Triangular Arbitrage: How to Profit from Price Differences?

Triangular Arbitrage

The cryptocurrency market is a dynamic and often unpredictable environment where profits are made not only through classic trading strategies but also by exploiting market inefficiencies. One such opportunity is arbitrage — a strategy where traders profit from the price difference of the same asset across different platforms.

In this article, we will focus on triangular arbitrage — one of the most interesting and technically sophisticated forms of arbitrage, which is particularly popular on crypto exchanges. We will examine how it works, what advantages and challenges are associated with it, and which tools allow for automating the process and achieving more stable profits.

Introduction to Arbitrage

Arbitrage is a method of extracting profit from market inefficiencies: any asset can be traded on different markets at prices that differ from each other, albeit slightly. For example, Bitcoin on one exchange might cost $80,000, and on another $80,300. An arbitrageur buys the coin on the first, transfers it to the second, and sells it — $300 is the total profit, though trading commissions and transfer fees must be deducted from it.

When it comes to cryptocurrency arbitrage, there is a fairly large choice of strategies: simple arbitrage, international arbitrage, peer-to-peer (P2P) arbitrage, and triangular arbitrage. They all differ in approach, profit conditions, the number of people involved, and other factors. The main goal of each of these types of arbitrage is to profit from market inefficiency.

However, one strategy stands out — triangular arbitrage, due to its significant difference from the others.

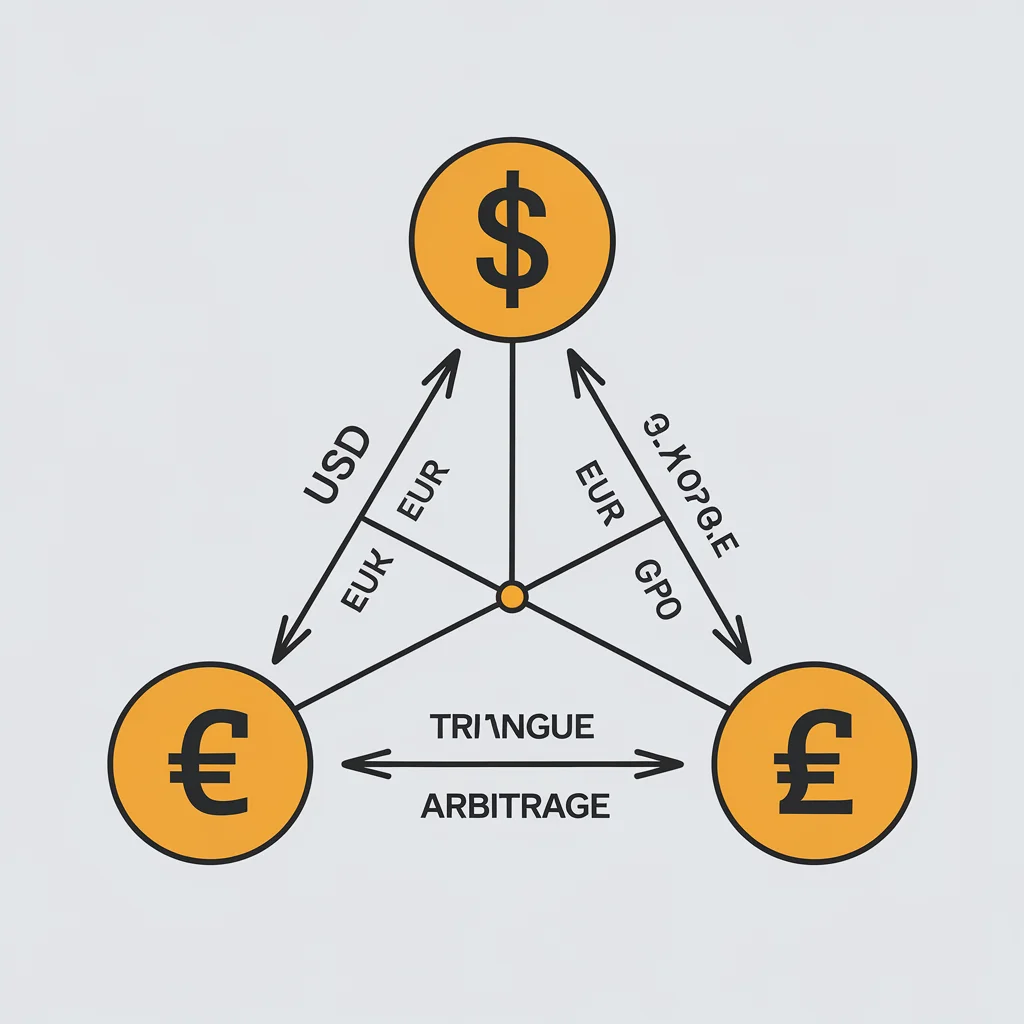

What is Triangular Arbitrage?

