Case Study on Futures + Futures Strategy on the Token Story (Ticker: IP) Across Kucoin and Bybit Exchanges

with ArbitrageScanner!

Arbitrage for the IP Token Using the Futures + Futures Strategy

The arbitrage opportunity was identified using a futures screener on a website. The profit came from the price difference, without involving funding.

I noticed IP, knowing that the asset was in the top 100 on CoinMarketCap, so I had no doubts that the arbitrage would work as expected.

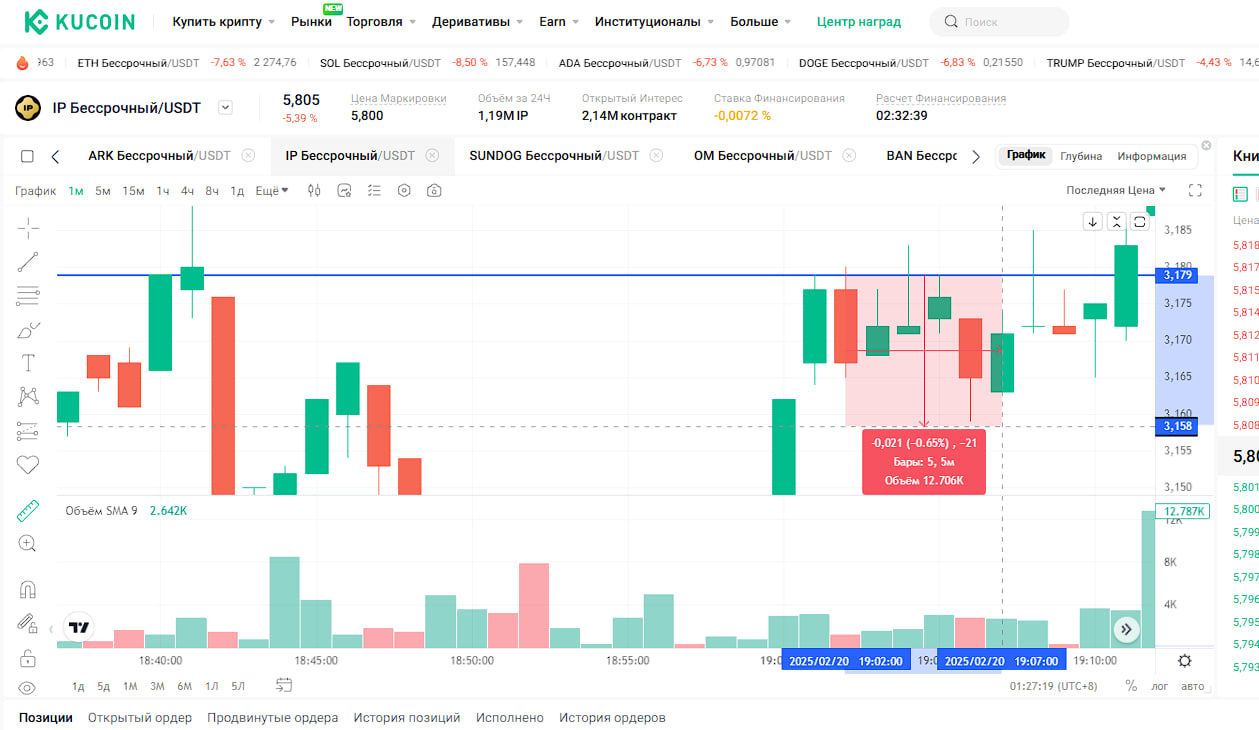

The trading volume of the asset on Kucoin was approximately $37 million at the time of entry, with a price of 3.16.

