Crypto Market Capitalization: What It Means and How It Affects the Crypto Market

Cryptocurrency Capitalization

The cryptocurrency market is growing rapidly, and its capitalization is becoming a vital indicator of the investment attractiveness of digital assets. In this article, we will break down what cryptocurrency market capitalization is, how it is distributed among Bitcoin, altcoins, DeFi, and stablecoins, as well as look at current trends, forecasts, and useful tips for beginners.

Total Crypto Market Capitalization

Cryptocurrency market capitalization is the aggregate of all digital assets circulating in the market. More accurately, it refers only to those cryptocurrencies listed on analytical services such as CoinMarketCap or CoinGecko. According to information from these services, there are more than 13 million cryptocurrencies today, but not all of them are included in the calculation of the total digital asset market capitalization.

Total capitalization is calculated as follows: the price of each cryptocurrency is multiplied by its circulating supply in the market, then added to other digital assets. This metric is fundamental because its state allows observers to track market dynamics: it helps to understand the degree of investor confidence and determine the total volume of funds invested in digital assets.

The market sentiment of participants can be easily tracked through crypto market capitalization: if capitalization grows, it means investors are buying cryptocurrencies and believe in further growth. If capitalization falls, it means the opposite.

Bitcoin (BTC) Capitalization

Bitcoin is the first and most popular cryptocurrency, with a capitalization that accounts for more than half of the entire crypto market. All investors would like to hold at least 1 BTC in their portfolio, but given its current price, this is an unattainable amount for the average market participant. It holds the status of "digital gold" due to its resistance to inflation.

The main factors that affect Bitcoin capitalization are:

-

Demand and supply of BTC;

-

The number of coins available for purchase. While there is no such exact metric in the market, the more investors are interested in buying BTC, the lower its supply on the market becomes;

-

News background and regulation;

-

The overall macroeconomic situation in the world. For example, if the US begins to pump its own economy with unbacked money (as happened in 2021), then a lot of cash will enter the risk asset market, which includes the cryptocurrency market, causing the value of digital assets to rise.

As a rule, if investors develop an interest in Bitcoin, other cryptocurrencies also become in demand.

DeFi Capitalization

Decentralized Finance (DeFi) represents a sector of the cryptocurrency industry where users can receive financial services without intermediaries. Financial services refer to loans secured by cryptocurrency, staking, or farming. In this regard, the capitalization of the DeFi sector is calculated differently: it takes into account the value of all locked assets (TVL – Total Value Locked) in the smart contracts of the protocols.

Several factors that affect the decentralized finance sector:

-

The most popular blockchains for DeFi are Ethereum, Solana, and Binance Smart Chain. The more various updates occur in the network, the more relevant they become for decentralized finance protocols;

-

User interest in staking, lending, and farming;

-

Regulation of the DeFi sector;

-

Hacks and leaks of funds from DeFi projects.

Stablecoin Capitalization

Stablecoins are cryptocurrencies pegged to the value of fiat assets, such as the US dollar. Stablecoin capitalization includes the total value of USDT, USDC, BUSD, DAI, and other similar assets.

Stablecoins perform several functions in the crypto market:

-

Providing liquidity on crypto exchanges. USDT is used by market makers to maintain supply and demand in the market;

-

Hedging volatility risks. If an investor does not want to suffer losses during high volatility, they can exchange cryptocurrency for USDT, whose rate is pegged to fiat currency and may change by only 1-2%;

-

Fast, cross-border, and cheap transfers. While the traditional banking system still has huge fees for international transfers, any amount in USDT can be sent with a fee of $1 to anywhere in the world;

-

A pillar for DeFi protocols. Stablecoins are used in the vast majority of operations in decentralized finance.

Demand for stablecoins grows during periods of high market instability, when investors exit volatile assets into stable digital counterparts.

Altcoin Capitalization

Altcoins are all cryptocurrencies except Bitcoin. Exactly how their capitalization is calculated was described above.

