WAVES Token Entry Strategy with Positive Funding

with ArbitrageScanner!

We have prepared each lesson in both text and video formats.

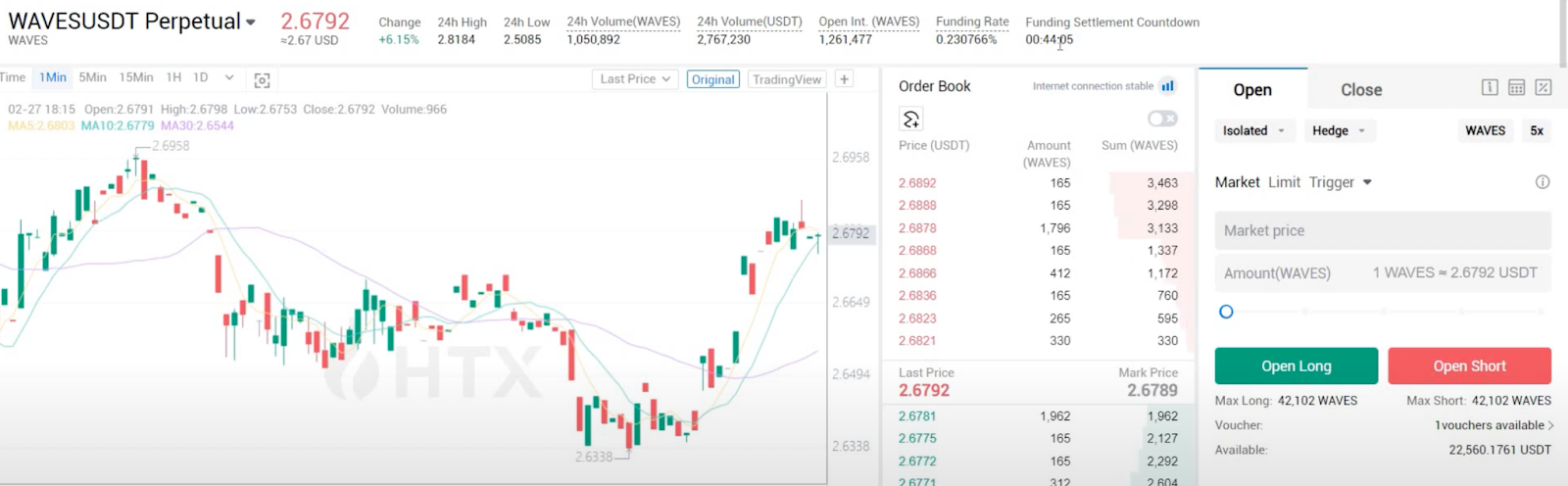

Thanks to our screener, we noticed a positive funding rate of 0.23% for the WAVES coin on the HTX exchange. We decided to use the spot + futures strategy by entering a spot position and a short position in futures to profit from the funding rate.