As a rule, triangular arbitrage is used in the crypto market because it is easiest to implement here, and a single person can do it. If you use this strategy in traditional markets, you would need to involve additional people, perhaps even from other countries.

The essence of triangular arbitrage is as follows: an arbitrageur buys a coin on one exchange, swaps it for another cryptocurrency, and then swaps it back to the first one. Sometimes triangular arbitrage can be conducted within a single crypto exchange, but in most cases, different platforms are used: bought on one, swapped on the second, swapped again on the third.

The complexity of this approach lies in the need to constantly monitor coin prices, and given the nature of the crypto market, such as volatility, doing this can be extremely problematic. The main condition is to do everything quickly, as the spread (price difference) can disappear at any moment.

Mechanics of Triangular Arbitrage

How Triangular Arbitrage Works

Let’s break down with an example exactly how triangular arbitrage works:

Suppose a trader notices a price discrepancy between three cryptocurrencies: BTC, ETH, and USDT. After buying the first coin and then swapping it for the others, the final amount should be greater than it was initially. For example, a trader used 10,000 USDT, and if the end result was 10,050 USDT, then the arbitrage profit was 5%.

Identifying Arbitrage Opportunities

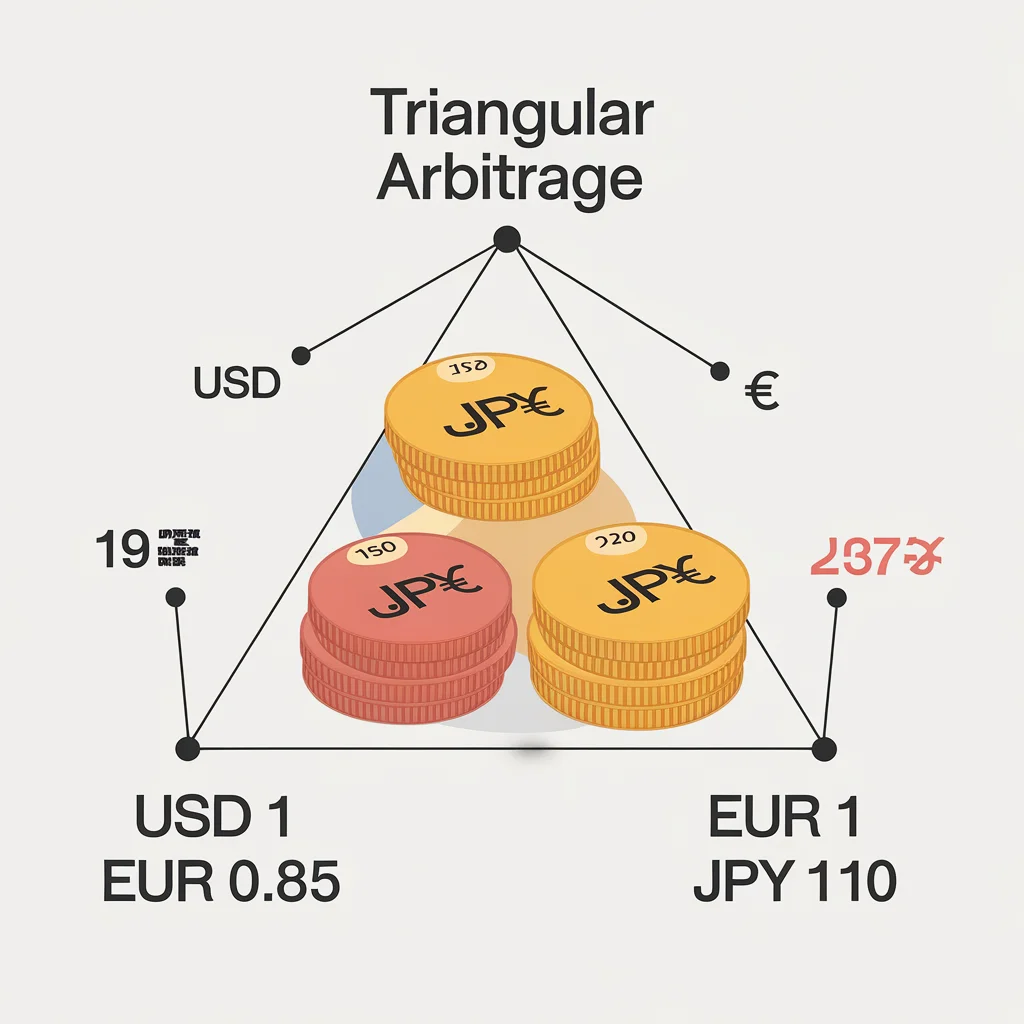

Returning to the previous example:

A trader noticed a price discrepancy between three cryptocurrencies: BTC, ETH, and USDT. For 1,000 USDT, they can buy 0.011 BTC, then swap it for 0.57 ETH, and after that, perform the swap back to USDT, receiving 1,030 coins. It turns out that the profitability of the entire process is 3% per one arbitrage circle.

Initially, the trader buys BTC at its market value, then swaps it at a more favorable rate for ETH, and sells the resulting coins for a larger amount of USDT compared to the amount spent on the BTC purchase.

Triangular arbitrage is quite difficult to execute: as mentioned, everything must be done precisely and quickly, which traders sometimes cannot handle. That is why they turn to the help of trading bots: they can automatically open trades based on pre-specified parameters. Trading bots help reduce risks associated with volatility and the fact that traders might simply miss an arbitrage opportunity.

Advantages of Triangular Arbitrage

Risk Reduction

In theory, a skilled arbitrageur can reduce the risks of this strategy to zero. The point is that traders using arbitrage strategies can hedge risks by using different assets and perpetual futures. For example, after buying a coin on one exchange, it must be transferred to another and sold at a higher price. To protect themselves from price changes during the transfer, the arbitrageur opens a short future at the same price they bought the coins on the spot market. In the end, they may not get as much profit because they have to pay an additional trading commission for opening the future and a small loss on that position, but there will still be a profit, meaning they hedged the risks.

