Crypto Arbitrage Trading: Complete Strategy Guide

with ArbitrageScanner!

Cryptocurrency Arbitrage Trading: A Complete Strategy Guide

Cryptocurrency arbitrage is a strategy for gaining profits from trading, which is most well-known to online users, compared to, for example, intraday trading or algorithmic trading. In general, arbitrage has existed for a long time and in fact - it is a common speculation of assets: bought in one place cheaper, in another sold more expensive.

However, with the emergence of the crypto market, it became clear that arbitrage is ideal for digital assets. The reason is the high volatility of cryptocurrencies, which has not disappeared even after 15 years of the market's existence.

Due to the high volatility of cryptocurrencies and the availability of many exchanges, the market will allow for extremely profitable arbitrage. In this guide, we will cover the basic aspects of arbitrage, types of strategies, risks and steps to start trading.

Understanding cryptocurrency arbitrage

Basic Concepts

Arbitrage is a trading strategy based on the price difference of one asset on different platforms or in different pairs. The key idea is to buy cheaper and sell more expensive items within a short time window.

How it works

The fact is that the cryptocurrency market does not have a single center that issues quotes for assets to all exchanges and platforms. Therefore, anywhere cryptocurrencies are traded, the price is set based on two factors:

-

Supply and demand within the same market (on an exchange or some platform);

-

The average market price of the cryptocurrency.

According to the ratio of these two indicators and forms the price, which may differ from the prices on other exchanges. This is why there is a possibility of cryptocurrency arbitrage in the cryptocurrency market - there is no single center of quotations, due to which there is inefficiency of the market.

Market Dynamics

It should also be taken into account that the price of cryptocurrencies can differ in different countries and on the sites within them. There are countries where, for example, hyperinflation is raging, so inside them people are ready to buy cryptocurrencies with a large markup, just to save their money from depreciation.

However, it is quite a complicated scheme, because you will need to do something with the fiat currency received, and without being in the country or having trusted people there - it is extremely problematic. In addition, the nominal value of this currency will decrease every day or even hour, so you need to react quickly.

In essence, this is a working option, but it only requires competent elaboration and finding “your” people.

Profit potential

Cryptocurrency arbitrage is not limited to some percentage of profit. Here everything depends on several factors:

-

How much time a person is willing to devote to arbitrage. If an hour a day, the profit will be low;

-

What bindings can be found - options for cryptocurrency arbitrage. Someone finds a bundle with a profit of 1%, and someone in 10%;

-

How the capital is planned to allocate to arbitrage. Since the profit here is in percentages, the more you invest, the more you will get.

Arbitrage strategies

Inter-exchange arbitrage

The most popular type of cryptocurrency arbitrage, which involves buying a digital asset on one exchange cheaper, transferring it to another exchange and selling it more expensive.

Spatial arbitrage

This approach utilizes price differences between exchanges in different geographic regions. Such differences are more common between developed and emerging markets. The example of countries and hyperinflation fits here.

Triangular arbitrage

A more complex type of arbitrage that involves converting cryptocurrency into other coins for profit. For example, you have 1 BTC and you notice that on one exchange 1 BTC can be bought for 20 ETH. On another exchange, you can buy 1 BTC for 4,000 USDT and 1 ETH for 210 USDT. Here's how the exchange scheme will look like:

-

Step 1: Exchange 1 BTC for ETH. You get: 1 BTC × 20 = 20 ETH;

-

Step 2: Exchange 20 ETH to USDT; you get: 20 ETH × 210 = 4,200 USDT;

-

Step 3: Exchange 4,200 USDT for BTC; You get: 4,200 USDT ÷ 4,000 = 1.05 BTC.

In the end, your profit would be 0.05 BTC.

Decentralized arbitrage

Based on the price difference between centralized (CEX) and decentralized exchanges (DEX). Such opportunities may arise not only because of the peculiarities of smart contracts and low liquidity on DEX, but also because most tokens are listed earlier on DEX than on CEX. There are cases in the network that before listing on centralized platforms arbitrageurs bought on decentralized ones, transferred to CEX and sold more expensive by 50-70%.