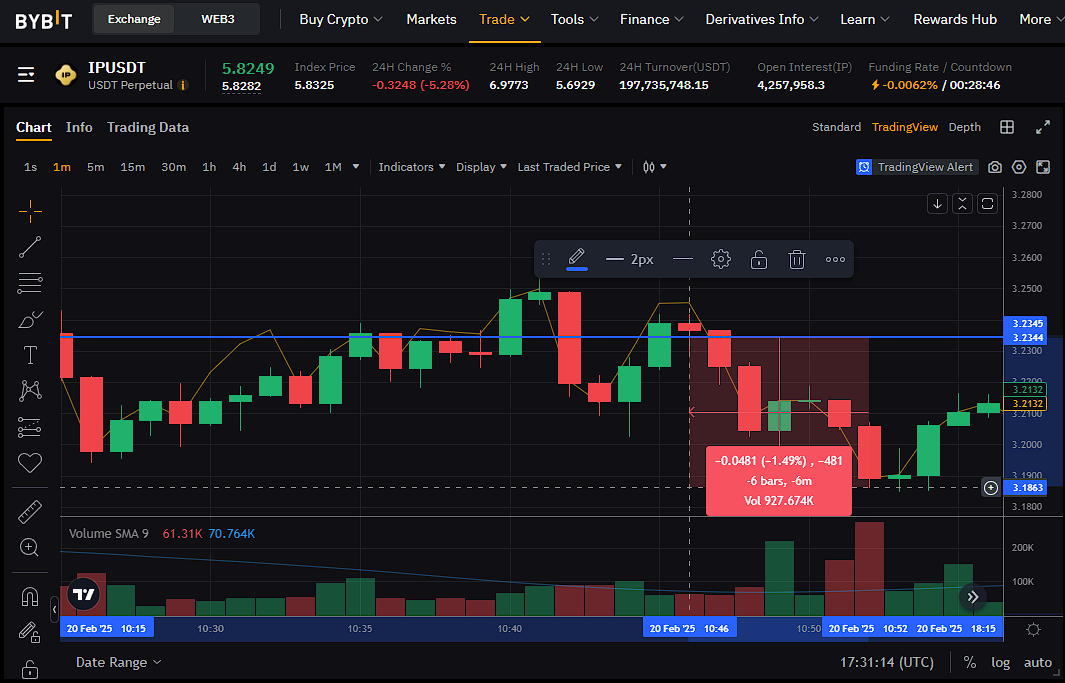

The trading volume on Bybit was over $900 million, with an entry price of around 3.22.

The initial signals indicated that everything was proceeding as planned.

