Crypto Miners: A Simple Explanation of the Bitcoin and Altcoin Mining Process

with ArbitrageScanner!

Cryptocurrency Mining: What Is It?

Cryptocurrency mining, also known as crypto harvesting, is the process of creating new cryptocurrency coins and verifying transactions to add them to the blockchain.

This crucial activity lies at the heart of the decentralized nature of cryptocurrencies, ensuring their security and integrity. Mining involves solving complex mathematical problems using powerful computers, and miners receive rewards in the form of new coins for their computational efforts.

In this article, we will provide a detailed overview of the technical process of mining, its types, and how to correctly start mining cryptocurrencies.

The Concept and Essence of Mining

Understanding the cryptocurrency mining process: it typically involves using specialized hardware or software to solve cryptographic puzzles. During the mining process, transactions are verified and added to the blockchain ledger. Successful miners receive rewards in the form of cryptocurrency tokens.

The entire mining process is divided into several stages, each of which is described in detail below:

-

The first important stage in the cryptocurrency mining process is transaction verification. Every time a cryptocurrency transaction is initiated, it is broadcast to the network and collected in a pool of unconfirmed transactions. Miners select transactions from this pool and verify their legitimacy, ensuring that the transaction details comply with the network rules. This includes checking that the sender has sufficient funds to cover the transaction and that it matches the protocol format. Verification helps prevent double-spending and fraud, maintaining the integrity of the cryptocurrency system;

-

After transactions are selected for inclusion in a new block, miners must solve a complex mathematical problem known as a cryptographic puzzle. Solving this puzzle requires significant computational power and involves finding a hash value that meets specific criteria set by the blockchain protocol. The process of solving this puzzle is known as Proof of Work (PoW). It involves repeatedly hashing data from the block header with different values until the resulting hash matches the target difficulty level. The puzzle difficulty is periodically adjusted so that new blocks are added at a constant rate, regardless of the network's total computational power;

-

When a miner successfully solves the cryptographic puzzle, they create a new block. This block contains a list of confirmed transactions, a reference to the previous block in the blockchain (known as the previous block hash), and the solution to the cryptographic puzzle. The new block is then broadcast to the network for verification by other miners. This process ensures that the blockchain remains an immutable ledger for all transactions;

-

Once a new block is successfully created and accepted by the network, the miner who solved the puzzle receives a reward. This reward consists of new cryptocurrencies and transaction fees paid by users to include their transactions in the block. The block reward serves as an incentive for miners to provide their computational resources to the network. Over time, the block reward typically decreases according to the cryptocurrency protocol. For example, the Bitcoin block reward is halved approximately every four years, an event known as halving;

-

Cryptocurrency mining also plays a vital role in securing the network and maintaining its decentralized nature. By requiring miners to solve cryptographic puzzles and confirm transactions, the network ensures that malicious actors cannot easily alter the blockchain. The decentralized nature of mining, where multiple independent miners participate in the confirmation process, prevents any single entity from gaining control over the network. This decentralization is a key feature of cryptocurrencies, ensuring there is no single point of failure and the system remains resilient to attacks;

-

To maintain a stable block creation time, the network adjusts the mining difficulty based on the network's total computational power. If more miners join and the computational power increases, the difficulty of the tasks increases to prevent accelerated block creation. Conversely, if miners leave and the computational power decreases, the difficulty is reduced. This adjustment mechanism ensures a stable addition of blocks, which is crucial for the stability and predictability of the blockchain.

Types of Mining

Hybrid Mining

In hybrid mining, PoW miners generate new transaction blocks but do not confirm them. Instead, PoS miners decide whether to confirm the blocks or not. To do this, they need votes. Voting rights are acquired by staking a portion of their tokens.

Then, the hybrid PoW-PoS algorithm selects 5 random votes to determine the effectiveness of the new blocks. A minimum of three confirmations (3/5) is required to add transaction blocks to the blockchain. Miners then receive rewards in a ratio of 60% and 30% for PoW and PoS miners, respectively. The remaining 10% is transferred to the blockchain development fund.

Pros:

-

Hybrid mining eliminates the drawbacks of PoW and PoS consensus;

-

Reduces energy consumption;

-

Increases mining efficiency.

Cons:

-

There is a possibility of deteriorating mining decentralization.

Espers and VirtacoinPlus (XVP) are two examples of cryptocurrencies with hybrid mining systems.

CPU Mining

CPU mining is the use of a PC's central processing units to mine cryptocurrencies. CPU mining does not require advanced or specialized mining equipment: regular computers are sufficient, but miners can use high-performance video cards to improve mining.

