A Comprehensive Guide to Choosing a Cryptocurrency Exchange

with ArbitrageScanner!

A complete guide to choosing a cryptocurrency exchange

Choosing the right cryptocurrency exchange is considered to be the main step for the purpose of successful as well as safe trading of digital assets. But in 2025 in the market a huge number of crypto exchanges, to understand together with which beginners are able to be extremely problematic.

In this post I will examine in detail, as well as how to choose a cryptocurrency exchange, the equipment of their work, as well as provide advice for the purpose of experienced traders as well as beginners in the market.

Introduction of cryptocurrency exchanges

Cryptocurrency exchanges are online platforms, together with the support of which users can change or trade various cryptocurrencies. Cryptocurrency exchanges designate an arbitrator among the buyer and also the seller, providing clarity of the operation, but charge a small percentage because of this - the trader's commission. Any market has its own trading commission, as well as the presence of devices for the purpose of forex trading, trading pairs and many other aspects.

Crypto exchanges can be compared with stock exchanges, together with which a socket was originally borrowed for the purpose of cryptocurrency platforms. Most of the trading devices that have been introduced in crypto trading also came here from traditional ones.

Types of exchanges

In 2025 there are two main types of cryptocurrency exchanges: concentrated (CEX) and decentralized (DEX). Let's talk in more detail about each type.

Centralized exchanges (CEX)

Centralized exchange - a crypto exchange that is ruled by one system, controlling all actions as well as user funds. More common type of crypto exchanges, which only in the analytical service CoinMarketCap has about 250. However, there are still and also these, which according to the same or other reasons did not manage to be in the index of crypto exchanges, for this reason in reality today there is a regime of 500 crypto platforms that give users the opportunity to trade cryptocurrencies.

CEX gives users high liquidity, an extensive selection of trader pairs and a convenient interface, then possesses to themselves newcomers to the crypto market. On the other hand, in order to work with almost all centralized exchanges today you must pass the procedure of verification of identity.

Decentralized Exchanges (DEX)

A decentralized exchange is a protocol that is not controlled by any system or group of people. Addition of new trading pairs, development and any other tasks related to DEX, are decided together with the community voting line. In case of a positive outcome, the development is added by the site programmers, which have only this function.

Compared to CEX, DEX contains the least liquidity and also a more complicated interface. In the presence of this control over funds remains because of the user (the exchange is connected to a crypto wallet, from which places cryptocurrency can be withdrawn only at the request of the user). In addition, DEX does not need to go through the verification procedure, which provides increased privacy in the market.

How cryptocurrency exchanges work

Mechanics of centralized exchanges

Initially, the user registers in the exchange, along with the support of email or phone number. Then it is necessary to undergo a verification operation (KYC), after which the user will be available to all services provided by the exchange without exception. It remains to increase the deposit and also to start trading.

Each exchange has a book of orders, according to which it is possible to understand, one or another order in some asset is now more: to buy or sell. In this regard, one or another type of order will prefer the user for the basis of trading, will depend on whether the circulation will be realized instantly or will need to delay the specific value. Thus or otherwise, the orders of users are all without exception also automatically executed.

Operations in decentralized exchanges

Decentralized exchanges allow users to connect their cryptocurrency wallets directly to the platform. Trading activity is performed through smart contracts, providing direct interchange among participants without intermediaries. This reduces the dangers associated with saving money in the exchange, but will require understanding of the activity together with crypto wallets and also smart contracts.

In 2025, earlier virtually all DEXs have different orders, which in addition are carried out automatically, although a number of years ago everything worked only in manual mode.

Key selection criteria

Now let's proceed to the key aspects that need to be taken into account when choosing an exchange for trading.

Trading pairs and asset selection

Make sure that the market has a large list of trading pairs, and in addition in time adds new, important vapors. You may be surprised, but today there are still exchanges with which open 10 trading pairs for the purpose of trading and all, the newest they do not tend to add in any way. It is clear that when trading in time you will need no more than 3-4 pairs, but the selection must be, as well as the more HYIP cryptocurrencies must add to the exchange that users could earn in it.

