How to pick an exchange for arbitrage?

Choosing the right crypto exchange for arbitrage requires a careful approach.

First thing to consider is fees. Different exchanges charge fees for deposits, withdrawals, transactions, and trades. The lower these fees, the higher your final profit.

Second, check the liquidity of the exchange. Since profitable arbitrage opportunities can disappear fast, you need to act quickly. This means fast order execution is crucial. If the exchange has low liquidity, your order might take too long to fill, and you could either miss out on profits or even incur losses due to missed opportunities. You can check liquidity in a few ways:

- Check the trading volume on CoinMarketCap or CoinGecko.

- Look at the order book on the exchange. If there are many orders with a minimal spread between the buy and sell prices, that indicates good liquidity.

- Observe order execution time. The faster trades are executed, the better it is for crypto arbitrage.

Third, consider the speed of transaction processing and withdrawals. Your profit will depend on how fast transactions are processed, so make sure the exchange's conditions meet your needs.

Lastly, don’t forget to complete KYC. On some exchanges, KYC is needed to perform trades, and on most, it's required for deposits and withdrawals in fiat.

Best Exchanges for Arbitrage in 2025

To make things easier for you, we've put together our own top list of crypto exchanges for arbitrage.

Bybit — a crypto platform for spot trading and derivatives. Launched in 2018, Bybit ranks 4th in trading volume among crypto exchanges as of September 2024. The platform offers spot trading, derivatives (perpetual contracts in USDT and USDC, inverse perpetual contracts, futures), an NFT marketplace, and Bybit Earn staking. It provides users with leverage up to 100x.

- Daily trading volume: $4,232,689,826;

- Fees: 0.1% for takers, 0.1% for makers.

OKX — a centralized crypto exchange, originally launched in 2013, rebranded in 2022. It ranks among the top ten crypto exchanges according to CoinMarketCap. The platform offers spot trading, options, and derivatives, including margin trading, futures, perpetual swaps, and options. Leverage is available up to 125x.

- Daily trading volume: $1,366,515,110;

- Fees: 0.1% for takers, 0.08% for makers.

Gate.io — a centralized crypto exchange, launched in 2013, known for its wide selection of trading pairs, with over 3,600 available. The platform supports spot and margin trading. Its extended service portfolio includes options, futures, and derivatives, with margin leverage available up to 50x.

- Daily trading volume: $1,166,893,195;

- Fees: 0.2% for takers, 0.2% for makers

Huobi Global — a digital asset exchange founded in China in 2013. Users can trade on the spot market as well as in derivatives (futures contracts and options). The platform also offers staking, crypto loans, and more. Leverage is available up to 200x.

- Daily trading volume: $1,847,604,409;

- Fees: 0.2% for takers, 0.2% for makers.

KuCoin — a crypto exchange launched in 2013. It offers users spot and margin trading, perpetual futures, and an integrated P2P exchange. The maximum leverage for futures on KuCoin is 100x, but users need to complete KYC to access it.

- Daily trading volume: $477,086,201;

- Fees: 0.1% for takers, 0.1% for makers.

BingX — a relatively young crypto exchange compared to others in our list, launched in 2018. It offers a variety of products and services, including spot trading, derivatives, and copy trading. Users can access leverage up to 125x

- Daily trading volume: $279,485,589;

- Fees: 0.02% for takers, 0.045% for makers.

We recommend working with exchanges that you feel comfortable with, just don't forget the selection criteria we discussed earlier. Arbitragescanner.io supports 20 centralized exchanges, all of which offer spread opportunities. You can check out the full list of exchanges on our website.

There are several crypto arbitrage strategies used in 2024. Let's take a closer look at each of them.

Spot + Spot

Many believe arbitrage is simply buying cheaper on one exchange, transferring to another, and selling for a profit. However, it's not quite that simple. During the time it takes to complete these transactions, the price might change, potentially leading to losses.

To avoid such issues, it's best to initially acquire a certain token and wait for a profitable pairing opportunity. Here's an example:

- You buy LINK at $10 for 10,000 USDT.

