Crypto Arbitrage | Spot+Spot Strategy Case on Aptos (APT) Token Between MEXC and Poloniex

Case Review

In this case, we will examine a Spot+Spot arbitrage strategy using the Aptos (APT) token on the MEXC and Poloniex exchanges. The trade was executed on January 28, 2025, with a final profit of 3% on the deposit.

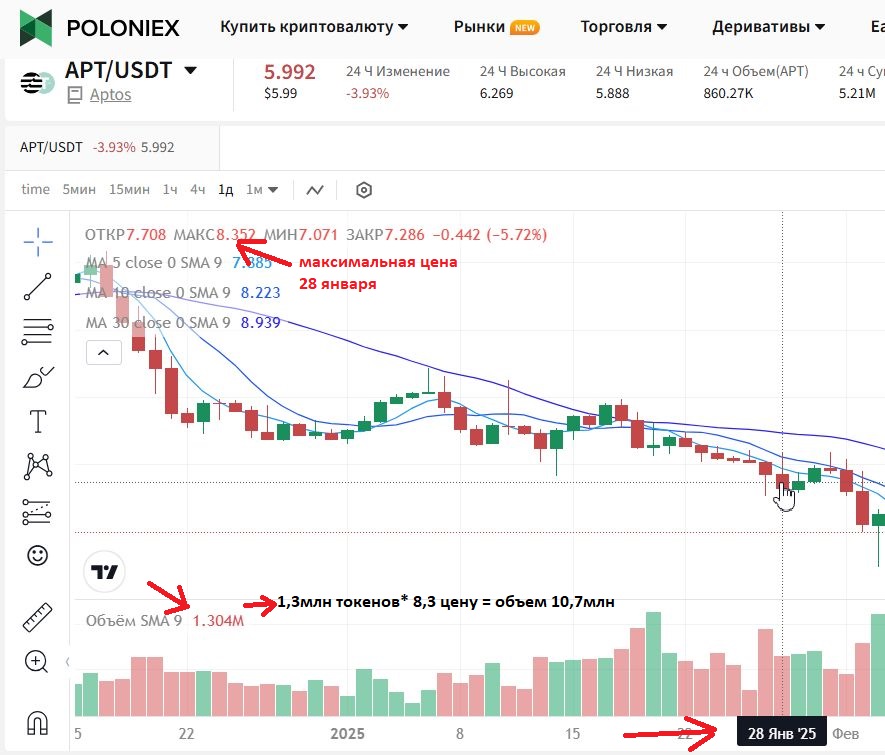

Finding the Arbitrage Opportunity

The user identified the opportunity using the spot screener in the web version of the platform. Knowing that the asset had high trader interest, they immediately checked the trading volumes on both exchanges.

- Volume on MEXC: 17-23 million USDT

- Volume on Poloniex: Around 10 million USDT

The initial analysis showed that liquidity was sufficient, which is a key factor for successful arbitrage.