Analyzing the commission structure

A centralized cryptocurrency exchange can have three types of commissions:

-

Trading commission;

-

For deposit and withdrawal of funds;

Trading commission is charged on every exchange, the only difference is its amount. It also happens that the exchange holds some kind of promotion on a certain trading pair - without charging trading commission for a certain time.

For the withdrawal of cryptocurrency or fiat money, the commission is always charged. When withdrawing cryptocurrency, the commission is needed to pay for the transaction on the blockchain, while when withdrawing fiat, the commission will be paid to the bank. Cryptocurrency or fiat deposit is free on most exchanges.

What commission and how much the exchange charges should be clarified initially, as the higher the commission, the more it will affect the final profit.

Liquidity and trading volume

Greater liquidity in the exchange will ensure active execution of orders. Let's say you want to buy bitcoin. Formed a request and also clicked “Buy” - exactly nothing happened. This indicates that there are not enough people in the market who would like to sell you bitcoin according to the price shown - not enough liquidity. Choose only those platforms that have deep liquidity.

Exchanges together with a huge trading size usually give more stable values and also a smaller spread among buying and also selling.

Deposit and withdrawal options

It's simple - compared to more options open with the purpose of deposit as well as withdrawal of funds together with the site, the easier it will be for you to interact with the exchange. It may happen that any method of withdrawal will be unavailable due to failures, then you can use another.

Security measures

Pay attention to security measures such as two-factor authentication (2fa), cold storage, wallet whitelisting and insurance against hacking. A strong marketplace must ensure that your funds and personal data are protected.

You should also consider to what extent the economic reserves of the exchange are approved. This has become a popular practice among crypto exchanges after the failure of the FTX cryptocurrency exchange.

In addition, some exchanges provide extended insurance that will cover all possible hacks and failures in the operation of the exchange.