High Market Liquidity

Arbitrageurs increase market liquidity because they use several cryptocurrencies in their strategy simultaneously. Of course, arbitrage is not always done with large capital, but there are enough traders resorting to this strategy. Due to the combined funds used, the liquidity of a certain cryptocurrency increases, making it easier to buy or sell, and price slippage occurs much less frequently.

Earning Potential Independent of Market Sentiment

In essence, triangular arbitrage does not depend on what is happening in the market — whether it is falling or rising. In theory, during moments of high market volatility, arbitrage situations may appear more frequently, but the risk also becomes higher as crypto prices can change every minute. For triangular arbitrage, a sideways market (flat) is ideal: prices are not volatile — therefore, the loop can be executed without difficulties or fears.

Correcting Market Inefficiencies

As strange as it may sound, arbitrageurs solve the problem of market inefficiency. The fact is that the arbitrage strategy is initially based on mean reversion: the value of an asset on different platforms will eventually equalize. The faster an arbitrageur finds a spread, the faster the market inefficiency will close, as they will be selling the cryptocurrency at an undervalued price, but this will not last long, and at some point, the price will equalize with the market average.

Disadvantages of Triangular Arbitrage

Risk of Slippage

Slippage is the difference between the specified purchase or sale price and the actual execution price. During moments of strong market volatility, the price of any cryptocurrency can slip. Let's explain with an example:

Suppose there is a general correction in the market, and one trader wanted to sell BTC for $80,000, but while they were placing a market order, the price already reached $79,900, which caused the order to be executed at the last price.

That is why in the advantages, we emphasized that a sideways market is most suitable for crypto arbitrage. Although it must be said that, in general, trading in a highly volatile market often ends poorly.

Necessity for Rapid Action

This is not just about the arbitrageur acting quickly (finding spreads, placing orders, monitoring quotes), but also about factors beyond their control. For example, transaction execution speed: there might be insufficient liquidity for a specific cryptocurrency on an exchange, or trades may be delayed due to technical features of the platform. It is also worth noting volatility, which can cause slippage, further complicating the process of opening a trade at the desired price.

