How to Account for Commissions When Conducting Arbitrage Operations

with ArbitrageScanner!

Commissions

Important: Exchanges charge a commission for each of your actions, so you need to be able to account for commission expenses to make a profit.

Reducing any commission expenses = increasing profit from each round; the ability to work with a lower profit percentage per round and thereby increase the number of rounds.

Types of commissions and what they are charged for:

- Taker – someone who immediately buys/sells at the price of an order placed by someone else. Without placing an order and without any waiting.

Here’s an example: if you buy bitcoins at the price of 17453.83, I will buy part of the bitcoins from the orders in the red order book. In this case, I will be a taker, but only for the part of the bitcoins that I buy from the order book.

- Maker – someone who creates buy/sell orders.

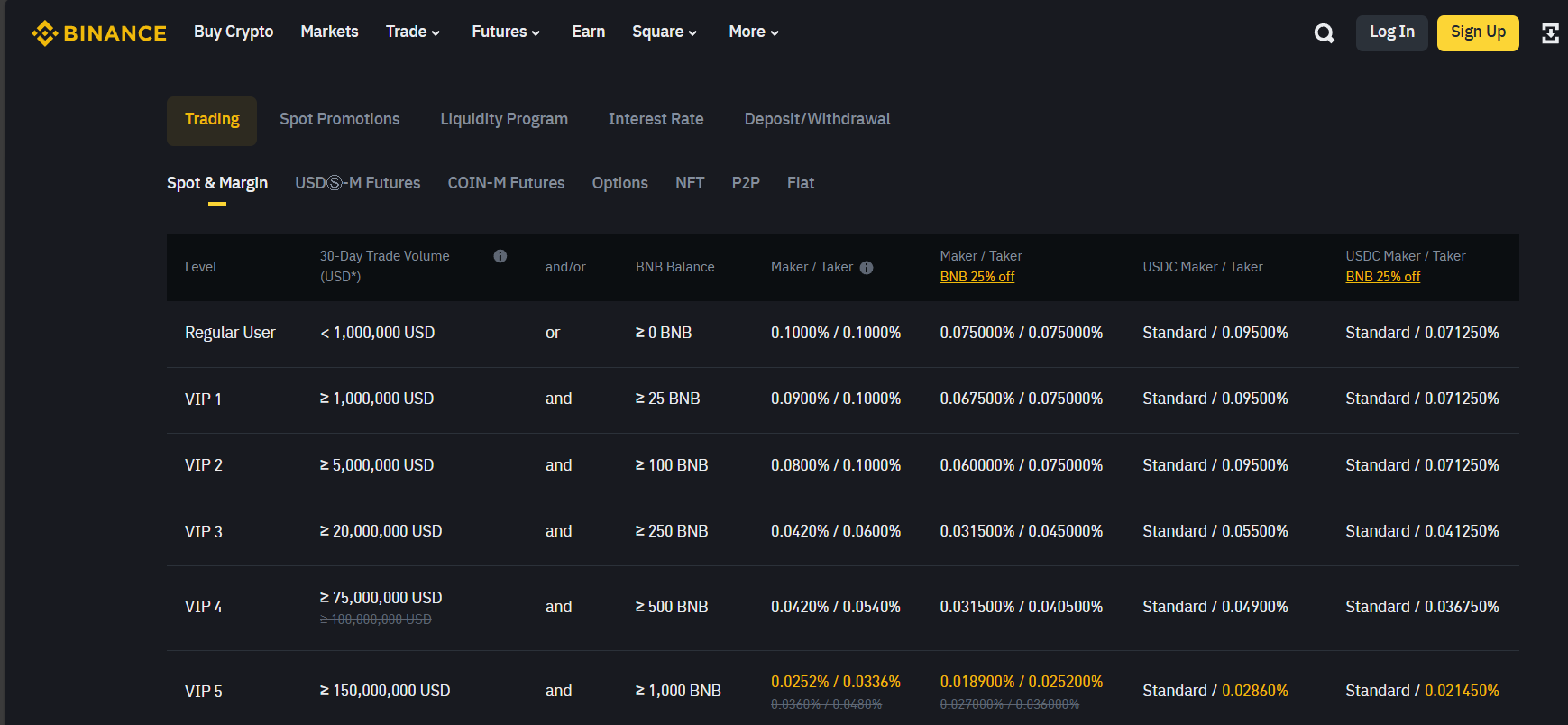

Most exchanges offer a lower commission for makers, but often you need to have a certain level/status, which is given after a certain trading volume or for holding the exchange’s tokens.

