Slippage: Why Your Profit Disappears

Slippage: Why Your Profit Disappears

Slippage is the difference between the current price and the actual execution price of your buy/sell order.

How Does It Work in Practice?

Imagine the following situation:

-

You spot an opportunity with a 1.5% spread and decide to enter with 10,000 coins.

-

At the best price level in the order book, there are only 2,000 coins available.

-

To fill your order completely, the algorithms have to “buy up” coins at higher prices further up the order book.

-

As a result, your average entry price ends up 0.7% worse than expected.

-

When closing the position, the same thing happens, and your average exit price is also 0.7% worse than expected.

-

In the end, the spread shrinks from 1.5% to 0.1%, and after fees it may drop to zero — or even become negative.

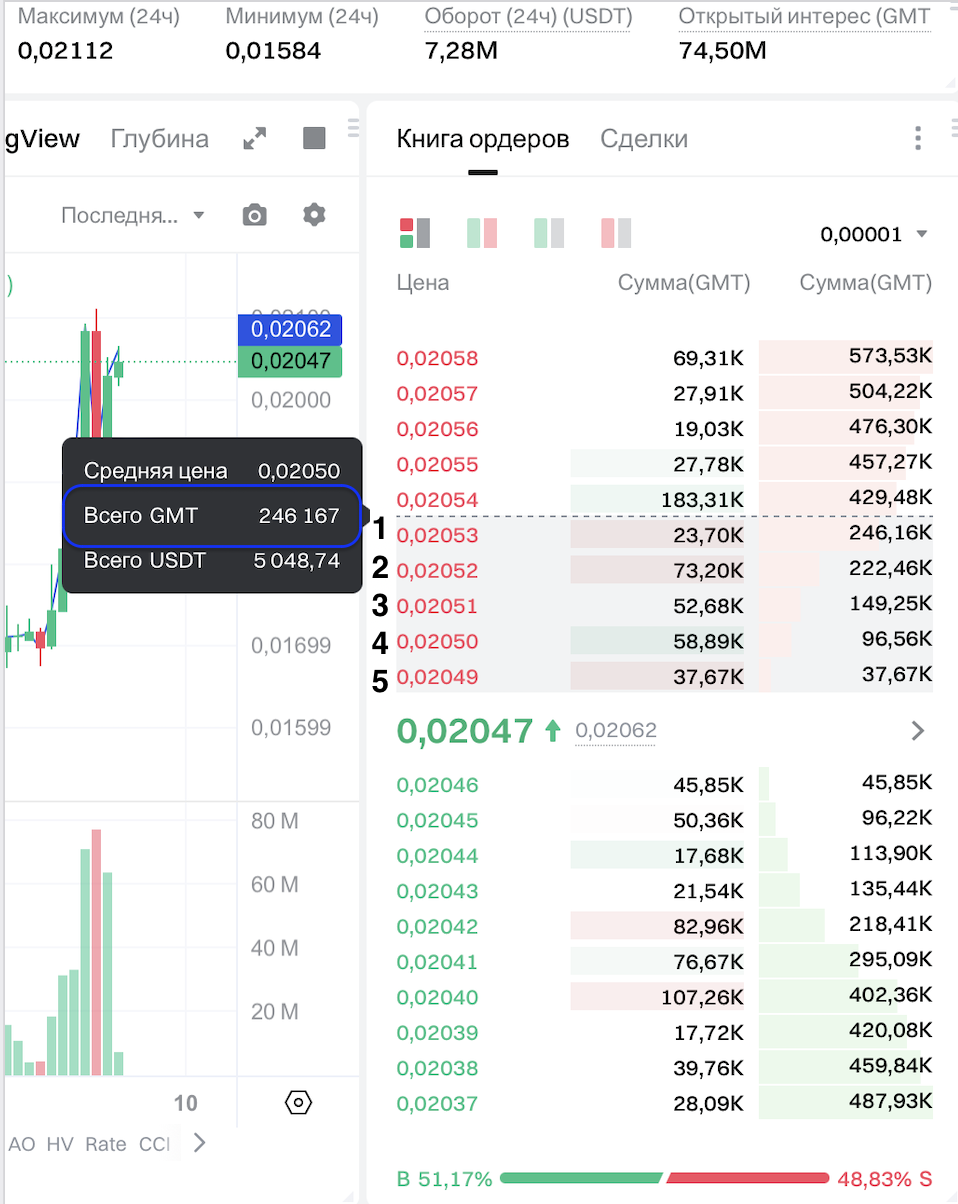

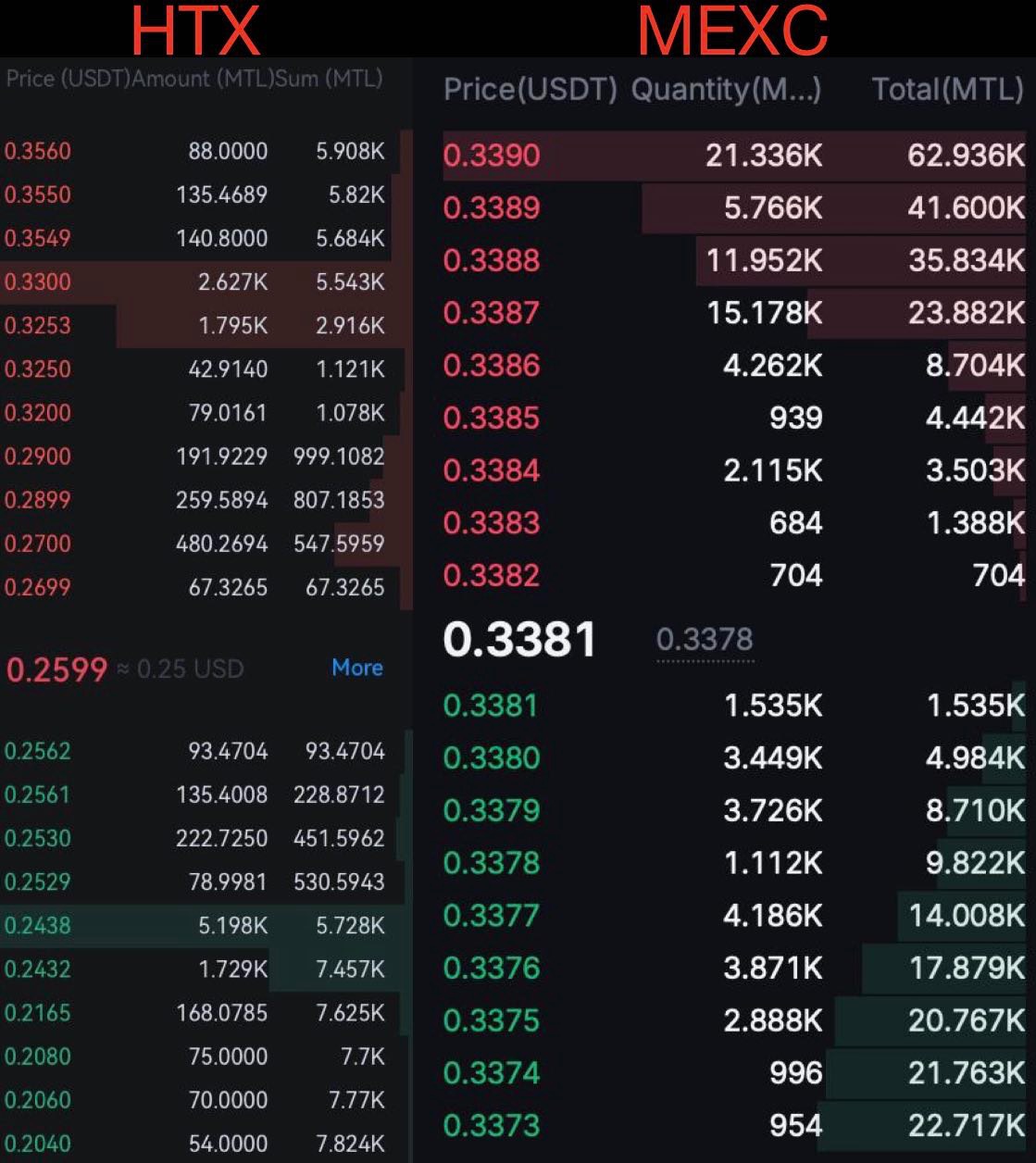

Example of Possible Slippage Using Real Data

MTL Spread Between HTX (spot) and MEXC (futures)

Order book for the MTL token on HTX (Spot) and MEXC (Futures)

We are considering opening positions for 5,000 MTL.

