Order Book

Order Book. Liquidity in the Order Book. Market Depth.

Order Book

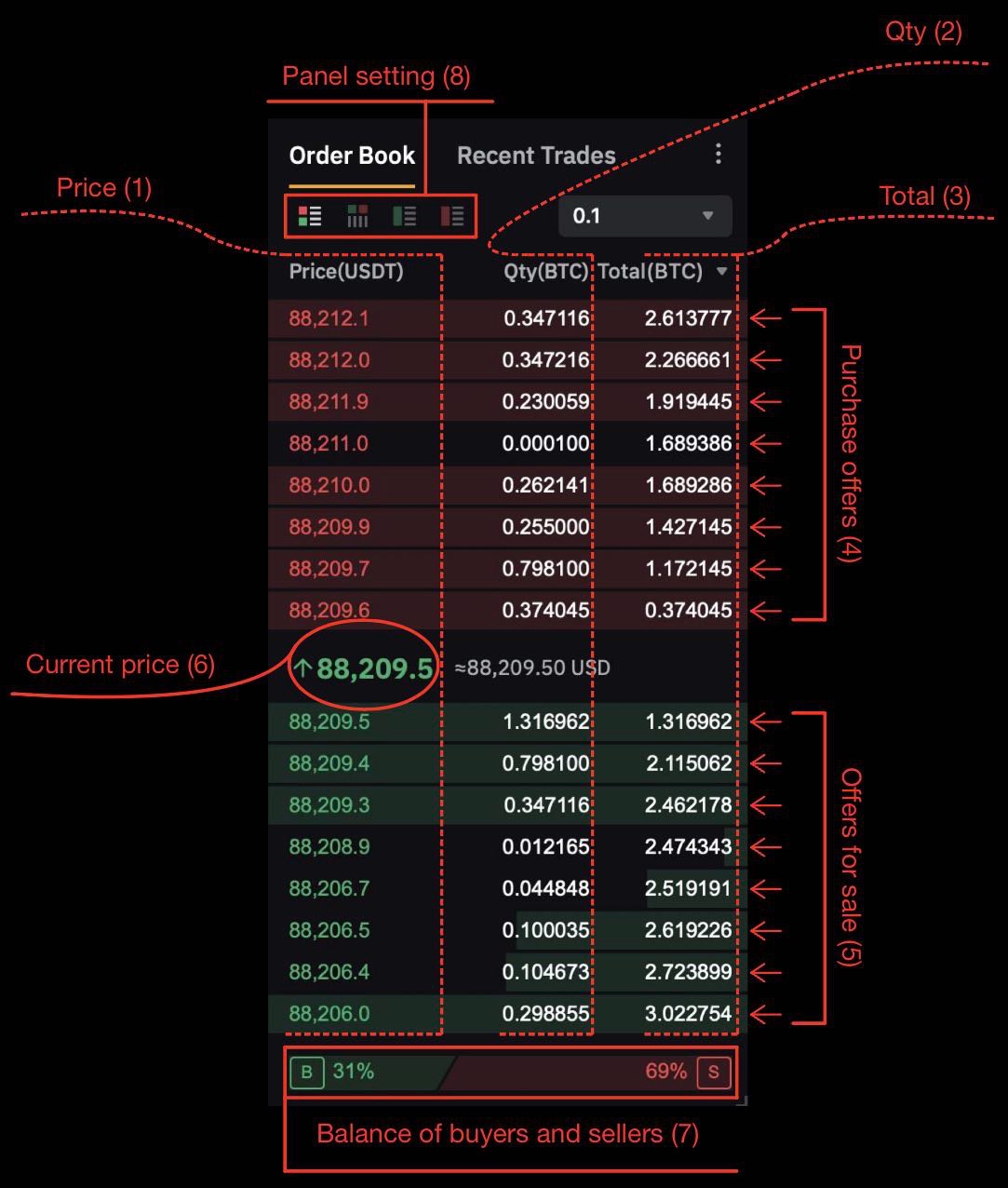

An order book (or market depth) is a dynamic list of all current buy and sell orders.

-

Price – buy and sell quotes in USDT are shown here. The upper part shows the prices at which traders want to sell, and the lower part shows the prices at which they want to buy.

-

Qty – the amount of the asset (in this case, BTC) available to trade at each price.

-

Total – the total amount of the asset at each price level available for buying and selling (this mode can be switched either by token or by USDT).

-

Red rows – sell offers. The more filled the red row is, the larger the sell volume at that price.

-

Green rows – buy offers. The more filled the green row is, the larger the buy volume at that price.

-

Current price – located between buy and sell offers. In this case, it is 88209.5 USDT. Next to it is the Mark Price, which reflects a fair market price based on spot prices from major exchanges.

-

Buyer/Seller balance – shows the percentage ratio between buy order volume (B – green) and sell order volume (S – red). This is the supply/demand ratio for the top 20 levels in the BTCUSDT order book. In the example, 31% are buyers and 69% are sellers.

-

Order book settings panel. It allows you to choose the order book view you need. For example, you can view Bids and Asks separately.

Liquidity in the Order Book

Liquidity in the order book allows us to assess how easy it is to execute trades and how much a trade affects the price.

When looking at this order book, two things stand out immediately:

-

Order prices differ quite significantly from each other.

-

At levels 0.0867 and 0.0880, there are orders with volumes that far exceed the other orders in the book.

What does all of this tell us:

If we want to buy 20,000 VIC on Bybit using a market order, it will not be filled at the current price. Instead, it will be split across multiple orders, and most of the VIC tokens will be bought at 0.088 USDT. If we then want to sell 20,000 VIC, almost all of them will be sold at 0.0867.

As a result, we get a difference between the expected entry/exit price and the real one. This difference is called slippage.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.