What is a Satoshi (SAT): Price in USD and Bitcoin Ratio

Satoshi Nakamoto and the Bitcoin Revolution: Mystery, Technology, Legacy

Bitcoin (BTC) is not just a digital currency; it is a revolutionary technology that has changed our understanding of finance. Its emergence was a response to the 2008 crisis, when trust in traditional banking systems was undermined. For the first time in history, it became possible to conduct transactions without intermediaries such as banks and government agencies. Bitcoin gave users full control over their funds, while blockchain technology ensured transparency, security, and decentralization.

Today, Bitcoin is quite expensive; however, almost any investor can still afford a Satoshi. In this article, we will break down what a Satoshi is, why they were named after Bitcoin's creator, and discuss the mystery surrounding the identity of the first cryptocurrency's founder.

What is a Satoshi?

The history of the Satoshi begins in 2008: while another financial crisis was raging across the globe, a person calling themselves Satoshi Nakamoto appeared. In 2025, it remains unclear whether this was one person or a group of individuals, despite numerous investigations into the matter.

On October 31, 2008, Satoshi published the Bitcoin White Paper (technical description). In it, the anonymous author described a decentralized network that would function on blockchain technology. BTC was presented as the currency used within the network, and all prospects for the development of this new financial instrument were outlined.

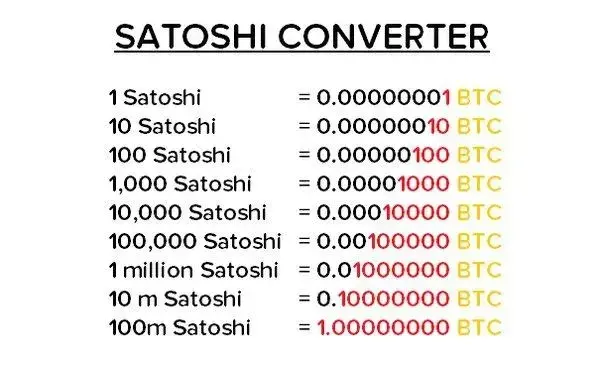

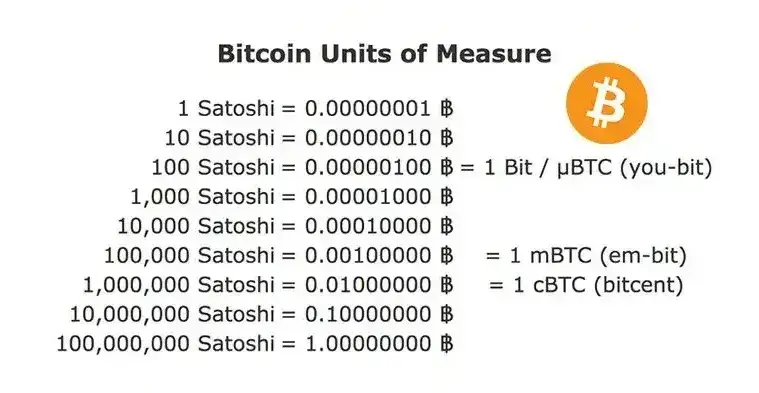

Just two months later, on January 3, 2009, Satoshi created the genesis block: from that moment, the Bitcoin blockchain was officially launched. A division process was embedded into BTC: the smallest "part" of one Bitcoin is called a Satoshi — one hundred-millionth of a BTC.

However, this name was not proposed by the creator of Bitcoin, but by a user on the BitcoinTalk forum under the pseudonym ribuck. Initially, he suggested using the name of the BTC creator to define one-hundredth of a Bitcoin, but later proposed using it for a smaller denomination. This idea was supported by other forum participants, after which the term "Satoshi" entered mass usage.

Content and Characteristics of the Bitcoin Blockchain

Bitcoin possesses several key characteristics:

-

Decentralization. Network management is carried out not by a single organization, but by thousands of nodes around the world;

-

Limited Emission. The total number of Bitcoins is capped at 21 million coins, which prevents inflation;

-

Anonymity. Users can conduct transactions without revealing their identity;

-

Security. The use of cryptographic methods makes the network resistant to hacker attacks;

-

Divisibility. One Bitcoin consists of 100 million Satoshis (the smallest unit of BTC).

Possible Identities of Satoshi Nakamoto

Hal Finney

Hal was a crypto enthusiast long before the creation of Bitcoin; he was always interested in cryptography. This is likely why Satoshi included his email address in the mailing list for the Bitcoin White Paper.

According to Finney's own accounts, he communicated with Satoshi via email and supported his initiative in every way, also helping with the testing of the decentralized network.