Here’s an example on the chart: if I place a “buy at 17200” order, I will create an order at that price. In this case, I will be a maker.

Taker and maker fees can vary, especially for different discount rates that exchanges offer for trading volume or holding exchange tokens. This nuance can help increase profit!

- Cryptocurrency withdrawal fee

On new exchanges for you, always first look at the withdrawal fees, as the fee can be super high. On normal exchanges, the fee usually depends on the network; in the ERC20 network, the fee can be $10, while in BSC it can be $1.

A common mistake in arbitrage is not accounting for the withdrawal fee. If you are arbitraging coins worth $1000 and the withdrawal fee is ~$10, then immediately factor it into the deal! In this example, it is 10/1000 = 0.01 = 1%.

So if you want to transfer from exchange to exchange through withdrawal after a round, then immediately factor in “fee for 2 trades” + “fee for 2 withdrawals” and take deals when this fee is covered.

Based on the example above, it would look like this: $10 coin withdrawal, $0.3 USDT withdrawal, 0.2% for 2 trades. $10/$1000 = 0.01 = 1% – coin withdrawal $0.3/$1000 = 0.003 = 0.3% – stablecoin withdrawal 0.002 = 0.2% – fee for 2 trades 1% + 0.3% + 0.2% = 1.5% – total fee per round, where we withdraw coins from exchange to exchange and also with stablecoins. So if you earned less than 1.5% from arbitrage, then rebalancing through withdrawal will lead to a loss and it’s better not to do it.

If withdrawing is not profitable, there are 2 strategies: a) Wait for the moment and do arbitrage in the opposite direction. b) Arbitrage at zero or a small loss when the price aligns.

- Gas – this is the fee you pay to miners for performing any transaction.

For example, when transferring from your crypto wallet to another wallet, you will pay a gas fee. And if you, for example, want to make a swap on a DEX (buy/sell crypto on a decentralized exchange), you will pay the network fee several times: transaction signature, fee for transferring the token to the exchange wallet, fee for transferring from the exchange wallet to yours. This is all just the network fee, and for the swap, you will also pay the exchange fee.

If you are arbitraging with DEX, then factor in the swap fee. Also, don’t forget that there will be a transfer fee during rebalancing. This is very important for expensive networks like ERC20.

Each of your trades will be accompanied by a fee, so in arbitrage, you need to account for it to arbitrage profitably.

Suppose you see a difference between the price of Bitcoin on Binance and the price on Bybit. On one exchange it’s $15,050 and on the other it’s $15,030, a difference of 0.13%. Then you look at the fees on both exchanges, and both have a fee of 0.1%.

So if you buy on one and immediately sell on the other exchange, you will pay a total fee of 0.2%, which means arbitrage is not possible (0.13% spread with 0.2% fee costs. 0.13 - 0.2 = -0.07%).

Look for ways to reduce the fee; the lower it is, the smaller the percentage you can arbitrage with, and the more rounds you will have.

You will need to get used to quickly calculating the fee and profit. With a bot, it’s easy to do, it will calculate everything itself.

Manually, you can either calculate in your head, but not everyone can do it quickly and correctly, or use a special table. The next lesson will cover working with the table.

You can immediately convert the fee into a number and catch the specific price difference without additional calculations. If you are arbitraging with several coins, it is easier to remember what the price difference should be and focus on it. Accuracy is lost, but speed increases.

Simple example:

The price of a coin is $1, the total fee is 0.2%. If we want to get a profit of 1%, then we need to catch a difference of $0.012 (1.2%).