However, liquidity and transaction execution speed can be checked even before starting arbitrage; there is nothing difficult about it, but you will know which exchanges are better to use for finding spreads.

Implementation Challenges

We clarified that today triangular arbitrage is unlikely without the use of special software that will not only open trades automatically but also monitor the information field for potential arbitrage opportunities.

All this requires a certain mindset and financial investment. Interestingly, one does not work without the other: if you have money but understand nothing about auxiliary software, buying it will give you nothing. And vice versa: if you are well-versed in software but have no money to acquire it, you are left trying manually, for which triangular arbitrage is poorly suited. If you are truly interested in arbitrage as a way to earn but have small capital, it is better to turn to statistical arbitrage.

Statistical Arbitrage

Statistical arbitrage is a trading strategy that involves a temporary price divergence of a single asset across different platforms, using mathematical and statistical calculations. Most often, arbitrage situations arise in the cryptocurrency market due to the inefficiency of modern trading platforms. The ArbitrageScanner service shows and explains these situations, offering many tools for crypto arbitrage.

In essence, statistical arbitrage is the original form of arbitrage, which is more easily implemented than triangular. Here, a trader needs to find two exchanges where the price of a cryptocurrency differs and earn on the price difference. Yes, the risk of volatility remains, but technically this strategy differs little from trading, which has long been mastered by almost all market participants.

Statistics play a key role in statistical arbitrage, as through quantitative analysis and modeling, traders can understand exactly where a price disproportion will occur.

The principle of statistical arbitrage is mean reversion. Arbitrage loops live for a certain amount of time, after which the price levels out and the arbitrage situation disappears, along with the opportunity to earn.

Automated Triangular Arbitrage Strategies

Due to the need to act as quickly as possible, especially in high volatility conditions, manual arbitrage often becomes inefficient. That is why trading bots and automated strategies are becoming increasingly popular today.

Automation allows:

-

Instantly responding to arbitrage opportunities;

-

Simultaneously monitoring dozens and hundreds of trading pairs;

-

Minimizing the human factor — error, delay, fatigue;

-

Working 24/7 without breaks.