For some time, the crypto community claimed that Hal was Satoshi. The reason was a similar writing style, comparing Finney’s manner of communication with Bitcoin's technical documentation. Furthermore, although the Bitcoin creator chose the pseudonym Satoshi Nakamoto, he was definitely a native English speaker. The Bitcoin White Paper contains many technical terms that only a native speaker knowledgeable in cryptography would use. As it turned out, Hal fit this description perfectly.

However, no other evidence was found, and Finney denied his involvement in the creation of Bitcoin, so the theory was never confirmed.

Dorian Nakamoto

In March 2014, Newsweek magazine reported that the creator of Bitcoin was a Japanese-American named Dorian Prentice Satoshi Nakamoto. A physicist by training, Mr. Nakamoto also worked in computer finance and secret defense projects.

Journalists provided several arguments in favor of Dorian Satoshi Nakamoto being the creator of Bitcoin:

-

Dorian Nakamoto lived in California, where members of the Gilmore group met. Moreover, he lived just blocks away from Hal Finney — a famous cypherpunk and one of the first participants in Bitcoin's development;

-

Education and Professional Experience. Nakamoto held a degree in physics and had significant experience in high-tech. He worked as a systems engineer on secret defense projects and in computer engineering at companies specializing in tech and financial services, including Citibank. These skills could have allowed him to develop the cryptocurrency;

-

Mysterious Phrase in an Interview. In a conversation with Newsweek journalists, he stated that he was "no longer involved in that" and that "other people are in charge of it now." These words were taken as an indirect admission of his involvement in Bitcoin's creation.

This story led to some media outlets setting up camp outside Mr. Nakamoto's house and later engaging in a car chase when he refused to answer questions. The feverish interest prompted the real Satoshi to intervene. In an email sent from an account known to be associated with him, he stated: "I am not Dorian Nakamoto."

Nick Szabo

Nick Szabo is an American computer scientist and cryptographer, considered one of the founders of Bitcoin precursors. Nick conceived the concept of a digital currency for the digital age by creating "Bit Gold," which can be considered a predecessor to Bitcoin. However, this project did not take off and was never adopted by society due to limitations.

After analyzing Satoshi's White Paper, some concluded that Nick Szabo is Satoshi Nakamoto. However, Nick has never accepted this hypothesis.

Craig Wright

The creator of BSV and self-proclaimed creator of Bitcoin. Bitcoin SV has a rather controversial reputation among the crypto community, for which Wright is to thank.

When creating BSV, Craig Wright secured the support of multi-billionaire Calvin Ayre, who invested $30 million in the project and became one of the company's managers. The BSV block size was increased to 64 MB, and in July 2019, a soft fork occurred with the Quasar update, allowing blocks up to 2 GB. The coin is developed by nChain; the lead developer is Daniel Connolly, who came from high-level IT management. CTO Steve Shadders shapes the project's vision, handles PR, and works with sponsors. The rest of the team is less known, but all are high-level specialists. Wright and Ayre actively promoted the project using any means, believing "bad PR is still PR."

In theory, Bitcoin SV will never have transaction processing issues thanks to the Quasar update, but a logical question arises — is it even necessary? At the time of the hard fork, the BSV block size was 64 MB, which was more than enough, as even at peak loads, only 15% of the network capacity was used.

As a result, in 2025, BSV ranks 83rd in the cryptocurrency ratings, with a capitalization of $671 million. Even these figures seem too high for the project, and it's not entirely clear why investors are still interested in this coin.

Meanwhile, Wright continues his attempts to prove to the world that it was he who created Bitcoin.

Satoshi Nakamoto's Legacy

Satoshi chose the perfect moment to create Bitcoin: in 2008, a financial crisis erupted, with the US as a major beneficiary. The banking sector failed its customers again: many financial organizations went bankrupt, and depositors' funds were not returned. Nakamoto showed the world a decentralized approach to finance, where Bitcoin cannot be blocked or taken away by someone just because a new law was introduced. Initially, Bitcoin was intended specifically as an alternative to the traditional financial system.

Today, BTC is something more than just a currency for payments. It is an investment tool that has long proven its viability to market participants: billions of dollars are invested in BTC today, yet it can still be used as a medium of exchange.

BTC has already surpassed the $100,000 mark and is now inaccessible to many ordinary investors. However, Satoshis can still be bought, and they cost no more than a fraction of a cent.

How Satoshi Works

In essence, a Satoshi is the same as Bitcoin, just in a smaller denomination. It can also be used in the Bitcoin blockchain for transactions, paying fees, trading, and so on. Typically, amounts in Satoshis are often written as amounts in BTC, which is why uncertainty arises with the fractional parts of the leading cryptocurrency.

Let's look at an example: if you buy $500 worth of Bitcoin, it might be displayed as 0.00607564 BTC or 607,564 Satoshis — there is no difference. However, on crypto platforms (exchanges or swap services), the amount must be entered in BTC, as Satoshi is not officially supported as a separate ticker.