Price $1 on one and $1.012 on the other – you can arbitrage and the profit will be 1%. Price $1 on one and $1.006 on the other – you can arbitrage with a small profit. Price $1.2 on one and $1.21 on the other – the profit will be less than 1%, you can arbitrage.

The method is not accurate, often it will not be 1%, but 0.1%, for example. But this way you can quickly navigate and understand whether to make a round or not.

This method works especially well during high volatility when you don’t have time to calculate properly as the price changes significantly.

Here’s a more complex example: You are trading a coin with a current price of 0.0484 USDT, and the round-trip fee is 0.2% (which is 0.002). To arbitrage to break even, you need a price difference of 0.0000968 USDT (calculated as 0.0484 * 0.002), rounded to 0.0001. If the price on one exchange is 0.0484 and on another 0.0483, you will break even, but if it’s 0.0484 and 0.0480, you will make a net profit of +0.6%. So we know for sure that the difference cannot be less than 0.0001, and the larger the difference, the better.

How to reduce fees for CEX exchanges?

There are 4 main ways:

- Obtaining VIP status for volume or holding exchange tokens

- Registering with a referral link with cashback

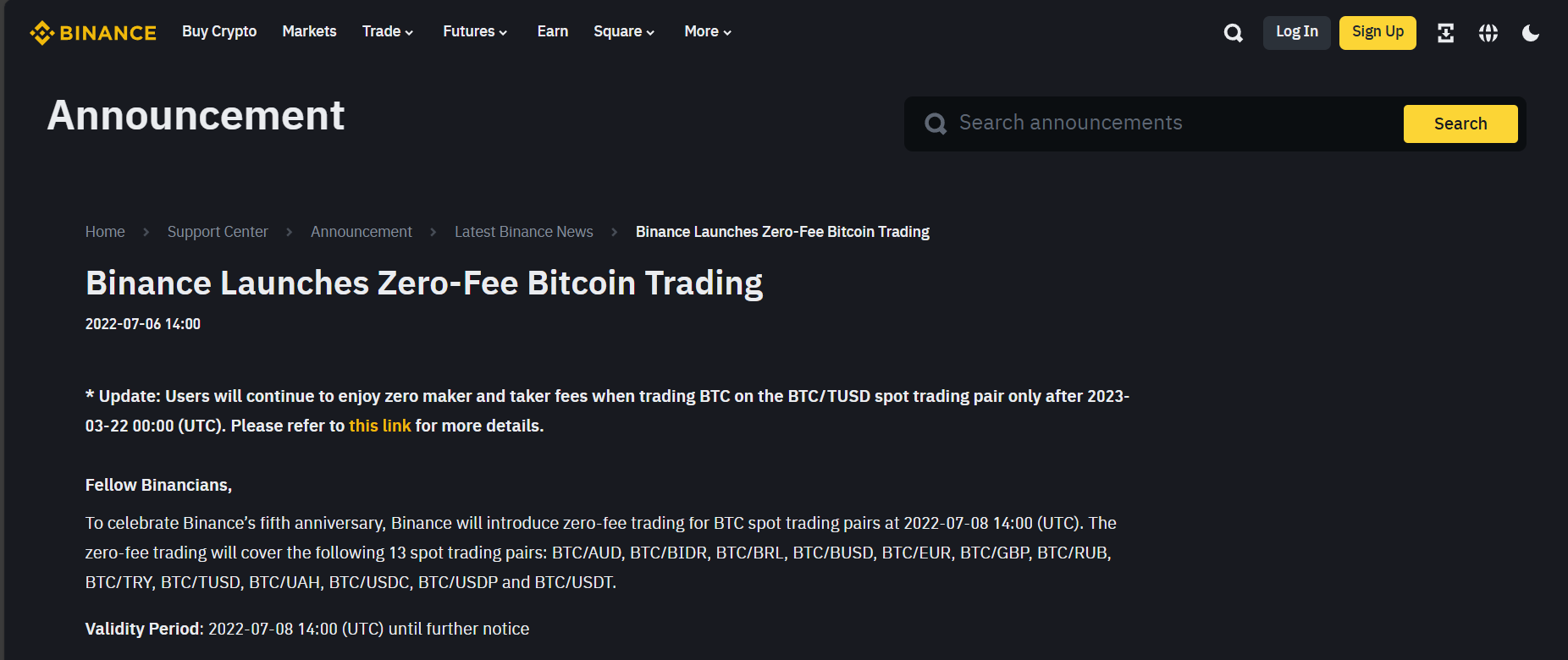

- Various promotions from exchanges

- Finding brokers of the desired exchange with better conditions (mainly for Binance)

