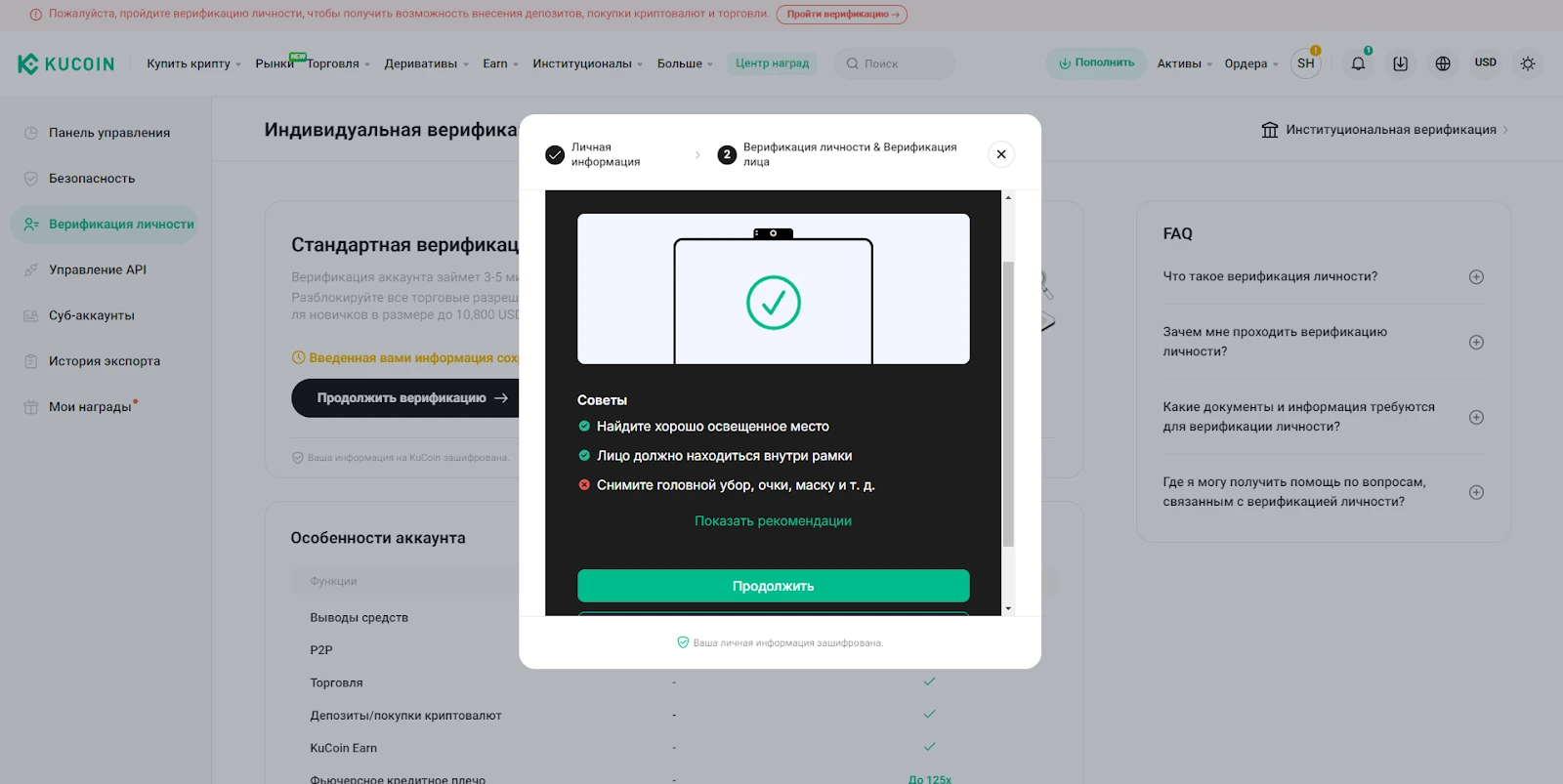

The next step is the identification of the person, so that the market can check whether your act has really been piled on you. This can be done through a smartphone with KuCoin or through a PC with a camera.

Next, the system will ask you to upload a “Passport” document - a photo or scan of your passport.