How to Use Satoshi

As mentioned, Satoshi and Bitcoin are interchangeable units of exchange. Neither denomination has specific advantages over the other, except in terms of price: Satoshis can be acquired much cheaper than a whole Bitcoin.

Here are several examples of using Satoshi:

-

Buying and selling on any cryptocurrency exchange;

-

Exchanging for other cryptocurrencies;

-

Purchasing goods or paying for services where Bitcoin is accepted;

-

Speculative investing.

You can buy Satoshis on any crypto exchange; to do this, you need to enter a trading pair, for example, BTC/USDT, and buy Bitcoin for less than its market price per unit. If we take the numbers from the example above, by buying 0.00607564 BTC, the user becomes the owner of 607,564 Satoshis.

Now let's calculate how much one Satoshi is worth at the time of writing:

-

BTC Price — $82,191;

-

1 Satoshi equals 0.00000001 BTC;

-

The cost of one Satoshi is $0.000822;

-

For $1 today, you can buy 0.000012 BTC or about 12,000 Satoshis;

-

For $10, you can buy 0.000122 BTC or 122,000 Satoshis;

-

1 million Satoshis or 0.01 BTC will cost $822.89.

How Satoshi Differs from Other Digital Denominations

Any currency, not just crypto, is divided into smaller parts. In the case of cryptocurrencies, the division depends on the developer's preference. A digital asset must have a division into smaller units; otherwise, its use might be inconvenient for traders and investors, potentially reducing the coin's relevance.

Let's compare BTC and ETH.

Several Bitcoin denominations should be highlighted:

-

1 Satoshi, i.e., 0.00000001 BTC;

-

100 Satoshis (microbitcoin (µBTC)), i.e., 0.000001 BTC;

-

100,000 Satoshis (millibitcoin (mBTC)), i.e., 0.001 BTC.

Ethereum is divided into the smallest units:

-

1 wei = 0.000000001 gwei = 0.000000000000000001 ETH;

-

1,000,000,000 wei = 1 gwei = 0.000000001 ETH;

-

1,000,000,000,000,000,000 wei = 1,000,000,000 gwei = 1 ETH.

Frequently Asked Questions

What does Satoshi mean?

Satoshi is the minimum part of a Bitcoin, named in honor of its creator.

How many dollars is 1 Satoshi worth?

The value depends on the current Bitcoin exchange rate. For example, at a BTC rate of $82,191, one Satoshi is worth $0.000822.

How does Satoshi differ from other digital denominations?

Other cryptocurrencies are also divided into small units; for example, Ethereum uses wei and gwei.

Satoshi Nakamoto's Anonymity

One can assume that the anonymity Nakamoto maintains is the right path. Suppose Satoshi decided to reveal his identity immediately after creating Bitcoin. What could that have threatened the crypto industry with:

-

Relevant authorities, most likely from the US, might have become interested in him almost immediately. Given that cryptocurrency in its early stages was often used by criminal elements, Nakamoto could have been forced to track transactions on the blockchain to identify criminals;

-

Considering the main cryptocurrency's blockchain has some flaws (scalability issues), Satoshi's de-anonymization could have allowed for cooperation with other crypto enthusiasts, which could have contributed to a more detailed refinement of the network;

-

Knowing Satoshi's identity, various influential people could have approached him with proposals for more centralized mining, i.e., conducting transactions that interest them.

Initially, it might seem that two out of the three points would have been good to implement at the dawn of the crypto industry. No criminals in the market, and a near-perfect blockchain. However, there would have been a high probability that the entire crypto industry would have been taken "under the wing" of authorities, and today there would not be the market we are all used to.

What if Satoshi Returns?

It is not entirely clear whether this would be a plus or a minus for the crypto industry. Essentially, he could appear, tell how it all really happened, who stood behind the creation of Bitcoin with him, why he decided to disappear, and so on. In doing so, he would dispel a certain aura of mystery about cryptocurrencies, and it's not clear who that would benefit. Perhaps everyone would simply say once again that Craig Wright blatantly lied to everyone.

But what could really affect the market are the Bitcoins stored in Satoshi's wallet. According to the latest data, Bitcoin's creator has kept 1.1 million BTC in his wallet since 2009. At the current exchange rate, this would be more than $90 billion. If he decided to sell all his savings, it would definitely impact the market, at least in the short term. The thing is, if Satoshi had appeared in 2017-2018 and started selling off his Bitcoins, it could have ended in a market crash because there wasn't much capital here yet. Today, many institutional investors and companies buy BTC daily, so the emerging supply would be bought up extremely quickly.

Therefore, it can be said that the de-anonymization of Satoshi Nakamoto in 2025 will not significantly affect the crypto market.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.