Case study on the spot + futures strategy on the OM token.

with ArbitrageScanner!

How to Earn +4.18% on Your Deposit in an Hour

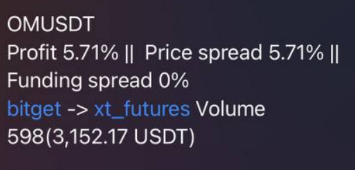

I spotted this opportunity in a Telegram bot screener and decided to take my time to verify everything first.

The token was actively traded on all exchanges, so it didn't bother me that deposits/withdrawals were closed somewhere. Deposits were only available on the Ethereum network, while withdrawals were possible on BEP20 and Mantra.

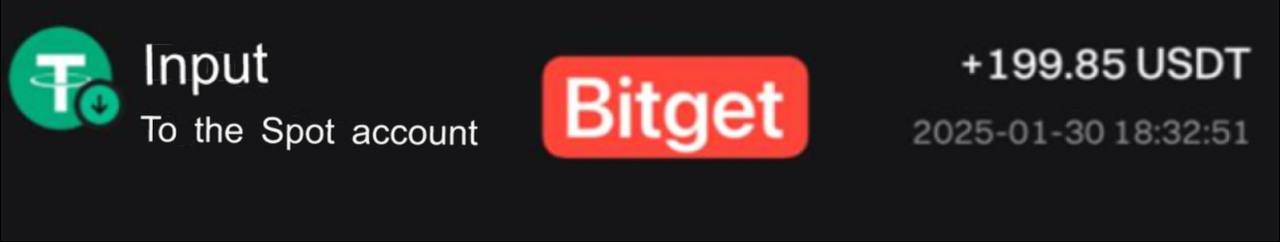

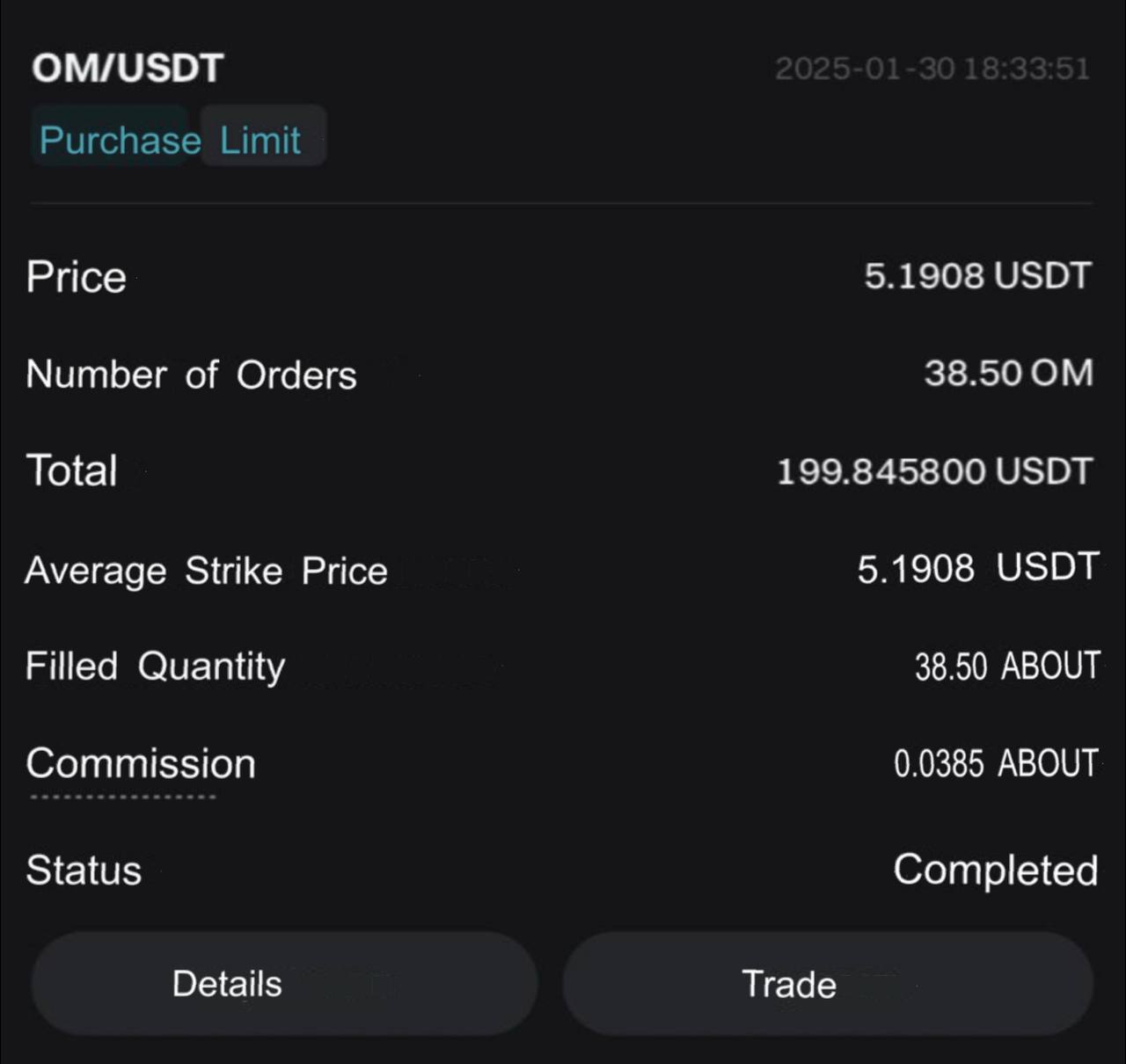

I proceeded to transfer my balance to the exchanges. I sent 199 USDT to Bitget and 148 USDT to XT.

First, I opened a short position on XT with a limit order at 5.84 USDT.

Next, I bought OM on the spot market on Bitget with the entire amount using a limit order.

With the assets purchased, I waited for the prices to converge.

