What is Solana (SOL): Project Overview and Future Prospects

with ArbitrageScanner!

What is Solana (SOL): Project Overview and Future Prospects

Today, the cryptocurrency market is flooded with a vast array of coins. Almost all of them claim to offer something unique—something never seen before in any other crypto project. However, most have either failed to deliver on their promises or were never truly special to begin with.

Solana does not belong to this category. It is a crypto project with a radically different approach to blockchain operations. As strange as it may sound, the Solana blockchain focuses primarily on time.

In this article, we will explain why the Solana project has become so popular, discuss its underlying mechanism, and explore its growing ecosystem.

General Description of Solana

What is Solana

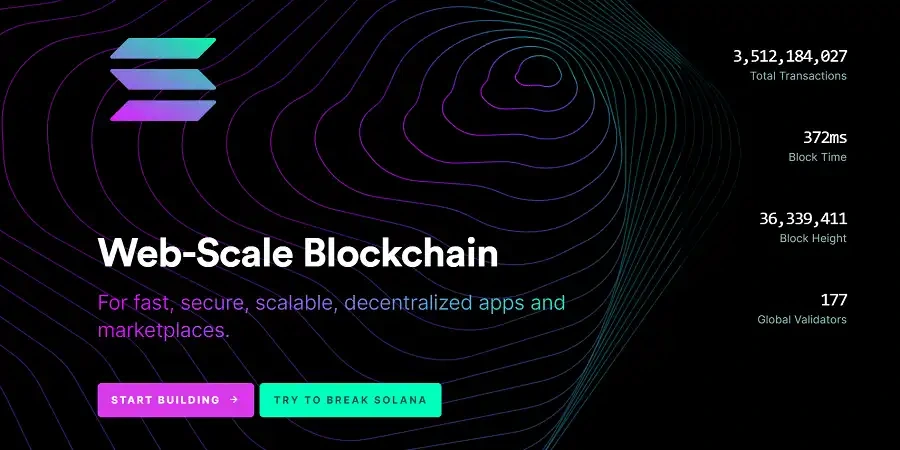

Solana is a high-performance cryptocurrency blockchain that supports smart contracts and decentralized applications (dApps). It utilizes a Proof of Stake consensus mechanism combined with timestamped transactions for maximum efficiency.

This allows Solana to process up to 65,000 transactions per second (TPS). In comparison, Bitcoin handles about 7 TPS, and Ethereum handles roughly 30 TPS. Unlike other similar projects, such as Polkadot or Ethereum, Solana is a single-layer blockchain (L1) and does not delegate operations to other connected chains (L2).

The Solana team designed their blockchain with a long-term perspective. Founder Anatoly Yakovenko observed how telecommunications technology nearly doubled in capacity every year during his time at Qualcomm.

History of Creation

Initially, Anatoly Yakovenko (Solana's founder) wasn't very interested in Bitcoin, and Ethereum only slightly piqued his curiosity. However, he briefly engaged in Bitcoin mining while developing a computer network for training. In 2017, during what he described as a "caffeine-induced fever dream at 4 AM," he realized that Bitcoin's SHA256 hash function could be used to create a decentralized clock on a cryptocurrency blockchain.

Yakovenko hypothesized that timestamping transactions would exponentially increase the scalability of a cryptocurrency blockchain without compromising its security or decentralization. He knew this was possible because Google and Intel had implemented similar technologies in their databases, albeit in a centralized manner. The revolutionary Solana whitepaper was published in November 2017.

Solana is developed by the namesake company based in San Diego, California. The Solana team consists of former employees from Qualcomm, Google, Apple, Microsoft, and Dropbox. Beyond being based on similar database technologies used by Google and Microsoft, its architecture is also inspired by Filecoin, a decentralized data storage project.

Technology and Working Mechanisms of Solana

Consensus Mechanisms

It is worth starting with a term that everyone who has ever been interested in Solana has heard: Proof of History (PoH). PoH is not a standalone consensus mechanism but rather an optimization for Proof of Stake.

How Proof of History Works

Proof of History (PoH) involves placing timestamps on transactions as they are added to the Solana block. A new block in the blockchain is generated every 400 ms (compared to about 30 seconds in Ethereum and 10 minutes in Bitcoin). Without diving too deep into details, the decentralized clock used as a reference for timestamps is the SHA256 hash function. This function's name might sound familiar—it is implemented in the Bitcoin blockchain with the Proof of Work consensus algorithm.

