Crypto whale wallets: where are the millions stored?

with ArbitrageScanner!

Whale wallets: a complete guide to monitoring and analysis

Crypto whales are players capable of moving the market with a single click. Their transactions cause waves of interest and, at times, real market storms. In this article, we will explain who they are, how to track their wallets, and most importantly—how to use this information to your advantage.

Who are crypto whales?

Whales in the crypto market are large investors who own a significant amount of a specific digital asset. The analogy with a whale is used for a reason: when it rises from the ocean floor and dives back, waves spread across the surface, affecting everything in their radius. Similarly, if a large cryptocurrency holder decides to sell all their assets, they can drive down the price because a massive supply hits the market.

However, the opposite can also happen: if a whale buys a large amount of a cryptocurrency, the crypto community will definitely notice, and some may copy the trade, leading to a price increase. You can find out which address bought cryptocurrency and when by using on-chain analysis: blockchain analytics that allow for tracking transactions and address balances.

One might wonder: how does tracking transactions and addresses inside the blockchain help investors? In fact, these two data sources can reveal a lot about the market situation: which cryptocurrencies are being withdrawn from exchanges and which are being deposited; which coins investors prefer to hold and accumulate; and the overall market sentiment.

Crypto whales are not necessarily individuals. Most often, an address belongs to:

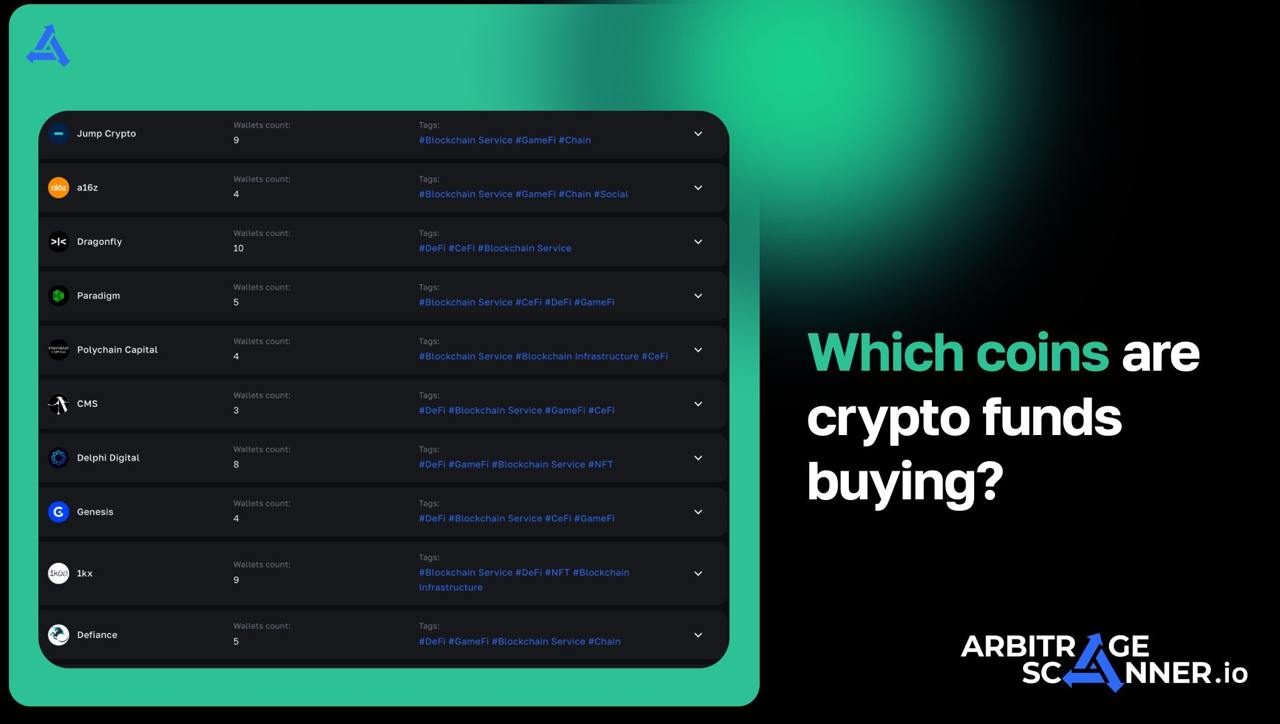

- Investment funds

- Project development teams

- Government organizations

- Groups of institutional traders

- High-profile media investors

Enterprising crypto enthusiasts have long been copying whale trades thanks to on-chain analysis. Think about it: behind big capital, there isn't just one person—it’s a group of people, including numerous analysts who monitor markets daily for promising assets. Furthermore, whales often possess insider information, based on which they might invest in a new token. What a retail investor won't know until the official announcement is often known to a large player much earlier, making their trades a useful guide, though not always.

The issue is that when dealing with relatively new crypto projects with a capitalization of only a few hundred thousand dollars, there is a high probability of encountering a scammer posing as a whale. They might purchase a large number of tokens to create the appearance of a truly valuable asset, only to dump all tokens on the market later, crashing the price and pocketing the profit.

Therefore, searching for crypto whales must be approached with caution, as it is quite easy to stumble upon scammers.

Why track whale wallets?

Market influence

As mentioned, crypto whales can influence the market. Let’s break down exactly how this happens:

- If a large amount of an asset enters the market, a price decrease follows. The higher the supply, the lower the demand at current prices, as market participants realize they can buy it cheaper.

- If a crypto whale starts buying up all available supply from the market, the price is set to rise. Market participants see growing demand and raise their prices accordingly.

- The moment a whale starts transferring cryptocurrency to centralized exchanges, it signals an intention to sell. The specific reason is never known, but it usually reflects negatively on the price.

- Conversely, when a whale withdraws cryptocurrency from exchanges, it is a long-term signal, as they don’t want to sell but prefer to hold in anticipation of a better exit price.

Thus, tracking whale trades, especially in mid-cap coins, allows market participants to optimize their strategies and minimize losses.

Liquidity and price analysis

Analyzing whale trades also helps understand aspects related to liquidity and pricing:

- Where market liquidity is moving—what whales prefer to invest in today. If a cryptocurrency has good prospects, several whales will invest in it, representing serious capital committed to that specific asset.

- Market depth—how quickly orders are executed. The more liquid an asset, the easier it is to buy or sell. Generally, large investors choose the most liquid cryptocurrencies because they may need to withdraw funds for reinvestment at any moment.

- Strength of support and resistance levels. For example, if a large investor purchased a massive amount of crypto and the price only rose by 3%, it indicates a strong resistance level and that buyers' strength is currently insufficient to overcome it.

- Whether a cryptocurrency is overvalued or undervalued. Suppose a new token is growing actively with many small and medium investors. However, there are only a few whales among them—this suggests large investors aren't interested because the asset is currently overvalued.

How to start whale watching?

First, decide on a few cryptocurrencies that interest you personally. Technically, you could just copy whale trades without understanding the tokens they buy. However, practice shows this can end poorly. A simple rule applies here: don't invest in what you don't know. Many projects appear daily, some launched by scammers. To protect yourself, it's recommended to start with a specific list of cryptocurrencies to track.

After that, you need an on-chain analysis service. It will help you quickly find wallets of interest and track all relevant information. Notable services include:

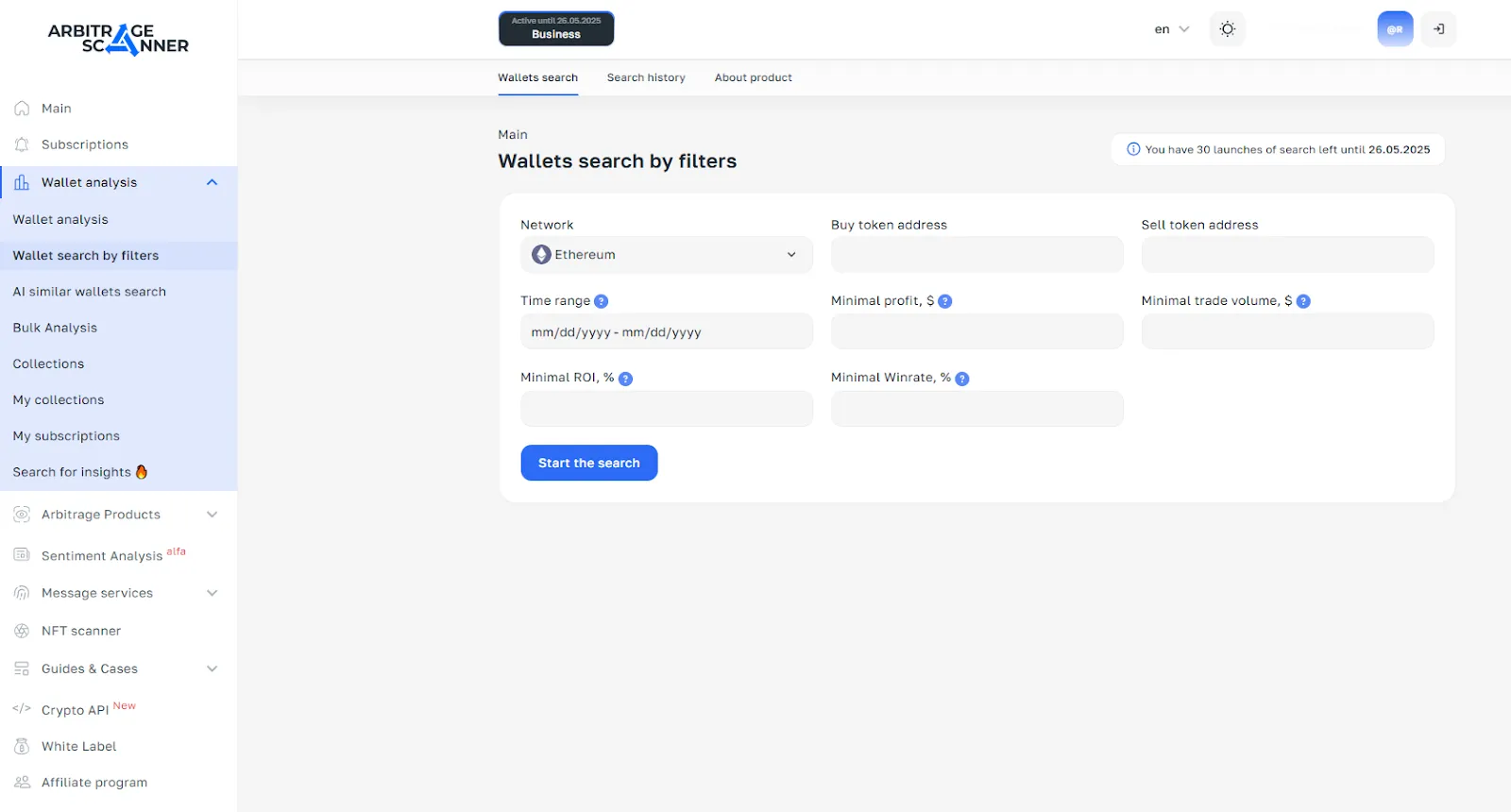

- Arbitragescanner. This is an advanced service for on-chain analysis. It allows you to easily find whale wallets. Furthermore, the tool integrates AI to help find similar wallets: if you find one whale, Arbitragescanner helps locate others based on that profile. You will have several addresses to monitor and adjust your strategy. The service also offers tools to find profitable arbitrage loops, allowing you to earn in both bull and bear markets.