Here’s an example:

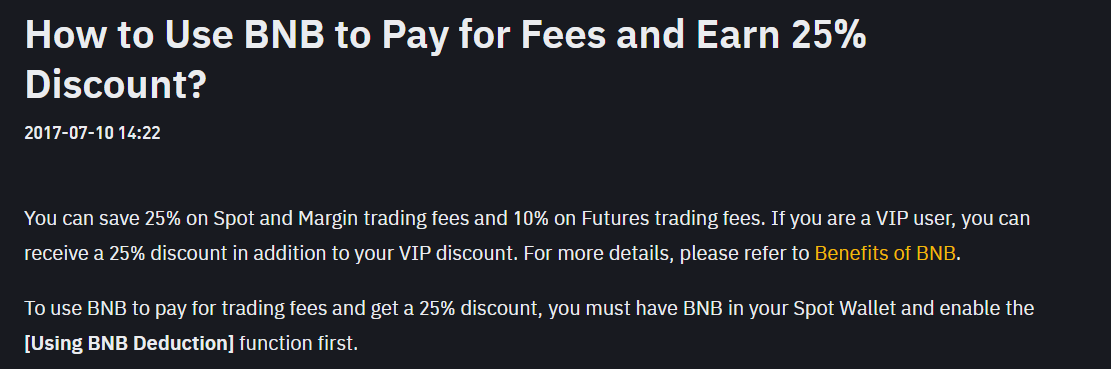

You found an arbitrage opportunity between Binance and Bybit on ETH/BTC. Bybit has a 0% spot fee due to a promotion, while Binance has a 0.1% fee. You can reduce the fee on Binance by 20% using BNB, which brings it down to 0.08%. You can get a 20% cashback on Binance for registering with a referral link, reducing the fee to 0.064%.

Additionally, you can obtain VIP status on Binance for volume. If you trade $3-5 million in a month, you get a base fee of 0.06% for takers. Then reduce it by 20% using BNB, and after the 20% cashback from the referral system, the fee is 0.0384%.

If you make $1,000,000 in volume on this pair, instead of paying $1000, you pay $384, saving $616. Some students achieve this volume in a month with a capital of $3000.

Further research led you to find a Binance broker, the exchange Pexpay, which currently has a promotion with a 0% spot fee on all pairs. As a result, we can arbitrage between Pexpay and Bybit with a 0% fee, allowing us to take rounds even with a 0.1-0.2% profit, which we would have previously skipped due to fee costs, and there will be many such deals per day.

Thoroughly study the exchanges you work with. Learn their discount systems and find ways to minimize your fees as much as possible.

Beginners usually ignore this, thinking it’s a small matter. If the fee per round was $1 and becomes $0.6, the $0.4 saved doesn’t seem like much. But if you do 1000 rounds in a month, or maybe in a few days with good volatility, those $0.4 per round turn into $400. Over time, these efforts to optimize exchanges pay off significantly! Over a year, saving a few hundredths of a percent per round can result in thousands of dollars in missed profit, or even more, because you could have done 20% more rounds by cutting these costs.

How to save on fees in DEX

There are very few clear and understandable ways here, as DeFi is still developing and different solutions are constantly emerging. The simplest and most understandable example is various aggregators, the most famous for DEX being the 1inch liquidity aggregator.

The essence of such aggregators is to provide access to a large number of others through one site. Through 1inch, you use 100+ DEX exchanges at once, and through the Rubic cross-chain aggregator, for example, you use 20-30 cross-chains.

Such aggregators automatically find different ways to save on each transaction.

Since most will use regular swap platforms, let’s look at how to save using 1inch as an example.

