Case study on the Futures + Futures funding strategy on the FUN Token

with ArbitrageScanner!

Funding is a powerful tool for profit!

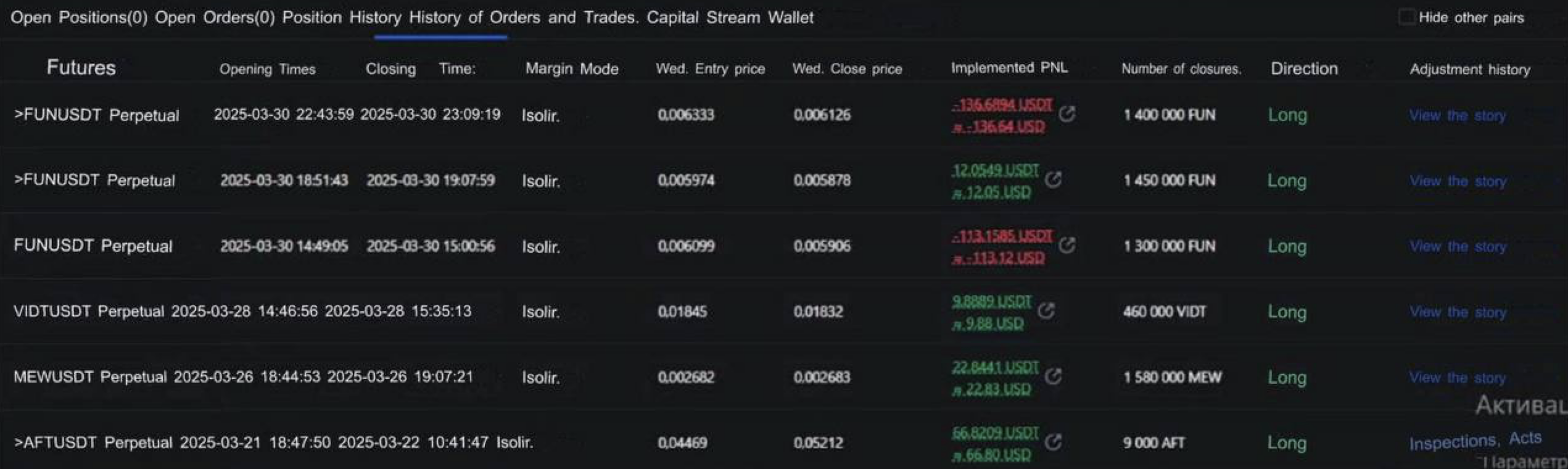

Arbitrage on funding rates is one of the most undervalued strategies. In this case study, I will break down how I managed to earn 177 USDT in 24 hours on the FUN token by exploiting the funding rate difference between MEXC and XT. I will show three entries and their results.

