YoBit Cryptocurrency Exchange: Official Website Login and Platform Review

YoBit Exchange in 2025: Website, Login, Registration, Deposits, and Reviews

YoBit cryptocurrency exchange is one of the most mysterious platforms on the market. Founded in 2015, it attracts users with its anonymity, a wide range of trading pairs, and various tools for earning. However, the lack of transparency, complaints about support, and a controversial reputation raise questions about its reliability.

In this review, we will take a detailed look at the exchange's functionality, its pros and cons, and real user reviews.

General Information about YoBit

A cryptocurrency exchange founded in 2015. There is no information online about who developed the exchange or which jurisdiction it falls under. The exchange website is available in several languages: English, Chinese, Russian, Spanish, Turkish, and others.

Daily trading volume reaches $172 million. YoBit attracts customers with its anonymity: there is no verification on the exchange, and to protect your account, you will be prompted to set up two-factor authentication. One of the advantages of the exchange is the absence of limits on deposits and withdrawals, which gives its clients complete freedom of action regarding their funds.

Registration and Login to YoBit Exchange

Registration Process

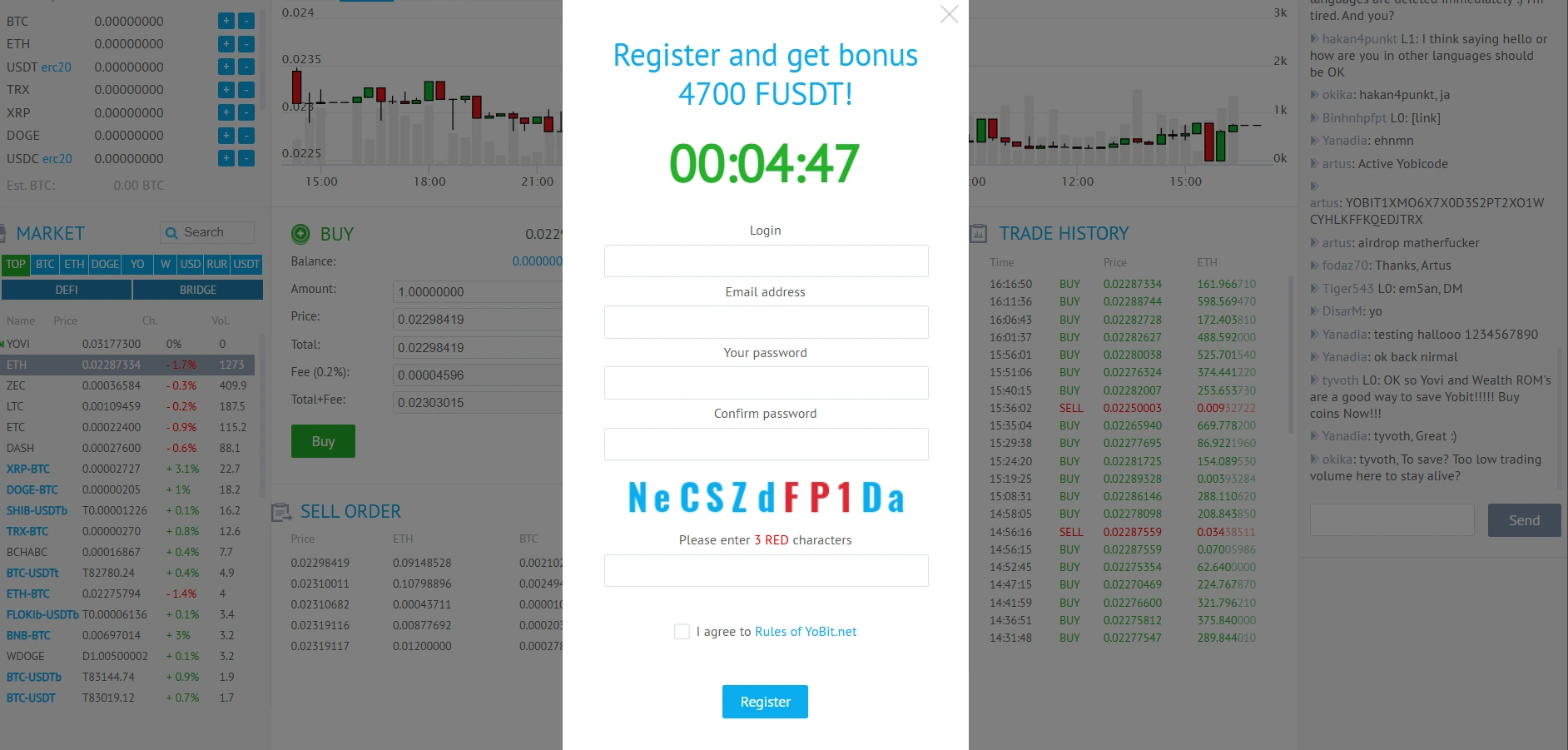

YoBit is one of the few exchanges that asks you to create a login during registration. Furthermore, the login cannot be the same as your email address. This is not very convenient, especially if the user forgets the account password and wants to reset it: you need to provide both the email and the login, which can be easily forgotten.

To create an account on YoBit, you need to:

-

Go to the main page of the exchange and click "Registration";

-

Next, you need to provide a login, email, password, and pass the captcha;

-

After this, a registration confirmation link will be sent to the user's email.

Account Verification

YoBit is one of the few crypto exchanges today where identity verification (KYC) is completely absent. At the same time, the platform allows you to deposit and withdraw fiat currencies. This is likely one of the reasons why YoBit is still popular among the crypto community, and from the further review, you will understand why.

Profile and Dashboard Settings

Hovering over your login will open a menu that includes:

-

Settings – here you can enable two-factor authentication – this is a prerequisite for starting trading on the exchange. You can also reset your password and set up email notifications here;

-

YoBit-code – users can create a special code in which a certain amount of cryptocurrency will be locked and given to someone;

-

Fees – what commission is charged for depositing and withdrawing funds;

-

Affiliate – the exchange's partner program, which offers 20% of trading commissions for each referred user.