1. 1inch offers cashback from 5% to 95% in 1inch tokens from your gas payment in the ERC20 network for swaps through 1inch.

Considering that the swap fee there is $5-100, this is a significant saving. Some of my students arbitraged using the cashback feature, making break-even trades considering the fee, and profiting from the cashback in 1inch tokens. This scheme worked well for them during the bull run when the swap fee in the Ethereum network was $50-80.

They worked approximately according to this scheme, as shown in the screenshots. They sold ETH at 1333, bought at 1332, the swap fee here is ~ $5. With 1 ETH, the profit is $1, and from the $5 fee, they get $4.75 cashback in 1inch tokens.

During the last bull run, they made a good profit from this strategy, but unfortunately, they didn’t save any screenshots.

2. Optimizing gas prices and transaction paths can often save a lot. You can choose a gas price, and the service will select an even better price. This feature works much worse on DEX, and this can be clearly seen.

3. Reducing slippage by distributing trades across different liquidity providers.

If you sell 10k ETH directly through Uniswap, it will be a trade with only Uniswap’s liquidity and only in the selected pair. But if you use 1inch, it will automatically execute several trades with different liquidity pools, which helps significantly reduce slippage.

Here’s what the path of such a transaction looks like through 1inch when different liquidity providers are used.

This feature works well for large volume swaps, for coins available on multiple DEXs, not just one. “Large volume” can even be $100 if the project’s market cap is $50,000, for example.

You can sell a coin worth $1000 and get a price 5-7% higher than selling the same volume through a CEX, and 1-3% higher than selling through just one DEX. The only downside is the increased fee due to the number of swaps in such a transaction, but the benefit usually outweighs the fee by several times.

4. Fusion function – something like a delayed order that will be executed within 10 minutes, and you don’t pay any swap fee. The fee is covered by 1inch market makers who earn from arbitrage. There will be information in the cases on how this works and how to become such a market maker (resolver) and earn from this 1inch feature.

Overall, this function is very similar to OTC; you place an “order” and wait for it to be filled, but the “order” has a floating price within a certain range, so it may close not at the market rate but at a slight loss. If the trade volume is small, this loss may still be more profitable than paying the fee yourself. This will be especially noticeable during a bull run when the swap fee increases tenfold.

Another way to save when working in DeFi is to set the fee yourself.

On DEXs, this can be done through the exchange’s interface, but many miss the fact that you can save on coin transfers. If you deposit crypto from your wallet to the exchange, especially in an expensive network, you can check the gas price on scanners and set the minimum. The transaction will take longer, but the transaction cost will be 20-30% lower than the one set automatically by the wallet. However, don’t set it below the minimum price, or the transaction may get stuck for a very long time.

You can check the gas price on sites like Etherscan - https://etherscan.io/gastracker (for the ERC20 network).

And here’s a tip – at night, network load decreases and gas prices drop. Gas prices are affected by network load, so if the gas price is very high for you, check the weekly price chart; it might be just one super high price due to the launch of a popular NFT collection causing “gas wars.” You can wait out such moments and avoid extra costs.

During “gas wars,” everyone stops swapping abruptly, and there is a significant difference on DEX. You can wait for the gas price to drop and start arbitraging at that moment. This works with both ETH and BTC, even for volumes of 10-50 BTC per swap, especially if the gas price increase coincides with high market volatility.

I made a good profit with this method during the last bull run and didn’t publicize this trick much before this training.

The DEX+CEX combination works very well for many coins, especially if 90% of the coin’s trading volume is on a CEX exchange.

How to find commission discounts on Binance (suitable for any CEX)

This is done by searching through a search engine or by searching the commission section on the site, as well as tracking exchange news. All exchanges have a “fees” page where they list conditions and main discounts, as well as a promotions section where you can find information on how to make deals even more profitable.

Another way to find discounts is to write to the exchange’s support through a ticket (from the exchange’s website) or write in the exchange’s chat and ask the admins. You will get information faster in the chat, but it’s better to combine both methods, as chat admins are not always aware of all the information.

Here’s an example of how to search for commission discounts:

Enter the query:

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.