The CPU core performs complex mathematical calculations, verifies transactions, and contributes to the creation of new coins. Monero (XMR), Litecoin (LTC), Dogecoin (DOGE), and Vertcoin (VTC) are some cryptocurrencies mined using a processor.

Pros:

-

CPU mining is effective for a wide range of cryptocurrencies;

-

Affordable price;

-

Accessible to anyone with a computer.

Cons:

-

Can be unprofitable due to high electricity rates;

-

In some situations, it may be impossible to scale;

-

CPU mining is ineffective for some cryptocurrencies, such as Bitcoin.

Cloud Mining

Cloud mining is the mining of cryptocurrency using remote mining equipment from a third-party cloud service provider. Miners buy mining contracts from the provider and can track performance on a real-time dashboard.

Cloud providers remotely install mining rigs in regions with favorable legislation, affordable electricity, and cold climates, then offer mining contracts based on the generated hash rate. Customers then purchase these contracts and receive mining rewards based on their performance.

Pros:

-

Cloud mining reduces physical and technical requirements for crypto miners, as they only need to purchase contracts;

-

Cloud mining is cost-effective;

-

Cloud mining can be scaled on the provider's side.

Cons:

-

Clients depend on service providers and cannot take independent actions;

When choosing this type of mining, one should consider the track record, uptime, and contract terms.

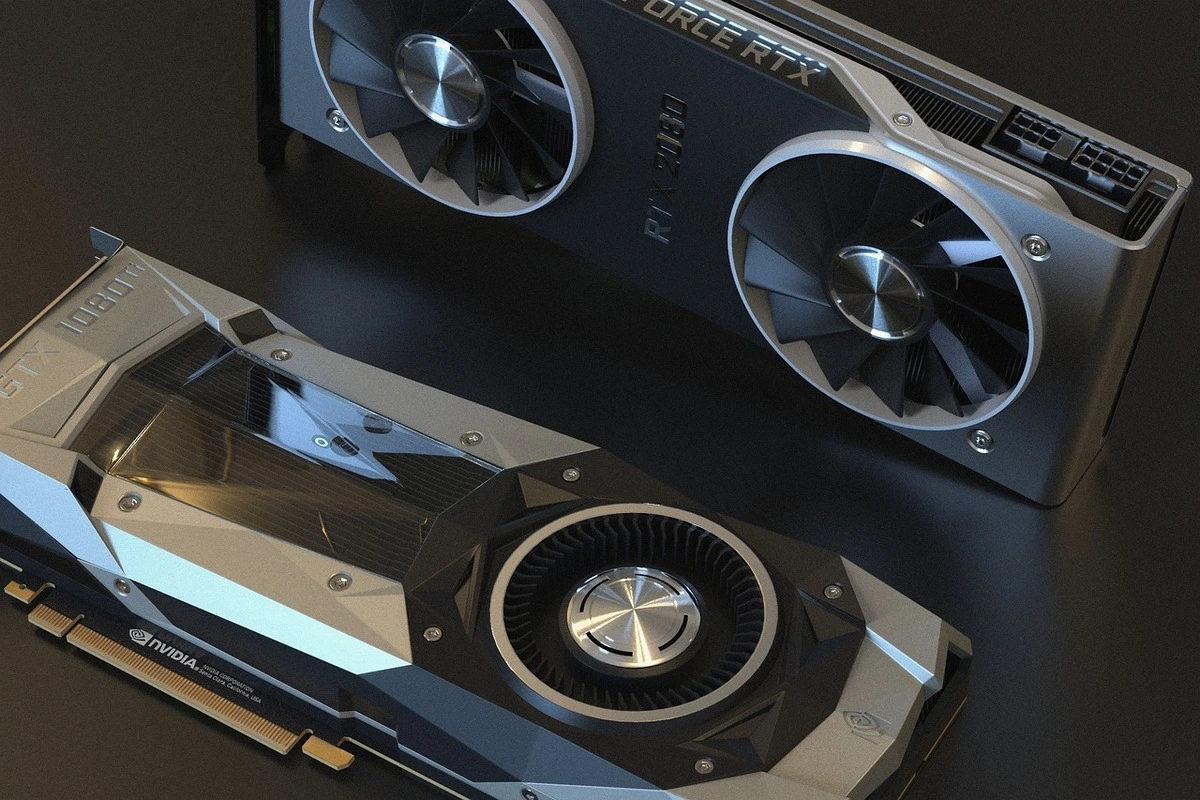

GPU Mining

Graphics processors have a higher clock speed, typically 80 times the average CPU speed. The efficiency of GPU mining is based on continuous repeated decoding of various hashes, with only one digit changing in each attempt.