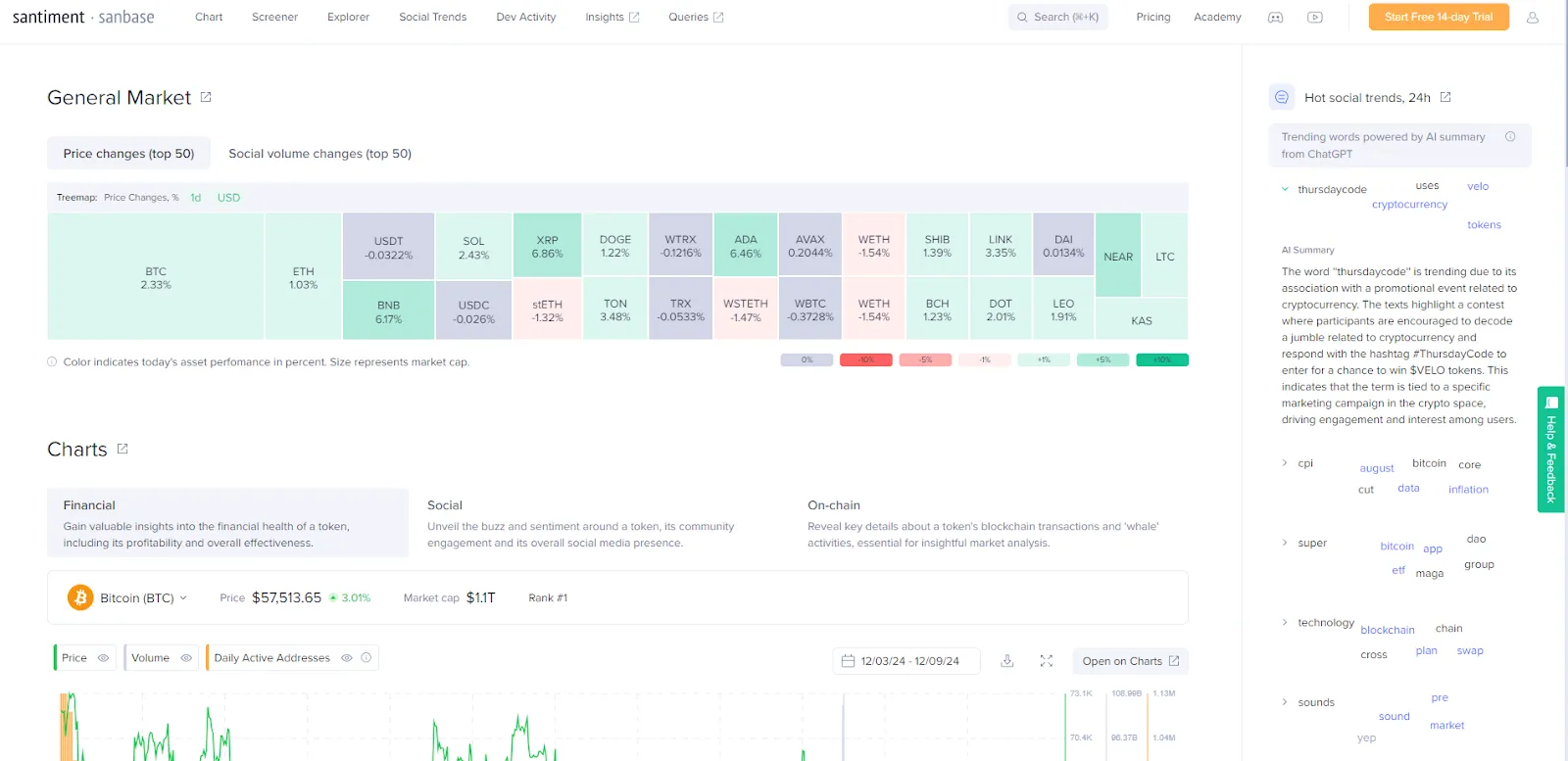

- Santiment. A veteran in blockchain analytics that lacks modern tooling. This service was one of the first and was a breakthrough in its time. It offers extensive data: from transaction activity and miner actions to its own indices like NVT and MVRV. It also has something others lack—social analysis. Santiment tracks what tokens the community is discussing to form trade hypotheses. However, everything beyond social analysis feels outdated. Charts and signals look like basic visualizations without much depth. If you seek a comprehensive market picture or serious profits, this toolkit may be insufficient. Santiment is good as a secondary tool, but not as a primary one.