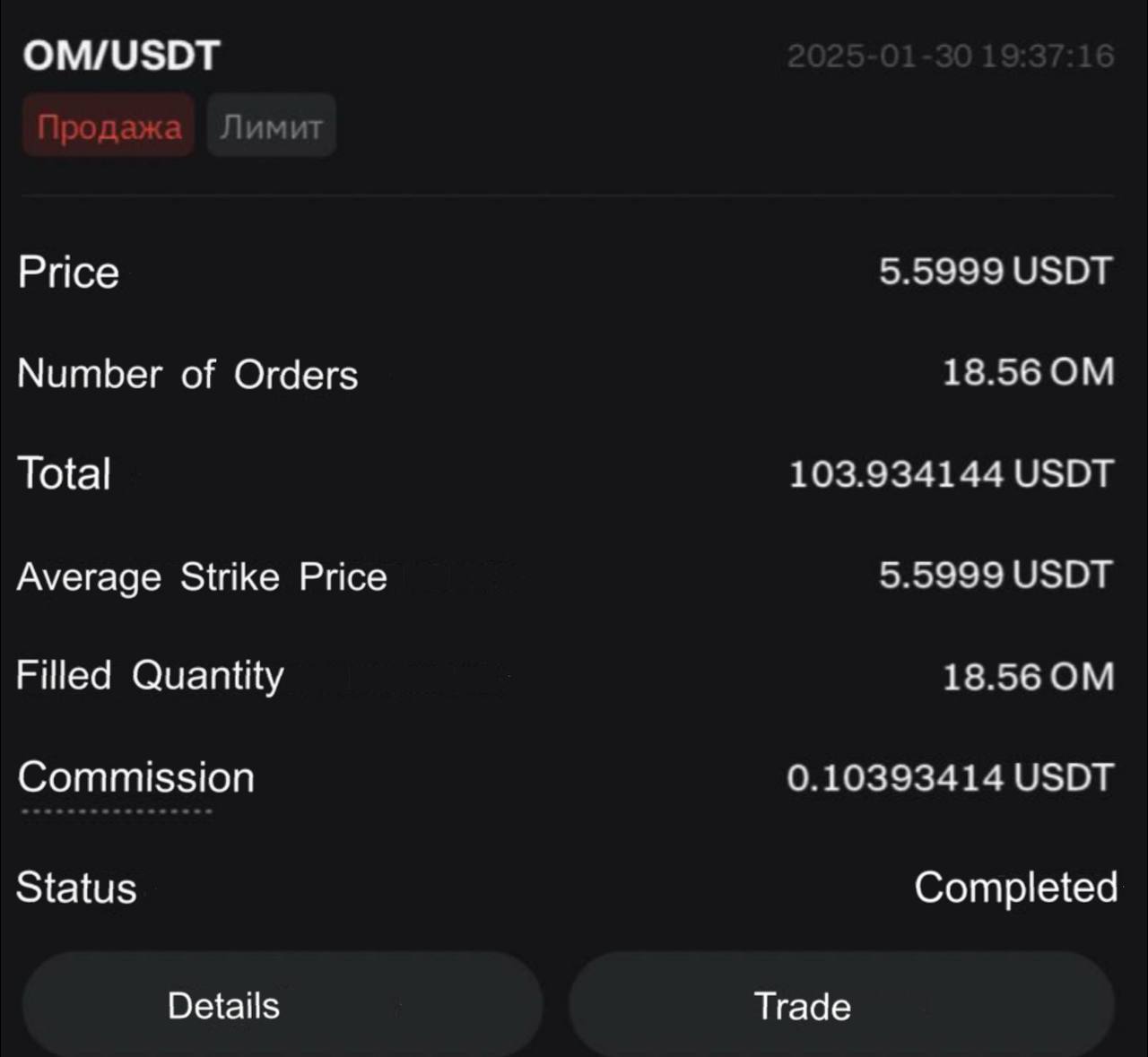

After 4 minutes, the spot price on Bitget increased by $4, and I immediately locked in this profit without closing the short position on XT.

An hour later, when the spot price dropped slightly, I decided to buy the coin again on the spot market, but this time with half of the deposit (99 USDT), and placed a limit sell order at 5.59. This way, I "insured" the short position on XT against a possible price increase.

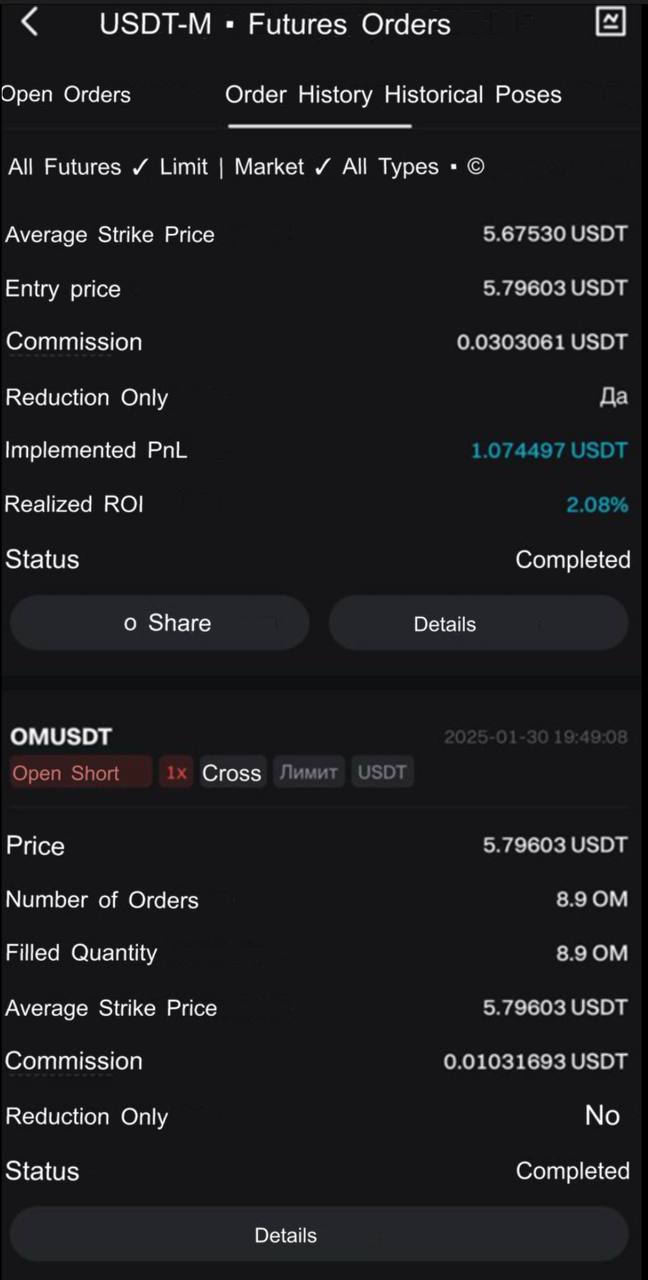

I noticed that the spread between the spot and futures prices within Bitget was the same as between Bitget and the futures price on XT. So, I also opened a short position on Bitget.

After waiting another hour, I closed the short position on XT with a profit of 4.7 USDT and the positions on Bitget with an additional profit of 5.8 USDT.

- Token: Om (OM)

- Exchanges: Buy on Bitget (Spot) -> Sell on XT (Futures)

- Strategy: Spot + Futures

- Total Volume: 347

- Profit: 14.5 USDT = 4.18% of the deposit for the trade.

- Result: 361.5 USDT, including all fees.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.