How to find coins for long-term funding arbitrage

How to find long-term funding?

I prefer to do this on the Lbank or MEXC exchanges (with MEXC, the strategy is slightly different—I’ll talk about it a bit later).

What is long-term funding?

By this, I mean funding that has 3-4 or more payouts.

How to find it?

It’s simple. Let’s break it down step by step:

-

Use the funding table

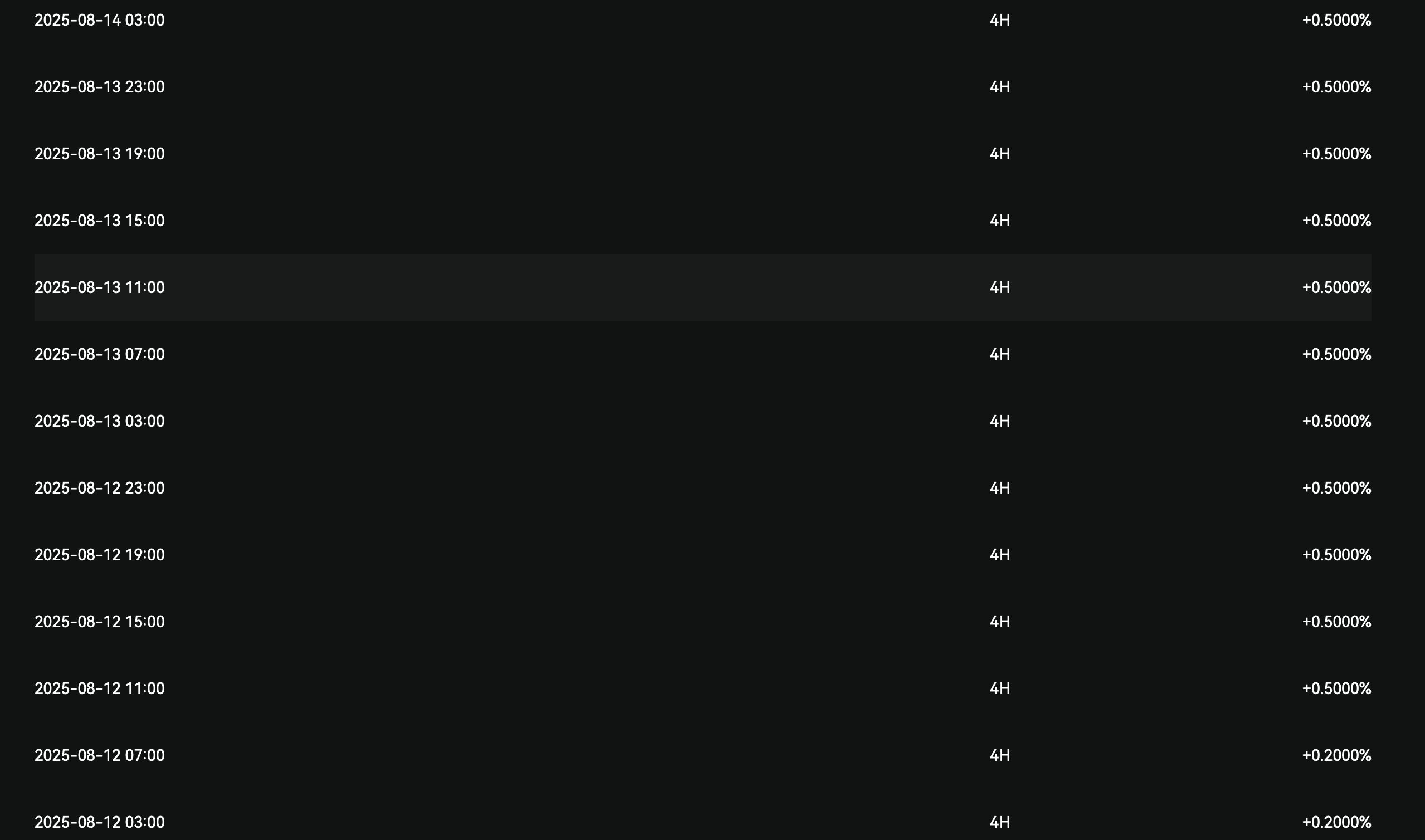