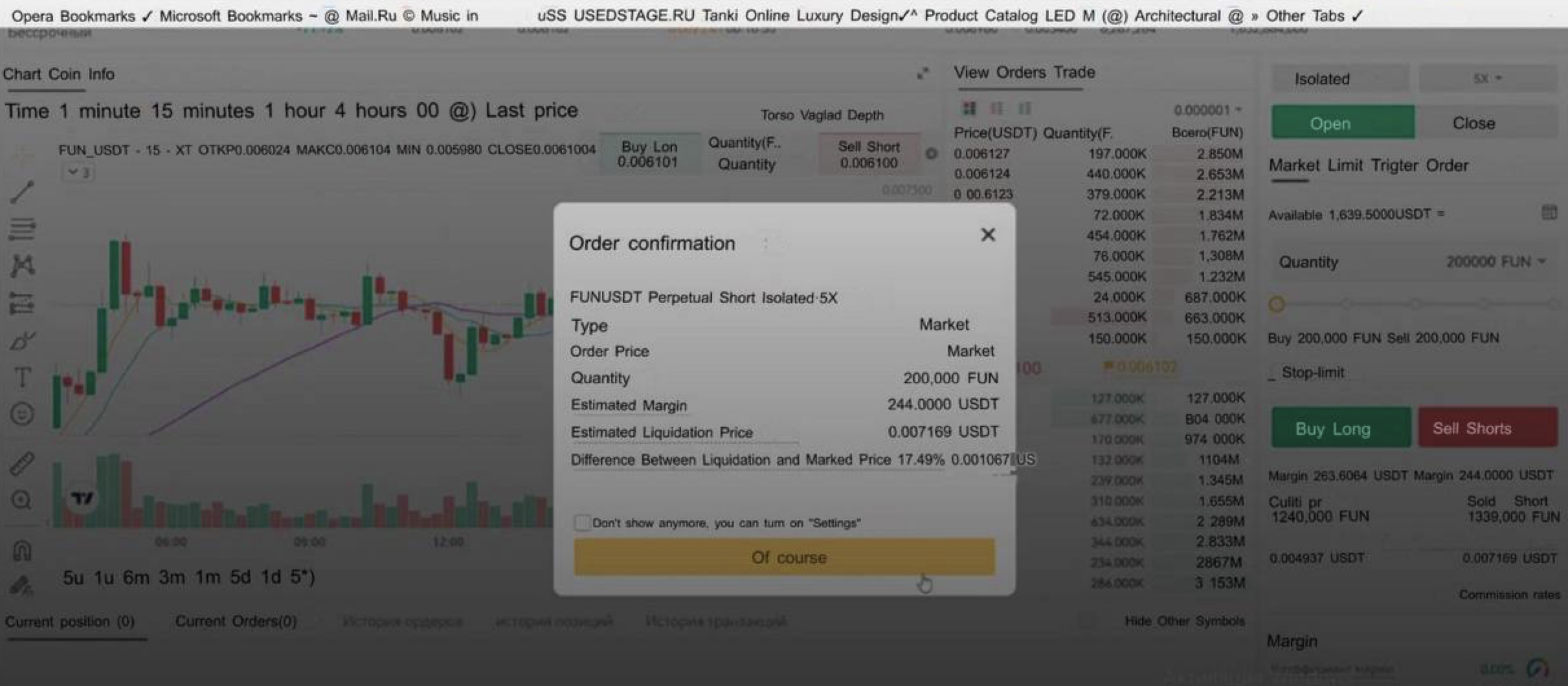

First Entry

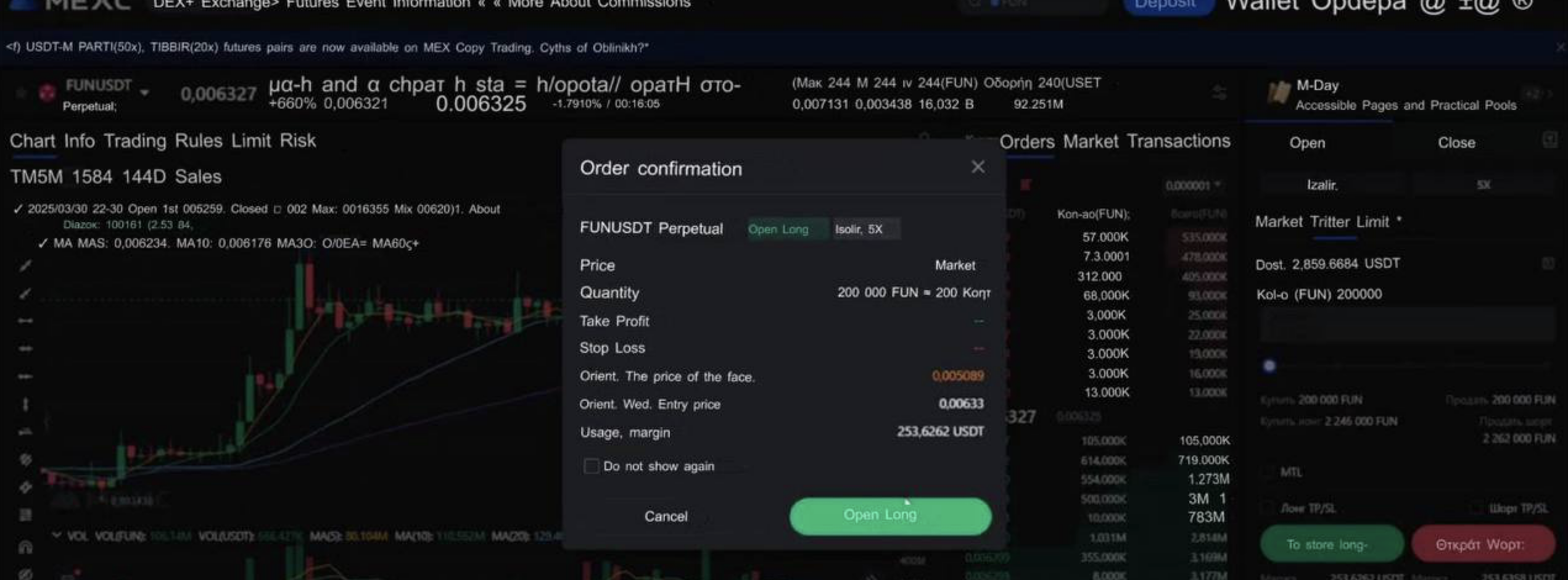

I found the pair using a futures scanner on a website, noticed a good funding rate, and decided to act.

