Starter Guide to Spot Futures Crypto Arbitrage

with ArbitrageScanner!

Starter Guide to Spot Futures Crypto Arbitrage

Discover the lucrative world of spot futures crypto arbitrage with our beginner's guide, harnessing the power of volatility for maximum gains!

Cryptocurrencies have revolutionized trading and investment, creating opportunities for strategies such as spot futures crypto arbitrage. This comprehensive guide identifies potential risks, and provides valuable tips for engaging in this profitable trading approach. By leveraging price disparities between spot and futures markets. Spot futures crypto arbitrage enables individuals earn on the cryptocurrency market. Nonetheless, it is crucial to acknowledge the associated risks and implement effective risk management strategies. Delve into the realm of spot futures crypto arbitrage and unlock its potential for financial gains.

Spot Futures Crypto Arbitrage – what is it?

Not so long ago, cryptocurrency, blockchain and exchanges such as CEX and DEX became an integral part of the financial market. Because of this new field, old trading strategies have been revitalized and inspired to create new ones. Such a strategy as spot futures crypto-arbitrage has found its perfect application in the market and has been warmly welcomed by traders. It involves using the price difference between the futures market and the spot market of cryptocurrencies.

The futures market allows a trader to buy an asset for the future at a certain price that has been assigned at that time period. The spot market assumes that the cryptocurrencies that are purchased by the trader are intended for immediate sale of the asset. The difference in the price of that particular cryptocurrency between the two markets is what gives the opportunity for arbitrage. In this strategy, arbitrageurs make money by trying to buy the cryptocurrency on the spot market at the lowest price and sell it at the highest price on the futures market.

There is also another type of spot futures trading - open-ended futures contracts. These are also called open-ended swaps and are one of the most common types of contracts used by traders in the cryptocurrency market. Their purpose is to simulate the price movement of the underlying asset. They have no expiration date, which allows the trader to hold the position without a time limit. This is what distinguishes this type of futures from traditional futures contracts, which have an exact time expiration date.

The funding rate in spot futures trading is a certain mechanism that is used in open-ended swaps in order to maintain a balance between the spot price of the underlying asset and the market price of the contract. In other words, the funding rate is the interest rate that is exchanged between short and long positions in a contract from time to time.

Continuing the conversation about the funding rate, it is important to note that it is determined by the difference between the spot price of the underlying asset and the market price of the contract. However, if the market price of a perpetual swap is higher than the spot price, then this rate will be positive. Then long positions (traders who bet that the price will go up) pay to fund short positions (traders who bet that the price will go down). It also works the other way around. The short positions pay for the financing of the long positions.

This is all done to incentivize traders to balance perpetual swaps in line with the spot price of the underlying asset. When the price deviates significantly, an adjustment to the funding rate is made. This incentivizes the market and traders to take positions that will bring prices into balance.

It is also important to remember that the funding rate is applied once every few hours, it all depends on the cryptocurrency exchange.

