Opening and Closing Trades in Futures Markets

Opening and Closing Trades

When opening or closing a trade, we recommend not rushing—take a little more time and open the trade in parts, preferably in increments of 10%. For example, if you are arbitraging using the spot + futures strategy with a volume of 150 tokens, here’s how it should look in practice:

- If the 5/15-minute time frame suggests that the market is rising, first buy 15 tokens on spot.

- Open a short position for the same number of tokens.

- Repeat these steps until you have acquired the desired total amount of tokens.

- Always check that the number of tokens on spot matches the number of tokens in the short position.

(If the market were falling, you would first open a short position and then buy tokens on spot.)

This strategy is optimal because it protects you from sudden price spikes in either direction.

After opening a trade, we must wait for the prices to converge and then close the trade. It is not necessary to wait until the spot and futures prices are identical—you can close the trade even with a small spread. For example, if you entered with a 1% difference and now the spread is 0.1 - 0.2%, this is a good level to exit. If the spread was initially 10 - 20%, you can exit when the current spread is around 1 - 3%.

Tracking price convergence is very convenient using our screener. Simply add the token of interest to your whitelist and wait for a notification.

Once the price has converged, exit the trade in parts as well. Close a portion on spot, a portion on futures, and repeat this process several times.

Closing a Trade

Let’s consider closing a trade using the futures + futures strategy:

We have a long position open on HTX and a short position on Gate.

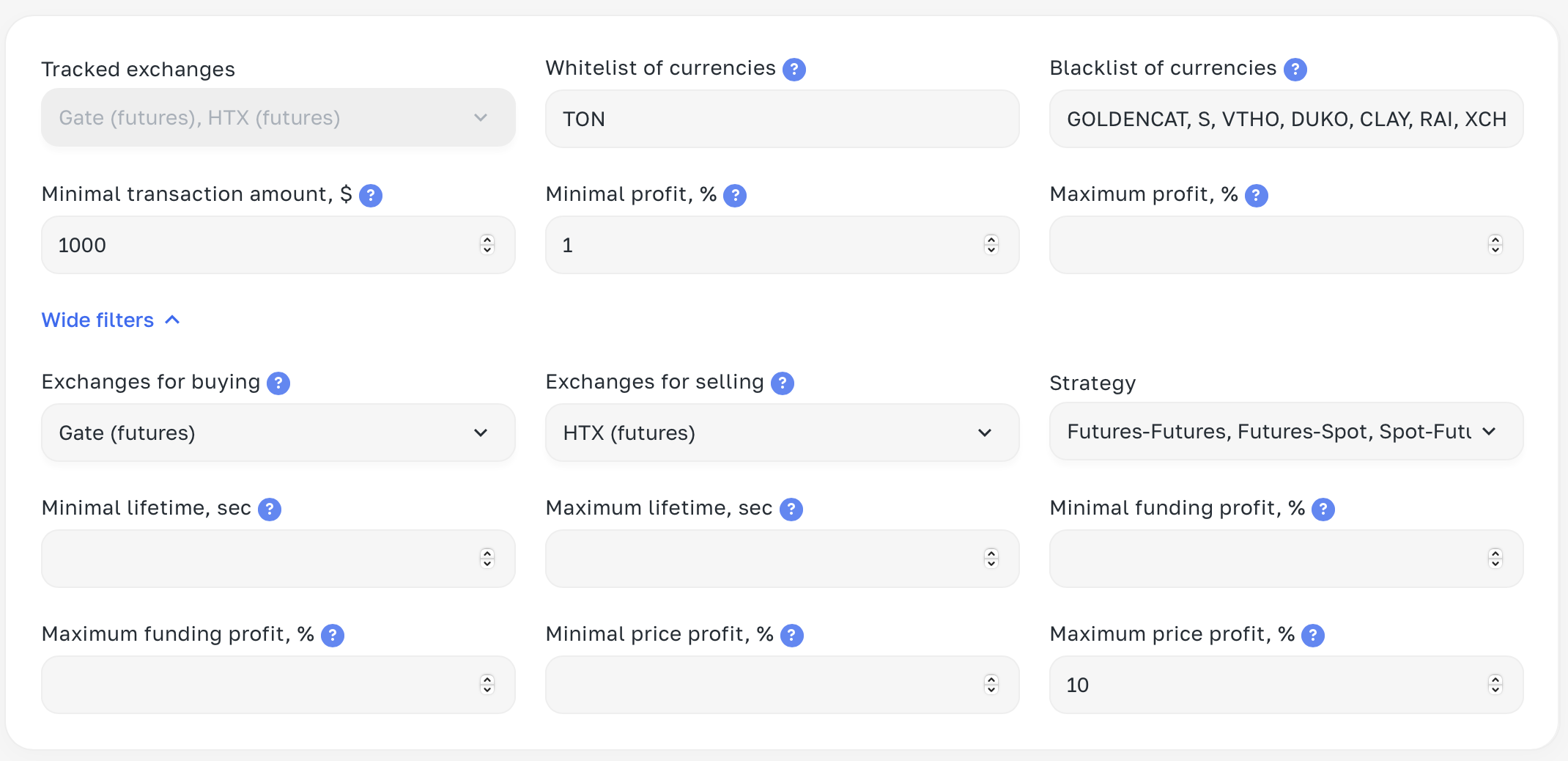

Right now, things are looking great because the price is higher on the exchange where we have a long position, making it profitable to exit the trade. We originally entered under the opposite conditions. To catch such a favorable situation, we set up the necessary parameters in the futures screener:

a) Added the token of interest to the whitelist.

b) Set up conditions: buy on Gate, sell on HTX (we initially entered the trade in the reverse order).

We exit the trade in parts. If we have a total of 16 TON, we place an order for 2 tokens.

We place the same-sized order on the other exchange.

By using small orders, we gradually exit the trade on each exchange.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.