This is why GPU mining is more efficient than CPU mining. GPUs have a higher hash rate and perform more work simultaneously than CPUs due to a large number of arithmetic logic units (ALUs) responsible for performing mathematical calculations.

Litecoin (LTC), Monero, Ravencoin, Haven Protocol (XHV), Ethereum Classic (ETC), and Bitcoin Gold are some coins mined using GPUs.

Pros:

-

It is more efficient than CPU mining;

-

GPU mining is scalable and works faster.

Cons:

-

GPU mining is harder to set up than CPU mining;

-

Maintenance and cooling costs are higher.

ASIC Mining

ASICs are high-performance devices that process data and transactions faster than GPUs and regular CPUs. ASIC mining is the use of devices to verify and add transactions to the blockchain thanks to the ASIC's ability to overcome high mining difficulty. Due to the increased difficulty of Bitcoin mining, mining has shifted from GPUs to ASICs.

Pros:

-

High efficiency in Bitcoin mining;

-

ASIC miners provide more value for the money.

Cons:

-

Costs may be more than individual or small miners can afford.

ASIC devices are widely used in mining hosting services due to their efficiency and ROI.

How to Start Mining?

To start cryptocurrency mining, you need to:

-

Choose the cryptocurrency you intend to mine based on available hardware and goals;

-

Choose mining hardware. Decide whether you will use a personal computer, an ASIC miner, or a GPU-based rig;

-

Install mining software compatible with your hardware and the chosen cryptocurrency;

-

Join a mining pool (optional): join a mining pool to combine your computational power with others, increasing the probability of solving a block and receiving a reward;

-

Start the mining process and monitor your hardware and software to ensure optimal performance.

Understanding the Economics of Crypto Mining

Starting to mine a specific cryptocurrency should be based on the potential profit the process will bring. The choice of cryptocurrency should be based on the following factors:

-

Market Capitalization. Cryptocurrencies with higher market capitalization tend to be more stable and profitable;

-

Mining Difficulty Level. Lower difficulty levels mean easier mining but potentially smaller rewards;

-

Community Support. Strong community support can indicate a more sustainable and profitable coin.

Risks of Cryptocurrency Mining

While rewards can be tempting, cryptocurrency mining comes with its fair share of risks. Here are some of the main ones to consider:

-

High initial investment. Setting up a mining rig can be expensive and require high-performance GPUs, ASIC chips, and significant electricity costs;

-

Volatility. Cryptocurrencies are known for their volatility, and the value of the coins you mine can fluctuate significantly;

-

Regulatory Uncertainty. Governments around the world are still trying to decide how to regulate cryptocurrencies, creating legal risks;

-

Environmental Impact. Cryptocurrency mining consumes vast amounts of energy, leading to environmental concerns.

Legal Aspects of Mining

In many countries, cryptocurrency mining sits in a regulatory gray area. It is important to stay informed about the legal situation in your region. Here are a few points to look out for:

-

Taxation. Many countries tax crypto mining profits. Ensure you understand your tax obligations;

-

Energy Regulation. Some regions have strict energy rules that could affect your crypto mining;

-

Environmental Legislation. Familiarize yourself with any environmental laws that may impact your digital asset mining activities.

Criticism and Challenges of Mining

Cryptocurrency mining is a responsible task, and like any other job, it comes with challenges. Here is a brief overview of these difficulties:

-

Energy Consumption. PoW is notorious for being energy-intensive. In fact, a large mining farm can consume as much electricity as an entire country;

-

High Costs. Expensive hardware and electricity bills require significant initial investments;

-

Regulatory Uncertainty. Some governments do not support mining due to its energy consumption and environmental impact;

-

Centralization Risks. The intensive nature of PoW can lead to a concentration of power in the hands of large mining pools and industrial miners. This can hinder the decentralization that blockchain strives for.

Conclusion

Cryptocurrency mining is a fairly complex process that comes with both significant risks and rewards. Before diving in, it is important to understand the economics, choose the right cryptocurrency, and optimize your mining. Stay informed about regulatory and environmental issues and interact with the mining community for support. Whether you decide to start mining or not, being well-informed will help you make the best decision for your situation.

Different types of cryptocurrency mining have their own advantages and disadvantages, so miners should carefully study them before starting the harvesting process. This will help them create practical plans for setting up mining rigs or purchasing mining contracts on cloud platforms.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.