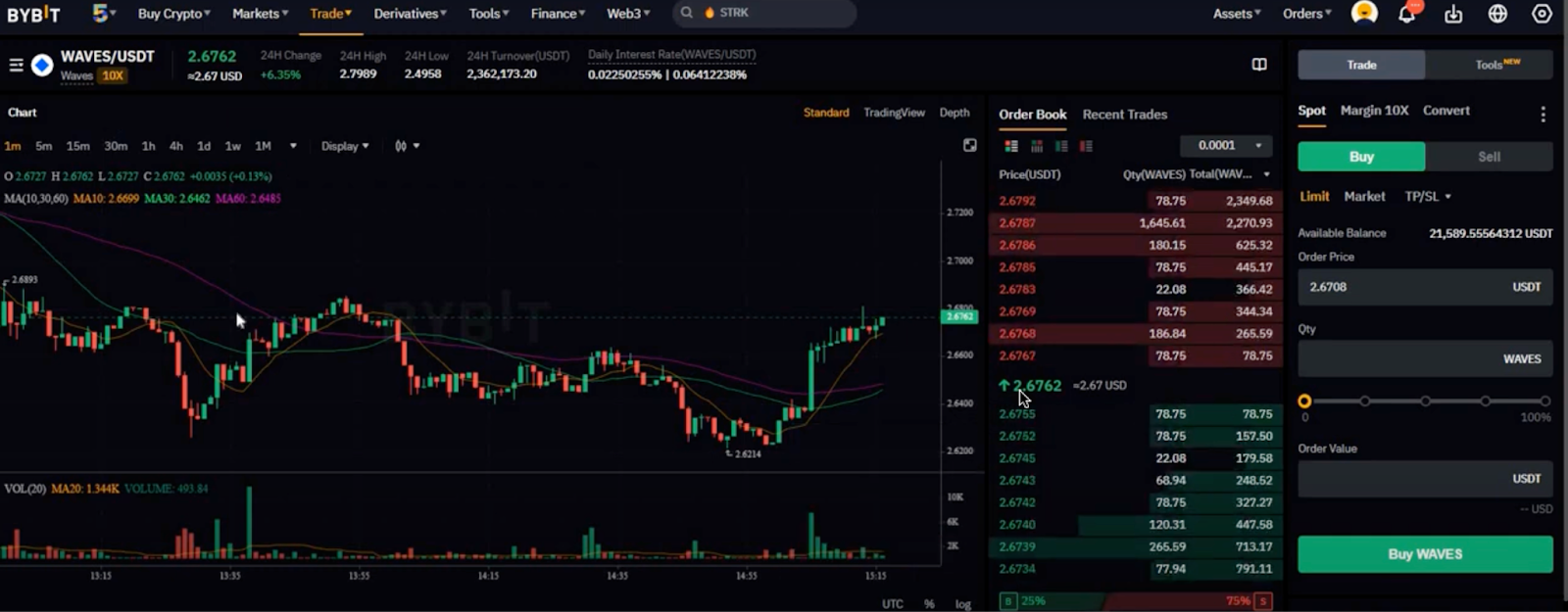

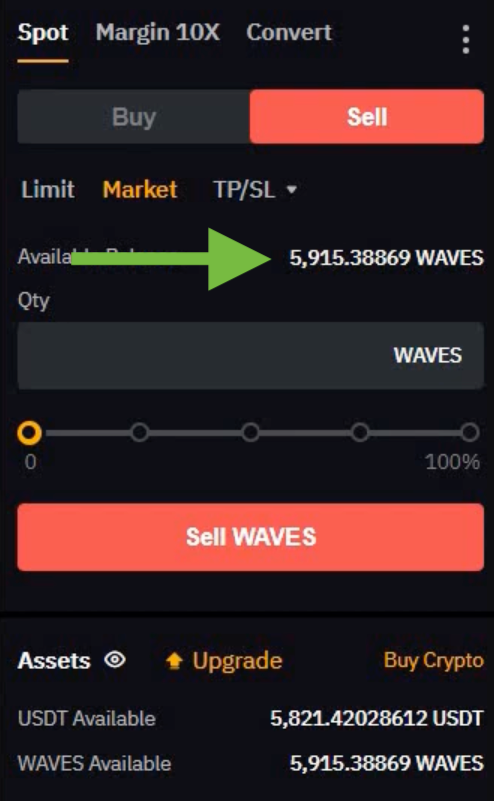

We chose to buy the coins on the spot market at Bybit due to good liquidity and a relatively small spread of about 0.4%.

I have been monitoring the feasibility of this trade and know that it’s possible to capture a spread of over 0.5%. I will attempt to achieve this.

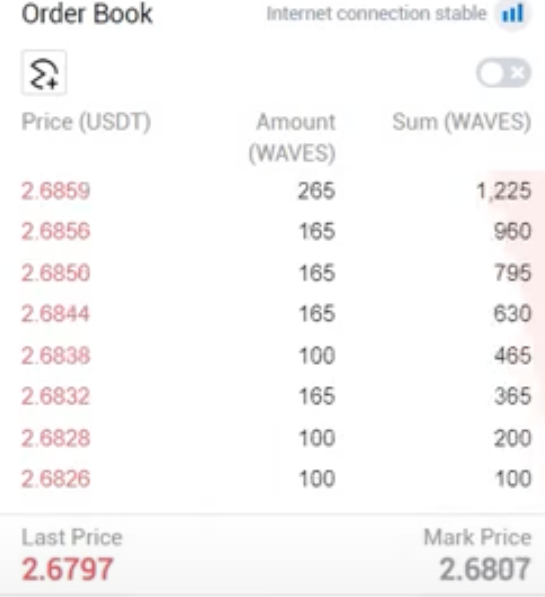

Each exchange offers good liquidity, but I don’t like that on HTX, there are many orders set at 100/165, which are orders placed by bots/market makers.

This makes it challenging to enter a large volume. If I place an order at this price, the likelihood of it being filled is low. Therefore, on HTX, I will be buying directly from the order book rather than through limit orders.

