How to Properly Close Arbitrage Trades

with ArbitrageScanner!

We have prepared each lesson in both text and video formats.

We believe that it’s important not only to open trades correctly but also to exit them wisely.

In this lesson, we will explore different theoretical approaches to closing trades and demonstrate the correct way to do it using real examples.

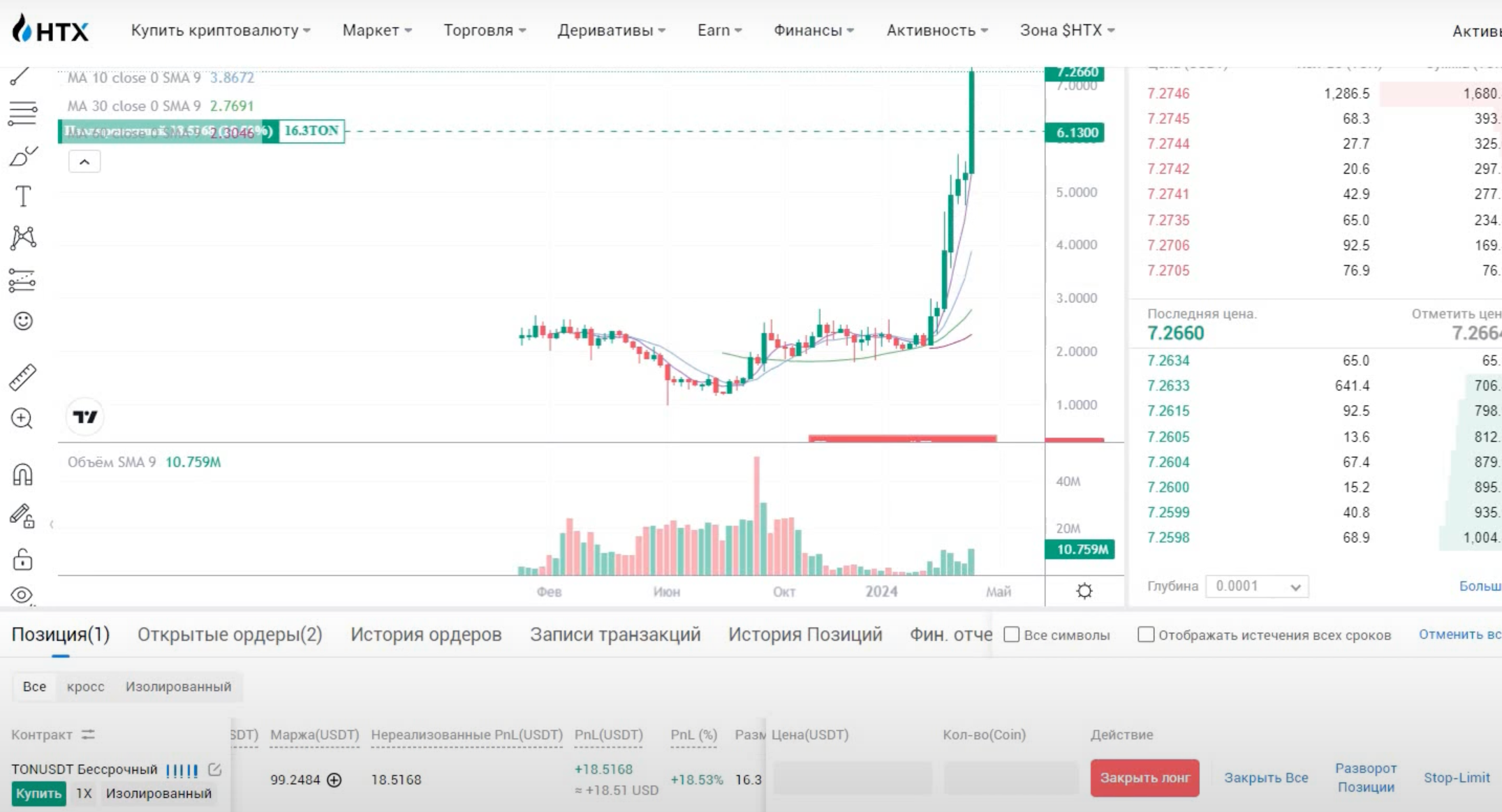

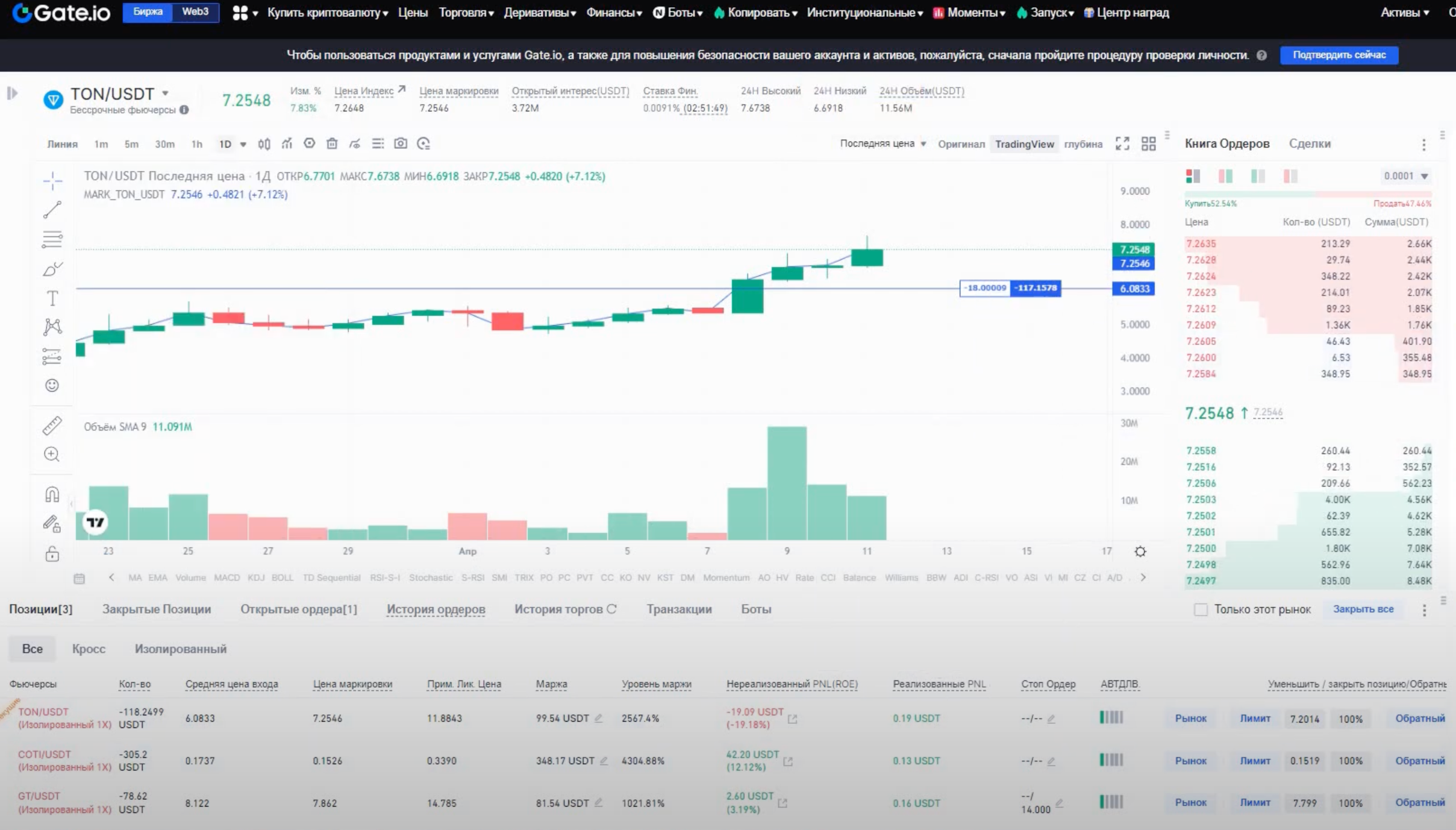

TON Example

- On HTX, we have a long position.

- On Gate, we have a short position.

Right now, the market situation is favorable because the price is higher on the exchange where we have a long position, making it profitable to close the trade. Initially, we entered the trade under the opposite conditions.

To identify such profitable opportunities, we used a futures screener with the following parameters:

a) Added the desired token to the whitelist.

b) Set buy on Gate and sell on HTX (we originally entered the trade in reverse).

