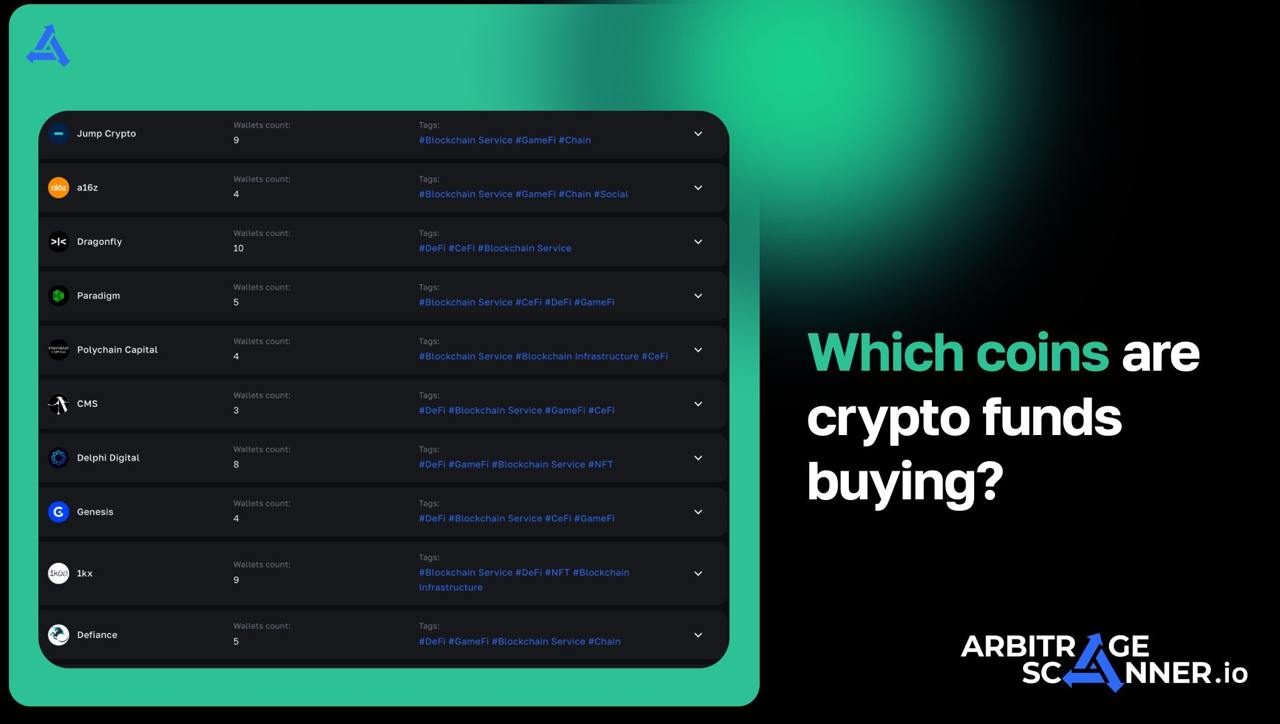

Which coins are crypto funds buying?

with ArbitrageScanner!

VC wallets and balances:

|

VC Name |

Balance |

Balance Value |

|

7.92T |

$165.56M |

|

|

839.82B |

$17.55M |

|

|

350B |

$7.32M |

|

|

84.35B |

$1.76M |

|

|

84.35B |

$1.76M |

|

|

52.32B |

$1.09M |

|

|

43.92B |

$917.89K |

2) Mantra DAO

Funds have also been actively acquiring $OM tokens, increasing their holdings by $21,338,483.62 or 5,321,317.61 OM. The total holdings now stand at 17,424,898.01 OM, with a weekly growth rate of 43.96%. Mantra DAO is a decentralized financial services platform and a Layer 1 blockchain.

VC wallets and balances:

|

VC Name |

Balance |

Balance Value |

|

17.19M |

$67.73M |

|

|

112.01K |

$441.31K |

|

|

47.22K |

$186.06K |

|

|

34.09K |

$134.31K |

|

|

1.29K |

$5.08K |

3) Polygon

VC wallets and balances:

|

VC Name |

Balance |

Balance Value |

|

25M |

$10.94M |

|

|

13.73M |

$6.01M |

|

|

7.56M |

$3.31M |

|

|

599.85K |

$262.45K |

|

|

589.82K |

$258.06K |

|

|

459.88K |

$201.21K |

|

|

395.56K |

$173.07K |

The activity of venture capital funds over the past week demonstrates their confidence in several promising projects. However, it is important to remember that their actions do not always guarantee success. This is not financial advice or a recommendation to buy. DYOR (Do Your Own Research)

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.