How to make money from venture capital investments in cryptocurrency

Today, we will talk about Pantera Capital, one of the leading venture capital players in the cryptocurrency and Web3 space. It is the first fund in the United States to focus its investments on digital assets and blockchain technologies, becoming a pioneer in the industry. Pantera Capital stands alongside giants like Andreessen Horowitz (a16z) and Paradigm, and was already actively investing in cryptocurrencies when many were still skeptical. At a time when Bitcoin was only worth $65, Pantera Capital had already seen the future of cryptocurrencies and became the first U.S. fund focused on digital assets. Today, its investments are concentrated in the blockchain sector and Web3 technologies.

Pantera Capital Investments

Currently, we can highlight some key investments made by Pantera Capital. These projects are available for public analysis, and you can track them yourself through various venture fund listings – link. Thanks to open data and on-chain analysis tools, every investor can study the transactions and investment steps of the fund, enabling them to timely spot shifts in strategy and assess the development prospects of projects within the Web3 and blockchain technology sectors.

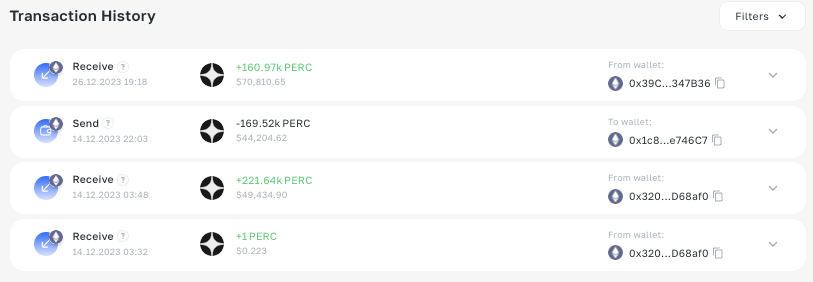

For example, the $PERC token is a platform aimed at improving gaming through Web3 technologies. It offers solutions for integrating blockchain technologies into the gaming industry, including tools for managing digital assets and monetization.

During the analysis we see tokens stitched to the fund's wallet in December 2023, since the last actions with the PERC token its price has changed by 293.54%

The on-chain strategy involves tracking venture fund transactions on the blockchain. This allows investors to analyze which projects the funds are supporting, the volume of their investments, and changes in their portfolios. Such an approach enables investors to respond quickly to the actions of funds, identify trends, and adjust their own investment strategies. On-chain analytics provide transparent data on asset movements, helping investors better understand which projects might be promising in the future.

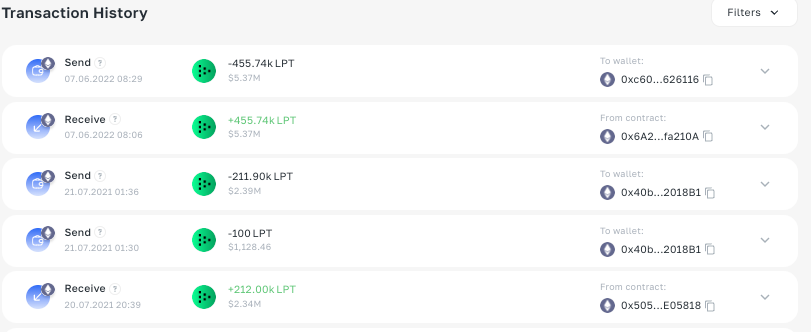

For example, consider the LPT token. Livepeer is a decentralized video streaming platform that operates on the Ethereum blockchain. It provides infrastructure for video transcoding, significantly reducing the costs associated with video streaming. The LPT token is used for staking, governance, and rewarding participants who offer their computational power for video encoding

Back in 2022, Pantera Capital made an investment in the LPT token (Livepeer), and two years later, the token's price has risen significantly, reaching an increase of 241.58%

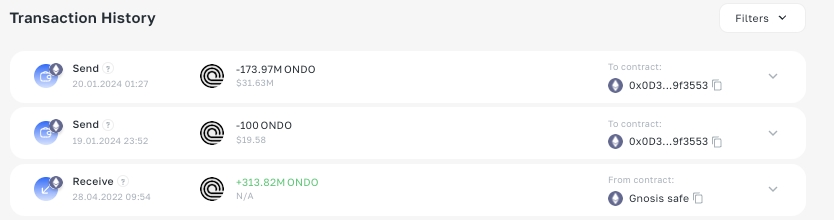

ONDO (Ondo Finance) is a decentralized finance (DeFi) platform that offers structured investment products. Users can earn both fixed and variable returns, allowing them to manage risks more flexibly and optimize their earnings. Ondo aims to bridge traditional financial markets with DeFi, providing a wider range of investment solutions.

Pantera Capital is the lead fund in ONDO's investment round

Since the latest actions involving the ONDO token, there has been a remarkable price increase of 1991.30%. The exact reason for ONDO's rapid growth remains somewhat unclear, but the platform's strategic partnerships with major financial institutions like BlackRock may have influenced investor sentiment.

At the end of March, Ondo Finance transferred $95 million of its assets into the tokenized BlackRock BUIDL fund to facilitate instant settlements for its ONDO token, which is backed by U.S. Treasury assets. While this specific transaction is unlikely to have directly triggered the recent price movement of ONDO, the association with BlackRock seems to have bolstered ONDO holders' confidence in the token's future prospect. Wallet BlackRock—Link

Wallets Pantera Capital:

0×12c

0×88

0x51

NOTE: The tokens mentioned in this article are not financial advice. Please manage risks and conduct your own analysis (DYOR).

You can also read our case study: How to Make Money with Whale Wallets

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.