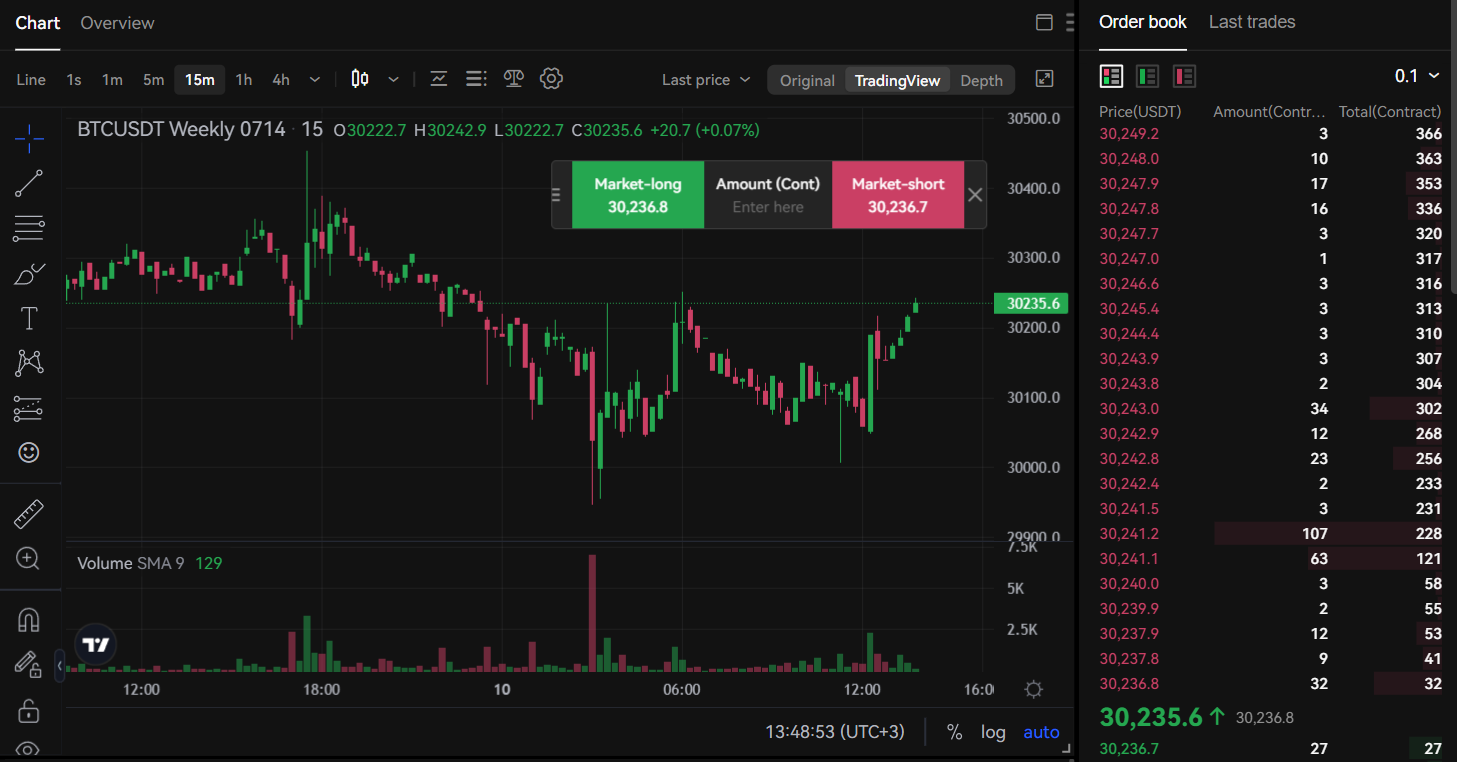

Step-by-step tutorial for the Spot-Futures Arbitrage

Assuming we have 30 090,99 USDT for spot-futures arbitrage when the price of Bitcoin is 30 090.99 USDT, here's our plan:

- Transfer 15 045.495 USDT to the futures account and the remaining 15 045.495 USDT to the trading account.

- Purchase 0.5 BTC (15 045,495 USDT) in the spot market and short 0.5 BTC in the perpetual futures market using the 15 045.495 USDT.

- If the funding rate right before the charges is 0.05%, you will receive 7.5227475 USDT.

Calculation: 0.5 × 30 090,99 × 0.05% = 7.5227475 USDT

- Assuming the funding rate remains at 0.05%, we can receive this payment three times a day, resulting in an Annual Percentage Rate (APR) of 82.374085125%.

Calculation: 7.5227475 × 3 × 365 = 8237.4085125 USDT

Adjusted APR calculation: (8237.4085125 / 30 090,99) * 100% = 27.375%

- To boost the annualized return, let's utilize leverage in the perpetual futures market. By holding a short position with 2x leverage, we can buy 0.6666 BTC with 20058,653934 USDT and short 0.6666 BTC with 10032,336066 USDT in the perpetual futures market.