Working with the YoBit Exchange

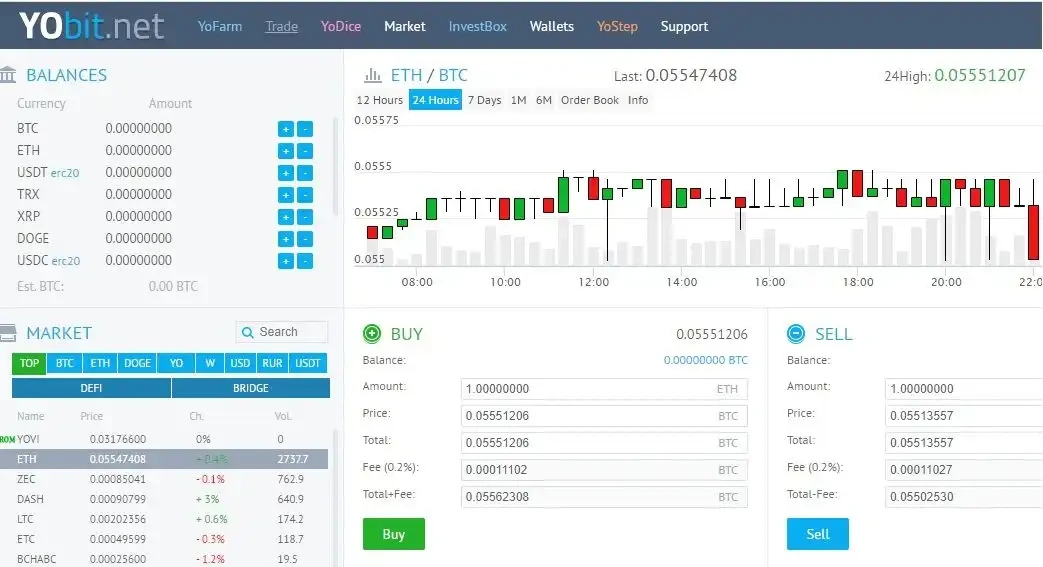

Trading on YoBit

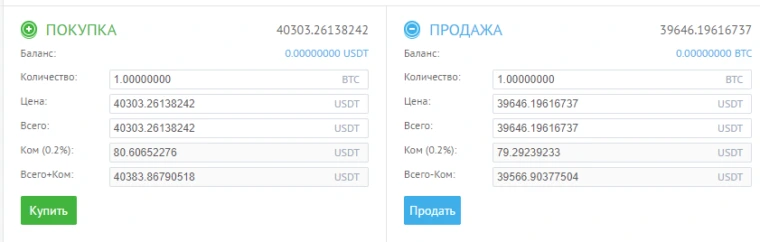

The exchange offers only spot trading; there is no margin or futures trading. Commission fees are the same for everyone, they do not decrease based on trading volume, and amount to 0.2% for both makers and takers.

Market and Trading Pairs

The exchange is, if not the leader, then clearly among them, in terms of the number of currency pairs presented – over 2,160. It features various altcoins and tokens that haven't functioned for a long time, but they are still present on the exchange.

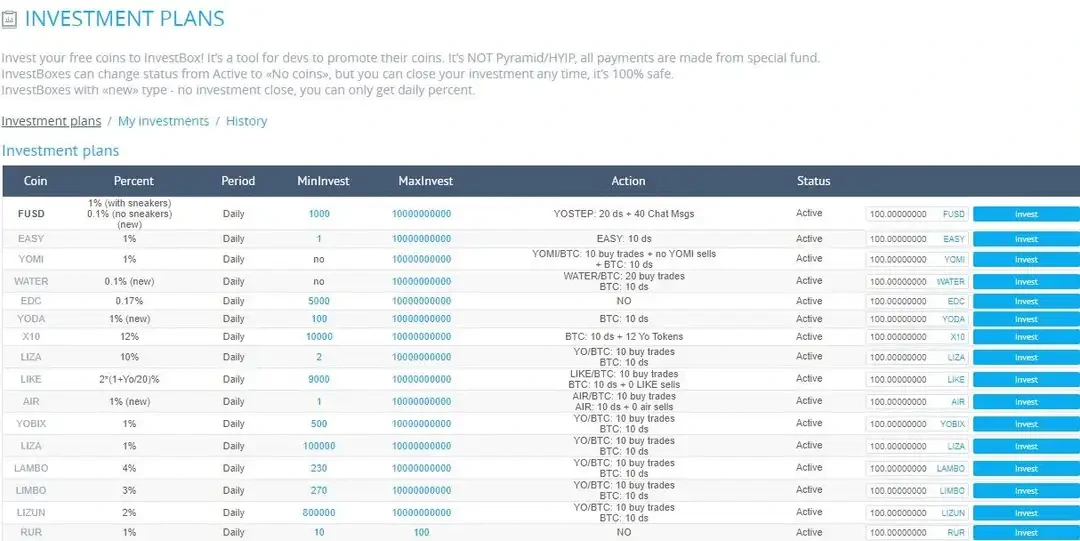

InvestBox

YoBit emphasizes that the offered investment tools are not Ponzi schemes or high-yield investment plans (HYIP). Furthermore, they are 100% safe, according to exchange representatives – a rather bold statement. In the crypto market, if someone tries to convince you that investing in anything is 100% safe, it’s a scam.

The operating principle of InvestBox is the same as cryptocurrency lending, where users lend their coins to make a profit. At YoBit, these plans offer daily profits of up to 5%. BTC offers one of the highest returns (15% per week), but you will need to invest at least 50 BTC.

YoDice

In YoDice, users can roll virtual dice and, depending on the amount they bet in Bitcoin, earn YoDice tokens as a reward.