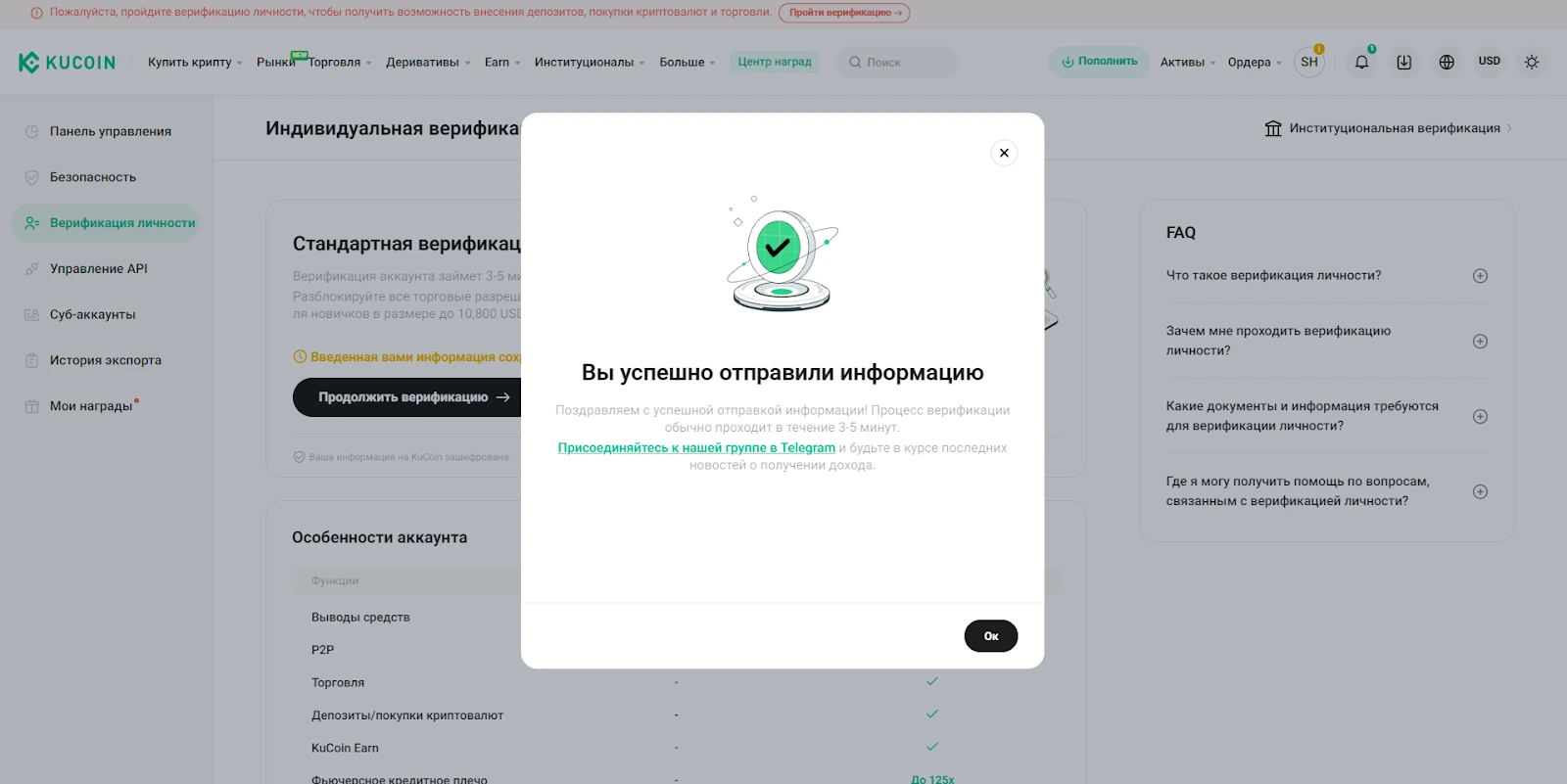

The user will now have access to:

-

Spot trading;

-

Futures trading;

-

Fiat currency deposit;

-

P2P exchange;

-

Other financial products of the exchange.