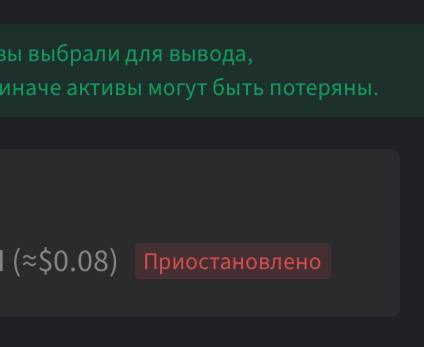

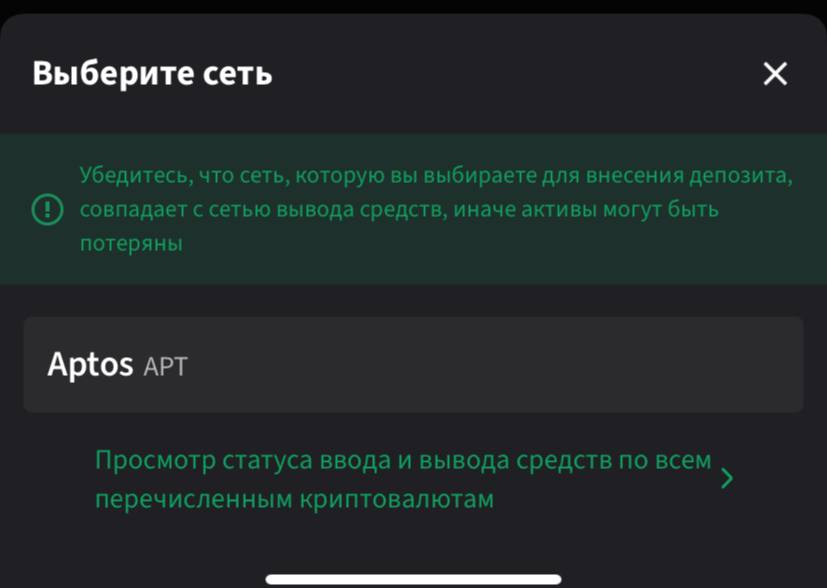

Checking Deposit and Withdrawal Availability

The next step was to confirm that APT could be withdrawn and deposited on both exchanges within the same network.

- MEXC → Withdrawal available in the Aptos network

- Poloniex → Deposit available in the Aptos network

When deposits or withdrawals are suspended, the exchange displays a "Suspended" message, but in this case, everything was functioning properly.

Executing the Trade

1. Buying APT on MEXC

The user placed a limit (taker) order and purchased APT for 330 USDT.

The screenshot displays:

- Asset ticker

- Trade date

- Order type

- Purchase price

- Volume of purchased tokens

- Total transaction amount

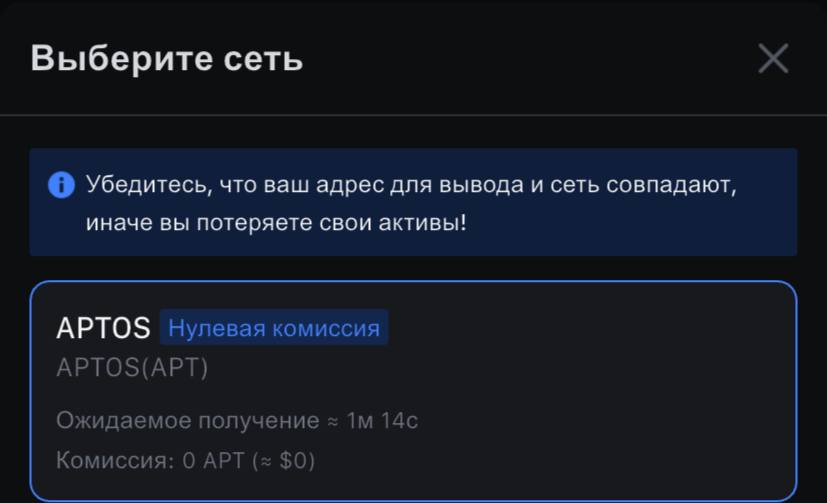

2. Transferring APT from MEXC to Poloniex

After purchasing the token, the user immediately transferred it to Poloniex.

- The transaction itself was processed quickly, but the exchange credited the deposit with a slight delay.

Although rare, such delays can happen and may work against you. To mitigate risks, it’s best to hedge your position by shorting the asset on the target exchange until the deposit is credited and the sale is completed.

3. Selling APT on Poloniex

Once the APT deposit was credited, the user sold the tokens using a limit order for 340 USDT.

The second screenshot displays:

- Trade date and time

- Asset ticker

- APT volume (after deducting fees)

- Selling price

There was strong buy demand in the Poloniex order book at a favorable price, allowing the trade to close quickly.

A larger deposit could have been used since there was decent buying demand at a good price in the Poloniex order book.

Case Summary

- Token: APT (Aptos)

- Transfer network: Aptos

- Exchanges: Buy on MEXC → Sell on Poloniex

- Strategy: Spot+Spot

- Deposit: 330 USDT

- Profit: +10 USDT (+3%)

- Final amount: 340 USDT (after all fees)