Technical requirements

-

In cryptocurrency arbitrage, the speed of transaction execution is important - the faster it is, the more likely you are not to miss an opportunity. Before conducting a bundle, it's best to find out how you need the blockchain is currently doing in terms of workload;

-

You'll also need fast internet and an adequate PC or smartphone, to execute transactions;

-

Use an analytics platform such as CoinMarketCap or Coingecko to find price differences;

-

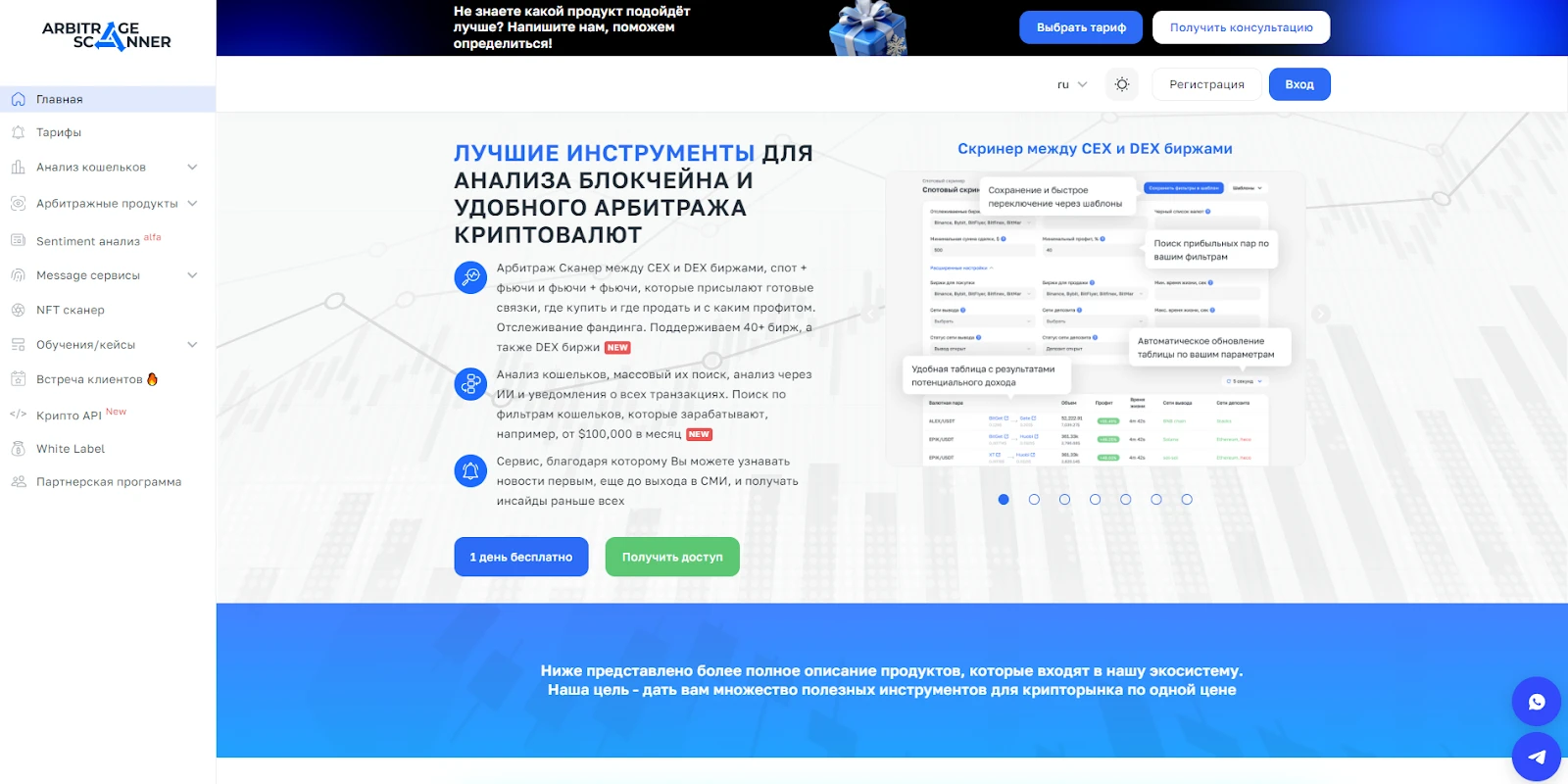

You can use services that automatically provide spreads on digital assets, such as ArbitrageScanner, the best service for cryptocurrency arbitrage, which provides many tools to find market inefficiencies.

