XT Exchange Risk Analysis Case Study

with ArbitrageScanner!

We have prepared each lesson in both text and video formats.

In this lesson, we will cover 2 cases.

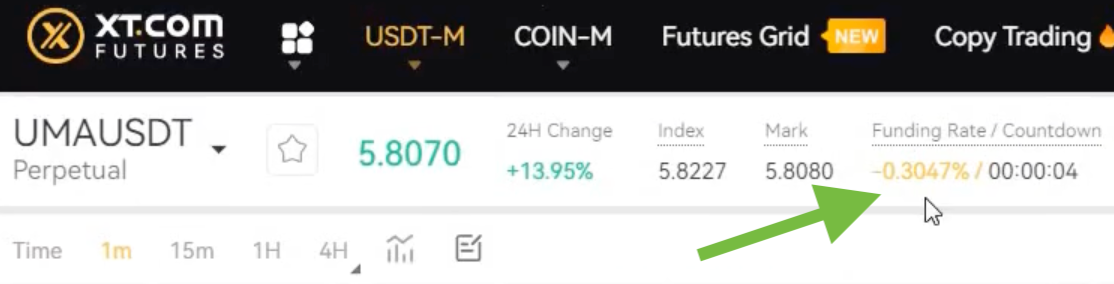

The first case we will examine involves the UMA coin.

The essence of the case is that we entered the trade at price parity and aimed to profit from the difference in funding rates.

On Bybit, we went long, and on HTX, we went short. On Bybit, we earned 0.52%, and on HTX, we paid 0.3%, resulting in a net yield of 0.22%. We used 3x leverage to increase the funding accrual threefold, giving us a total profit of 0.66%.

However, the most interesting aspect lies elsewhere. On the HTX exchange, we entered the position one hour before the funding was credited. The funding rate was not -0.3%, but +0.2%. Based on our calculations, we expected to earn (0.52 + 0.2) x 3 = 2.16%. But HTX swiftly changed the funding rate, leaving us glad that we earned something at all. Take note of this scenario and keep in mind that such situations sometimes occur.

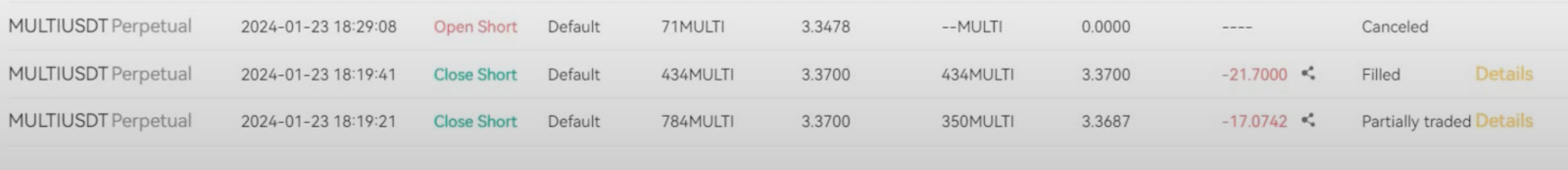

The second case we want to show is with the MULTI coin.

Initially, this trade was planned as funding arbitrage, but we managed to catch a profitable price convergence.

When the trade was opened, the price spread was 4%, and later the difference turned into -1%. Thus, we easily earned 3% just by seeing a notification from the screener.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.