Here is a brief description of how it works:

-

Bet in Bitcoin: users can participate in the dice game by placing a bet in Bitcoin. The minimum amount to participate is 0.001 BTC, and the more you bet, the higher the potential reward in YoDice tokens;

-

Token rewards: the number of YoDice tokens earned is directly proportional to the size of the bet. The larger the bet, the more tokens you receive as a reward.

Token rewards are distributed by tiers:

-

With a bet of more than 0.001 BTC, you get 10 YoDice tokens;

-

With a bet of more than 0.01 BTC, you get 110 YoDice tokens;

-

With a bet of more than 0.1 BTC, you get 1,200 YoDice tokens;

-

With a bet of more than 1 BTC, you get as many as 13,000 YoDice tokens.

Earned YoDice tokens can be withdrawn every 10 minutes.

YoFarm

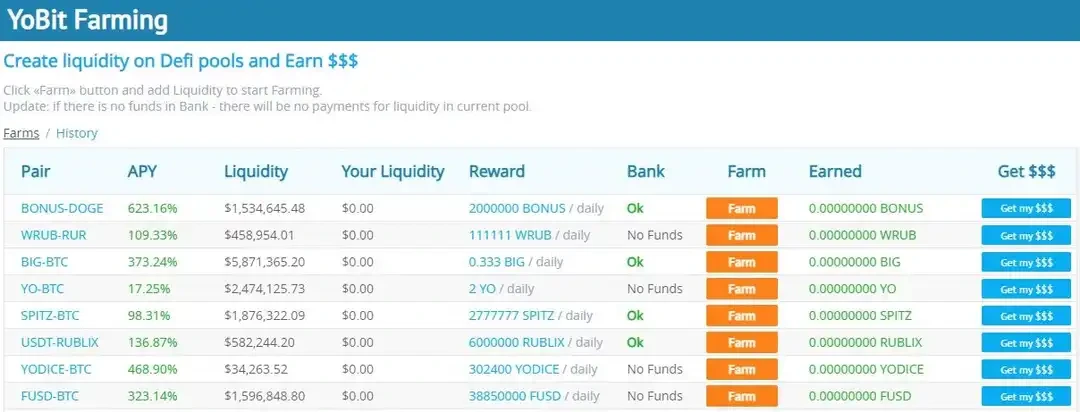

In decentralized finance, liquidity farming is a method by which users can earn rewards by providing liquidity to a decentralized exchange (DEX) or liquidity pool. YoBit offers a choice of 23 liquidity pools with impressive APY.

The liquidity of the BONUS-DOGE pair is over $1.5 million, and the APY is 623.16%. The APY for the YODICE-BTC pair is 468.90%. The lowest APY of 4.39% is offered in the BTC-USDT pair.

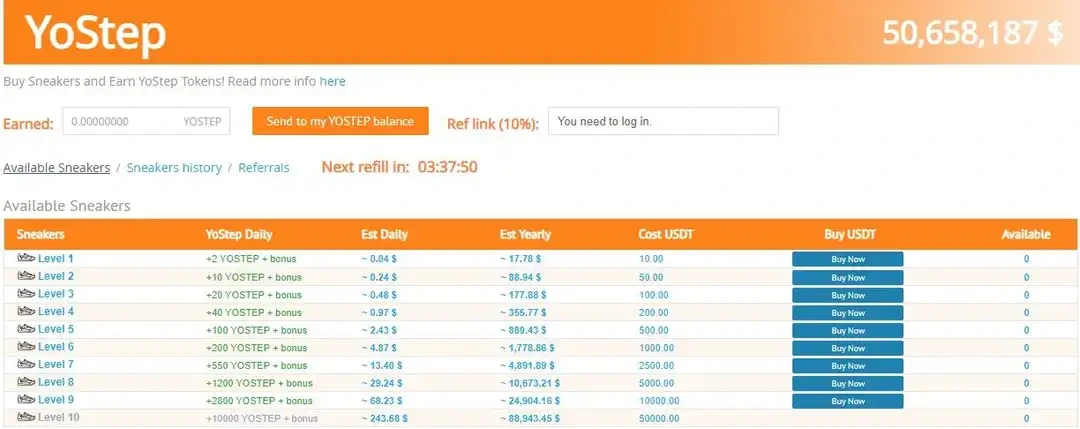

YoStep

YoStep rewards users daily with YOSTEP tokens if they buy virtual sneakers through YoBit. To receive these rewards, users must perform simple actions on the exchange, such as playing the YOSTEP coin game at least 10 times daily. The minimum purchase amount starts at 10 USDT and is limited to 50,000 USDT.