Reviews of the top exchanges

Best centralized exchanges

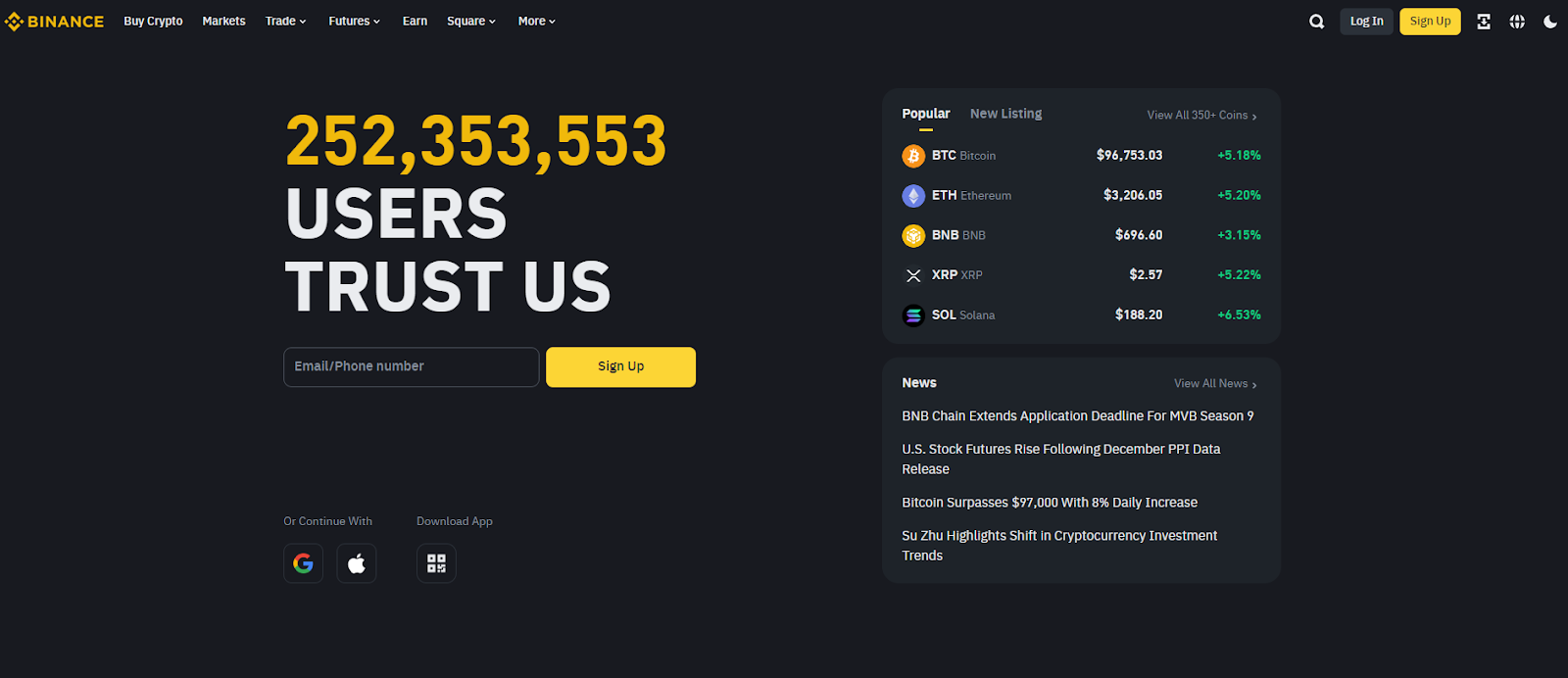

Binance

-

Wide selection of assets. Supports over 1,300 trading pairs, including major ones such as Bitcoin, Ethereum;

-

Low commissions. Trading fees range from 0.1% and can be reduced when paying with Binance Coin token (BNB);

-

Trading tools. Binance offers futures, options, margin trading and a staking platform;

-

Security. Utilizes cold wallets, two-factor authentication (2FA) and a risk management system;

-

Global reach. Operates in over 180 countries with localized versions of the site and multi-language support;

-

Educational Resources. Binance Academy provides educational materials for beginners and professionals.

