Futures arbitrage case | +19% for one arbitrage opportunity

BLOCK Coin Futures Arbitrage

The perpetual screener showed a spread for the BLOCK coin on the Gate exchange between spot and futures.

We arbitraged using the spot + futures strategy, we bought on spot and took a short position on futures (the price on spot must necessarily be cheaper).

I had a small balance on the Gate exchange, so I decided to use 2x leverage in order to enter the trade with a smaller amount of investment.

Let me explain that without using leverage you need to buy 100 coins on the spot and open a short position for 100 coins, but with a leverage of 2x if you buy 100 coins on the spot, you will only need 50 in the short position.

On the one hand, this is convenient, but on the other hand the other carries additional risks, since leverage brings the liquidation price proportionately closer.

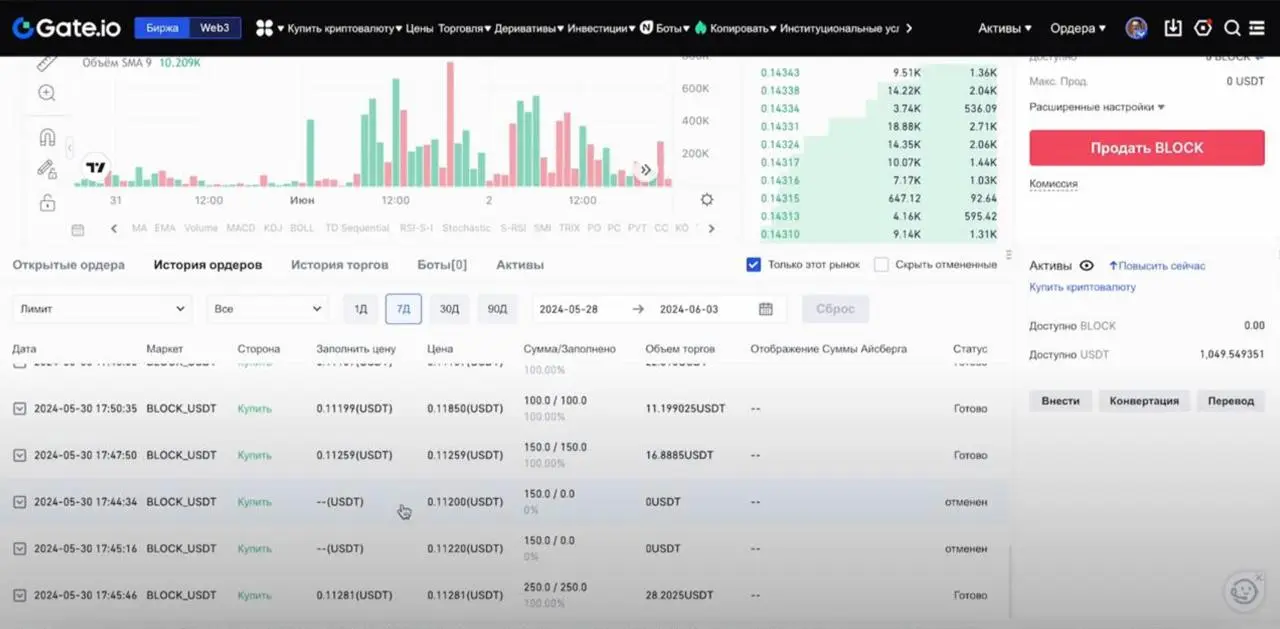

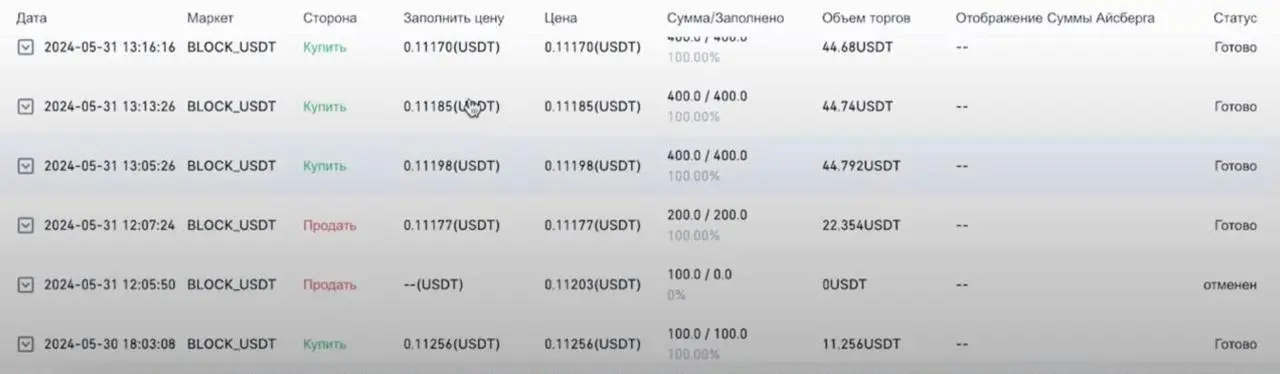

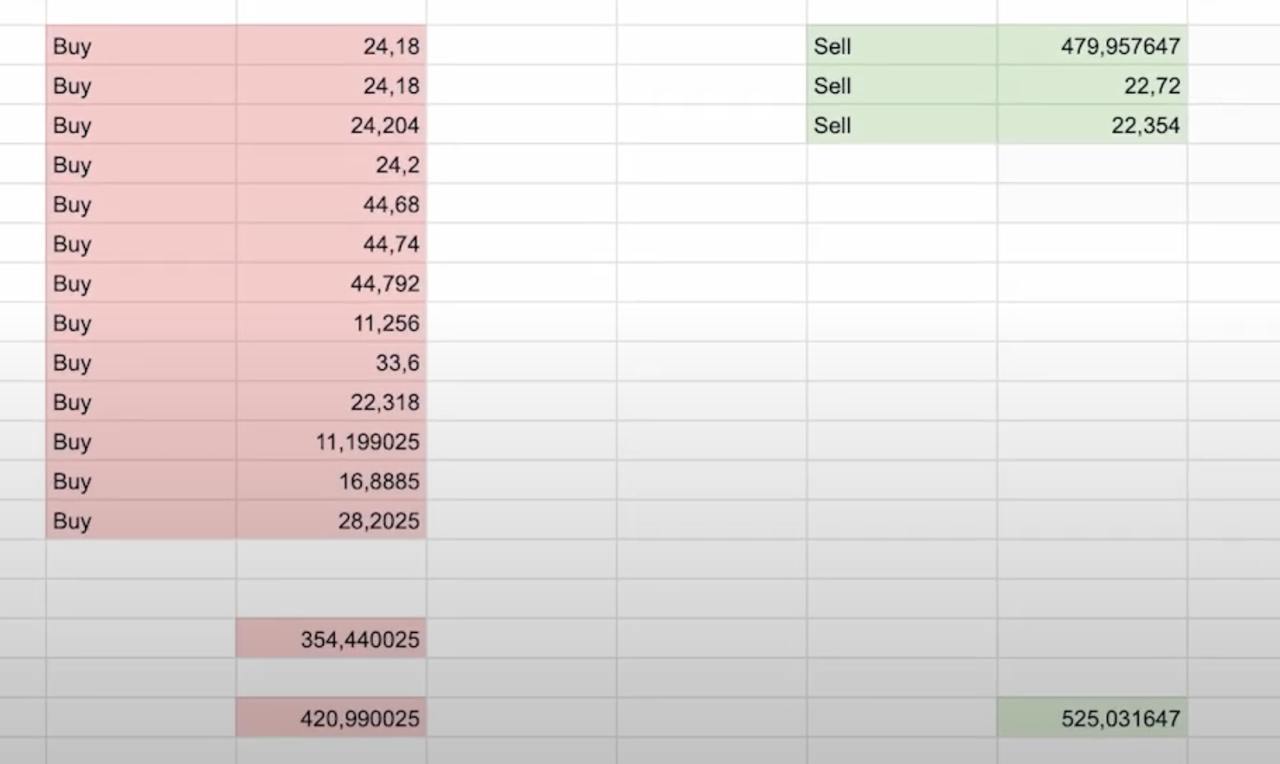

Buying coins on the spot (carried out in parts):

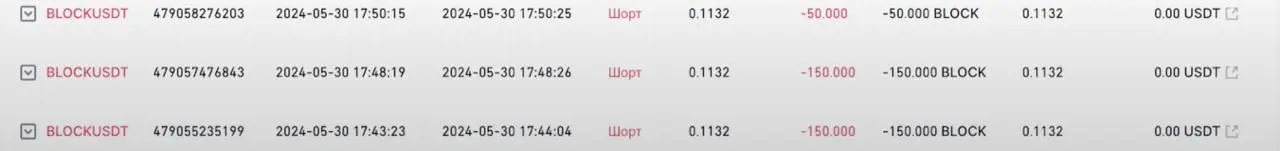

Opening a short position (we also open in parts of 5-10%, and not all at once):

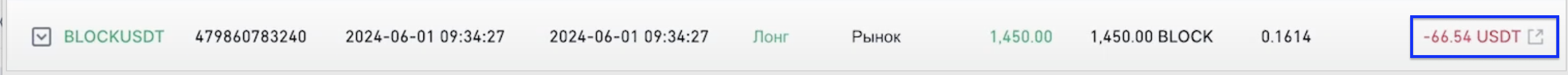

As already mentioned, leverage has additional risks. The liquidation price was 0.169, so I set my stop loss at 0.1614.

Until now, everything was correct, but then I made a mistake — I did not place a limit order to sell on the spot. This is an error, because when the stop loss was triggered, my short position was closed, but the tokens remained on the spot.

In the chart below, the blue arrow indicates the point at which the stop loss was triggered. As you can see, I was lucky that the price continued to rise, and I was able to sell the coins on the spot for even more money. But I might not be lucky, the price could turn down and I would have to sell tokens on spot at a loss, receiving a minus both on futures and on spot.

Of course, it turned out to make good money in the end, but this is rather a “survivor’s mistake.”

The short position was closed with a minus of $66.55:

Spot sales brought in $547.65:

I spent $354.44 to buy coins on the spot, and also had a loss on futures of $66.55. In total we get:

547.65 - (354.44 + 66.55) = $126.66 net profit.

To open a trade, we needed $354.44 on spot and $178 on futures, for a total of $534.44.

It follows that the income in percentage terms was 23.7%.

I repeat that what happened is more likely the result of luck and the favor of fate, so the main conclusion is: do not forget to set stop losses and place limit sell orders.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.