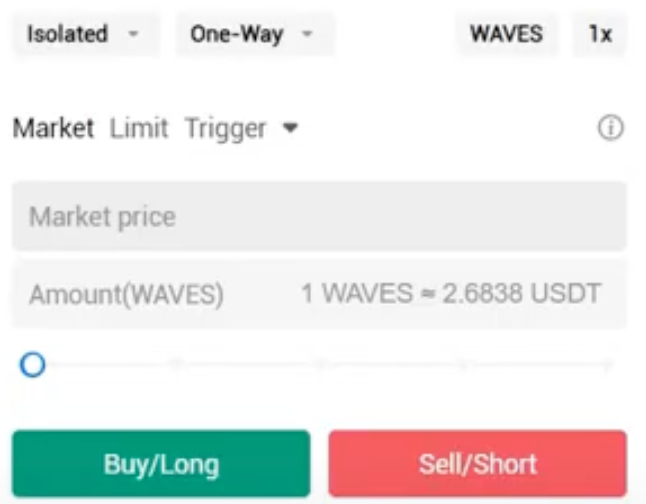

The first step is setting up and checking the settings: isolated margin mode and 1x leverage.

I use 1x leverage because I don't want to risk sudden price spikes. Sure, 10x leverage would increase funding gains tenfold (from 0.22% to 2.2%), but if the funding rate flips, it could cause problems.

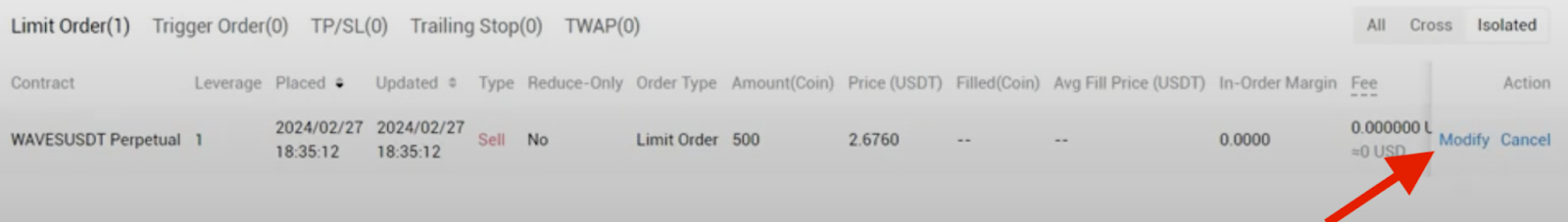

Another very useful feature is the ability to edit the purchase price of an already placed order.

As we have often mentioned in our lessons and cases, it is highly advisable to enter futures trades 2-4 hours before the funding rate accrues. This is because, 15 minutes before funding is credited, long position holders (when the rate is positive) will start closing their trades to avoid paying the funding fee, which in turn will affect the price, causing it to drop.

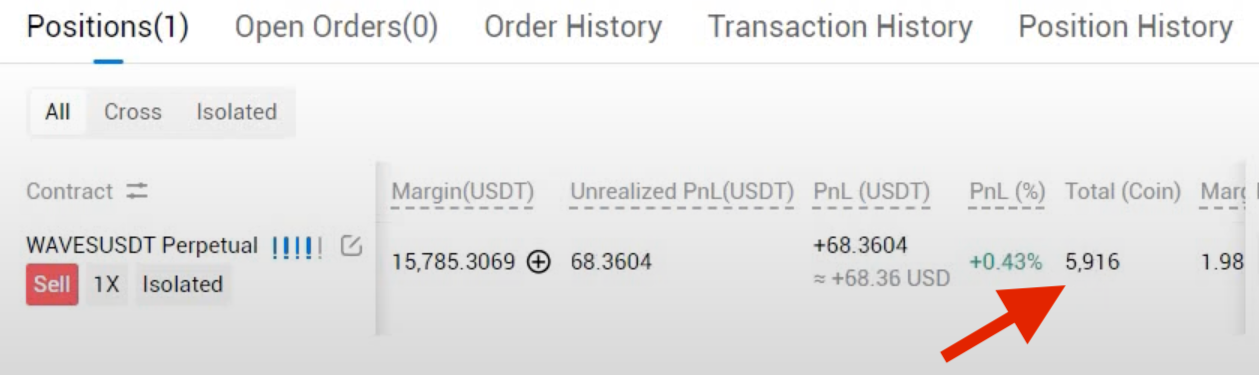

We buy the coins on the spot and enter a short position, then verify the quantities on both exchanges.

The number of tokens matches, so now we just receive the funding rate, wait for prices to converge, and close the trade.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.