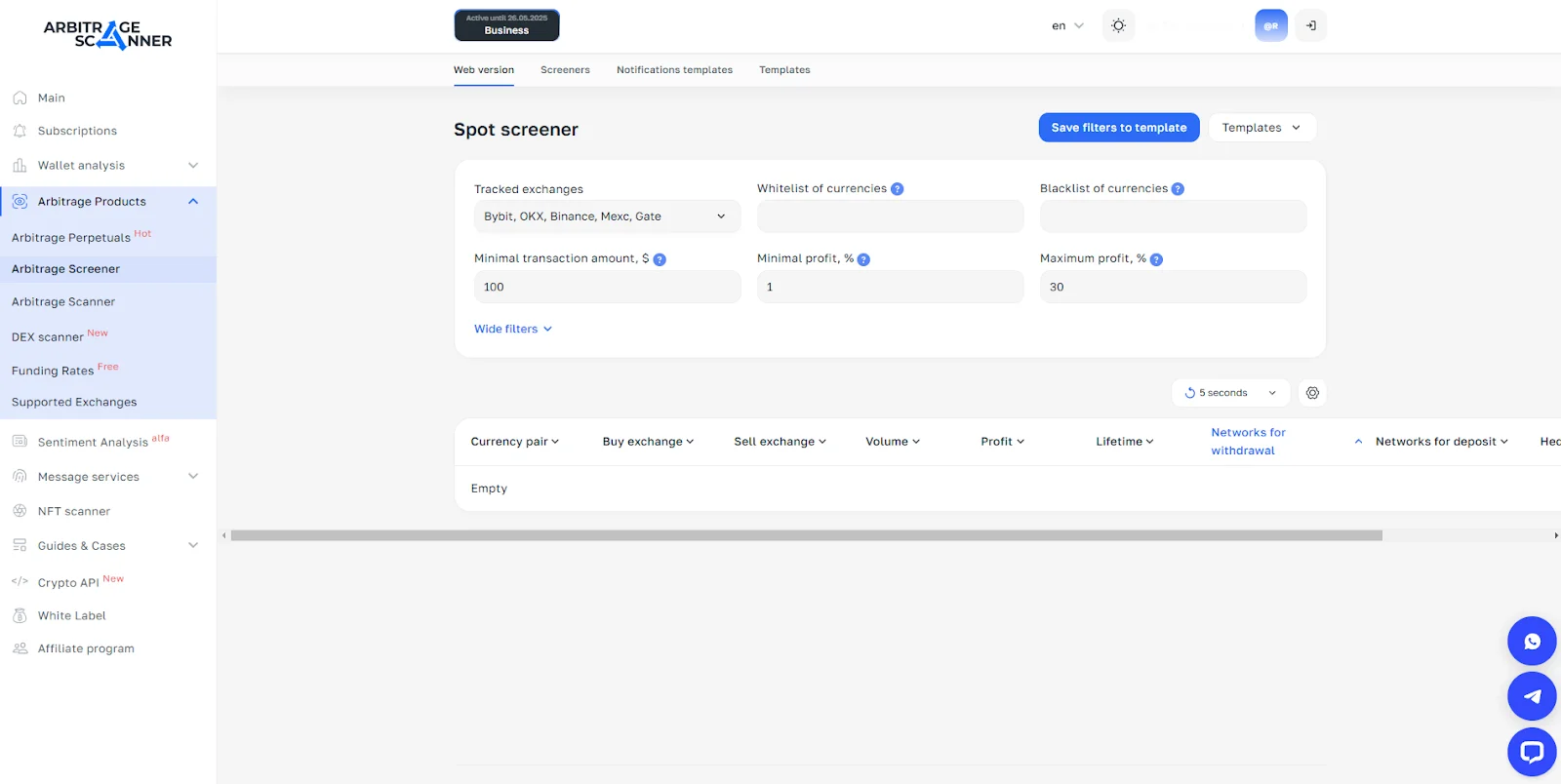

The most suitable service for finding arbitrage loops is ArbitrageScanner. With its help, loops across most top crypto exchanges will be available to you, which can be filtered by profit, transaction volume, number of coins, and more. ArbitrageScanner allows you to reduce the time spent searching for an arbitrage loop by hundreds of times, immediately notifying the user of market inefficiency. You cannot set up automatic trade execution through it, but do you really need that? All software for automatic trade execution is connected via API, through which attackers can gain access to your exchange accounts and steal cryptocurrency.

In ArbitrageScanner, everything is configured manually, while the search for information across platforms happens automatically, which saves you from unnecessary worries. Go to the website and sign up for a test day to see the usefulness of the service tools for yourself.

Conclusion

Triangular arbitrage is an interesting and potentially profitable strategy that allows earning not on market movement but on its temporary inefficiencies. Thanks to the growth of automation and the development of specialized software, anyone can try themselves as an arbitrageur today. However, one should not forget the high requirements for speed, accuracy, liquidity, and technical preparation.

If you are just starting your path in crypto arbitrage, we recommend starting with statistical arbitrage or studying bots to better understand market mechanics and minimize risks.

FAQ

Is triangular arbitrage legal?

Yes, triangular arbitrage is a completely legal strategy based on price differences in the markets. However, you should consider the rules of specific exchanges, as some of them may limit the use of automated strategies.

It should be noted that at some point, crypto exchanges even thought about financially rewarding arbitrageurs because they help the market. Unfortunately, this didn’t go further than an idea, but it became clear that crypto arbitrage is completely legal.

How to trade triangular arbitrage?

To start, you need to:

-

Choose exchanges with good liquidity (e.g., Binance, KuCoin, OKX);

-

Monitor rates and find spreads;

-

Calculate commissions at each stage;

-

Use a bot or API integration for automation;

-

Open trades quickly to lock in profit before prices change.

How profitable is triangular arbitrage?

Profitability depends on:

-

The amount of funds involved. The larger the amount allocated to the loop, the higher the profit can be, though it depends on the amount of cryptocurrency available at the lower price;

-

The frequency of finding arbitrage loops. ArbitrageScanner can find 2 loops per second, so using the service tools, you definitely won't miss a suitable moment;

-

Commissions and slippage. This depends heavily on the specific exchange and market sentiment;

-

Order execution speed. This is also a factor that is individual for each crypto platform. However, it should be noted that such problems are not observed on top crypto exchanges.

On average, a single trade can bring from 0.5% to 5%, but keep in mind that such opportunities may be short-lived and require a quick reaction. Also, be careful with extremely large spreads: if the cost of a cryptocurrency on two platforms differs by more than 15%, it’s worth investigating why before starting the loop.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.