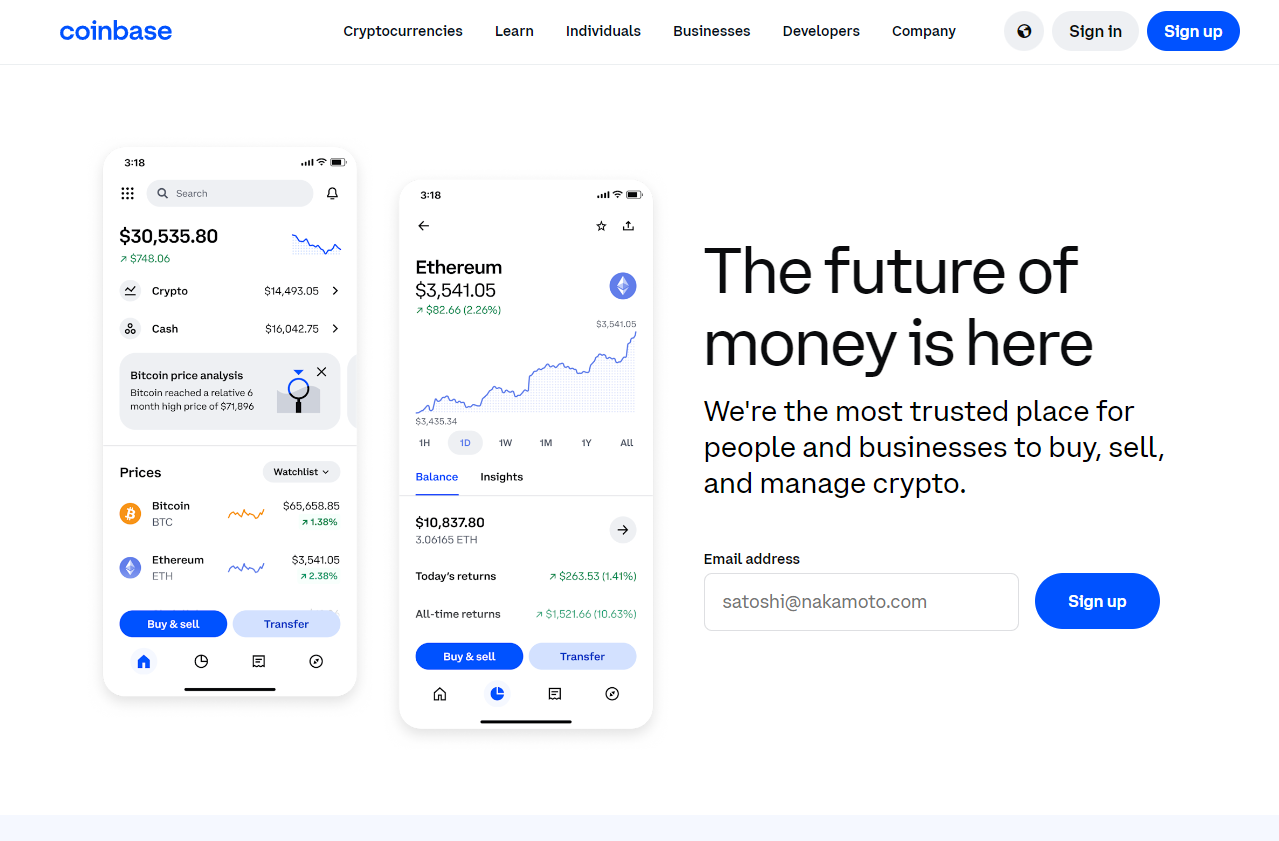

Coinbase

-

Ease of Use. User-friendly interface and a slick application, perfect for beginners;

-

Fiat support. Supports cryptocurrency purchases together with bank transfers and plastic cards;

-

High level of security. 98% of user funds are stored in cold wallets; Supports asset insurance;

-

Additional features. Coinbase Earn gives you the opportunity to earn cryptocurrency for exploring new projects;

-

Premium platform. Coinbase Pro offers low commissions and advanced tools for experienced traders.

