BLOCK Token Arbitrage 12% ROI Case Study

While you're thinking — others are already earning

with ArbitrageScanner!

with ArbitrageScanner!

Try ArbitrageScanner, find arbitrage opportunities and make profit. Buy a subscription now and get +30% bonus days for free!

In this case study, we will look at how you could make +12% on the BLOCK token using a spot + futures strategy

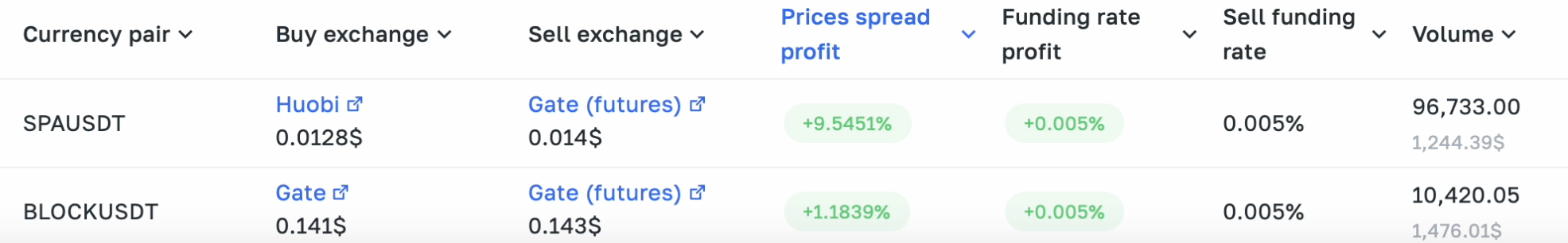

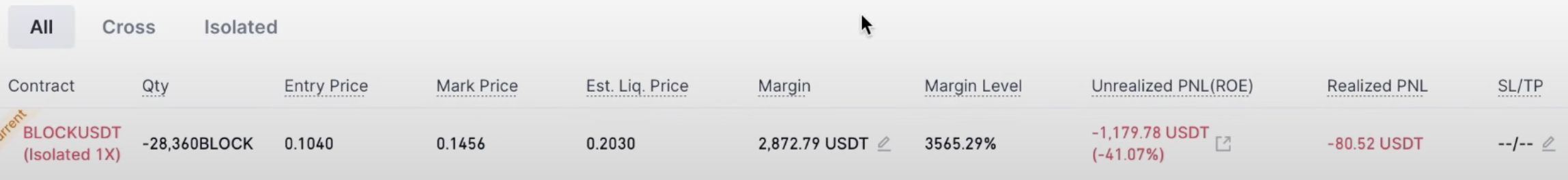

When the person entered into a trade when the difference between spot and futures was 12%. Thanks to our Futures Screener, we successfully caught the convergence and exit the trade.

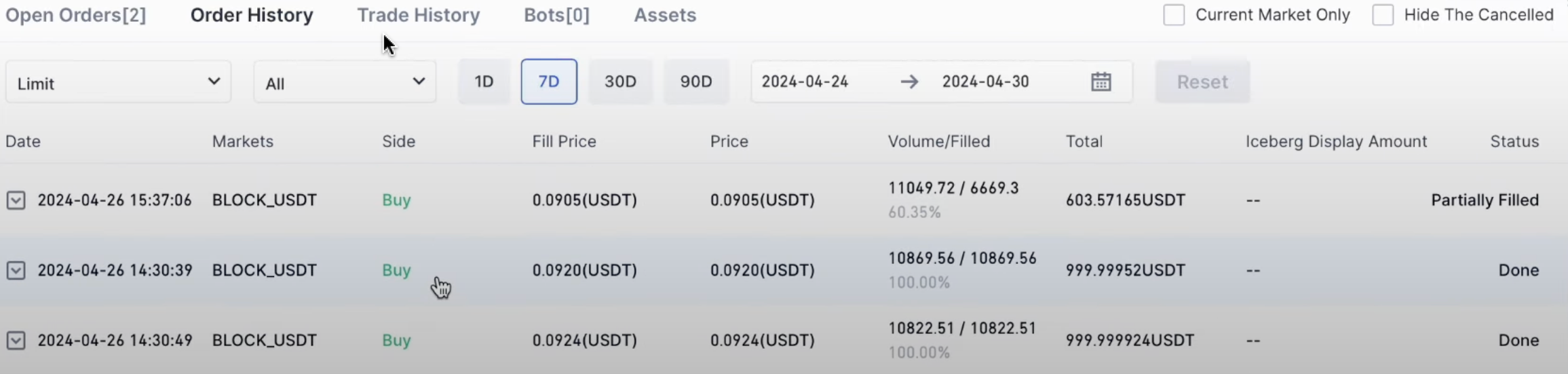

In fact, thanks to the correct entry into the trade through orders, we initially entered with a difference of 15%.

At the time of exit from the deal, the actual spread was around 3%.

0.145 : 0.141 = 1.028% => almost 3%. It follows that 15 - 3 = 12%

We caught a convergence of 12% + all this time for 5 days we received a funding rate every 4 hours.

We entered into a deal for approximately $3,000. 12% of 3000 is $360.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.