Experienced investor vs Beginner. What is the difference?

PSYCHOLOGY OF A BEGINNER AND PROFESSIONAL INVESTOR: WHAT ARE THE DIFFERENCES?

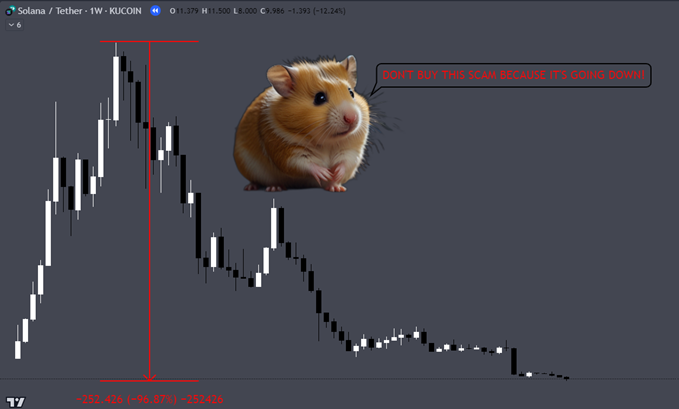

Beginners, seeing prolonged drops and lack of growth, begin to get disappointed in the coin and the market as a whole. Greedy ones will always seek any other asset and way to earn here and now.

Fig. 1 - "Drop of SOL/USDT 1W Kucoin after peak in 2021"

For example, beginners often seek an asset where growth is active, where social networks are also filled with positive comments from other market beginners (Fig. 2).

Fig. 2 - "Growth of MEW/USDT 1D OKX"

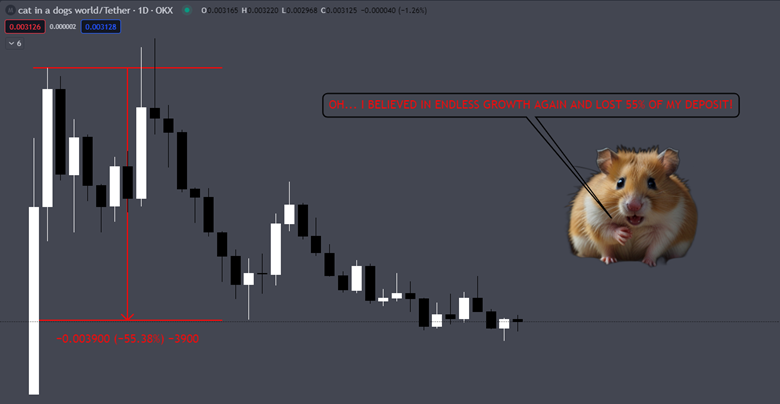

Belief in endless growth often forces inexperienced market participants to buy at peaks. And, as a rule, the asset goes into a deep correction. Hamsters who bought in start to panic and sell the coin at a loss, turning their deposit into dust. (Fig. 3)

Fig. 3 - "Drop of MEW/USDT 1D OKX"

Such thoughtless decisions arise from emotions inherent in a person not prepared for the market. Greed and fear for their money, and of course, the lack of a clear plan for buying and selling the asset, will lead to failure.

A number of important postulates observed by a professional investor:

- Do not fall in love with the coin, invest in technology and the team. You can see the potential of the coin only when an analysis of the project is done. Beginners, on the other hand, only see the price chart, interpreting it as follows: if it falls - it's a scam, and if it rises, it means it's fundamental.

- Time rewards. Smart money always comes in the hardest times. And it's not about the size of the capital. A smart investor can always see the potential with deep project analysis, while a beginner wants it here and now.

- Act according to a clear plan. A professional always acts calmly. He does not chase a coin that is rising. On the contrary, he calmly waits for a clear picture to make a confident trade. And during local corrections, if necessary, he strengthens his position. A wise investor always has a clear plan for any scenario of movement for any asset in the portfolio.

SO WHAT SETS A PROFESSIONAL INVESTOR APART FROM A BEGINNER?

A professional always conducts a thorough analysis before investing, dissecting the project(s) thoroughly (Fig. 4).

Fig. 4 - "Rise of SOL/USDT 1W Kucoin after global bottom"

Thus, a professional is able to see enormous potential and development prospects. Beginners, on the other hand, fill their bags hoping to make a quick profit at the moment, not realizing that the project unfolds over time. It is logical that beginners, not seeing growth, quickly get disappointed and sell the asset at a loss.

!!! NOTE: an investor earns profit over time, on projects that have a foundation not fully disclosed. The presence of fundamentals and a strong team, as well as partnerships with powerful companies - all these are derivatives of the equation called profit.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.