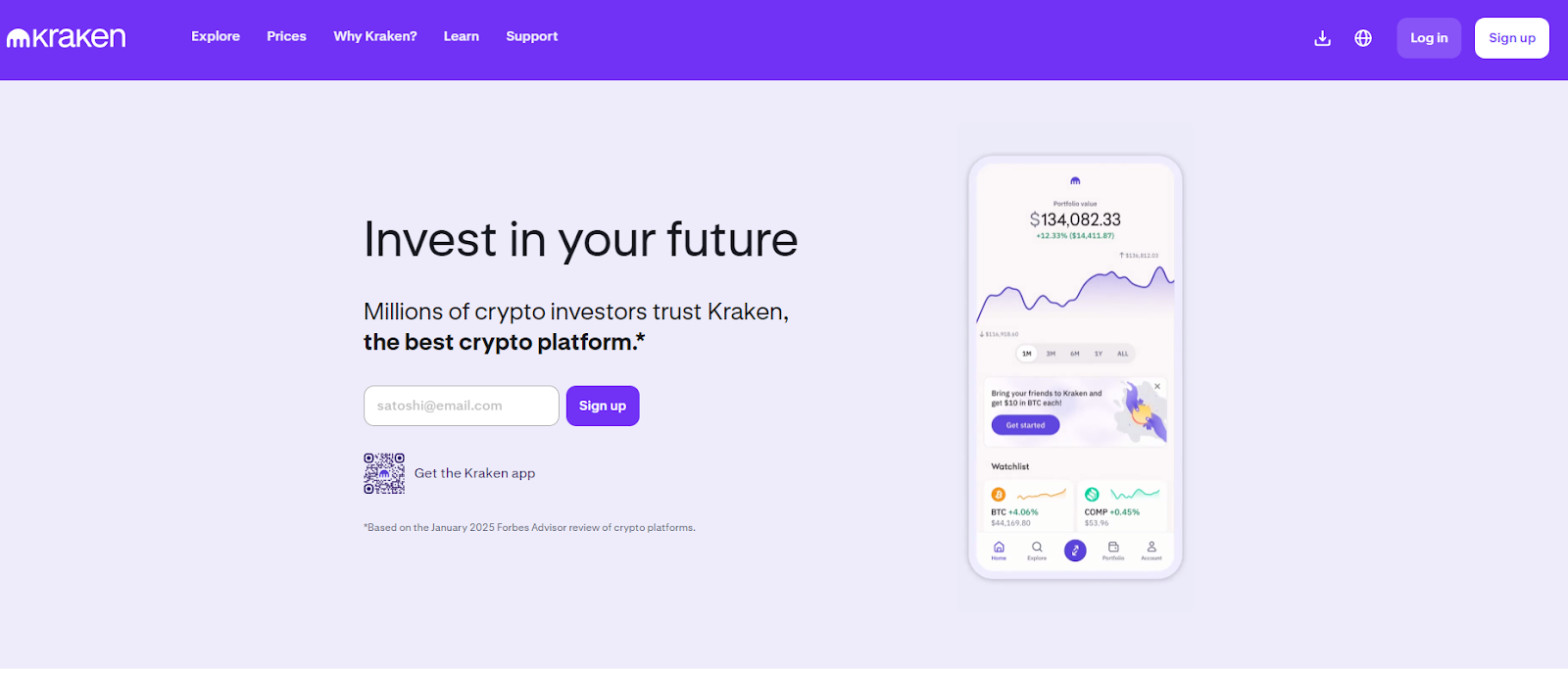

Kraken

-

Reliability. Working together since 2011, earning a reputation as one of the most secure exchanges;

-

Variety of trading pairs. Holds more than 780 trading pairs, including rare altcoins;

-

Margin trading. Gives the amount along with leverage up to 5x, and in addition futures trading;

-

Security. Clients' assets are kept in offline wallets, security audits are constantly conducted;

-

Assistance of fiat money units. Gives the opportunity to supplement and also extract funds in dollars, euros and other currencies;

-

Advanced analytics. Tools to analyze the market, including charts and data according to the volume of trading.

Popular decentralized exchanges

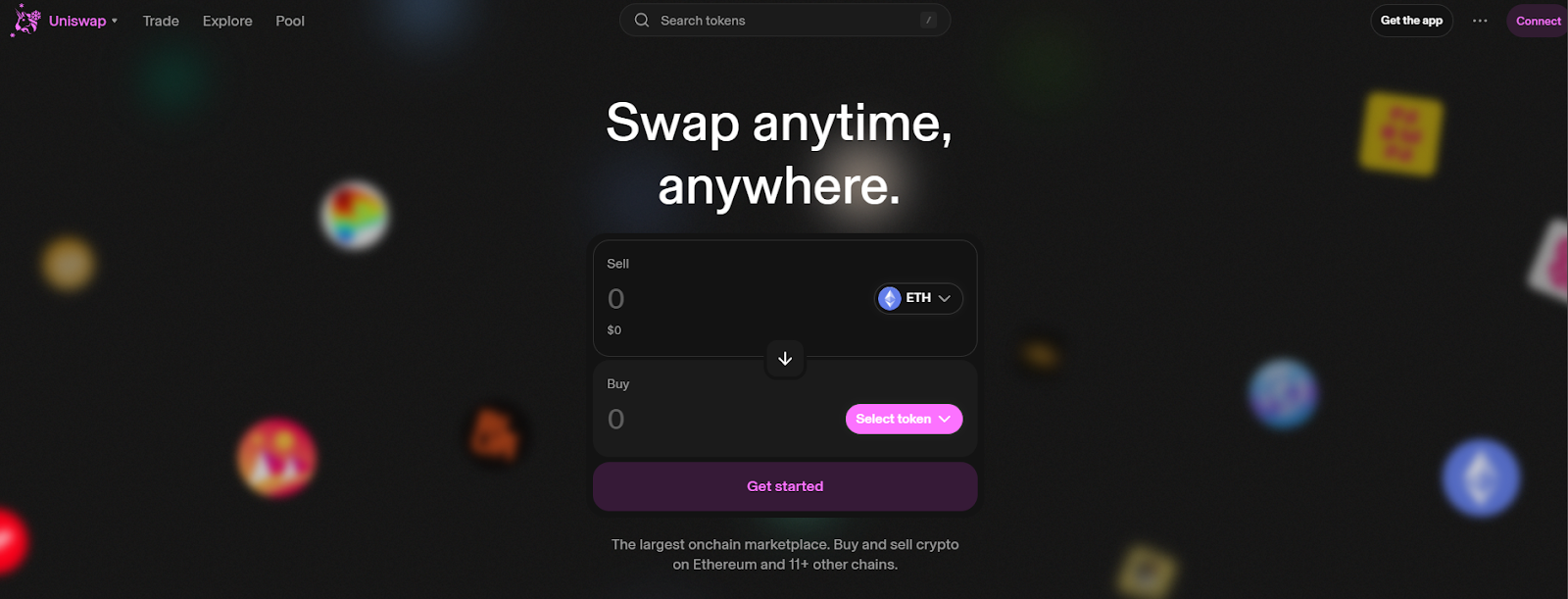

Uniswap

-

Smart contracts in Ethereum. Works through the Proceedings (scientific society), which excludes arbitrators and also provides autonomy;

