When Arbitrage Becomes Most Likely: 15 Scenarios for Maximum Profit!

#Scanner

Our clients have shared cases with us in which arbitrage becomes most likely. We've structured this into a list to make it clearer for you. We'll also show a real customer case for each of these points and dive into how much they earned.

Let's take a look at this list:

- Listing on a new exchange. When a new token is listed on an exchange, price volatility is often observed. For example, we've already talked about how our clients earned over +50% on cryptocurrency arbitrage? The case of the Arkham (ARKM) coin listing on Binance.

- Trading launch. When new trading pairs are launched on an exchange, there can also be significant spreads. This is because traders are trying to assess the demand and supply for the new trading pair.

- Token or exchange hack. In such cases, the token's price sharply drops. Investors lose confidence in the token and sell it. This happened with CRV, where our clients managed to profit, and we talked about it here.

- Token migration to another network. During a token migration to another network, its price may temporarily differ on exchanges supporting both networks. Traders may not have time to move their tokens to the new network, and therefore, demand for tokens in the old network can be higher than supply.

- Launch of a new blockchain for the token. When a new blockchain is launched for a token, its price may temporarily differ on exchanges supporting both blockchains. Traders may not have time to move their tokens to the new blockchain, and therefore, demand for tokens in the old blockchain can be higher than supply.

- Suspension of coin deposits/withdrawals. When coin deposits/withdrawals are suspended, the price of the coin may temporarily rise. Traders who want to sell the coin are forced to sell it at a higher price to find buyers. We discussed a case when withdrawals were suspended for the MULTI token.

- Sharp token price increase on important news. In the case of a sudden increase in a token's price on important news, its price may temporarily rise. Traders buy tokens in anticipation of further price growth. For example, the same case with ARKM listing on Binance, the news first appeared in chats, and then an official announcement followed. You could have earned like our clients simply by seeing the news in the closed chat or by setting up TG Scanner for keywords.

- High market volatility. During high market volatility, arbitrageurs can profit from price differences between different cryptocurrencies or fiat currencies.

- Unusual network for deposits/withdrawals on some exchange. If an exchange supports token deposits/withdrawals in a network not supported by other exchanges, arbitrageurs can take advantage of this situation by buying tokens at a lower price on the exchange with the unusual network and selling them at a higher price on exchanges with more common networks. For example, the RUNE token on Buybit in the RUNE or Bep2 (beacon) network, while on other exchanges, it's on the Ethereum network.

- Links with regional exchanges. Exchanges from different regions may have different prices for the same asset. We've already talked about the case with a 70% profit on the Cyber token between Bithumb and Binance.

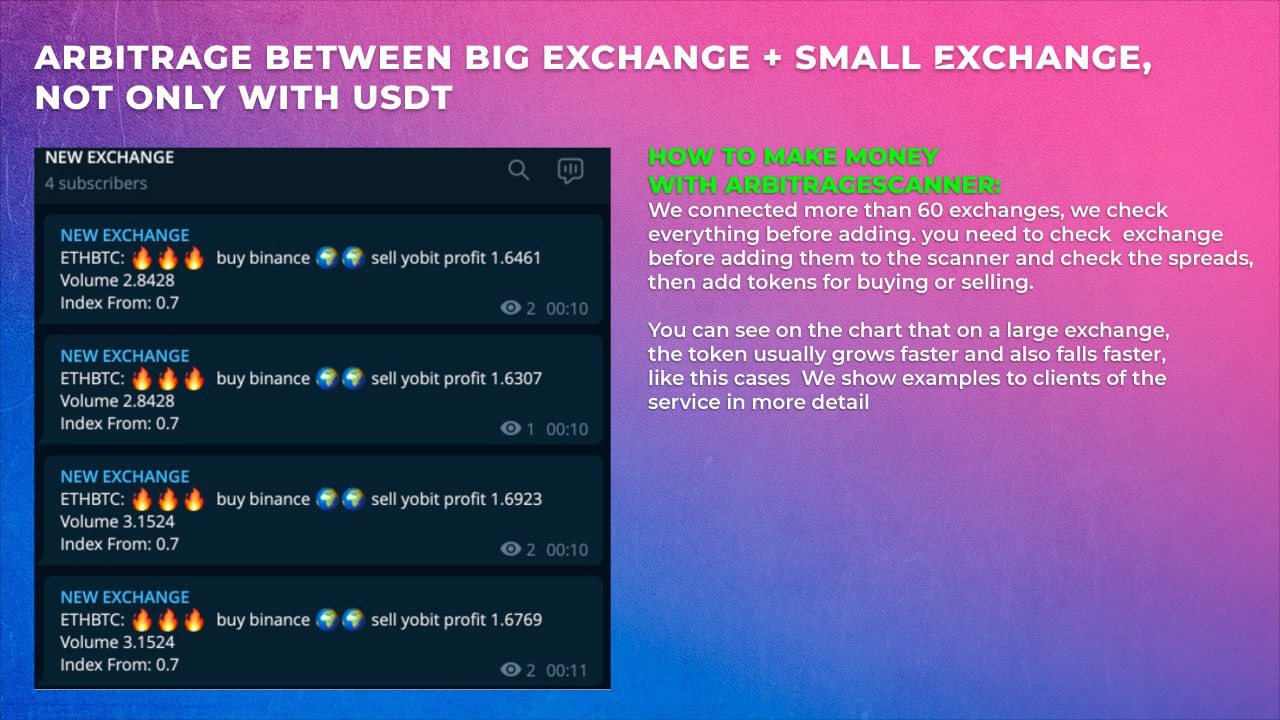

- Low-liquidity exchanges. Arbitrageurs can find spreads on low-liquidity exchanges where asset prices may be incorrect. Acendex, an exchange with low volume, for example, allowed arbitrage with BLUR tokens for $20-50 per order.

But it's important not to fall for a scam exchange, so check projects before using them!

- Placing large orders on small exchanges. If someone on a small exchange places a large buy or sell order for an asset, for example, someone placed a $5,000 sell order on Gate for the SIS token, while there are usually $20-30 orders there. The price rose, and there was arbitrage via withdrawal for an hour.

- Unpegging the stablecoin rate. If the stablecoin rate becomes unpegged from a fiat currency, you can profit from arbitrage. We talked about such a case with USDC and other cryptocurrencies paired with this stablecoin.

- Activity between 2 blockchains. If one blockchain is more active than another, you can profit from arbitrage. For example, you can take BCS and the less active BOBA. The principle is similar to the point about large and small exchanges.

- Between 2 blockchains or DEXs for one coin. If one resource has a high level of liquidity, for example, 500K, and the other resource has less, say, 30K, you can profit from arbitrage.

For each of these points, we will provide separate case studies if we haven't already. We'll show with real examples from our clients how they earned with ArbitrageScanner. You can also become part of our community by purchasing a subscription to stay in the loop!

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.