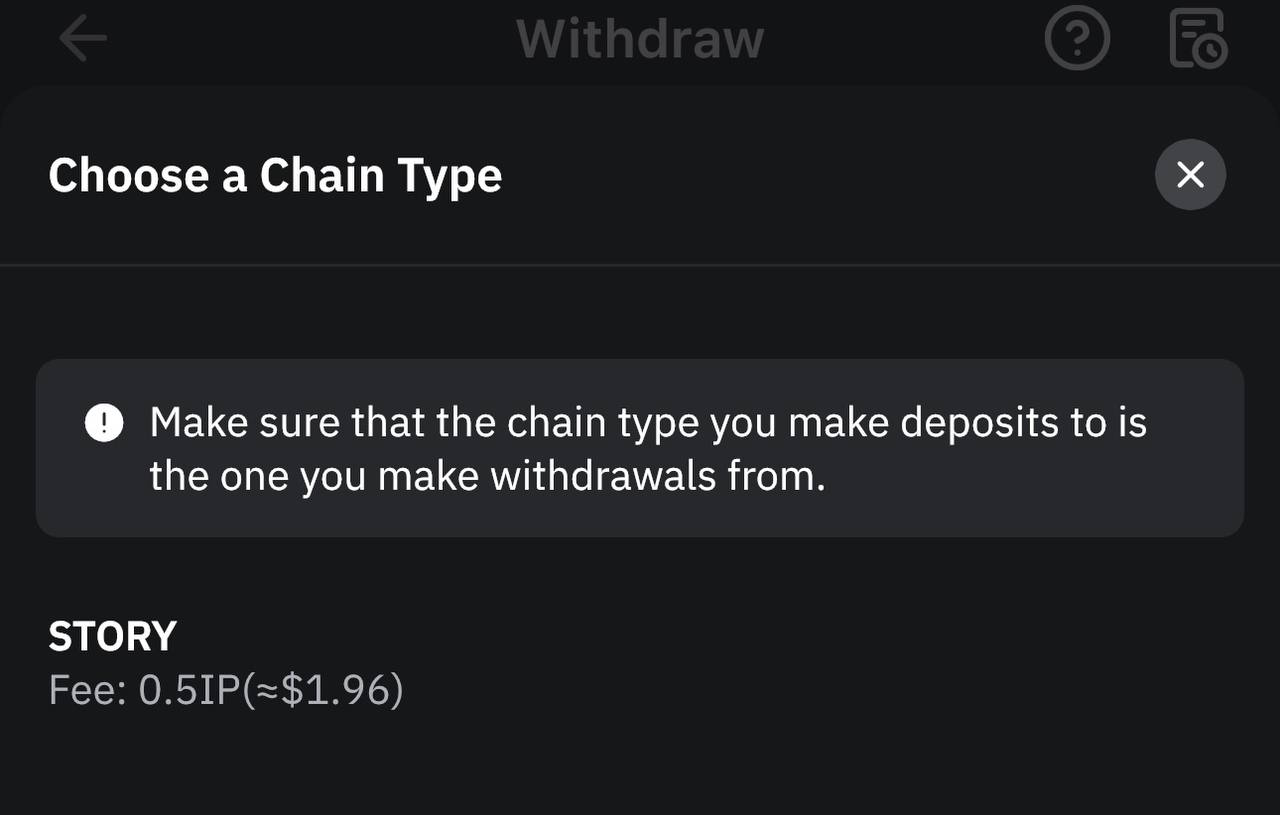

Next, I confirmed that the asset was available for deposits and withdrawals on both exchanges in the IP network.