-

Liquidity pool. Users can add their assets to liquidity pools and earn in commissions;

-

No registration. No account required, users connect their own wallets, similar to MetaMask;

-

Interface simplicity. Subconsciously accessible design, optimal for beginners as well as experienced traders.

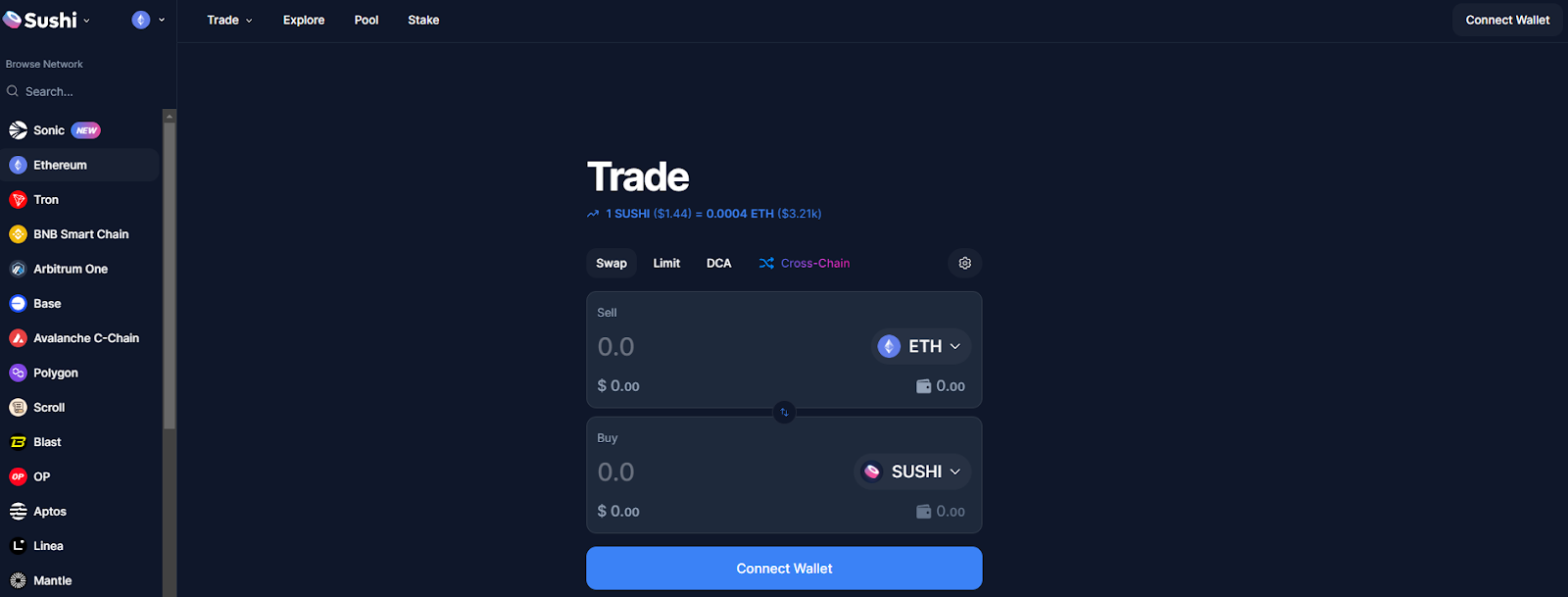

SushiSwap

-

Automated Market Making (AMM). Just like Uniswap, uses liquidity pools, but adds its own unique features;

-

Staking as well as pharming. Users have a good chance of staking SUSHI tokens and earning rewards;

-

Extensive ecosystem. Gives a supporting list of features such as a borrowing platform (BentoBox);

-

Cross-platform. SushiSwap supports a large number of blockchains, including Ethereum, Binance Smart Chain, and Polygon;

-

Commissions. 0.3% of each transaction, with 0.05% going to SUSHI token holders.

