Lesson 3: Funding rate and price spread arbitrage

03/04/2024

#Tutorials #Lesson #Arbitrage Perpetuals

We have prepared each lesson in text and video format. They are available to our clients.

There are 2 main types of trading on crypto exchanges - spot and futures.

The difference is that when you buy a coin on the spot, you can withdraw this coin to a cold wallet, transfer and sell it on another exchange, put it in staking, etc. In fact, you own this active one.

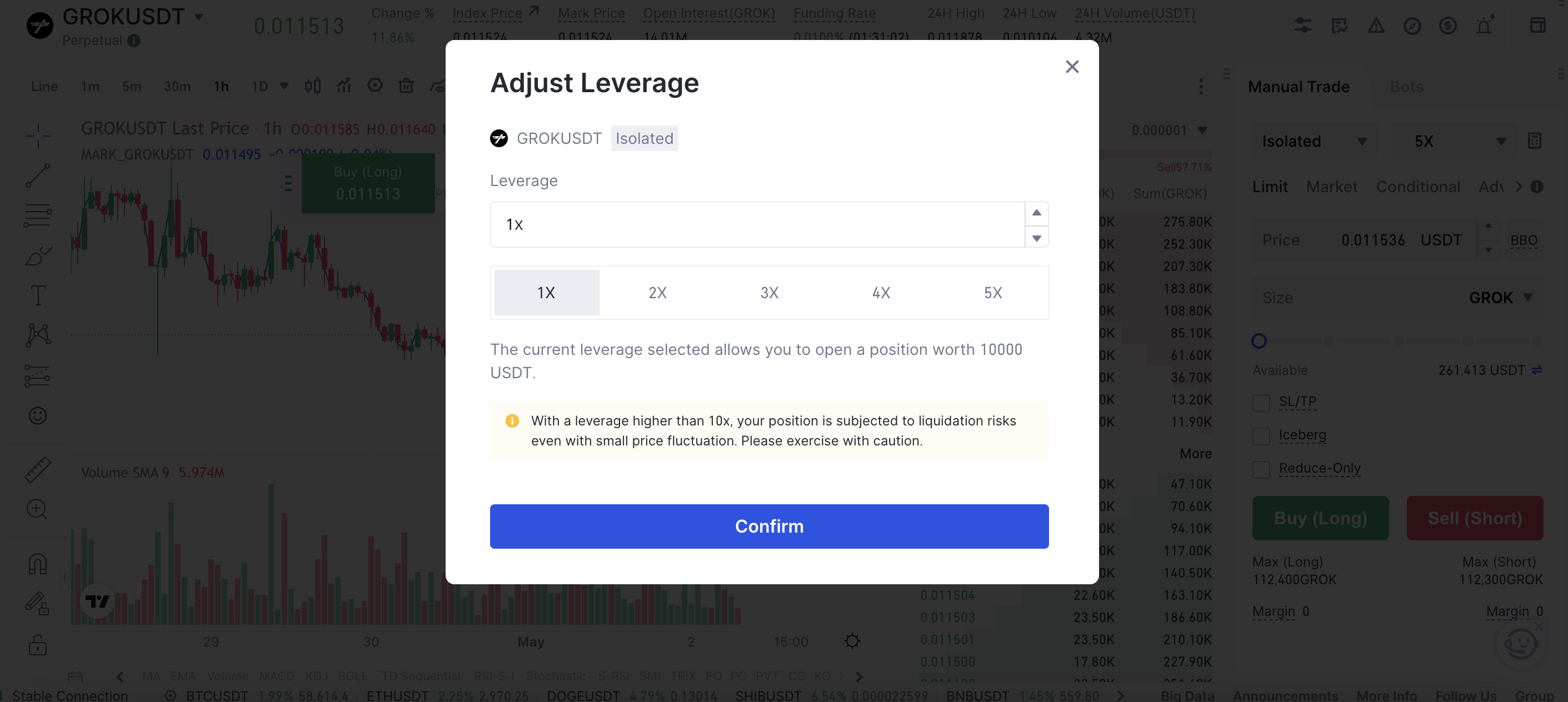

Another important aspect of futures trading is the ability to set leverage. Leverage increases the price change by a selected number of times. If you went short with 1x leverage and the price fell 3%, you would have earned 3%, but if you had gone short with 2x leverage, you would have earned 6%. Remember, this works not only with earnings, but also with loss of funds.

We recommend entering into trades with 1x leverage, increasing leverage increases risk.

In spot-futures arbitrage, a situation is possible in which

The full version of the article is available only to users with subscriptions. Click the button and select the appropriate tariff to have access to all useful articles.