Unlike the leading cryptocurrency, where SHA256 is used to "solve" equations to create a new block, Solana uses the repeated outputs of the hash function as timestamps. This creates a sort of "clock tick," where each tick lasts 400 ms (rather than one second like a conventional clock).

Requirements for New Validators

The process of selecting validators in the Solana network is quite interesting. Like in any blockchain, validators are responsible for confirming transactions and adding them to new blocks. Validators rotate every 4 blocks (1.6 seconds). While a node holds the leader position, it places as many transactions as possible into the four blocks it creates and shows these blocks to specific groups of nodes called Solana clusters. These nodes verify the transactions using the digital timestamps as a guide and then quickly pass the records to other relevant nodes in the network.

Unlike other Proof of Stake cryptocurrencies, becoming a validator on the Solana blockchain does not require a specific minimum number of coins. For example, Ethereum validators must stake 32 ETH, which is a significant amount. Naturally, the size of the block reward is proportional to the number of SOL tokens the validator has staked in the network.

While validator selection is pseudo-random, the amount of SOL tokens you stake also influences the probability of a network user becoming the next block-producing validator. Participants who violate the rules have their stakes slashed, and the saved funds are added to the rewards for block generation.

Blockchain Fees

The Solana network features three types of fees:

-

Transaction fee – paid for transferring SOL to another address;

-

Prioritization fee – if you need to speed up the transaction verification process;

-

Rent fee – allows for storing data within the blockchain.

The minimum network fee is 0.0001 SOL, which is slightly more than $0.01. Even such a small fee allows the Solana blockchain to remain secure, thanks to Proof of History.

SOL Token

What is the SOL Token?

SOL is the native token created on the Solana blockchain. It is burned to pay for network fees. SOL can also be used to run a blockchain node. SOL tokens are used for trading, P2P payments, and incentivizing SOL staking.

How to Mine SOL?

SOL token holders can help secure the Solana network and receive rewards based on the current inflation rate. The reward size depends on the amount of "staked" SOL tokens, validator fees, and their uptime. Solana's initial inflation rate is 8% per year. it decreases by 15% annually until it reaches a long-term fixed inflation rate of 1.5%.

SOL Tokens in the Solana Project

The SOL token in the Solana blockchain is used for:

-

Network governance;

-

Paying blockchain fees.

It is worth noting that the project's creators initially implemented a deflationary model: a portion of transaction fees does not go to validators but is simply destroyed. If a transaction fails, the fee is still burned. This helps control the total supply of SOL in circulation.

Solana Ecosystem

Applications Based on Solana

-

Raydium – an automated market maker (AMM) built on the Solana blockchain that uses the Serum decentralized exchange (DEX) central order book to provide fast trades, shared liquidity, and new yield-generating features;

-

Jupiter Station – an advanced platform offering a range of perpetual contracts and other trading tools for decentralized exchange trading. It is designed for simplicity and versatility when interacting with DEXs;

-

CUDIS – a decentralized lifestyle asset network. It is based on the CUDIS data aggregator, using the CUDIS app and smart ring as tools, with the CUDIS token as an incentive. The company has earned over $4M in ring sales, sold over 15,000 rings, and has over 100,000 community members from 100+ countries;

-

Pump.fun – a platform on the Solana blockchain that allows users to easily create and trade meme tokens. Launched in January 2024, it quickly gained popularity among crypto enthusiasts due to its ease of use and low transaction costs.

Phantom Wallet

Phantom Wallet is a multi-chain Web3 wallet supporting the Solana, Ethereum, and Polygon networks. With self-custody of funds, users can use decentralized applications without third-party intervention. Phantom works as a browser extension, similar to MetaMask. For those who want to use it on mobile devices, Phantom Wallet also has apps for Android and iOS.

Phantom Wallet was launched in 2021 with 40,000 active beta testers supporting the Solana ecosystem. That same year, it raised $9M to implement its development plans and introduced an in-app token swap feature. A year later, it raised $109M in a Series B funding round at a $1.2B valuation, becoming a coveted "unicorn." Today, Phantom Wallet boasts over 3M users and numerous features added since its founding.