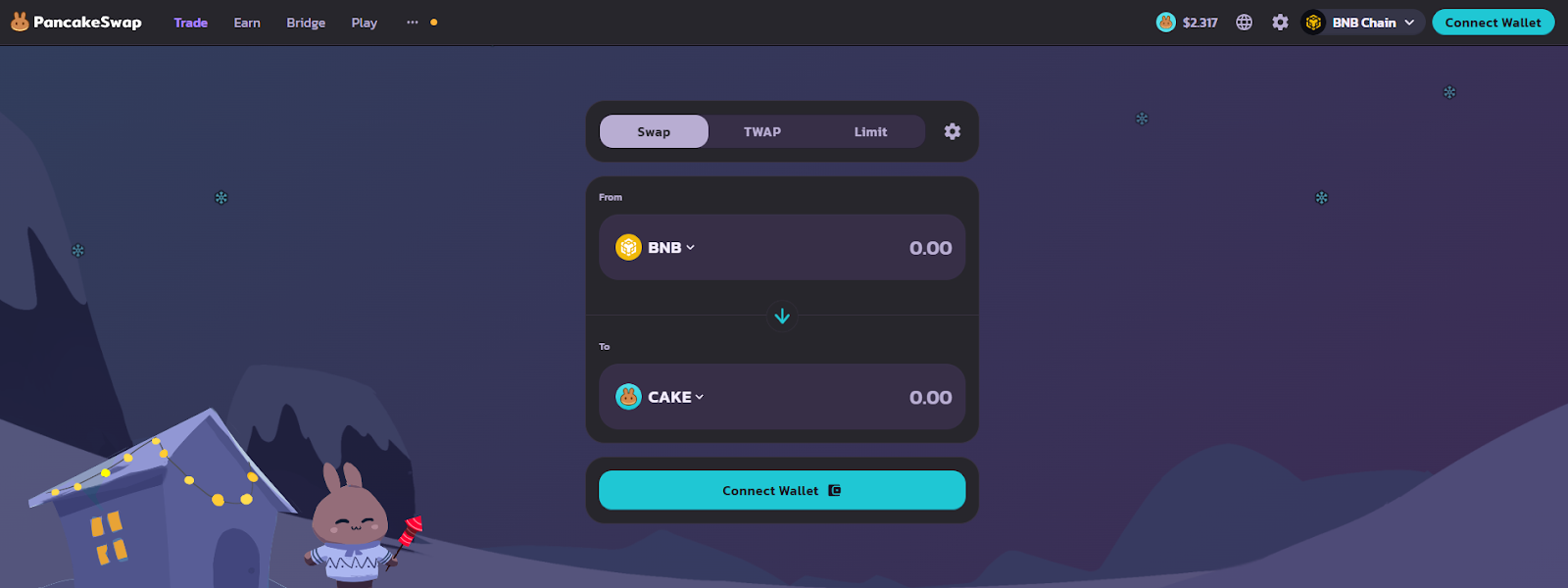

PancakeSwap

-

Founded in the Binance Smart Chain (BSC). Thanks to low fees and fast transactions, PancakeSwap has attracted a lot of users;

-

Farming as well as stealing features. Users can farm as well as steak CAKE tokens, earning auxiliary income;

-

Decentralization. The platform is managed by the community through voting by CAKE token holders;

-

Games and lotteries. PancakeSwap provides gamified features such as lotteries and price predictions;

-

Public Availability. Supports many BEP-20 tokens, providing a wide selection for trading.

Multi-exchange solutions

Portfolio Management

Here we are talking about a portfolio tracker. Suppose a trader has several wallets, which are connected to this tracker. What this gives:

-

The trader has a common understanding of all crypto assets in different exchanges as well as wallets;

-

Track the value of all cryptocurrencies in the portfolio in the order of the present time. This can help to make timely decisions in a highly volatile crypto market;

-

Set notifications about important changes in the portfolio or cryptocurrencies;

-

Analyze portfolio performance with return charts, asset allocation analysis and other indicators;

-

Register and also show the situation of transactions.