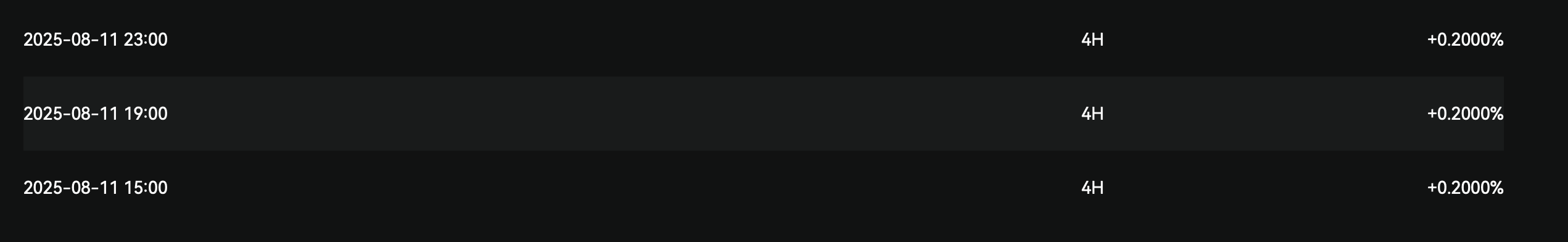

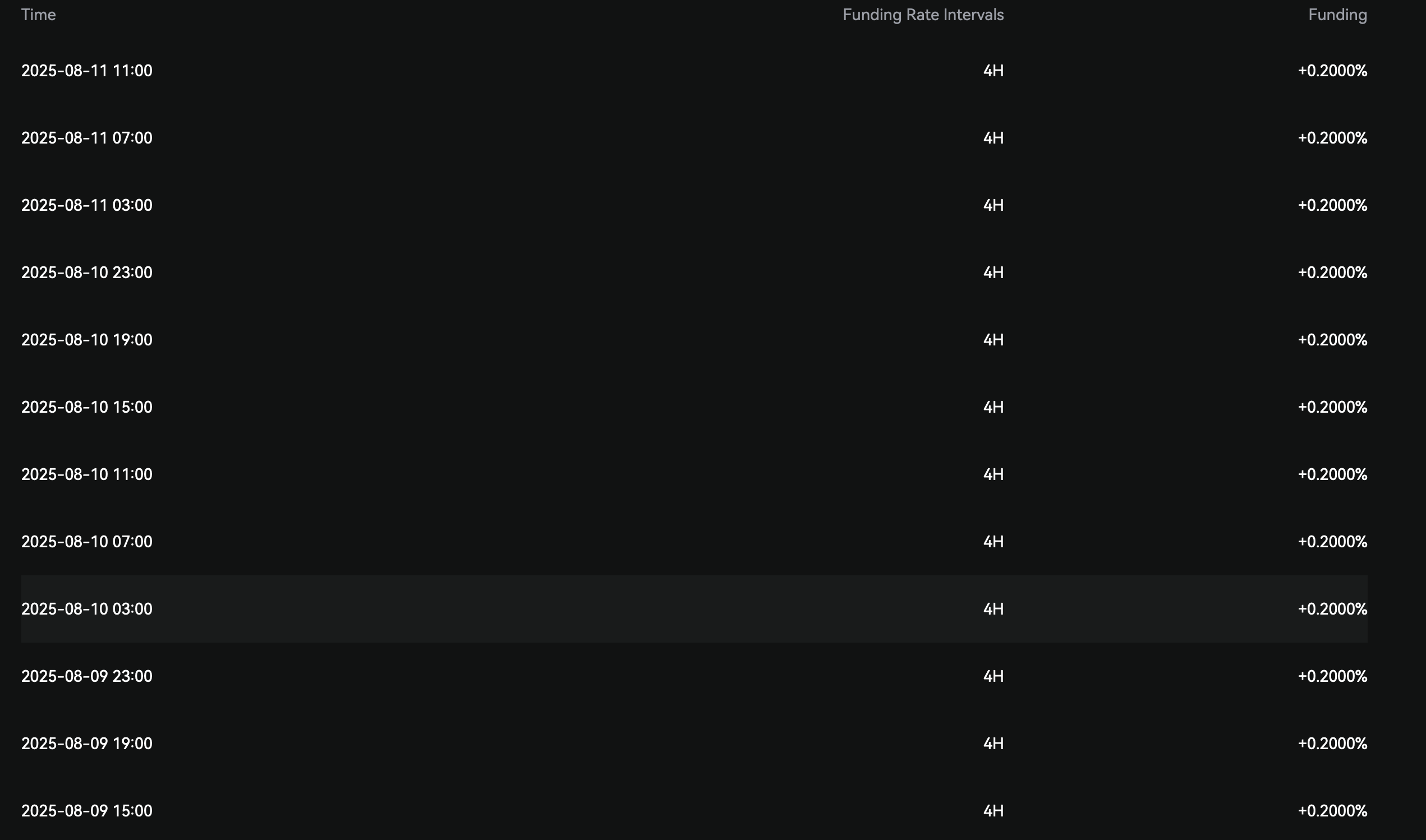

I often use the general funding table, just scrolling through all the coins one by one and looking for funding (in the Lbank column) with equal percentages, e.g., 0.2/0.5/0.3, etc. (BUT IT DOESN’T NECESSARILY HAVE TO BE AN EXACT NUMBER—SOMETIMES FUNDING JUMPS AROUND LIKE 0.34/0.42/0.28 BUT STAYS NEGATIVE). -

