Setting Stop-Loss and Take-Profit in Arbitrage Strategies

with ArbitrageScanner!

We have prepared each lesson in both text and video formats.

In this lesson, we will cover stop-loss and take-profit—key exchange options that allow you to optimize arbitrage by providing better risk management and minimizing the chances of liquidation.

You can set these parameters either when opening a position or in an already open trade.

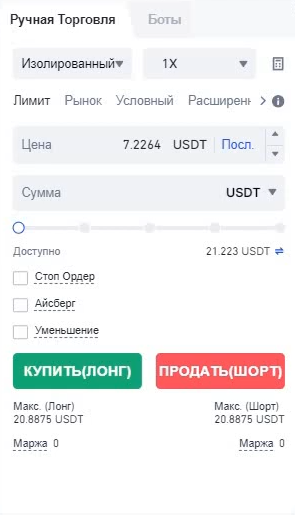

- When opening a trade:

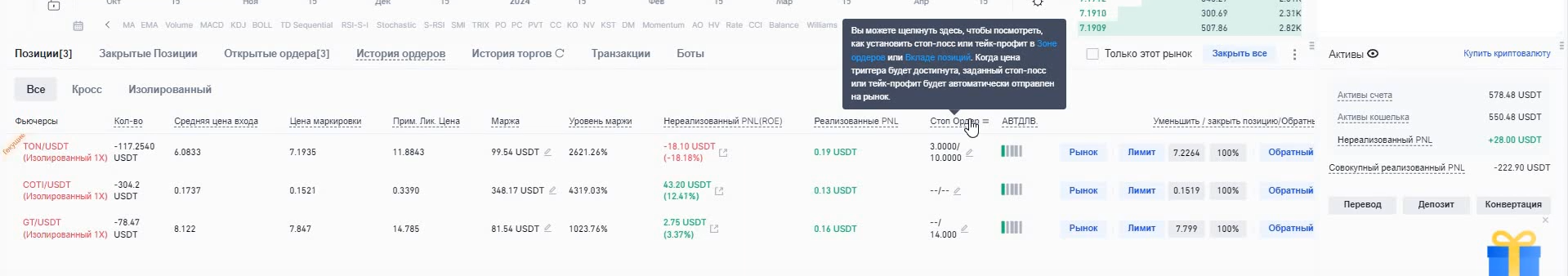

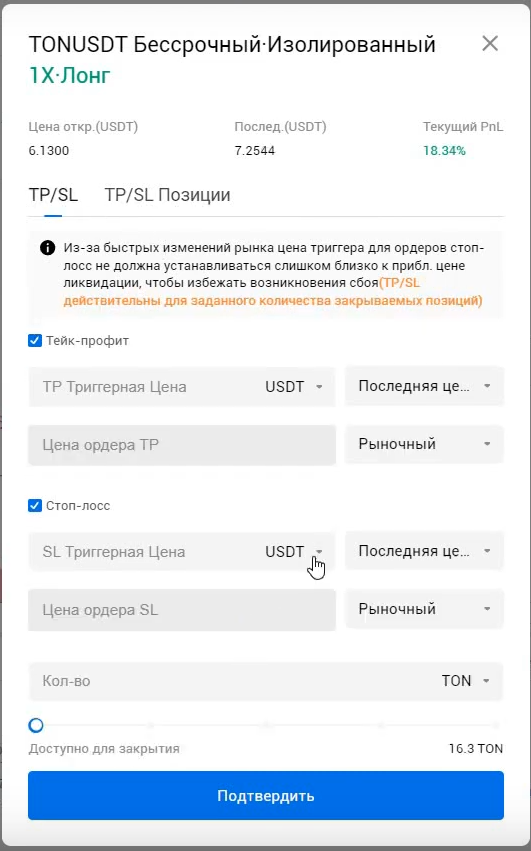

- In an open trade:

Different exchanges may have slight variations. For example, here’s how it works on Gate:

So, what exactly are stop-loss and take-profit? These are pending orders that close a position when the asset reaches a specific price.

- Stop-loss (from "stop loss") prevents excessive losses.

- Take-profit (from "take profit") locks in profits.