Geographical availability

Restrictions for US users

The lack of a KuCoin license in the US means that only many services are available. Investors from the US have all chances to open unverified accounts as well as manage the allocation to sell cryptocurrencies, manage existing trades, cover futures as well as margin views, as well as pay ETFs as well as food products together with profitability. But cryptocurrency acquisition, steaking, spot trading activities, API services, derivatives, margin trading activities, plastic services as well as other basic functions are unattainable. Using a VPN to access these functions is dangerous and can also lead to account blocking.

Accessibility for international users

KuCoin operates in most countries of the world, providing services to users in more than 200 countries.

But in some countries access to the platform is limited due to regional regulatory generally recognized measures as well as international penalties. In particular, the limits apply to users from the United States, mainland China, Hong Kong, Singapore, Thailand, Malaysia and Ontario, Canada.

A whole list of features is available for Russians in KuCoin, including KYC verification.

Regulatory Compliance

It has not been noticed that the market does not comply with the regulatory conditions of some countries. A sample of this - residents of the U.S., which is a very limited list of opportunities for the site.

Legal proceedings

On March 26, 2024, the U.S. authorities accused KuCoin and its founders of violating laws on the war on money laundering and also of conducting business according to the transfer of funds in the absence of a license. The company did not confirm or deny these accusations.

In 2023, KuCoin faced a lawsuit in New York for operating without proper registration and later agreed to block users from New York and pay $22 million in compensation.

Since 2020, KuCoin has not been seriously hacked in any way: at this time, the exchange's hot wallet was hacked and hackers stole $280 million in cryptocurrency.

Automated trading functions

Built-in trading bots

KuCoin trading bot is a free tool designed to automate trading processes and optimize strategies on the cryptocurrency market. It allows users to save time and effort by providing the ability to trade around the clock without constant market monitoring.

The main strategies of the KuCoin trading bot:

-

Classic Grid. The strategy is aimed at profiting from market fluctuations by placing buy and sell orders in a certain price range. The bot buys assets at a lower price and sells at a higher price, capitalizing on market volatility;

-

DCA (Dollar Cost Averaging). DCA allows you to invest fixed amounts in a selected asset at regular intervals, regardless of its current price. This helps to reduce the impact of volatility and mitigate the risks associated with lump sum large investments;

-

Smart Rebalance. Maintains a set ratio of different cryptocurrencies in the portfolio. The bot automatically rebalances the portfolio by selling assets with excessive growth and buying those whose share has decreased, maintaining optimal allocation and reducing risk;

-

AI Spot Trend. Using artificial intelligence algorithms, a bot analyzes market trends and executes trades based on predicted price movements. This strategy is particularly effective in rising markets, helping users maximize profits.

Integration with third-party services

Many automated trading services support KuCoin exchange, among them: 3Commas, Cryptohopper, RevenueBot. However, these are the same trading bots provided by the exchange, so whether it makes sense to connect some service is a matter for everyone.

In addition, third-party services are connected using API, and although the security of the exchange is at a high level, hackers can still steal your funds in this way. Therefore, we would recommend using KuCoin tools rather than connecting third-party services via API.

Conclusion

Despite strong security measures, KuCoin lacks basic licenses from regulators in key cryptocurrency hubs. The lack of licenses is a significant disadvantage for users who favor regulated platforms.

However, leaving this point aside, KuCoin is quite a good exchange that offers plenty of trading and investment tools, progressive trading commissions and regularly adds new trading pairs. In any case, KuCoin is definitely not worse than other exchanges in the top 10.

FAQ

How does KuCoin's commission structure compare to other major exchanges?

KuCoin's commissions are lower than average due to KCS rebates, cryptocurrency rank tiers and VIP tier system.

What automated trading options are available for KuCoin users?

KuCoin offers built-in trading bots and support for third-party services for automation.

Can US residents safely trade on KuCoin without verification?

Officially, KuCoin is not available for US users, and trading via VPN can be risky.

How does KuCoin protect users' assets and keep the platform secure?

KuCoin uses cold wallets, data encryption and multi-factor authentication to protect assets, with a large variation of passwords and anti-phishing codes.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.