The following factors affect the capitalization of altcoins:

-

Development of blockchain technologies. Altcoins can present the latest developments to the market, thereby increasing investor interest;

-

Influence of hard forks and network updates: every change in a coin's blockchain can increase its competitiveness;

-

Interest in new tokens (ICO, IDO, IEO);

-

Competition with Bitcoin and stablecoins.

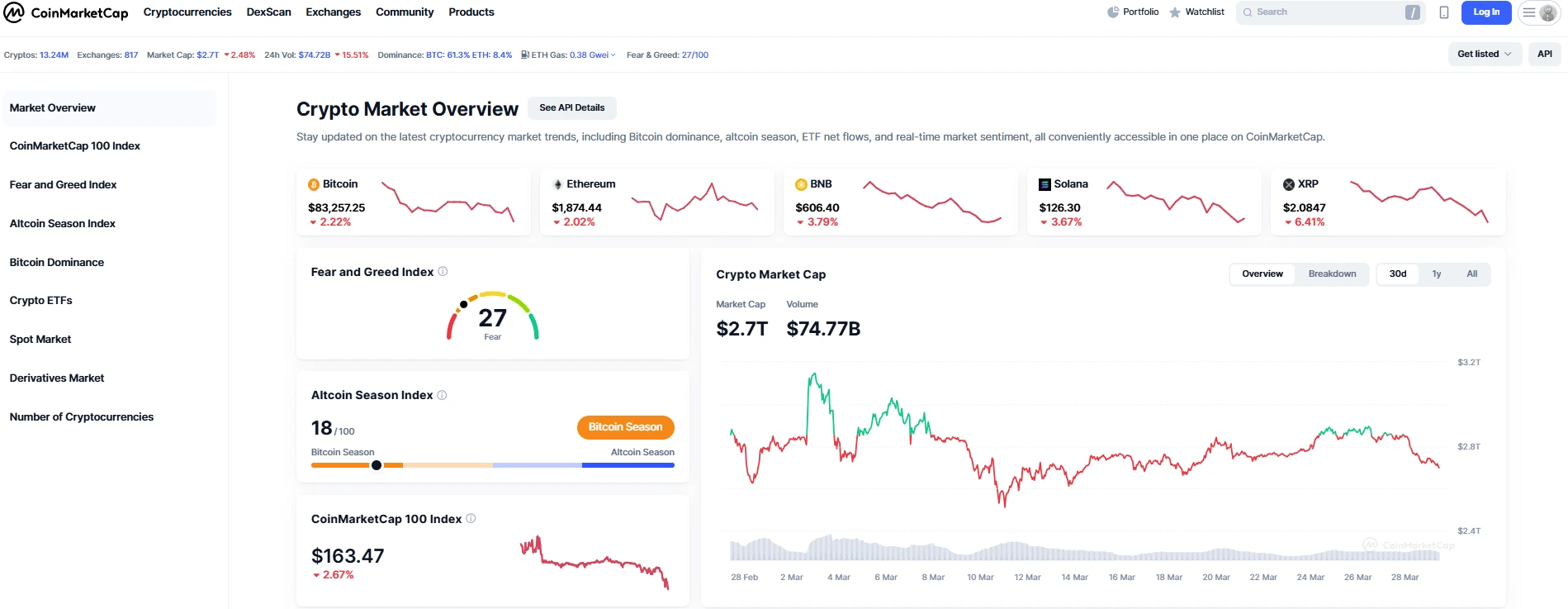

Market Capitalization Charts

Graphical display of capitalization allows investors and analysts to track changes in market dynamics. The most popular data sources are:

-

CoinMarketCap;

-

CoinGecko;

-

TradingView.

Using charts helps predict market trends and adjust investment strategies.