There are several rules to keep in mind:

-

Users will receive sneaker rewards twice a day;

-

The temporary purchase limit for one user is 80 pairs of sneakers. However, Yo token holders can purchase up to 160 pairs of sneakers;

-

The number of sneakers available for purchase is limited;

-

To successfully make a payment, users need to play the Dice game at least 10 times;

-

Sneakers may need repair once a month, for which YO tokens can be used at a price of 5% of the cost.

How to Deposit and Withdraw Money from YoBit

Fees and Limits, Deposit and Withdrawal Methods

The trading commission on the exchange is 0.2% of the transaction amount. There are no opportunities for commission reduction on YoBit.

Regarding the commission for depositing and withdrawing funds, the situation is as follows:

Cryptocurrency:

-

Deposit – free;

-

Withdrawal – 0.0005 BTC.

Fiat (Deposit):

-

AdvCash, Payeer – free;

-

Capitalist – 1%.

Fiat (Withdrawal):

-

AdvCash – 4%;

-

Perfect Money – 1%;

-

Payeer – 5% (USD), 12% + 2 RUB (RUB);

-

VISA/Mastercard/MIR bank cards – 4%;

-

Mobile phone – 3%.

It is also interesting that you can withdraw funds to a bank card, but you cannot deposit from it. The reason for this is unclear.

Customer Support Service

YoBit claims to respond to most customer inquiries within an hour, and some within 24 hours.

Judging by online reviews, customer service at the exchange leaves much to be desired: inquiries are received, but responses do not reach everyone, and tickets are lost forever. The average response time for crypto exchange queries is more than two hours.

Many users have accused YoBit of not responding to emails, requests, and Telegram messages.

YoBit Security

YoBit seems to keep its security protocols secret, leaving users in the dark.

According to CER, an independent cryptocurrency security and audit company, YoBit isn't even in the top 100 cryptocurrency exchanges by security level. Furthermore, the exchange has not undergone penetration testing, does not offer bug bounties, and is not ISO 27001 certified. CER assigned YoBit a low DD rating. However, it is important to note that YoBit has apparently never been hacked, which is a positive factor.

The lack of a detailed description of security measures from YoBit raises questions about the exchange's commitment to ensuring the safety of user funds. In this regard, YoBit's approach appears to deviate from the norm, potentially undermining user trust in the platform.

How to Buy Cryptocurrency on YoBit Exchange

The process takes place in several stages:

-

You need to find the "Market" tab and select the desired trading pair;

-

Then you will be automatically redirected to the "Trade" page, where the chart of the selected trading pair and the order book will be displayed;

-

At the bottom, there is an application form for buying or selling cryptocurrency. To buy cryptocurrency, enter its quantity. The system will automatically calculate the transaction fee and the total cost of the operation.

-

Click "Buy," after which the cryptocurrency will appear in your exchange wallet.

Pros and Cons of YoBit

Pros:

-

YoBit boasts an extensive list of supported coins and trading pairs;

-

The platform offers opportunities for additional earnings;

-

Some YoBit features, such as InvestBox and YoStep, have relatively low entry barriers;

-

You can work with the exchange without KYC.

Cons:

-

YoBit falls short on transparency: there is no clear information about its founders, headquarters, or security system;

-

The platform's home page has a cluttered and confusing design;

-

YoBit's security methods are questionable;

-

Independent auditors do not even include YoBit in the top 100 exchanges for security;

-

Numerous users online report unresponsiveness from YoBit customer support across various channels;

-

YoBit does not support direct deposits via debit or credit cards.