Let’s break it down with an example:

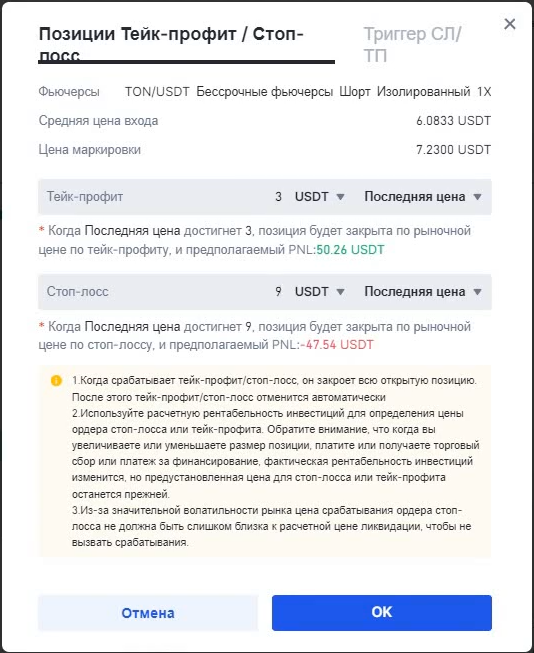

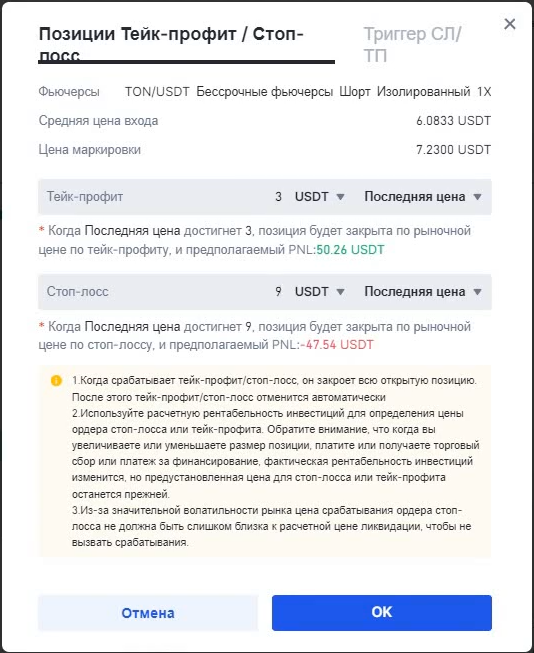

We have an open short position on the TON token, with stop orders set at $3 and $10. The trade will automatically close when one of these price levels is reached.

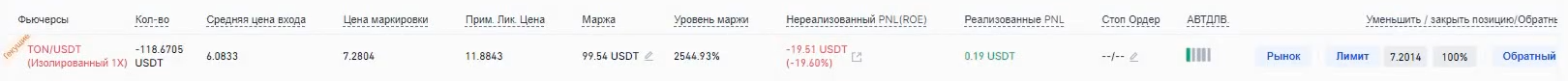

We entered the trade at $6.08, with a liquidation price at $11.88. To avoid liquidation, we set a stop-loss. We also calculated that $3 is the price level at which we want to secure our profit, so we set a take-profit at that level.

Using these parameters is crucial in arbitrage. A sudden price spike up or down could liquidate your futures position, and then the price might reverse—leaving you with losses that the spot price won't cover.

Practical Example

Let’s analyze a real trade:

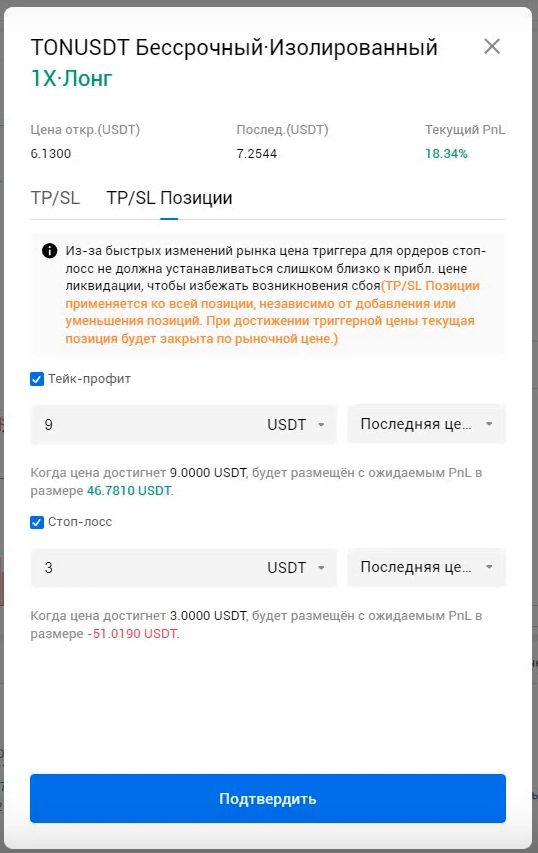

- We entered an arbitrage trade using the futures-futures strategy.