- You choose suitable exchanges for arbitrage — Bybit and BingX. You deposit 1,000 LINK on Bybit and 10,000 USDT on BingX.

- You receive an arbitrage signal from Arbitragescanner.io: the price of LINK on Bybit is $10.1, while it's $10 on BingX. The price difference is 1%, and the trading fee on both platforms is 0.12%, meaning your profit per trade would be 0.88%.

- Then, you place a sell order on Bybit. It's important not to offload all tokens at once, as smaller lots get bought faster. You place 500 LINK, wait for it to be bought, then buy tokens on BingX.

This is how proper crypto arbitrage works, minimizing risks. Cross-exchange arbitrage without pre-purchased tokens is also possible, for instance, with the help of an arbitrage screener, which you can find on Arbitragescanner.io. With it, you can execute a cross-exchange arbitrage strategy, getting real-time pairings as they appear.

Spot + Futures

A relatively new but effective method of crypto arbitrage. Here, it’s worth mentioning «funding» — these are periodic payments made to traders with open positions in the perpetual futures market. Payments are calculated based on the price difference between the futures contract and the underlying asset (cryptocurrency).

The essence of this type of arbitrage is that you buy a token on spot and open a short position on futures but at a higher price. Then, you just wait for the prices to converge and close the deal.

Now let’s move on to an example:

- Suppose you have 30,000 USDT on Bybit.

- You get a signal that BTC is priced at 49,000 USDT on spot, while it's 50,000 USDT on futures. This is a good arbitrage opportunity: you buy BTC for 15,000 USDT on spot and open a short futures position with 1x leverage for 15,000 USDT.

- Then, you wait for the prices on spot and futures to converge and secure your profit by selling on both markets.

- Also, don’t forget about funding rates: if the rate is negative, short holders pay the difference in price between spot and futures to long holders. If it's positive, it's the other way around.

With favorable conditions, you can profit both from the price convergence and from funding.

Futures + Futures

The strategy here is to open a long position on futures at an exchange where the price is lower, and then open a short position at an exchange where the price is higher. After this, you wait for the prices to converge and close the deal.

For example:

- On Bybit, the BTC futures price is 50,000 USDT, while on BingX it’s 51,000 USDT.

- You open a long position on Bybit and a short position on BingX.

- You wait for the prices to converge and then close both positions. Suppose the price converged at $51,500. In that case, the profit from the long position will be 1,500 USDT, while the loss from the short position will be 500 USDT, resulting in a net profit of 1,000 USDT.

It’s important to pay attention to funding rates when opening futures positions. Depending on whether the rate is positive or negative, your profit can be affected. If you end up holding a futures position for a long time and need to pay the funding rate, the profitability of the pair might be questionable.

Arbitrage on Decentralized Exchanges

Decentralized exchanges can also be used for crypto arbitrage, both for spot and futures trading.

ApeX-omni is a derivatives crypto exchange founded in 2022. It offers trading with up to 100x leverage, instant transactions, and low trading fees. The exchange provides liquidity aggregation across different blockchains without the need for cross-chain bridges, enhancing user security.

- Daily trading volume: $189,693,826;

- Fees: 0.02% for takers, 0.05% for makers.

SushiSwap is a decentralized exchange protocol that launched in September 2020. It is one of the most well-known decentralized applications (DApps) running on the Ethereum blockchain. SushiSwap lacks a traditional order book system; all cryptocurrency buy and sell operations are conducted through smart contracts.

- Daily trading volume: $2,414,018;

- Fees: None.

Uniswap is a decentralized exchange protocol running on the Ethereum blockchain, functioning as an automated liquidity system. Transactions are conducted without the need for an order book or central intermediaries.

- Daily trading volume: $533,425,408;

- Fees: 0.3% per transaction.

