Beginner’s Guide to Listing Arbitrage

with ArbitrageScanner!

Beginner’s Guide to Listing Arbitrage

Listing arbitrage is a strategy for earning from the price difference of the same coin across different exchanges at the moment it goes live for trading. This guide explains in simple terms how it works.

Step 1: Where to find listing announcements?

To make money, you need to know about listings in advance.

-

Private group: Announcements appear in a closed community, in the “Community Calls” threads.

-

Exchange announcements: You can independently track news on the official websites of exchanges.

Exchanges where listings often take place:

Important: Announcements can appear both several days in advance and right before trading starts. Sometimes listings get postponed, so always double-check the information.

Step 2: What is the strategy?

At the moment of listing, the price of the same coin on different exchanges can differ significantly. Our goal is to profit from this difference using futures.

The strategy consists of opening two opposite trades simultaneously:

-

Long: Opened on the exchange where the price is lower.

-

Short: Opened on the exchange where the price is higher.

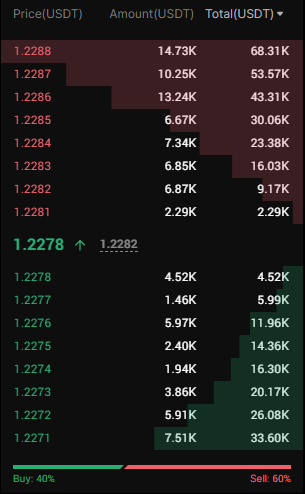

Example of how it looks when tabs with the same coin are open on different exchanges and the spread is visible.

This way, you “lock in” the price difference. Your profit is realized when prices on the exchanges converge (the spread closes) and you close both positions.

Step 3: Trade Execution Technique: Order Books and Orders

To lock in the spread, trades on both exchanges must be opened almost simultaneously. The key to a successful entry is analyzing the order book (the list of buy and sell orders).

Situation 1: Dense order book

If you see that there are many orders close to the current price (the book is “dense”), you can act quickly.

-

What to do: Open trades using market orders on both exchanges. This is the fastest way to enter a position, especially when the spread is large.

Example of a dense order book

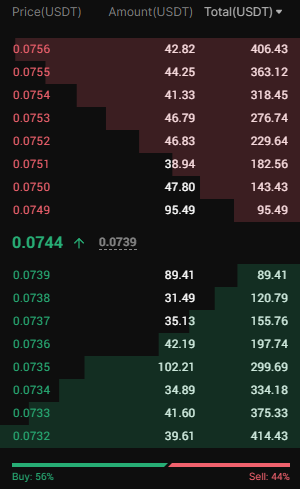

Situation 2: Thin order book (Risky!)

Often on one of the exchanges, the order book can be “empty” or “sparse” (few orders, large gaps between prices).

Example of a weak order book — if you place a market order here, you could immediately lose ~1.5% on the first fills, and with amounts over $100, the spread would be even worse.

-

Risk: If you open a market order here, it will “slip” through the book to the nearest available order, reducing your spread and thus your profit.

-

Correct strategy:

-

On the exchange with the thin book, place a limit order at your desired price.

-

Wait until it is fully filled.

-

Immediately after execution, open a market order on the second exchange (where the book is dense) for the same coin amount.

Pro tip: Split your orders

Regardless of how dense the order book is, it’s better not to enter the full position in one large order. Split your volume into several smaller orders and place them quickly one after another. This reduces your market impact and helps avoid strong slippage, preserving maximum profit.

Step 4: Why do price differences occur?

During listings, volatility is high. To reduce risks, exchanges introduce trade size limits, which creates price differences across platforms.

Examples of per-trade limits:

-

Mexc, Ourbit: $100–$200

-

Kcex: ~$300

-

BingX: ~$500

-

Weex: up to $1200

-

Gate.io: usually no limits

Because Gate.io often has no limits, favorable spreads frequently appear there for hedging positions from other exchanges.

Step 5: Main safety rule

Always use only 1x leverage!

This means you trade only with your own funds. Given the high volatility during listings, this protects your deposit from liquidation.