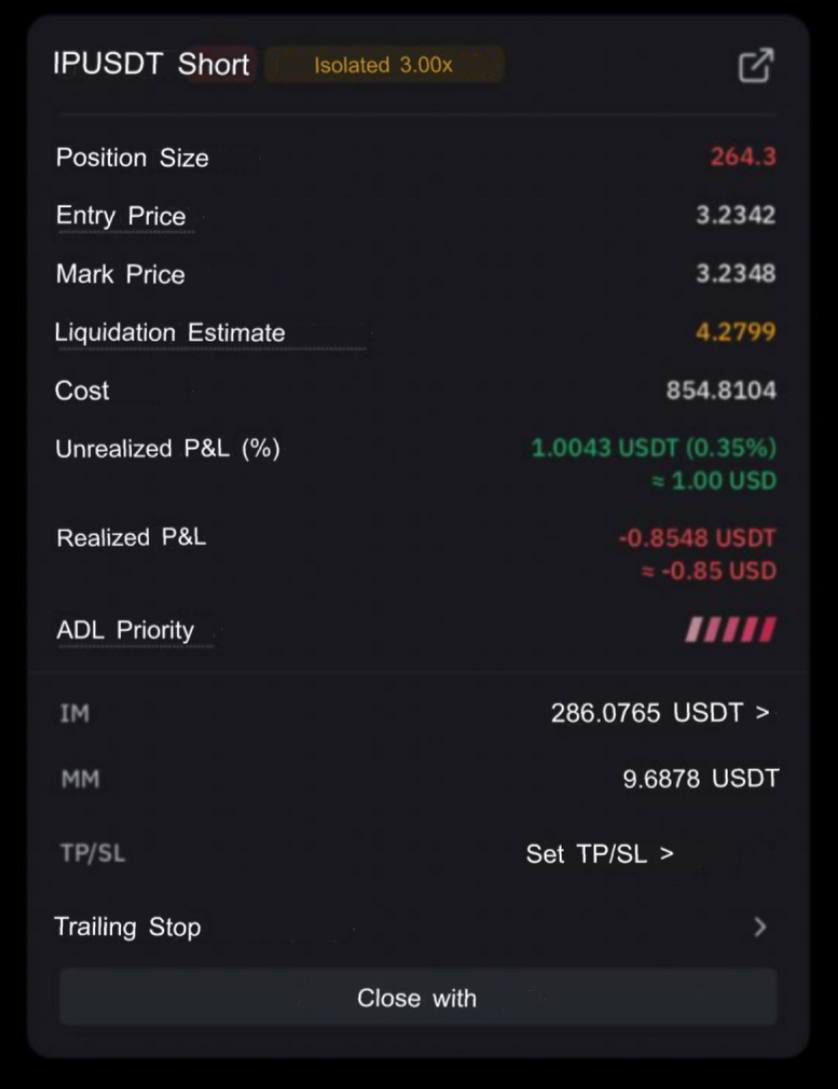

Then, I proceeded to enter the positions. First, I opened a short position on Bybit with 3x leverage for $286. The position size was $854.

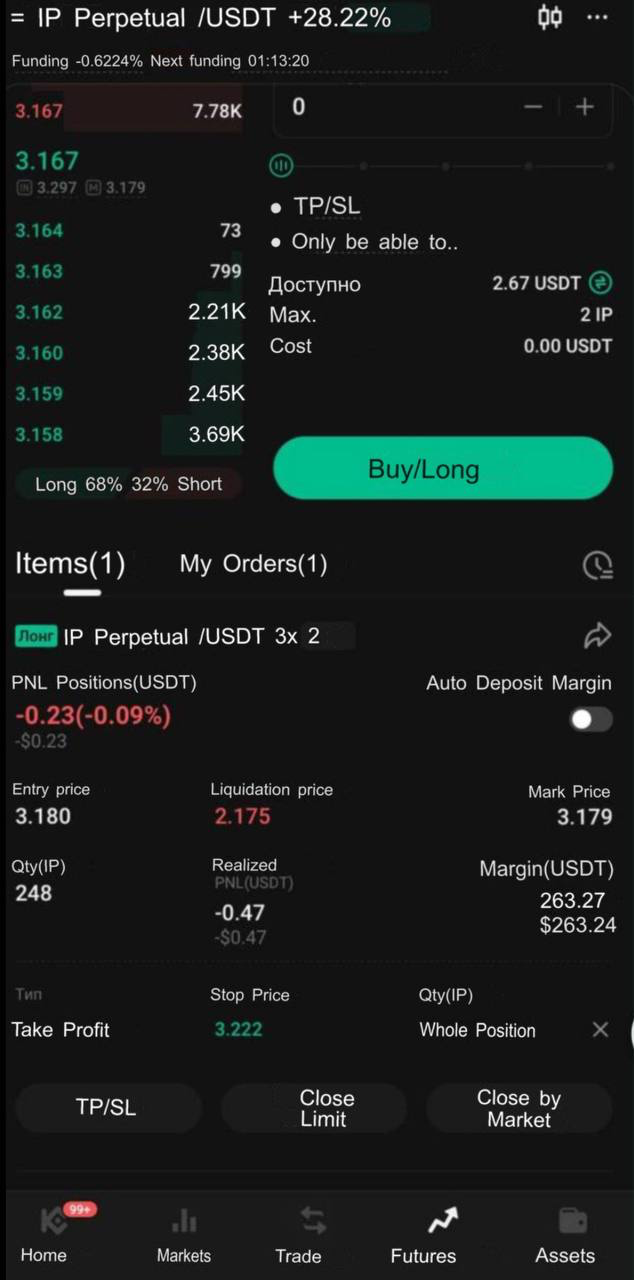

Immediately after, I opened a long position on Kucoin, also with 3x leverage for $263. The position size was $789.

The goal was to wait for the prices to converge and lock in the profit.

Within 10 minutes, the price of the IP futures on Bybit dropped more significantly (-1.5%) compared to Kucoin (-0.6%). I decided not to wait for the prices to fully equalize. I closed the short position with a limit order, securing a profit of +$16. The long position was closed at a slight loss of -$1.

- Token: Story (IP)

- Transfer Network: IP

- Exchanges: Buy on Kucoin (futures) → Sell on Bybit (futures)

- Strategy: Futures+Futures

- Deposit: $547

- Total volume with 3x leverage: $1,641

- Profit: $15 USDT = 2.74% of the deposit per arbitrage.

- Result: $562 USDT after all fees.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.