SCRT Coin Arbitrage with Negative Funding Rate

with ArbitrageScanner!

We have prepared each lesson in text and video format.

In this lesson, we will specifically show how to arbitrage a negative funding rate using the example of the SCRT coin.

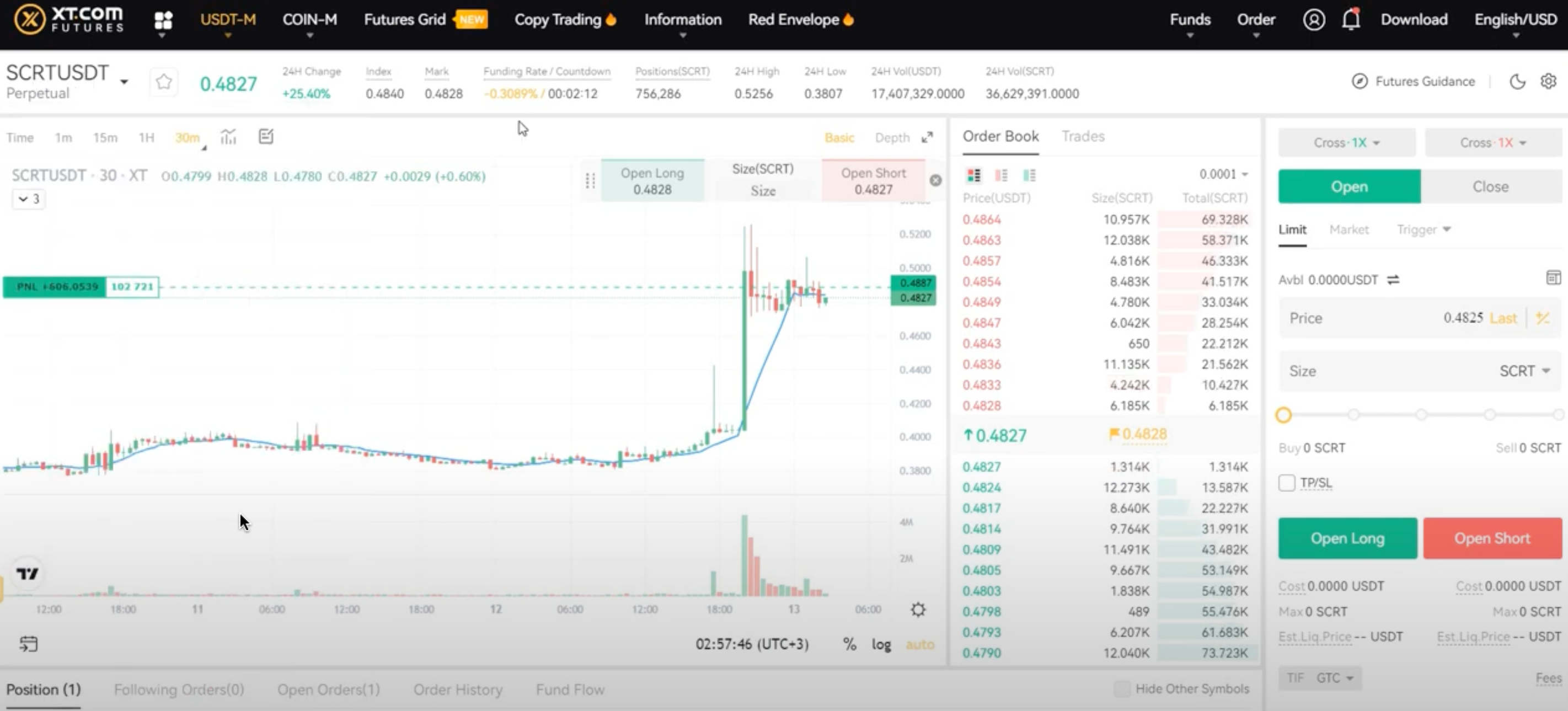

There was a noticeable difference in funding rates between the Bybit and XT exchanges.