Check the funding payout history

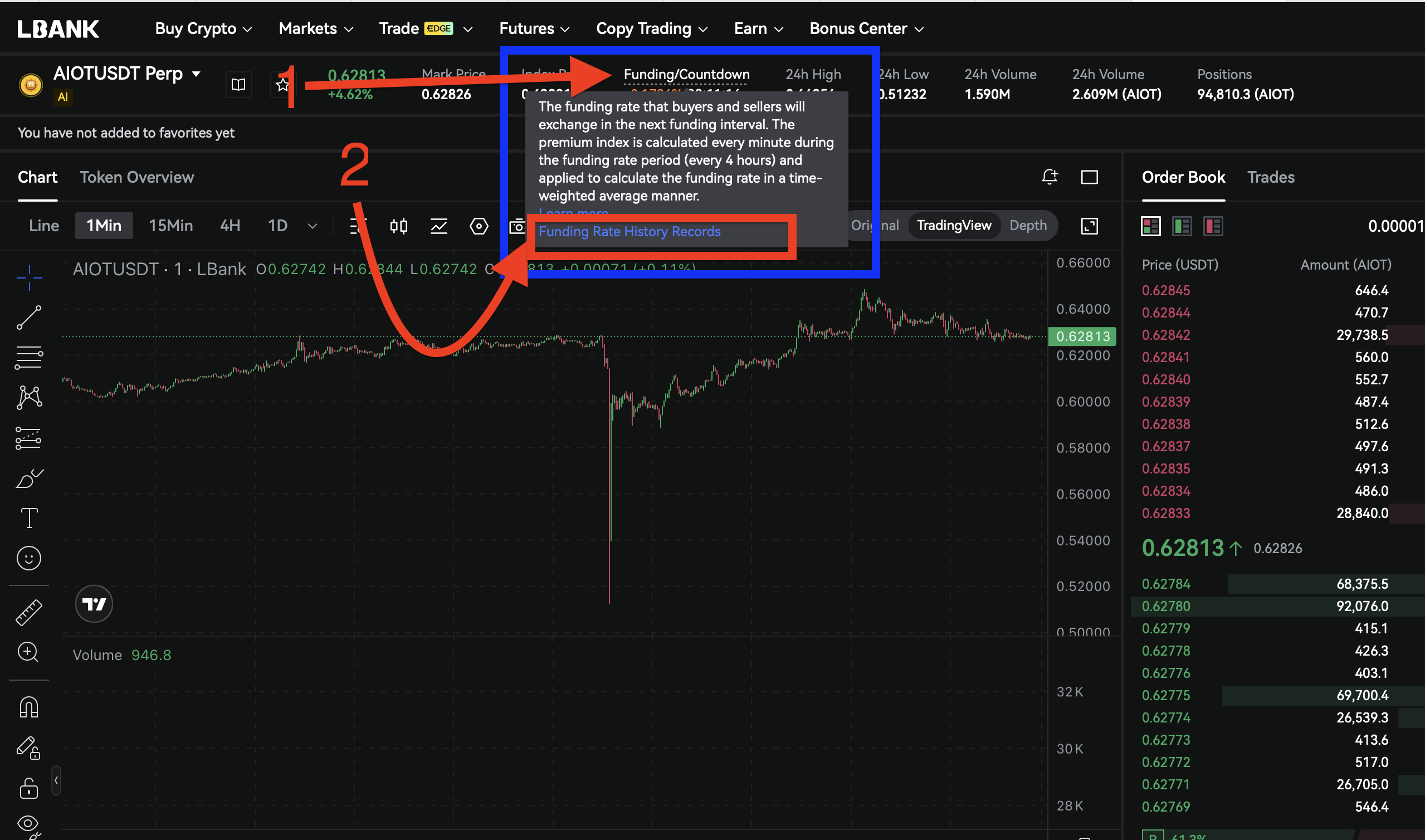

I go into the coin and check the payout history.

This is done here:

[Button: Funding Rate History Records]

If I see that the funding has been consistent for at least 2-3 payouts, then I check the price spread (the difference between prices).

Ideally, I’d enter with a spread in my favor or when the price is completely equal (but sometimes, it’s okay to enter with a small unfavorable spread that can be recovered in 1-2 payouts).

After entering such a trade, either set up Telegram notifications for funding changes or just periodically check the exchange manually.

A practical example

Recently, the coin LetsBonk was discussed in the chat:

Period: 2025-08-08 11:00 – 2025-08-14 03:00

It was possible to earn 10.3% with 1x leverage (the hedge was on the XT exchange).

It’s simpler than it seems. The key is not to be afraid to try—even on paper (if you want, I can tell you how I started arbitraging on paper—DM me @demianscanner) or with $3-5-10, but try!!! It’s much easier to learn in practice than in theory.

Bonus

Pay attention to LABUBU on the Lbank exchange and its payout history.

(Not financial advice, always think for yourself—Lbank may suddenly change the conditions.)

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.