MEXC rate: -1.79%

XT rate: 0.0025%

For this asset, payouts occur every 4 hours, and it doesn’t matter how early I enter—I will still receive my interest. At the time of discovering the pair, there were 11 minutes left until the rate was applied. This was a great window for entry, and to save time, I used market orders for 40K FUN with 5X leverage. Long on MEXC and Short on XT.

In total, I opened positions for 1.3M coins, accounting for leverage on each exchange. With 30 seconds left on the timer, I prepared to close.

Profit is generated from the funding payouts on XT and MEXC. In the first entry, fees cost recieved me 113 on XT → net result +$30.

- Token: FUN

- Exchanges: Buy on MEXC (futures) → Sell on XT (futures)

- Strategy: Futures + Futures

- Deposit: 1560 USDT

- Total volume: 1560 × 5 leverage = $7800

- Profit: 30 USDT = 1.9% of the deposit per pair.

- Result: 1590 USDT after all fees.

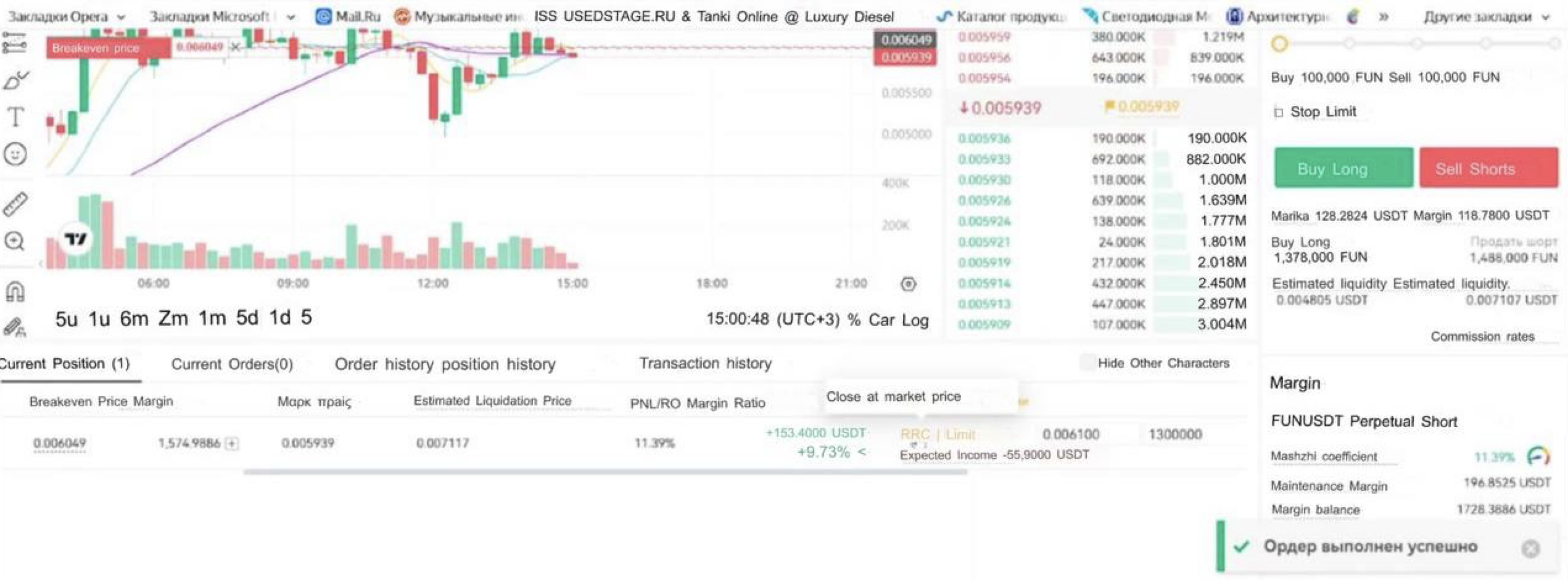

Second Entry

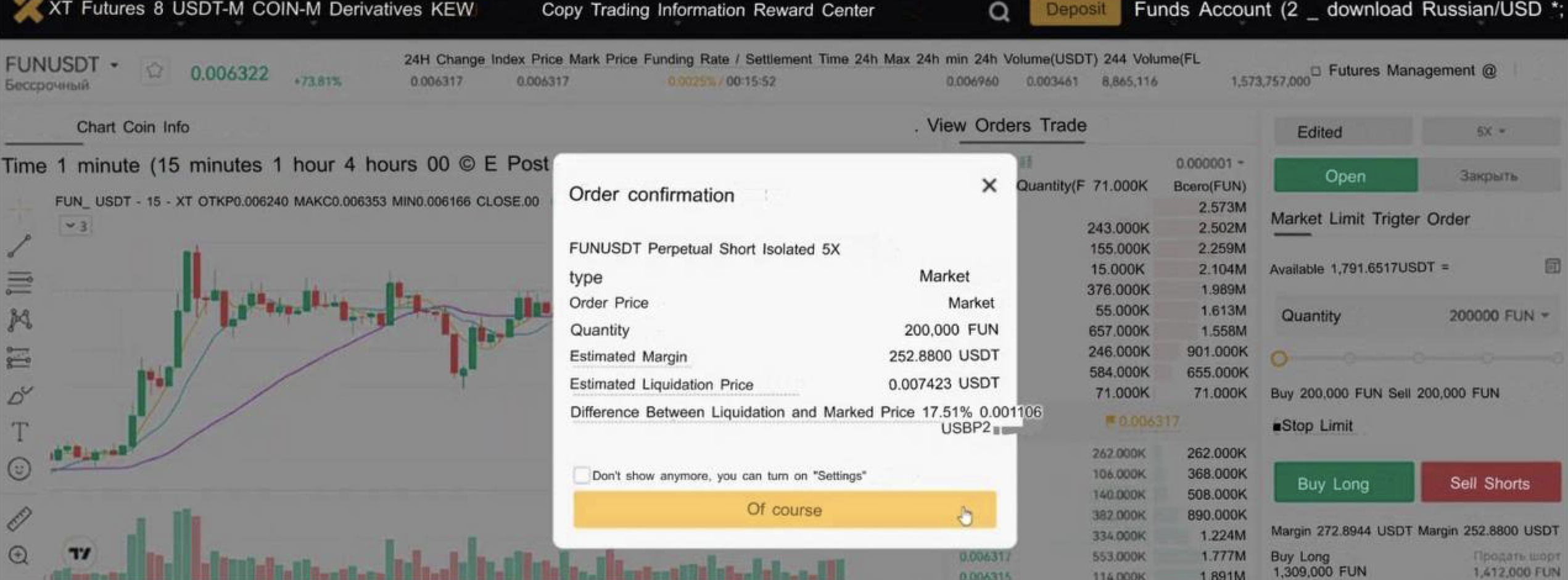

After 4 hours, the rates hadn’t changed, and the spread remained. This meant I could repeat the success but with a larger deposit.

MEXC rate: -1.79%

XT rate: 0.0025%

This time, I opened positions for 6000 FUN with 5X leverage. By the time the rate was applied, positions totaling 2.9M coins (accounting for leverage) were open.

I closed the positions in parts and locked in a profit of +$47.

- Token: FUN

- Exchanges: Buy on MEXC (futures) → Sell on XT (futures)

- Strategy: Futures + Futures

- Deposit: 3480 USDT

- Total volume: 3480 × 5 leverage = $17,400

- Profit: 47 USDT = 1.3% of the deposit per pair.

