Case on the futures + futures strategy on the SUNDOG token

28/03/2025

#Perpetuals screener 🔥

While you're thinking — others are already earning

with ArbitrageScanner!

with ArbitrageScanner!

Try ArbitrageScanner, find arbitrage opportunities and make profit. Buy a subscription now and get +30% bonus days for free!

SUNDOG Token Arbitrage Using a Futures + Futures Strategy

I saw this pair in the futures screener on the website.

I noticed a good price discrepancy percentage and decided to act.

The first thing I checked was the 24-hour trading volume. On ByBit, it was $173M.

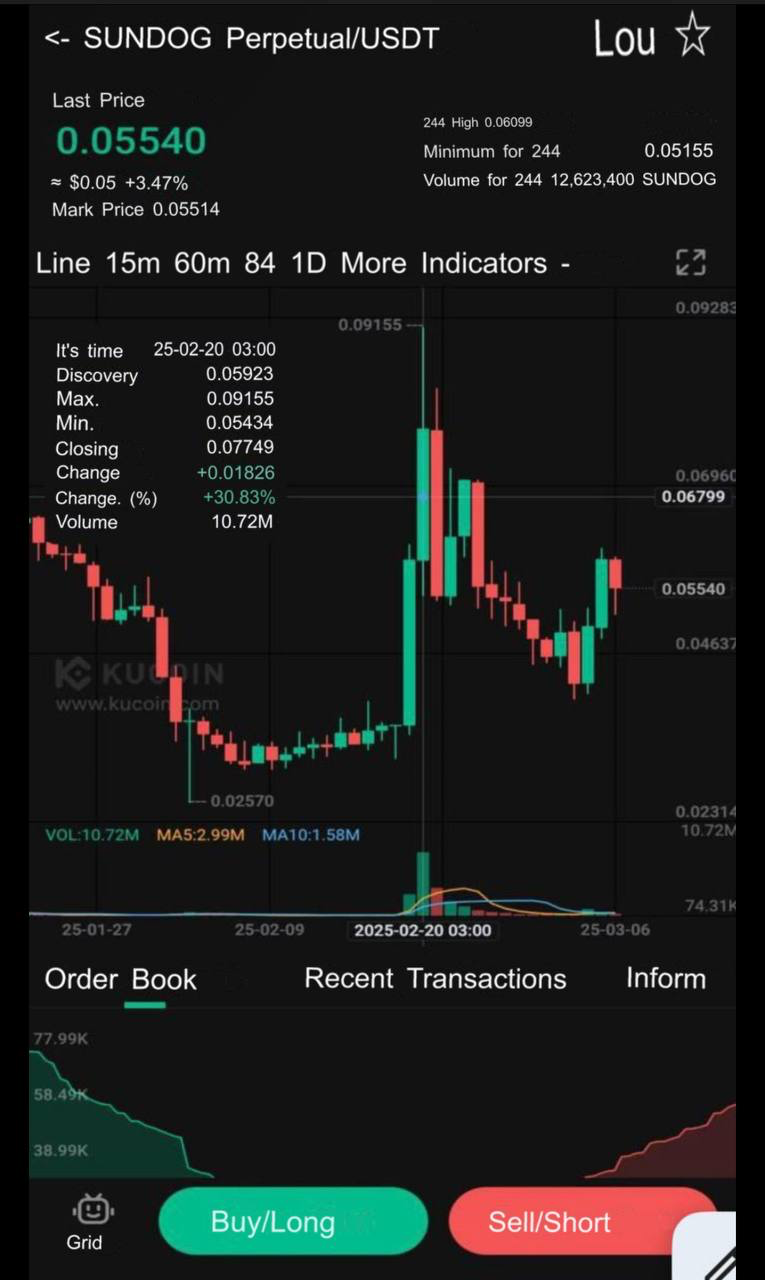

On KuCoin, the trading volume was $10M.

Trading was active. After analysis, we got a strong signal.

I opened positions, long on ByBit and short on KuCoin, and waited for the prices to converge.

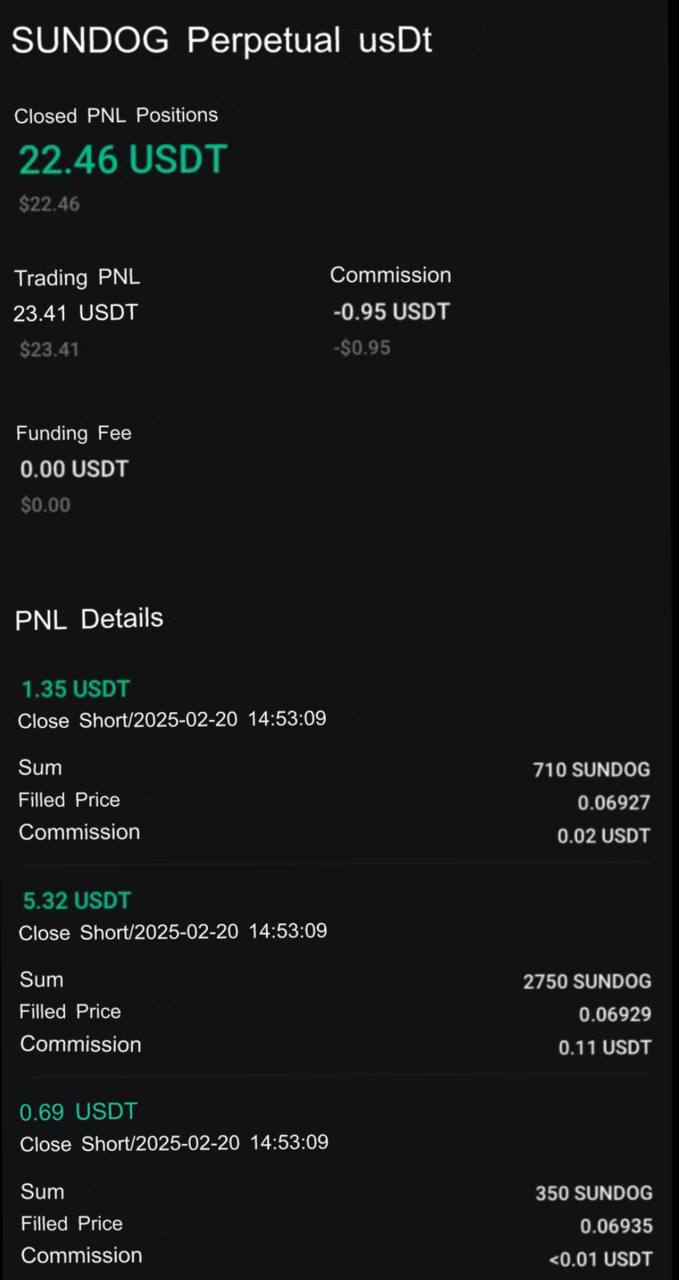

After 25 minutes, the prices aligned, resulting in a profit of +$30 after closing the positions.

The long position on ByBit brought $8.

And the short on KuCoin brought $22.

- Token: Sundog (SUNDOG)

- Exchanges: Buy on ByBit (futures) → Sell on KuCoin (futures)

- Strategy: Futures + Futures

- Deposit: 562 USDT

- Total volume: 562 x3 leverage = $1,686

- Profit: 30 USDT = 5.3% ROI on the deposit for the pair.

- Result: 592 USDT after all fees.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.