Risk Analysis

As with any trading strategy, in cryptocurrency arbitrage you need to consider the risks that can affect the final profit, namely:

-

Trading commissions of the platforms where the exchange will be made. There are times when a spread of 1% will have to be paid for trading commissions, and you will only waste your time. It is better to initially check if it makes sense to conduct a bundle;

-

Cryptocurrency arbitrage is strongly tied to the speed, so it is important to clarify in advance how things are at the blockchain cryptocurrency: it may be overloaded or it may be undergoing technical work, which caused the difference in price;

-

Some exchanges do not have enough liquidity for certain cryptocurrencies. It may happen that you transfer the cryptocurrency to the exchange and try to sell it, but no one will buy it. Not because of the high price, but because of the banal lack of buyers;

-

In a highly volatile market, a lot of arbitrage situations are created, which, on paper, can give a good profit. However, due to volatility, the price of cryptocurrency can change so quickly that you simply do not have time to transfer and sell it, because of which you will suffer losses.

All the risks described above can be mitigated by simply clarifying the information before starting arbitrage, as well as not engaging in it during high volatility in the market.

Implementation Guide

How to get started

-

To begin with, it is worthwhile to understand arbitrage, that is, to study useful information. There are a lot of unreliable sources on the web, studying which you will definitely incur losses. But going to ArbitrageScanner you can find free arbitrage training, as well as read cases from current clients of the service;

-

You need to register and pass the procedure of identity verification on the exchanges suitable for arbitrage, which everyone chooses himself. It is better to confirm your identity in order to have full access to all services of the exchange;

-

Determine the deposit that will be used for arbitrage, as well as to work out a strategy: for example, at what number of losses per day you stop arbitrage and postpone it until the next day, that to continue with a “cold” head;

Choosing crypto exchanges

-

Look for exchanges with minimal commissions, perhaps someone will offer special conditions for beginners (no trading commissions for a while), as well as discount vouchers;

-

The exchange should have good liquidity, that is, most cryptocurrencies should be easy to buy and sell;

-

Preferably, the exchange should have a fast support team that can help with a problem. You can find out about this online: if the support service of the exchange is mediocre, its users will definitely tell you this.

Conditions for starting an arbitrage bundle

-

There is a spread on cryptocurrency more trading commissions and network commissions that will have to be paid;

-

There is enough liquidity on both exchanges to make a trade;

-

The blockchain of the chosen cryptocurrency is not overloaded and conducts transactions quickly;

-

There is no high volatility in the market that can drastically change the price of the cryptocurrency.

Risk Management

To properly manage risk in crypto arbitrage, you need to adhere to two rules:

-

Limit the volume of trades per day, both profitable and negative. You should have a clear number of trades per day, otherwise you may overwork, your eyes may “blur”, which may result in losses;

-

Regularly evaluate the performance of your chosen exchanges. It happens that between two exchanges for a week there are no sensible connections, and on the other two exchanges during the day there are dozens of situations on which you can make money.

Conclusion

Cryptocurrency arbitrage trading is a profitable but complex strategy that requires a deep understanding of the market. On the other hand, there are no strategies or methods on the market right now that will allow you to make a profit for nothing. Against the background of other strategies, arbitrage stands out for the possible earnings - here it is unlimited. Moreover, arbitrageurs do not need to wait for an uptrend to make money, because the spread of cryptocurrencies appears sideways in the market.

Cryptocurrency arbitrage opens new opportunities for earning, attracting traders and investors, because the probable profit here is much greater.

Frequently Asked Questions (FAQ)

How profitable is cryptocurrency arbitrage trading?

Profitability depends on the initial capital, the speed of execution of trades and the arbitrage opportunity found. The average margin is 1-3% per trade, but it can be as high as 50-70%.

What is the minimum capital needed for arbitrage?

If you have never dealt with cryptocurrencies, it is better to start with $200-300. The first month you will incur losses and this is normal. It will be much easier to carry them over with a small deposit.

Which exchanges are best for arbitrage trading?

Popular exchanges are Binance, Bitget, MEXC, KuCoin. For decentralized strategies - Uniswap, SushiSwap.

What are the main risks in arbitrage trading?

The main risks are commissions, liquidity and technical failures. Risk management and strategy testing help minimize losses.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.