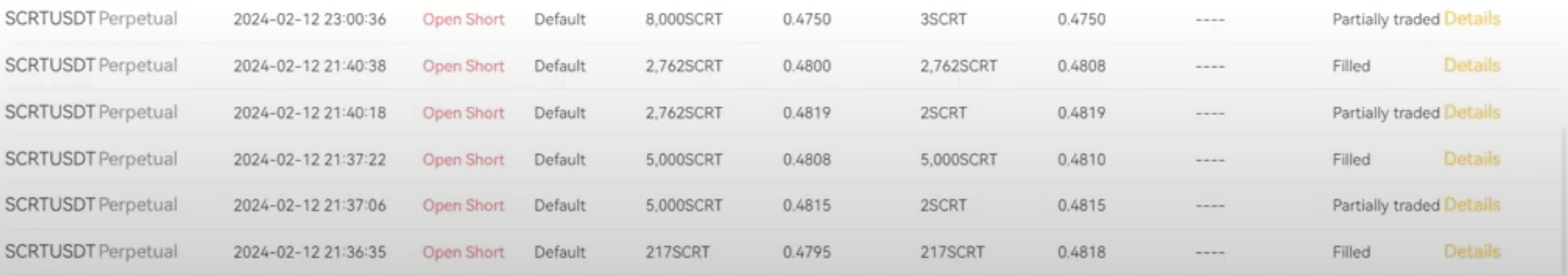

How it works: on an exchange that gives a large funding rate, we take a long position, and on the second we take a short position.

Total we get +1.2 - 0.3 = +0.9%.

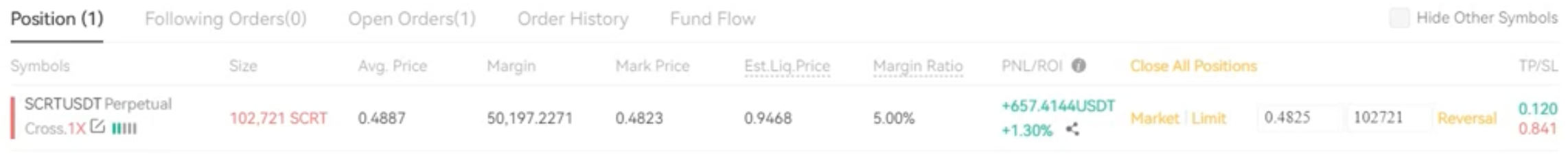

We entered into the deal with a total capital of more than $100k.

Pay attention to the average entry price - the spread is 0.83%, so we will also make money on price convergence.

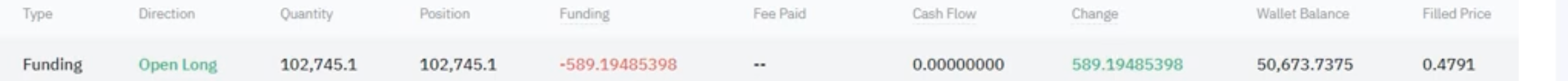

For clarity, I am attaching a screenshot showing the calculation of the funding rate on the Bybit exchange:

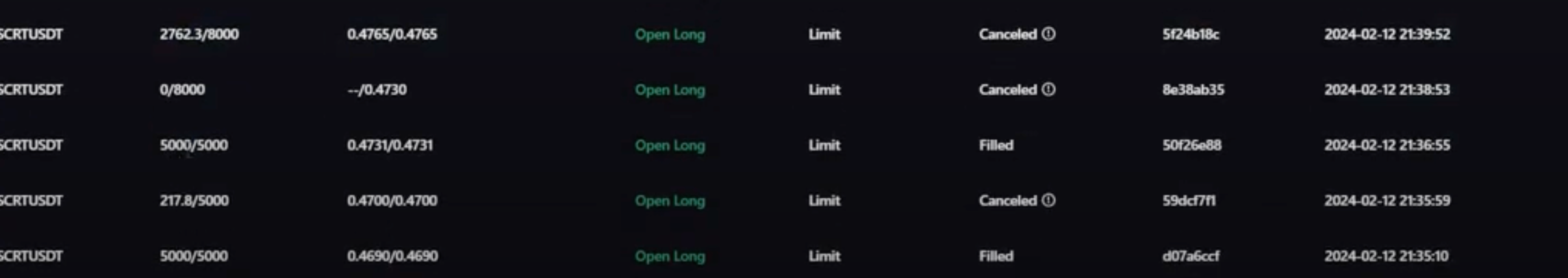

Separately, I would like to note the order of opening long/short positions, that is, what exactly should be opened first. Here you need to decide after the fact, paying attention to the market trend in the last minutes - if you see that the price is rising, then go long first, then short. The screenshot below shows just such a situation.

And don’t forget about the importance of entering a deal in parts, and not using your entire capital at once.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.