Advanced trading strategies

Experienced traders use various strategies such as arbitrage, margin trading and the use of derivatives. Understanding these methods and the risks involved is considered to be the key to successful trading.

Strategic recommendations

For beginners

-

Study the crypto market. There are a lot of pitfalls, which can be a huge problem in the initial stages. For example, in such a case, that USDT functions in several blockchains, and also in case you were sent a stablecoin in any way not in this line, in this case you can forget about the mute;

-

Start your way in the cryptocurrency market together with centralized exchanges. There is the most accessible interface, deep high liquidity, a huge selection of trading power as well as support that can help in solving problems. In addition, most CEX accept fiat for deposit;

-

Initially use the amount you are inclined to lose. In the event that you have no experience trading in economic bazaars, then the initial operations, together with a high probability, will become unprofitable. The initial six months to bear losses in trading - this is in accordance with the norm. Perhaps, this period will be less for you, but you should be prepared for any development of events;

-

Use all possible methods of protection of personal account in the exchange, where you trade. In addition, be sure to confirm your identity (KYC) to have access to all devices and services of the exchange;

-

There are crypto exchanges that offer demo accounts for the purpose of users. This will be an ideal place to start trading. Here you do not lose your money in case of unsuccessful trades and you can take more risks, as the resources are conditional.

For experienced traders

-

Decentralized exchanges can be a good option for you to increase your profits. Today, DEX has a much earlier listing of some tokens compared to CEX. A trader can purchase a token in advance of its listing on concentrated exchanges, because, as a rule, its value increases after its listing on large exchanges. After that it is possible to move the token to a concentrated exchange and also sell it, taking a good profit;

-

Do not neglect futures and options: with their support it is possible not only to realize profitable trading strategies, but also to diversify previously disclosed views. Large trading funds have long used these trading tools to optimize profits;

-

Trader simulators allow you to control your strategies in the absence of a nick for the purpose of money. In addition, there are neural networks, such as ChatGPT, which can help you create a personal trading strategy;

-

Constant portfolio rebalancing is a guarantee of success. It all depends on the market situation: if everything is quiet, rebalancing should be done once a quarter. In the case of significant volatility and volatility of the market as a whole, rebalancing should be done as soon as possible;

-

Follow the news agenda. World events have a direct impact on financial markets. For example, the selection of Donald Trump as the next U.S. president has had a favorable impact on cryptocurrency trading, while the escalation of conflict in the Middle East has had a negative impact.

Conclusion

Choosing a cryptocurrency exchange is an important step in building a successful trading strategy. Consider the type of exchange, its list of features, security, high liquidity and commissions. For the purpose of beginners, it is recommended to focus on the usual and reliable platforms, and experienced traders can use modern devices and strategies.

Also, the right choice of platform for the purpose of trading guarantees you access to the best devices, as well as get rid of scammers. It is important to take into account that even today there are exchanges that steal the funds of their own clients, so you need to use only proven sites, along with good reviews.

The right approach to the choice of exchange and risk management can help you get the most out of the opportunities of the cryptocurrency market.

Frequently Asked Questions (FAQ)

What documents are required for verification in cryptocurrency exchanges?

Usually you need to upload your passport, ID card or driver's license. Many exchanges also charge a proof of address, for example, a result due to public services, in order to increase the daily means of depositing as well as concluding money.

How do the insurance politicians of the exchanges protect my assets?

Big exchanges provide insurance for the money in their platform against cyber attacks. But the resources in users' wallets are usually not covered by insurance. In addition, the insurance does not cover unverified users in any way.

What are the tax consequences of trading in several exchanges?

Trading in cryptocurrencies is usually subject to capital gains or income tax. Keeping a record of all transactions across multiple exchanges can help to properly declare income, but it all depends on the jurisdiction in which the trader resides.

How do exchanges handle network forks and airdrops?

Some exchanges support forks as well as airdrops, automatically adding new tokens to your non-measures. But the help depends on the policy of a particular platform.

What is important to consider the presence of selection among spot as well as margin trading?

Spot trading involves buying and selling assets according to the current market price, which is less risky. Margin trading involves the use of loan money in order to increase positions, but it is accompanied by high risks and requires experience.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.