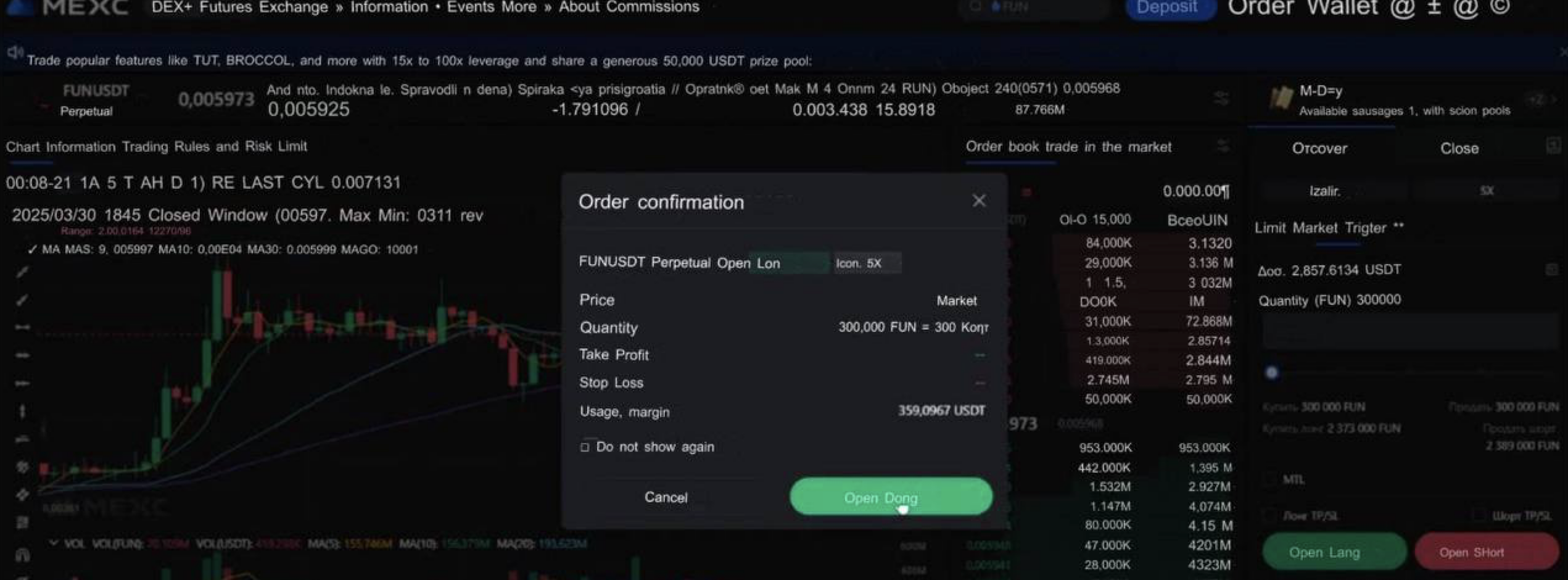

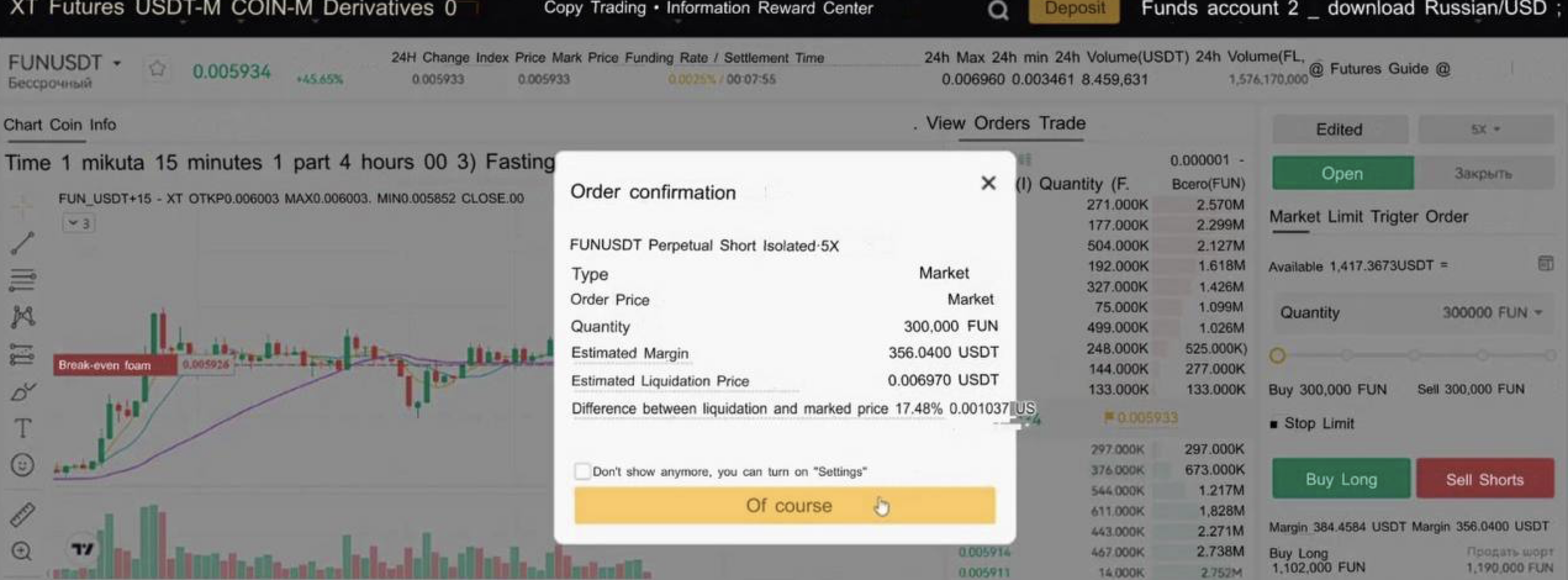

Third Entry

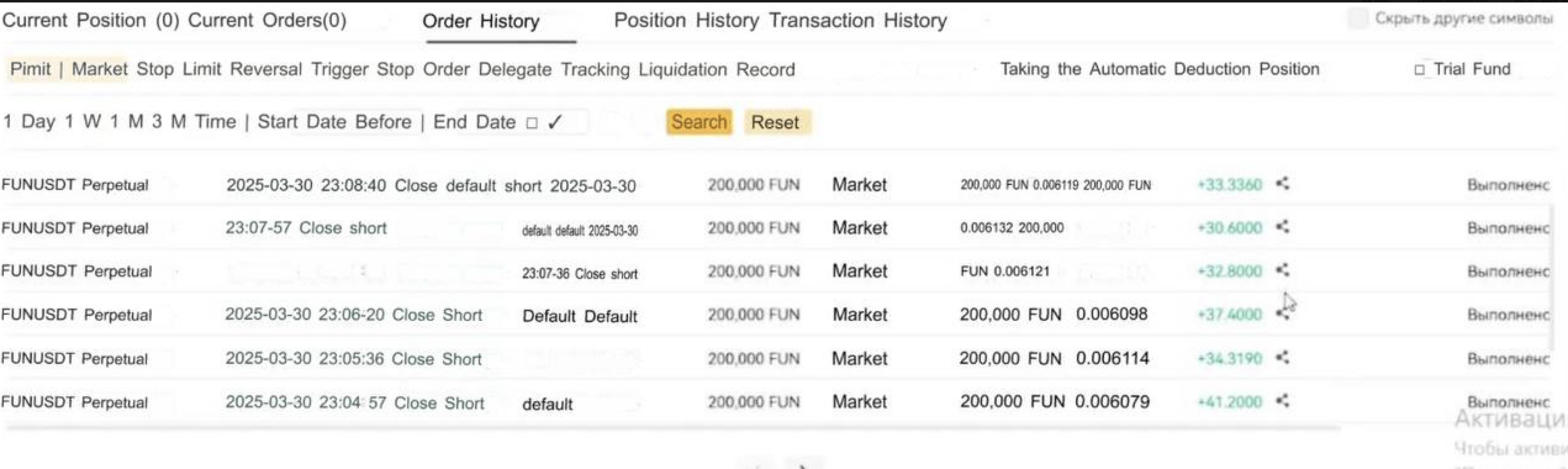

Another 4 hours later, the funding rate spread still hadn’t changed, so I opened positions again. This time, 40K FUN with 5X leverage on the same exchanges. In total, positions for 2.8M coins (accounting for leverage) were opened.

I waited for the payout and closed the positions in batches of 200K coins.

Short position: +242 USDT

Long position: -142 USDT

This time, when closing the positions, I also managed to profit from the price difference between the two exchanges. This increased the final profit, even though the funding rates remained the same.

- Token: FUN

- Exchanges: Buy on MEXC (futures) → Sell on XT (futures)

- Strategy: Futures + Futures

- Deposit: 3360 USDT

- Total volume: 3360 × 5 leverage = $16,800

- Profit: 100 USDT = 2.97% of the deposit per pair.

Over 24 hours, the strategy yielded 177 USDT, or 3.36% of the deposit in net profit. If the rate difference had remained stable, scaling up and increasing the working deposit would have been possible.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.