Cryptocurrency arbitrage strategies: Arbitrage through withdrawal

Recently, we talked about the risk-free arbitrage strategy, and today let's talk about the basic withdrawal arbitrage strategy:

Step 1. Find a signal that a spread has appeared. For example, we took the TAP coin.

The signal is a notification from our cryptocurrency arbitrage scanner or screener.

Step 2. Check 2 exchanges for availability of deposit/withdraw and the possibility of transfer. In the case of TAP, we go to the Gate and Bybit exchanges.

At this stage, it is necessary to make sure that both exchanges have open input and output of cryptocurrency, and that they support transfers between each other. You can do this by checking the exchanges yourself. Also, check the orders in the order book.

Step 3. If input/output is closed, then add the coin to the blacklist.

If input or output of cryptocurrency is closed, then arbitrage is impossible. In this case, the coin should be added to the blacklist to avoid wasting time on its verification in the future.

Since our withdraw is open, we add this coin to the whitelist.

Step 4. If networks do not match, then find a bridge or a 3rd exchange.

If the deposit and withdraw networks do not match, then you need to find a bridge that allows you to transfer cryptocurrency to the desired network. You should choose a bridge that specifically supports the coin you need.

(The easiest way to find this project is to write a question in the chat about which bridges it supports, or study its website as there may be such information)

Or find a 3rd exchange where you can make a deposit in network 1 (e.g. ether) and withdraw in network 2 (BSK). Plus, there is a chance to find a more successful exchange for buying/selling in the desired network, some small exchange that is not in the scanner.

(To find such an exchange, you can enter the required pair into the scanner and quickly extract a bunch of potentially suitable exchanges between which there is a spread for this pair)

Step 5. After checking everything, buy the coin.

If all conditions are met, you can start arbitrage. Buy the coin on the exchange with a lower price and sell it on the exchange with a higher price.

Step 6. Buy the coin on the exchange with a lower price and sell it on the exchange with a higher price.

We will add the necessary filter for hedging strategy within ~30 days. We will separately tell you about the hedging strategy in the next posts.

Useful nuances

Setting up the scanner for the spread range

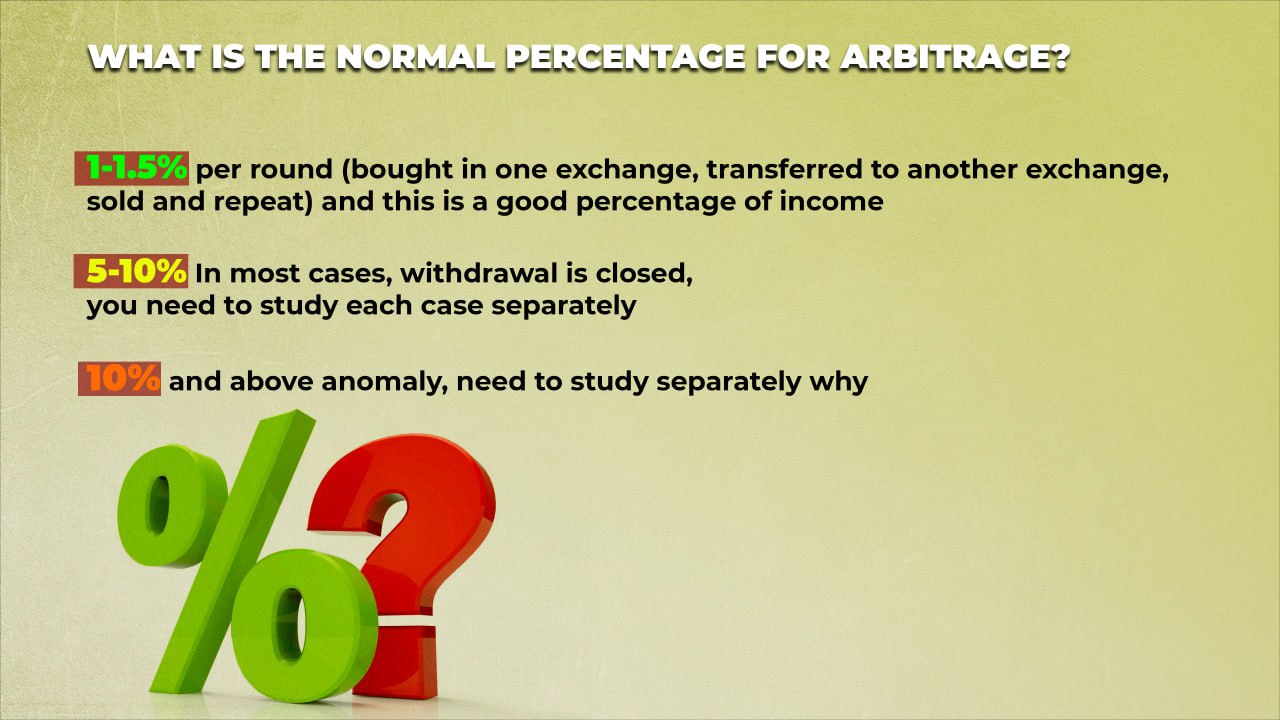

By setting up the scanner for a spread range from 1 to 5%, you will receive more signals for those coins where input/output is open and networks match. There will be even more such coins in the range of 1 to 3%.

Using a whitelist

If you have already checked some coins for arbitrage opportunities, it makes sense to add them to the whitelist.

You know for sure that these coins can be arbitrated between which exchanges, commission, average spread, etc. You set up notifications in your Telegram screener. This allows you to receive notifications as soon as there is a spread for such coins.

Arbitrage based on the whitelist greatly helps increase the percentage of successful trades.

Additional tips

Pay attention to the commission for deposit/withdrawal of cryptocurrency and always check the availability of withdrawal!

What strategy do you use?

Follow our social networks where we show cases of our clients who have earned with our service.

You can request a trial day or ask a question to our support.