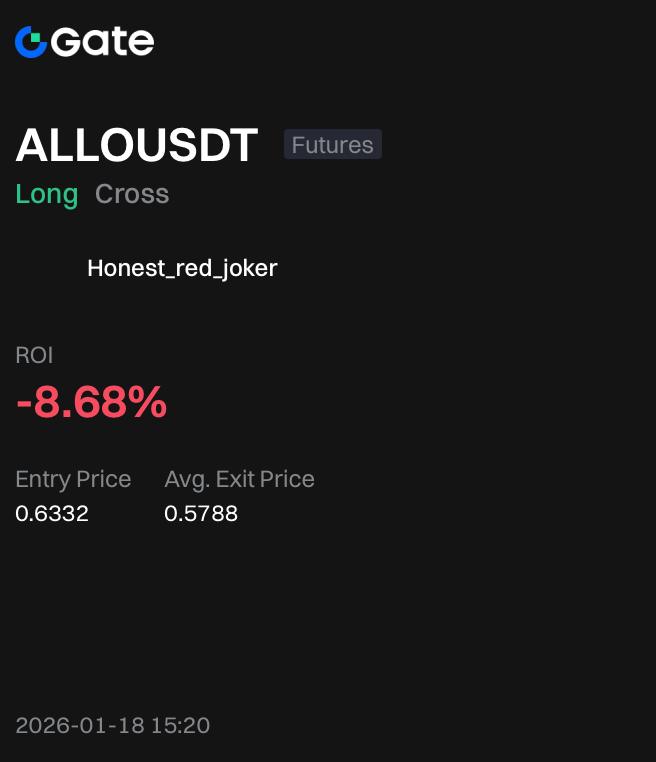

Step 6: Practical example — $279 on the ALLO coin

Let’s review a real trade from one of our community members.

Situation: ALLO token listing. In the private chat, a large spread was noticed, and it was discussed that Weex had an increased limit, allowing for greater profit potential.

Actions:

-

LONG was opened on Gate.io at ~0.6332$, as this was the lowest price.

-

SHORT positions were simultaneously opened on Weex, Kcex, and Mexc at prices of $0.76–$0.78, where the price was significantly higher.

The spread was over 20% — an excellent arbitrage opportunity.

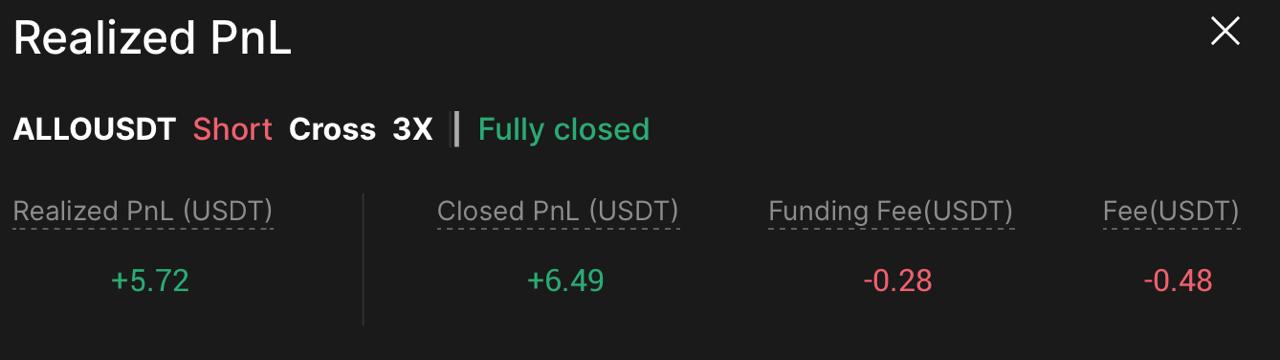

Result: Price convergence and profit realization

After some time, prices across exchanges began to converge. The trader closed all positions, securing $279 in net profit.

Realized PnL from all trades

Important note about timing: Price convergence (spread closing) does not always happen instantly. Often it takes several minutes, as in this case. However, sometimes the spread can persist from 10 minutes up to 2 hours. During this time, it is important to stay calm and wait for the spread to close.

Key takeaways from this case:

-

The strategy works: Correct long/short execution generates profit.

-

Speed matters: Profitable spreads don’t last long — you must act quickly.

-

Information is key: Chat discussions and knowledge of limits helped maximize profit.

-

Work with multiple exchanges: Monitoring several platforms is the foundation of this strategy.

Theory and written breakdowns are the foundation, but it’s better to see the process live at least once. Watch a short video of another listing trade to visually understand how fast you need to act and how positions are opened on different exchanges.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.