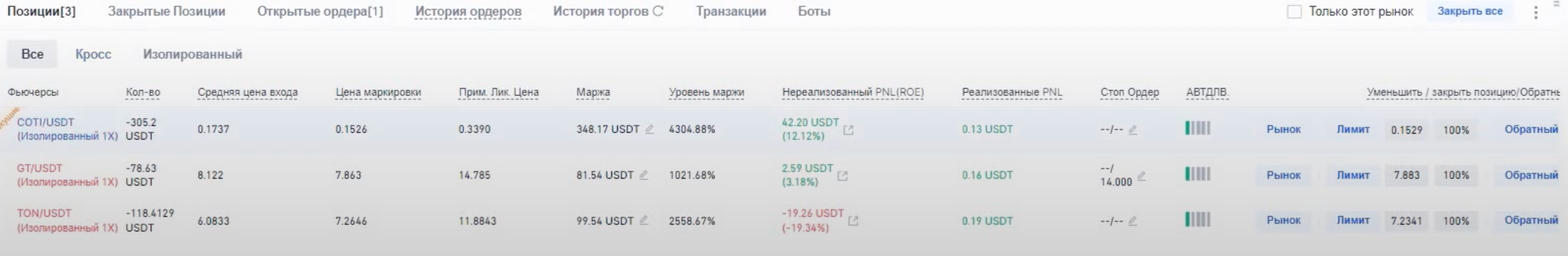

COTI Example

- On HTX, we hold spot coins.

- On Gate, we have a short position.

When we entered the trade, the futures price was higher than the spot price. To exit profitably, we now need the opposite condition. So, we return to the screener and adjust our settings accordingly.

GT Example

Let’s say we have:

- A short position on Gate.

- Spot holdings on HTX.

The problem with this trade is that the order book on HTX is illiquid—trades occur infrequently and in small volumes. Also, if you check the order volume, it’s likely that a trading bot is artificially generating trade activity.

Such illiquid tokens are not ideal for arbitrage, but if you still choose to trade them, consider these options:

a) Place a limit order at an acceptable price and wait. The waiting time is unpredictable.

b) Sell at market price at a loss and wait for a price drop to close the short in profit. However, this is no longer arbitrage but speculative trading, which carries additional risks.

c) Transfer the asset to a high-liquidity exchange. GT is Gate’s exchange token, so it has demand there. If the inter-exchange transfer fee is acceptable, this could be a viable solution.