Reviews of YoBit Exchange

YoBit is a unique platform that is perfect for "pump and dump" schemes. The exchange has received numerous complaints in this regard: claims stated that trading bots simulated demand for unknown altcoins that were not traded on any other exchanges. When traders entered the deal, they found that the electronic wallets of the given altcoin were disabled, meaning the altcoin was no longer serviced.

Due to this factor, there were a huge number of complaints to regulators, and in 2017, Roskomnadzor blocked the exchange's website, which was located on the yobit.net domain within the CIS. However, exchange representatives created another domain - yobit.io.

But this is not the only negative point regarding the exchange. On the bestchange.ru website, there are a huge number of reviews from dissatisfied users related to the following factors:

-

Support works poorly. Besides the fact that the exchange uses a ticket system and there is no way to contact support online, support responds quite slowly to these tickets in situations where help is needed immediately;

-

Although the rules for funding an account state that funds can take up to a week to arrive, users noticed an interesting feature: transactions under 1,000 rubles arrive almost instantly, while those above can take up to a week, which slows down the trading processes of exchange users;

-

The exchange has been accused multiple times of misappropriating client funds. Currencies simply disappeared from user accounts, and in most cases, support remained silent in response.

In 2016, the Waves blockchain platform accused YoBit of fraud. At the end of the crowdsale on June 1, 2016, WAVES tokens could not yet be withdrawn from the platform's personal account, but the WAVES/BTC trading pair had already appeared on the YoBit exchange at a price of about $14, which exceeded the token's real price. Waves tried to contact the exchange management, but there was no response.

Based on the facts listed above, YoBit has a fairly controversial reputation, and there are far fewer positive reviews of the exchange.

YoBit FAQ

How many cryptocurrencies does the YoBit exchange support?

YoBit supports over 2,160 trading pairs, including popular and rare altcoins, as well as tokens that have long since stopped trading on other exchanges.

What opportunities are provided besides trading?

In addition to spot trading, YoBit offers several ways to earn:

-

InvestBox – an opportunity to earn income from investments, though safety guarantees are absent;

-

YoDice – a dice game with the possibility of earning tokens;

-

YoFarm – liquidity farming with APY up to 623%;

-

YoStep – buying virtual sneakers and receiving YOSTEP tokens.

What are the deposit and withdrawal methods?

YoBit supports both cryptocurrency and fiat currency deposits and withdrawals.

Cryptocurrency operations: deposit is free, and the withdrawal fee is 0.0005 BTC.

Fiat operations:

-

Deposit: AdvCash and Payeer – free, Capitalist – 1%;

-

Withdrawal: AdvCash – 4%, Perfect Money – 1%, Payeer – from 5% (USD) to 12% + 2 RUB (RUB), VISA/Mastercard/MIR bank cards – 4%, mobile phone – 3%.

Is YoBit safe?

The safety of using YoBit is questionable. While the exchange claims never to have been hacked, the lack of transparency regarding security measures, poor protection metrics, and the absence of penetration testing or bug bounty programs raise concerns.

Is YoBit a scam?

The exchange is ambiguous: it has users successfully trading on the platform, but also many complaints about disappearing funds, withdrawal issues, and lack of support. This makes YoBit a highly risky choice.

What are the reviews for YoBit?

Reviews of YoBit are contradictory. Some users praise the platform for its lack of KYC and large selection of cryptocurrencies. However, there are many negative comments online regarding withdrawal problems, non-responsive support, and price manipulation of little-known tokens.

Conclusion

YoBit is an exchange that will suit lovers of anonymous trading and rare altcoins. However, users should consider the risks: lack of regulation, low level of transparency, poor customer service, and questionable methods of operation. Arbitrage Scanner supports a large number of exchanges for cryptocurrency arbitrage; you can find more details at this link. Before using the platform, it is important to weigh all the pros and cons and not store large sums on it. Ultimately, the choice is yours, but you should be extremely careful.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.