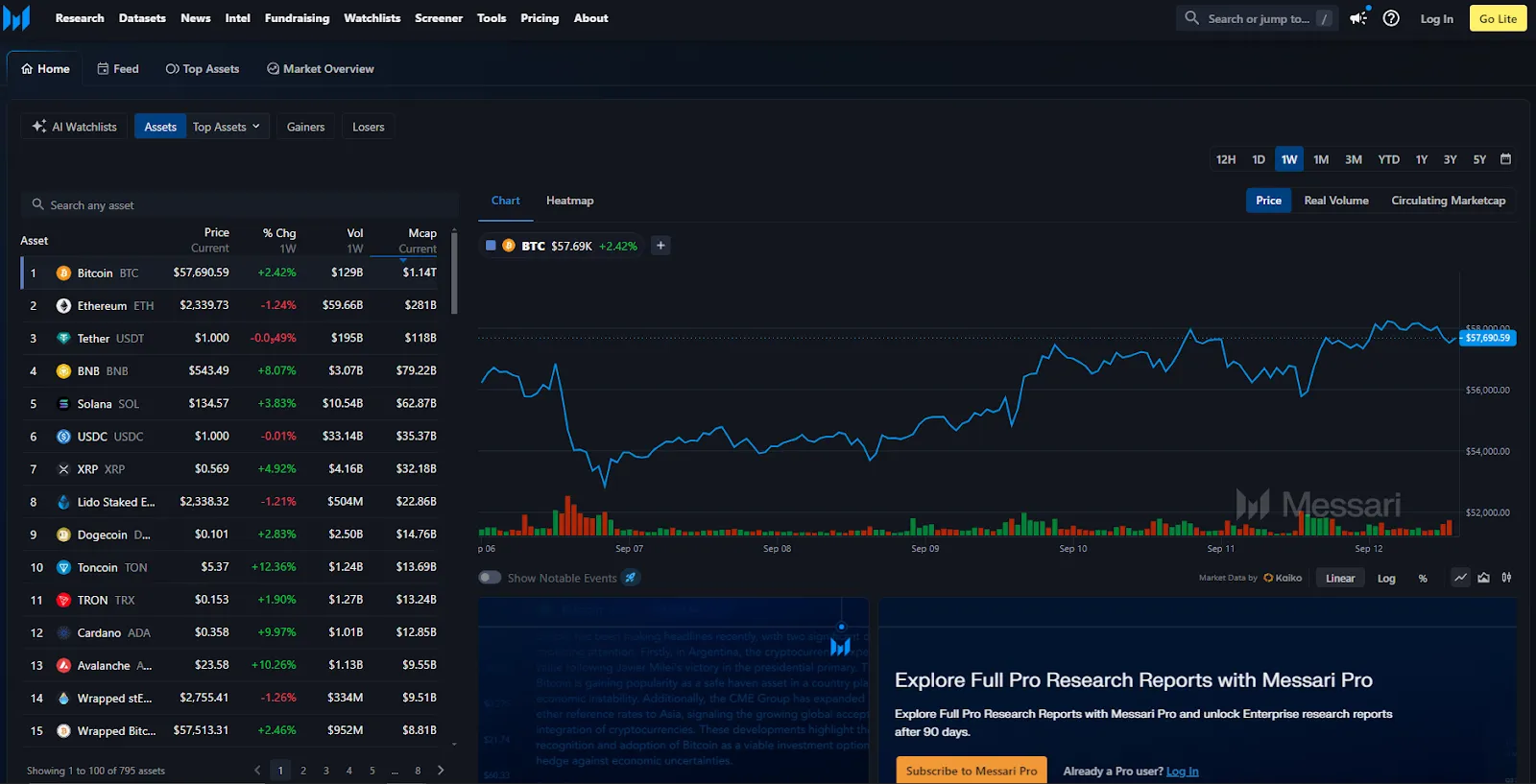

- Messari. This service is often praised as a convenient source for asset analysis. The interface is clean and understandable, with structured data: prices, volumes, capitalization, and 24-hour changes. There is even a crypto screener to filter coins. Essentially, it’s like CoinMarketCap but with a minimalist design. However, the toolkit feels bare: there is no deep on-chain analysis, no advanced signals, and social metrics are missing. For real-time market observation, Messari lacks flexibility and depth. It works well as a screener, but as a full analytical tool, it is still "raw."