- With 2x leverage, we will receive 33% more funding fee compared to 1x leverage.

Calculation: 0.666 × 30 090.99 × 0.05% = 10.2029967 USDT

|

Lavarage |

Spot Balance |

Margin Balance |

Funding Income |

APR % |

|

1x |

15 045,50 |

15 045,50 |

7,5227475 |

27,375 |

|

2x |

20058,65393 |

10032,33607 |

10,2029967 |

111,7228139 |

|

3x |

22 568,24 |

7 522,75 |

11,28412125 |

123,5611277 |

Spot-Futures Arbitrage: Risks to Consider

As everyone knows, crypto arbitrage is a fairly lucrative way to make money, but it's not without risks either. Let's take a look at the risks involved in spot futures arbitrage.

- Market volatility is one of the main risks. Crypto market prices are very unstable, but this is also a plus for arbitrage. Of course, sudden fluctuations can lead to significant losses as well as greater profits.

- Another risk is the exchange itself, no one is immune to hacker attacks (not even Binance). There may also be any other technical or regulatory issues.

- Delays in the execution of trades could result in missed profits or any other unfavorable outcome. This is affected by network load.

- To trade futures contracts, you face counterparty risk such as. It is important to choose exchanges that have a reliable clearing mechanism.

Essential Tips for Getting Started in Futures Arbitrage

If you are considering crypto arbitrage on spot-futures, here are some useful tips to help you get started:

- If you are just starting to trade on spot-futures, we advise you to start with small amounts. First, try to see if this arbitrage strategy suits you or not.

- To successfully earn, you need to research coins, exchanges where arbitrage opportunities may arise. You can also try calculating your profit on our profitability calculator or set up ArbitrageScanner and Screener to catch good spreads on coins.

- Assess your risks, do not put all your eggs in one basket, try stop-loss orders, invest only the funds that you are willing to lose under certain risks.

- This type of arbitrage requires practice and experience, look at your mistakes and learn from them, over time you will gain experience that can be converted into profit.

Comparing Futures Arbitrage with Other Types of Arbitrage

Spot futures arbitrage is just one of the many types of strategies. Let's take a look at what others there are:

For example, spatial arbitrage. When you use this type of arbitrage, it aims to utilize the price difference between different cryptocurrency exchanges. It differs from spot futures arbitrage in that spot futures arbitrage is aimed specifically at these markets whereas spatial arbitrage is aimed at the exchanges.

Statistical arbitrage focuses on analyzing and calculating statistical models to find arbitrage opportunities. This strategy is suitable for trading multiple assets at once, finding correlations and patterns.

You have three assets for example, you can use triangular arbitrage. The idea is that the trader makes quick trades on multiple exchanges to profit from the resulting price imbalance.

Manual arbitrage is suitable for all types of arbitrage mentioned above. Consider the ArbitrageScanner bot as an example, which displays the price differences across various exchanges. This bot offers great flexibility, allowing you to customize the notifications based on the exchanges and coins you're interested in, be it DEX, CEX, or different blockchains. You have full control over what notifications you receive. One key advantage of our bot is its strong emphasis on data security. Unlike automated bots that have been vulnerable to hacking and theft of clients' funds, our bot ensures your safety and the security of your funds by not requiring API access. We prioritize your protection. Additionally, we have introduced a new product called the arbitrage Screener. It provides a comprehensive range of data from multiple exchanges and currencies, and you can customize and configure it according to your specific requirements.

Conclusion

Spot futures crypto arbitrage offers profit opportunities by leveraging price differences between spot and futures markets. However, caution and risk management are crucial. Consider market volatility, exchange risks, execution delays, and counterparty risks. Start with a smaller capital, conduct thorough research, and develop effective risk management strategies. Learn from experience and adapt. Compare spot futures arbitrage with other types. Use ArbitrageScanner for manual arbitrage. With discipline and continuous learning, navigate spot futures crypto arbitrage successfully!

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.