Current Capitalization Data

Currently, the total volume of the cryptocurrency market is $2.7 trillion. The capitalization of Bitcoin, stablecoins, altcoins, and DeFi projects is constantly changing, driven by market conditions, regulatory news, and macroeconomic factors.

Analytics and Forecasts

The market is currently in a prolonged sideways movement, with rare dips into small corrections. Since November 2024, when it became known that Donald Trump would be the next US president, the cryptocurrency market significantly gained in capitalization: from $2.26 trillion to $3.72 trillion in mid-December 2024.

However, by Trump's inauguration, which took place in January 2025, it became clear that the euphoria from pre-election promises had passed, and in fact, not much had been done. As a result, the market began a systematic decline, and eventually, in the first 3 months of 2025, its capitalization decreased by $1 trillion.

Further movement of crypto market capitalization today depends on macroeconomic news. Two main topics that can affect the capitalization of the crypto market are:

-

The end of various armed conflicts in the Middle East and Ukraine. As practice shows, when wars rage in the world, investors prefer to withdraw funds from risky assets, which include cryptocurrencies. They prefer to keep money in so-called "safe-haven assets," the most popular of which is gold, which recently crossed the $3,000 per troy ounce mark and set a new historical high. In simple terms: when the world is not peaceful, cryptocurrencies become cheaper, gold grows;

-

Changes in US Fed monetary policy. The current Fed interest rate is 4.5%. This is a fairly high indicator for the states, but such a step is a necessary measure: inflation is raging in the country, and to curb it somehow, the central bank makes loans expensive. Here, too, everything is simple: the cheaper the loans, the more cash in the markets, the faster risky assets grow, and vice versa. In essence, as soon as the US Fed starts lowering the rate, we can immediately see the growth of the cryptocurrency market.

Popular Questions

What is cryptocurrency?

Cryptocurrency is a digital asset functioning within a blockchain that has a decentralized structure: many computers and devices around the world are responsible for its operation. This approach means there is no central management authority: no one can block cryptocurrency in the blockchain. However, this also carries a downside: if by chance cryptocurrency was sent to the wrong address, it will be impossible to recover it.

How does cryptocurrency work?

Cryptocurrencies use distributed networks to ensure the security and anonymity of transactions. Blockchain technology records all operations in an open ledger, in the form of blocks in a chain. For example, a BTC holder wants to send it to another wallet. He creates a transaction that goes to miners, who must verify its truthfulness: whether there really were that many BTC in his wallet. If it's true, information is added to a new block that the coins were transferred and are no longer in the first wallet. Data from blocks cannot be changed or deleted.

What is mining?

Mining is the process of confirming transactions and creating new blocks in the blockchain using computing power. As already mentioned, miners confirm the correctness of transactions, add information to new blocks, and receive a reward for this: for adding a new block, as well as a commission for conducting the transaction. The reward is credited in the blockchain's cryptocurrency, meaning if a miner verified a BTC transaction, the reward is also credited in BTC.

How to store cryptocurrency?

Cryptocurrency is stored in wallets—software or hardware devices for managing digital assets. More accurately, cryptocurrency is stored in the blockchain, and wallets allow you to enter the blockchain and access your coins to perform any operation with them.

Types of Cryptocurrency Wallets

There are two main types of wallets:

-

Hot wallets. These wallets are always connected to the network, so it's easier to send cryptocurrency with them; however, security suffers, as the private key (essentially the password for the stored cryptocurrencies) is easy to steal. Hot wallets include mobile, web, and desktop versions;

-

Cold wallets. These wallets do not have a permanent connection to the network, meaning it is much harder to obtain the private key. However, sending transactions is also more difficult: you need to regularly connect the wallet to the internet. Cold wallets include hardware and paper versions.

How to create a cryptocurrency address?

To create a crypto address, you need to install a wallet and generate private and public keys.

Cryptocurrency Security

Basic security principles include using hardware wallets, two-factor authentication, and avoiding phishing attacks. It is also recommended not to advertise your possession of digital assets, because private keys can be extracted from holders through force.