- A long position is open on HTX, and a short position on Gate.

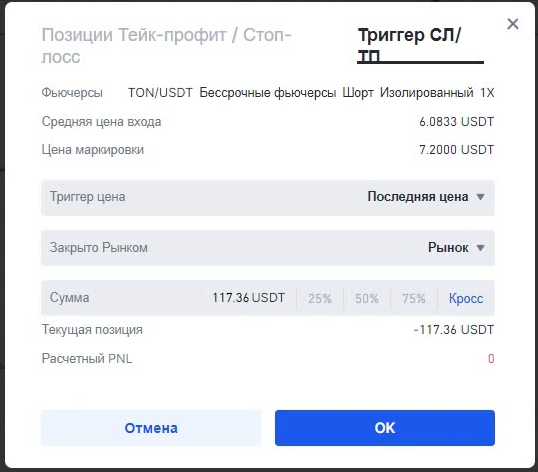

Here’s what a basic setup looks like:

With this setup, the stop order closes the position at market price, meaning it executes based on the available liquidity in the order book. If you're trading with large capital or on a low-liquidity exchange, this may result in additional losses.

For large capital, it’s better to use more advanced parameters.

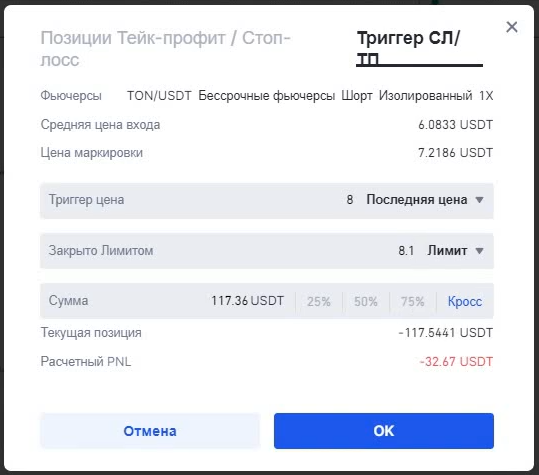

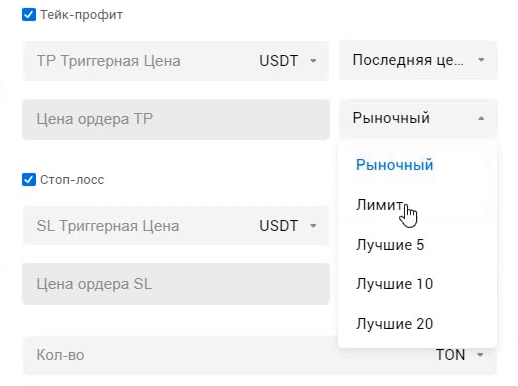

Instead of a simple stop order, you can use a limit-like stop order, where different stop-loss/take-profit levels are set for different trade volumes. This provides better risk management.

Trigger Price

The trigger price is the price level that activates an order.

For example, if the asset reaches $8, two possible scenarios can occur:

- Market execution – the position closes at the current market price.

- Limit execution – the position closes at a predefined price.

This flexibility allows you to ladder orders, closing the trade in small portions—especially useful for high-volume trades.

To set a limit price, select "Market", and then "Limit" will appear.

Of course, it’s best not to rely on stop-losses too often. To avoid this:

- Avoid highly volatile tokens.

- Do not use high leverage.

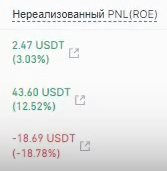

Pay attention to unrealized PNL—if it reaches 50-60%, it’s safer to close and reopen the trade.

Setting Stop-Loss and Take-Profit

- On Gate, we have a short position.

- On HTX, we have a long position.

On the second exchange, we set the opposite values.

Some exchanges offer additional features for stop-loss execution.

For example, on HTX, you can close a trade using the top 5/10/20 best prices from the order book.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.