Famous whale wallets

Crypto whales don’t always stay in the shadows; some are well-known to the community.

Satoshi Nakamoto

In this case, only the pseudonym is known. Satoshi Nakamoto is the creator of Bitcoin who disappeared over 10 years ago. Experts estimate Satoshi may own between 600,000 and 1.1 million BTC distributed across more than 20,000 wallets. He didn't intentionally distribute them; these were mining rewards from when he actively maintained the network. It remains unknown if Satoshi was one person or a group, and if these "dormant" coins will ever be used. If they are, it would significantly impact the market, as it represents nearly 1/21 of the total supply.

The Winklevoss Twins

Tyler and Cameron became famous for suing Mark Zuckerberg over Facebook's origins. After receiving a $20 million settlement, they bought $11 million worth of Bitcoin in 2013 at an average price of $120—about 92,000 BTC. By early 2025, with Bitcoin reaching $107,000, their investment grew 99-fold. They also founded the Gemini exchange. Their reserves have slightly decreased to 70,000 BTC, but they remain among the largest Bitcoin whales.

The US Government

The United States is also one of the largest crypto whales. Besides other assets, the country holds over 207,000 BTC. When Donald Trump announced a national Bitcoin reserve, the community hoped the US would buy more from the market. However, Trump later clarified that the reserve would consist only of coins confiscated from criminals, with no plans to purchase new coins from the market.

Barry Silbert

An early Bitcoin investor, Barry Silbert invested $16.8 million around the same time as the Winklevoss twins, though the exact amount of BTC is unknown. His profits were enough to found Grayscale Investments, an asset management company for institutional investors. It is believed he purchased Bitcoin seized from the Silk Road at prices much lower than the market rate.

Tim Draper

Tim was initially involved in large-scale Bitcoin mining. He sent all his coins to Mt. Gox, which claimed they were safe. After the exchange was hacked in 2014, losing 850,000 BTC, Draper started over. He rebuilt his portfolio by buying Bitcoin at various auctions below market price. He accumulated about 40,000 BTC, and while his balance has dropped to around 30,000 BTC, he remains a prominent whale.

How to make money from crypto whales?

Watching whales isn't just a hobby; it’s a strategy. However, it’s vital to interpret signals correctly rather than blindly copying. Here are some proven approaches:

Copying whale trades

This is a popular tactic. If a large wallet buys a token early, it might be a great entry point, especially for new projects. But consider the context:

- On which platform was it bought? Purchases on Ethereum vs. Solana carry different weight due to liquidity.

- What is the token? Check the whitepaper, team, and community. Sometimes whales just "play" with liquidity.

Filtering fakes

Not every large balance belongs to a real whale. "Fake" addresses are often created to mislead the market. They might:

- Perform fictitious purchases.

- Transfer funds between linked addresses.

- Participate in pump-and-dump schemes.

To protect yourself: check the wallet's history, look at the contracts it interacts with, and analyze the frequency of operations.

Accumulation phase

If large addresses are slowly and steadily buying a low-liquidity token, it may signal an upcoming pump.

Accumulation often happens near support levels when the price is stable.

Real whales prefer to build positions quietly to avoid hype. When the accumulation ends, active growth usually follows.

Conclusion

Whale wallets are more than just addresses with high balances. They are key players who move markets and influence investor psychology. Tracking them via on-chain analysis provides a unique advantage: access to data that doesn't lie.

However, whale watching should be part of a strategy, not a replacement for your own analysis. Combined with technical and fundamental approaches, it becomes a powerful lever for better decision-making.

Arbitrage Scanner gives you the decisive edge—the ability to see the crypto market from the inside and stay one step ahead.

Why does it matter?

Detect "whale" transactions first – get better prices before others

Early trend detection – maximize profits

Analyze smart contracts before the crowd knows about them

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.