How to send cryptocurrency?

Transfers are carried out by specifying the recipient's address, selecting the network, and confirming the transaction in the wallet. It is important to double-check the address where you are going to send the cryptocurrency, as its recovery in case of sending to the wrong place will be impossible.

Popular Cryptocurrencies

Popular cryptocurrencies include BTC, ETH, XRP, BNB, ADA, SOL, and others.

Cryptocurrency Sectors

The cryptocurrency market is divided into several key sectors, each of which plays an important role in the ecosystem. Understanding these sectors helps investors and users navigate market dynamics better and make informed decisions.

Traditional Cryptocurrencies (Bitcoin and its forks)

This sector includes Bitcoin (BTC) and its derivatives, such as Bitcoin Cash (BCH) and Bitcoin SV (BSV). They are mainly used as stores of value (digital gold) and payment systems.

Altcoins

All cryptocurrencies except Bitcoin are called altcoins. Among them, the following stand out:

-

Ethereum (ETH) – the main platform for smart contracts and decentralized applications;

-

XRP – focused on fast cross-border transfers;

-

Litecoin (LTC) – an alternative payment tool with fast transactions.

Stablecoins

Cryptocurrencies pegged to fiat money (USD, EUR) or assets (gold, oil). Their main goal is to minimize volatility. The most popular ones are:

-

Tether (USDT);

-

USD Coin (USDC);

-

DAI;

-

Binance USD (BUSD).

DeFi (Decentralized Finance)

This sector includes platforms providing financial services without intermediaries (banks). For example:

-

Uniswap (UNI) – a decentralized exchange (DEX);

-

Aave (AAVE) – a lending platform;

-

MakerDAO (MKR) – a system for issuing the DAI stablecoin.

NFT (Non-Fungible Tokens)

NFT tokens confirm ownership of digital objects (images, music, video). They are used in art, gaming, and collecting. Popular projects:

-

OpenSea;

-

Blur;

-

Bored Ape Yacht Club (BAYC).

GameFi (Gaming Cryptocurrencies)

Gaming tokens are used in blockchain games. Examples:

-

Axie Infinity (AXS);

-

Decentraland (MANA);

-

The Sandbox (SAND).

Metaverse

Projects creating digital worlds with an economy based on cryptocurrency. Examples:

-

Meta (formerly Facebook);

-

Decentraland;

-

The Sandbox.

Tips for Beginners

Entering the world of cryptocurrency can be difficult, especially for those unfamiliar with blockchain technologies. Below are key tips to help you start working with digital assets safely.

-

Learn the basics. Before buying your first cryptocurrency, understand how blockchain, Bitcoin, and smart contracts work. We recommend reading official guides and articles;

-

Choose reliable platforms. Use only verified exchanges and wallets for buying and storing cryptocurrencies. Popular crypto exchanges: Binance, Coinbase, Kraken, OKX. For storage, it's better to use non-custodial wallets, such as: MetaMask, Trust Wallet, Ledger (hardware wallet);

-

Do not store all funds on an exchange. Exchanges are prone to hacks. It's better to keep assets in a cold wallet and use the exchange only for trading operations;

-

Do not invest more than you can afford to lose. The crypto market is high-risk. Invest only free funds and diversify your portfolio;

-

Avoid scammers. There are many scam schemes in the crypto market. Be careful with projects promising "guaranteed profits." Check information before investing;

-

Follow the news. The market changes quickly, so it's important to stay informed. Useful resources: CoinMarketCap, CoinGecko, Coindesk;

-

Master the basics of technical analysis. Even basic knowledge of charts and indicators will help you understand when it's better to buy or sell assets;

-

Think long-term. Short-term fluctuations can be sharp, but in the long term, top cryptocurrencies grow.

- Join our Arbitrage Scanner community and open new cryptocurrency horizons together with our other clients.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.