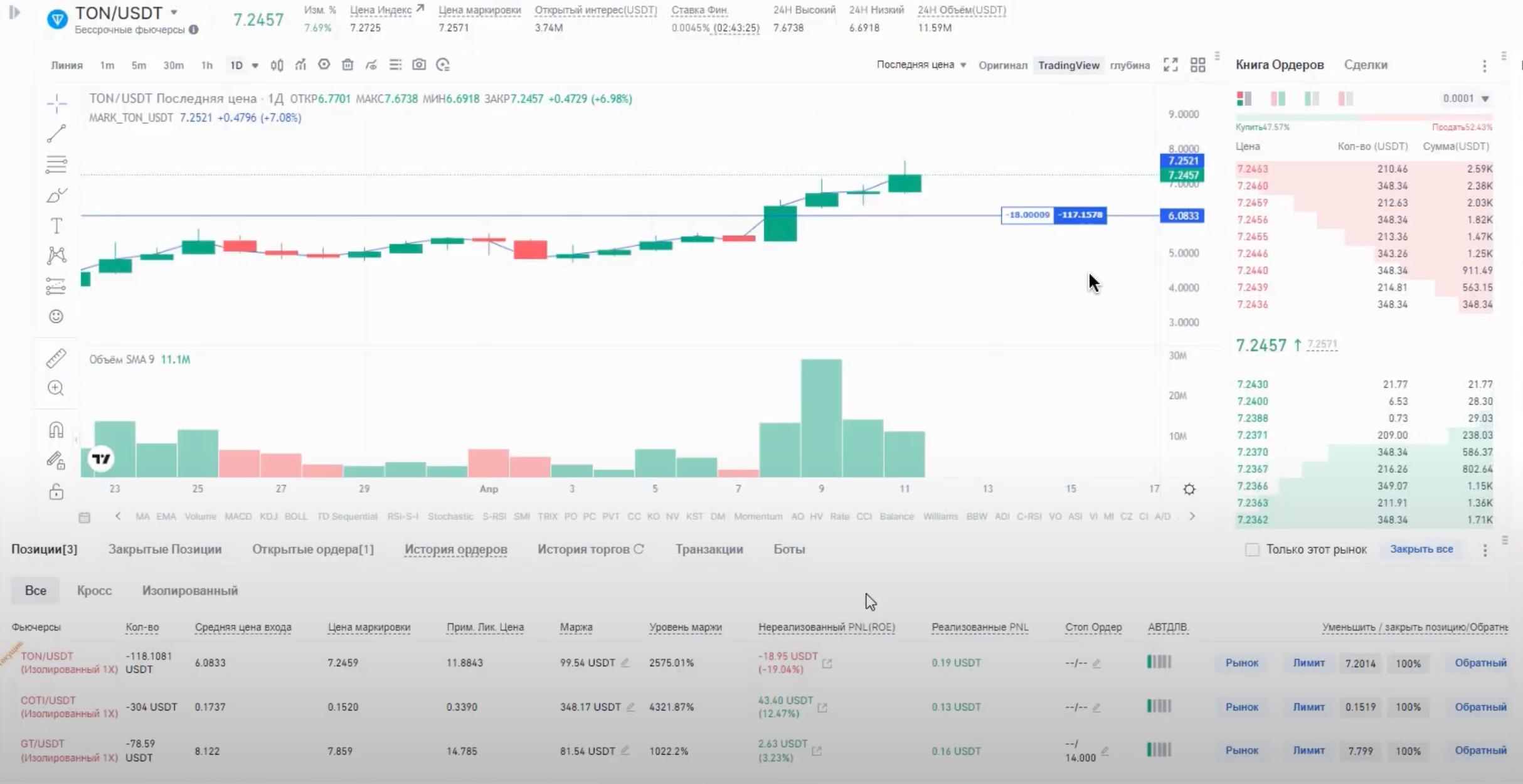

Practical Execution

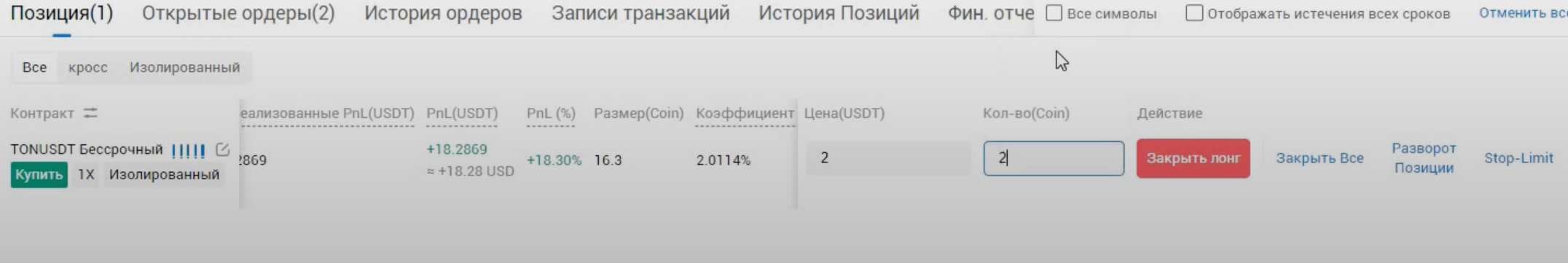

- On HTX, we have a long position.

- On Gate, we have a short position.

To exit the trade gradually, we follow a partial exit strategy:

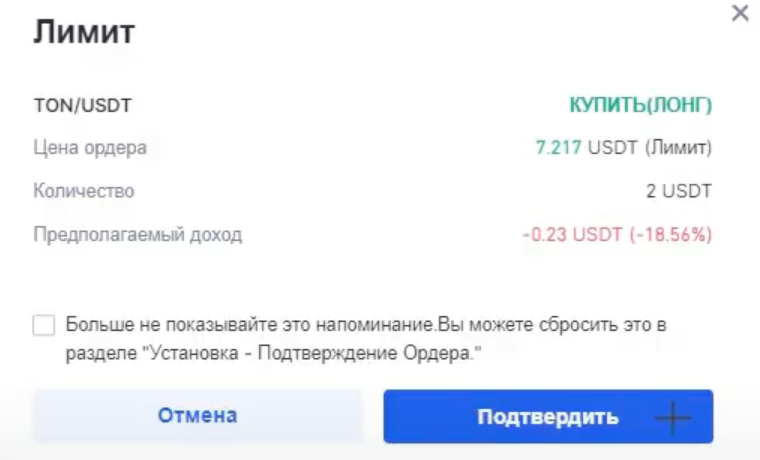

We have a total of 16 TON, We place an order for 2 TOT

We repeat the same on the other exchange.

By closing small portions at a time, we ensure a smooth exit from both exchanges.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.

Official YouTube channel of ArbitrageScanner.io