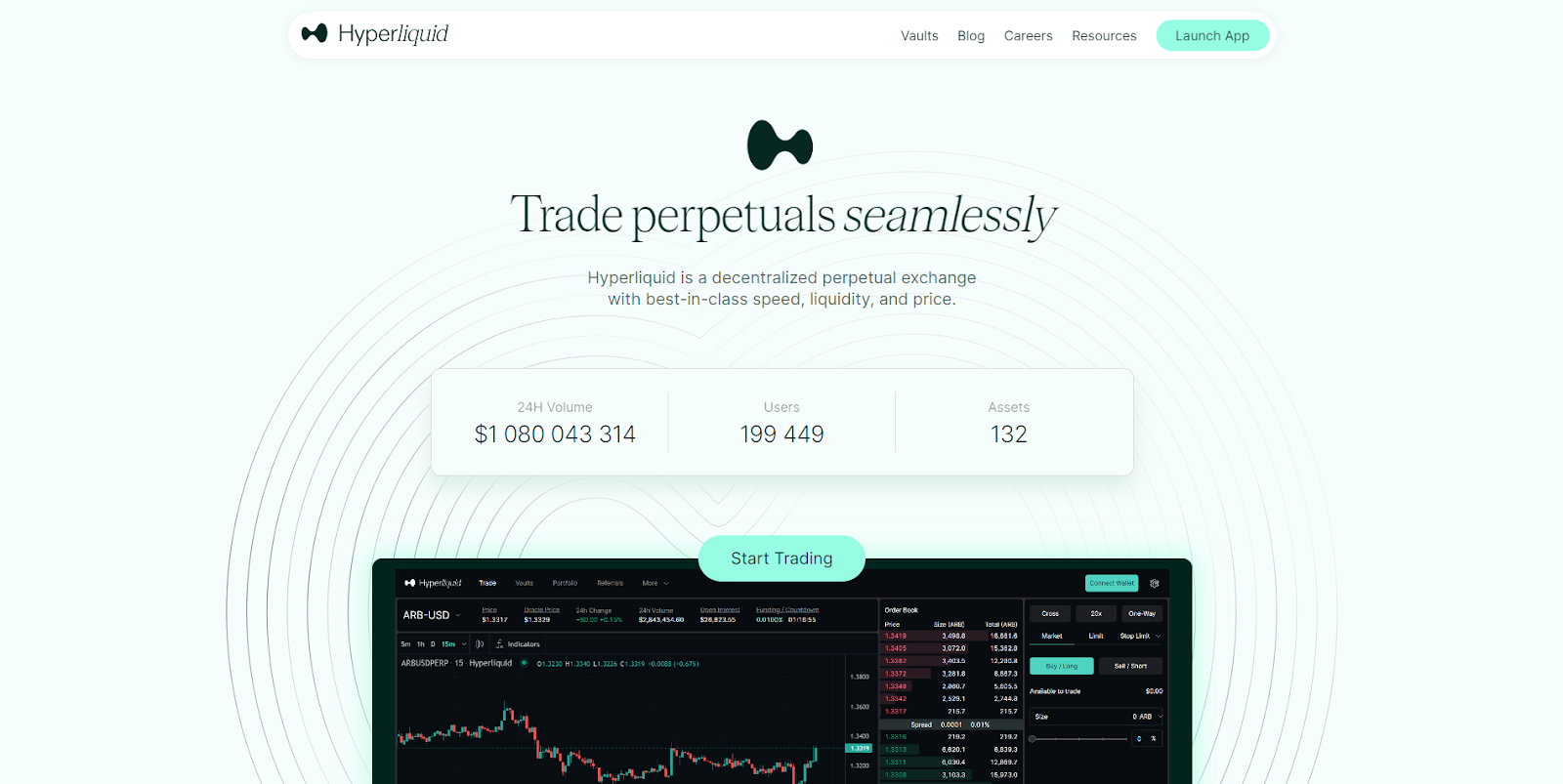

Hyperliquid is a decentralized crypto exchange founded in 2024. The exchange offers both spot trading and futures contracts, with leverage available up to 50x

- Daily trading volume: $908,495,449;

- Fees: 0.25% for takers, 0.2% for makers.

Conclusion

Hope it’s now clearer what crypto arbitrage is all about and how to choose the right exchange for it. If you're still asking yourself «how do I start crypto arbitrage?», feel free to check out our blog — it's packed with case studies, tutorials, and guides on crypto arbitrage.

Wishing you profitable trades!