Analysis of 3 Different Trade Entries with Key Nuances

10/04/2024

While you're thinking — others are already earning

with ArbitrageScanner!

with ArbitrageScanner!

Try ArbitrageScanner, find arbitrage opportunities and make profit. Buy a subscription now and get +30% bonus days for free!

We have prepared each lesson in both text and video formats

In this lesson, I will demonstrate the opening of three trades using the Spot + Futures strategy.

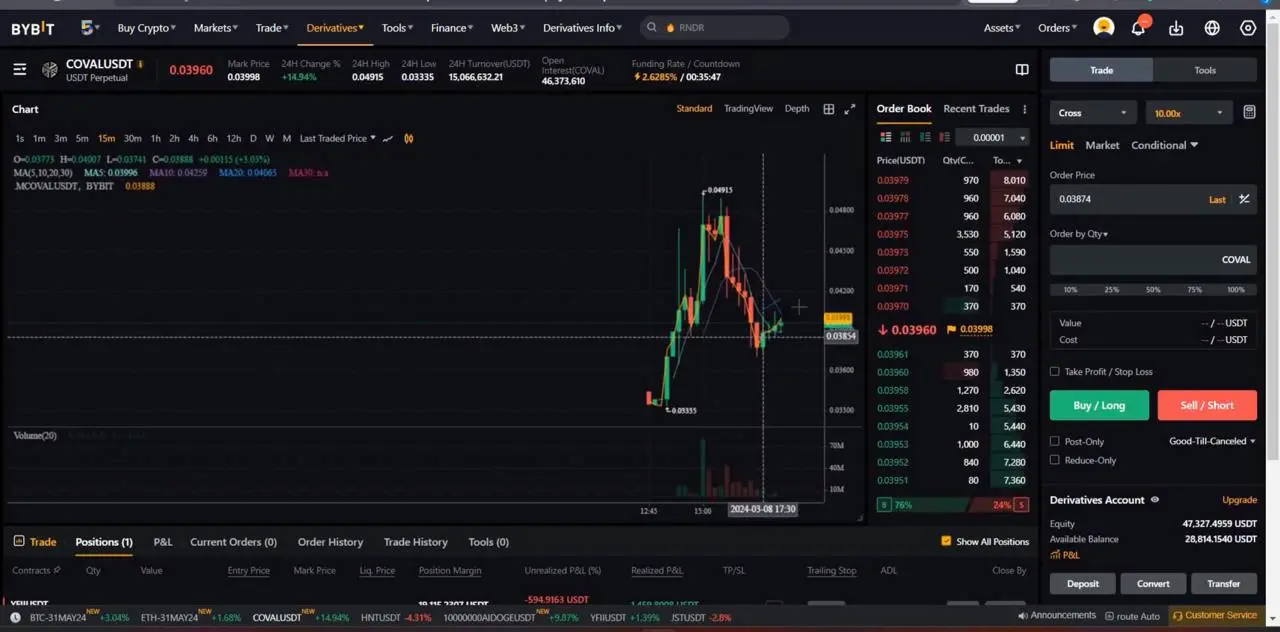

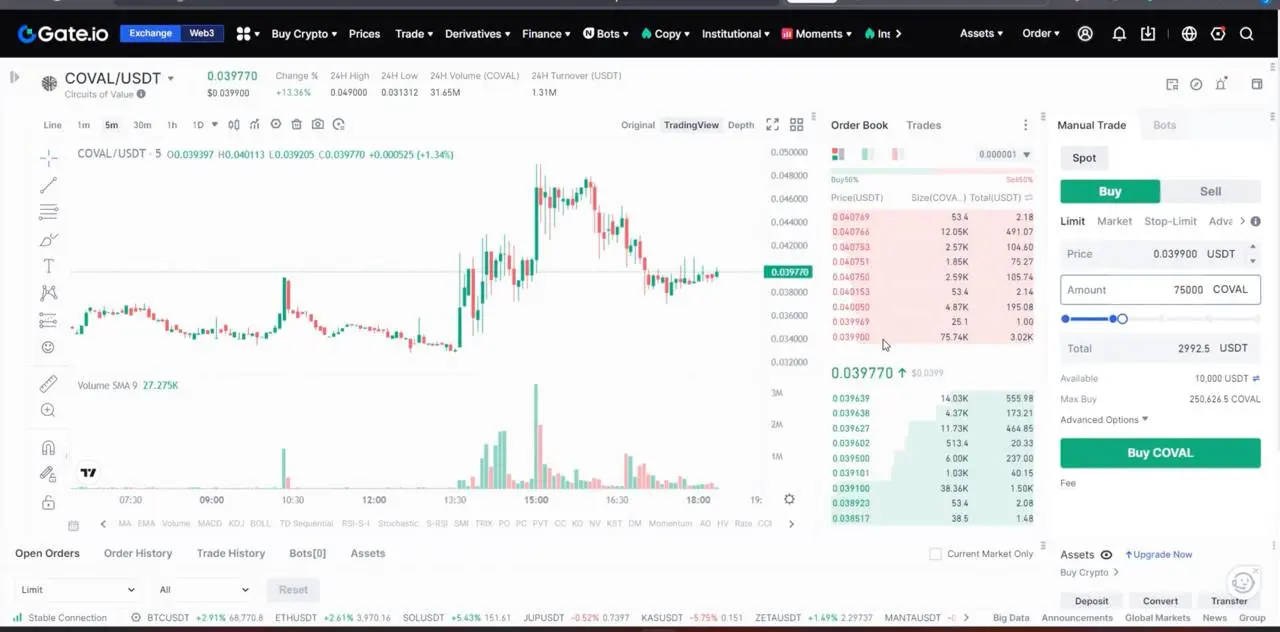

- Opening a trade on COVAL

The arbitrage is between the spot market on Gate and futures on Bybit. I plan to enter the trade with a total of $20,000, which means $10,000 on each exchange.

The Spot + Futures strategy implies buying on the spot market and opening a short position in futures.

In this trade, the primary goal is to earn from the high funding rate, while also trying to capture a price spread if possible.

The full version of the article is available only to users with subscriptions. Click the button and select the appropriate subscription to have access to all useful articles.