Advantages for Investors

Such a project could not go unnoticed by crypto investors, who have identified several key advantages:

-

SOL has limited emission. This means the network will not create SOL indefinitely, helping keep the token price under control. This is also aided by the burning of 50% of the fees for every transaction processed on the Solana blockchain;

-

Solana is one of the few blockchains with implemented smart contracts, putting it on par with Ethereum and Cardano. Furthermore, the project's network is autonomous, meaning it does not use any L2 solutions, parachains, or sidechains. In other words, Solana's functionality does not depend on anything else;

-

The Solana blockchain is a "pioneer" in using the PoH mechanism, along with other technical innovations. As time shows, they are highly in demand and effective, and it is likely that we will see many other projects with similar functionality in the future. Solana will become their progenitor, increasing interest in it.

Where to Buy SOL

If you want to purchase SOL tokens, you can do so on Binance, OKX, Bybit, Kraken, or Coinbase—reliable exchanges with high liquidity. However, this doesn't mean SOL isn't available on other exchanges; those listed are simply the most reliable.

You can also consider buying SOL tokens through decentralized exchanges. Always verify the SOL contract from the official website and in the pool where you intend to perform the swap to avoid buying a fake.

SOL can also be purchased via P2P platforms, as the token is extremely popular and listed on many crypto platforms.

Problems and the Future of Solana

Problems of Solana

One of the issues associated with Solana is SOL's emission. Between 2022 and 2027, the supply will increase by approximately 43%. If demand and interest do not continue to grow, the basic economy of supply and demand will become clear: the SOL token could become unwanted, leading to a price drop.

It is also questionable whether Solana will surpass other competitors like Ethereum, Avalanche, and NEAR. While Solana prides itself on not using second-layer blockchains, the fact remains that the average dApp user doesn't care what the underlying infrastructure looks like as long as it works well. Such short-sightedness could be detrimental to Solana.

What is the Future for Solana and the SOL Token?

Today, many crypto funds have applied to create a SOL-ETF. While it's too early to say we are awaiting a new investment tool, there is already reason to think about it.

Additionally, SOL remains in demand among investors and traders: on January 19, 2025, the token's value exceeded $294, setting a new all-time high.

It is also worth noting that decentralized exchanges on Solana have a higher trading volume than those on Ethereum. It turns out that market participants prefer a relatively new project over the first blockchain with smart contracts.

Based on the facts presented above, one can assume that the SOL token, as well as the project as a whole, faces steady growth in the foreseeable future.

Conclusion

Overall, Solana is a promising project supported and believed in by many major investors. First, the team is very cohesive and forward-thinking. Second, Solana has proven itself to be a more than convenient interface with hundreds of billions of confirmed transactions. Third, the company had humble beginnings—it didn't receive hundreds of millions of dollars in backing from venture investors looking for quick profits. Together, these facts point to one thing: results.

Frequently Asked Questions

What makes Solana unique?

Solana's uniqueness lies in its use of the Proof of History (PoH) mechanism, which significantly speeds up transaction processing and enhances network scalability. This allows the Solana blockchain to handle up to 65,000 transactions per second (TPS), far exceeding the performance of Ethereum and Bitcoin.

Solana also operates as a single Layer 1 (L1) blockchain without using Layer 2 (L2) solutions or parachains like its competitors. This makes the network more autonomous and developer-friendly.

Another key point is low fees. The minimum transaction cost in the network is only 0.0001 SOL, making Solana accessible for users and DeFi application developers.

What are the downsides of Solana?

Solana has its disadvantages.

-

Despite its impressive speed, some worry about the level of decentralization due to the small number of validators. In the past, network outages have also caused disruptions;

-

While Solana is more eco-friendly than Bitcoin, Solana's energy consumption remains a concern for the community;

-

Compared to Ethereum, Solana's developer ecosystem and established decentralized applications still lag behind;

-

Finally, tokenomics with high initial inflation raise questions about SOL's long-term value.

Solana is called the Ethereum killer – why?

Solana is sometimes called an "Ethereum killer" because of its ultra-high transaction speeds (65,000 transactions per second compared to 30 transactions per second on Ethereum). Like Ethereum, Solana is a public Layer 1 blockchain, but Solana's fees are very low compared to Ethereum's "gas" fees, which can reach several hundred dollars.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.