First Look

The trade looks attractive:

We buy 5,000 coins on HTX at 0.2599 and open a short position on MEXC for 5,000 coins at 0.3381.

↓

Wait for the price to converge

↓

Close positions

↓

Done — revenue is 5000 × (0.3381 − 0.2599) = 391 USDT in your pocket!

In theory, we can capture a 30.09% spread!

What Happens in Reality

In reality, it is not that pretty.

Here is how opening the positions will actually be executed:

Execution of opening positions for 5,000 MTL on HTX and MEXC

When buying coins on spot with a market order, the purchase is executed at prices from the red side of the book. Therefore, when placing a market buy order for 5,000 MTL on HTX spot, the following fills will occur:

|

Price (USDT) |

MTL Amount |

USDT Amount |

|

0.2699 |

67.3265 |

18.17 |

|

0.2700 |

480.2694 |

129.67 |

|

0.2899 |

259.5894 |

75.25 |

|

0.2900 |

191.9229 |

55.66 |

|

0.3200 |

79.0161 |

25.29 |

|

0.3250 |

42.9140 |

13.95 |

|

0.3253 |

1795 |

583.91 |

|

0.3300 |

2083.9617 |

687.71 |

So, here is what we get on the buy side:

-

USDT total: 1589.61

-

MTL amount: 5000

-

Average buy price: 1589.615 / 5000 = 0.317922 USDT

Now let’s move to the sell side (opening the short) on MEXC.

|

Price (USDT) |

MTL Amount |

USDT Amount |

|

0.3381 |

1535 |

518.98 |

|

0.3380 |

3449 |

1165.76 |

|

0.3379 |

16 |

5.41 |

Sell side results:

-

USDT total: 1691.15

-

MTL amount: 5000

-

Average sell price: 1691.155 / 5000 = 0.33823 USDT

Therefore, our spread is 6.39%.

What Changed?

Only during the opening stage, the spread shrank almost 5x! From the hypothetical 30.09% it dropped to 6.39%.

6.39% may still look good, but keep in mind that the same situation can repeat during closing. And if you also factor in trading fees, the trade may even turn against you.

How to Fight Slippage

Slippage is probably the most common arbitrage issue. Sometimes it eats profits not only for beginners but also for experienced traders. However, slippage is not a dealbreaker — you can and should fight it, and there are several methods.

Maker and Taker

Before diving into slippage-reduction strategies, it’s important to understand the terms “maker” and “taker.”

-

Maker — the participant who creates liquidity (places orders in the book).

-

Taker — the participant who consumes maker liquidity (fills existing orders).

What does it mean? Imagine an empty order book. For trading to start, at least one order must be placed. The orders you see in the book are created by makers. Essentially, the maker offers to sell to you (red side) or buy from you (green side) at a price chosen by the maker. Takers can buy from or sell to makers, and so can makers from the opposite side by placing an order at the same price.

Limit and Market Orders

Makers build the market using limit orders, while takers typically use market orders. If you place a limit order, you become a maker and offer to buy or sell a token at the price you set.

If you use a market order, you act as a taker and buy or sell the amount specified at the best available market price (or multiple best prices if needed).

So Where Does Slippage Come From?

Slippage is a taker problem. Market orders can quickly “slide” through the order book and fill multiple maker orders. The deeper the order goes into the book, the larger the slippage — and the larger the trader’s losses.

Limit Order Strategy

As mentioned above, limit orders are placed at a predefined price. This price remains unchanged throughout the order’s lifetime. Even if the market price moves far away, the order will not be canceled or changed without the maker’s own action.

Therefore, by using limit orders, you are protected from adverse execution price changes — and thus from slippage.

Small-Order Strategy

Using limit orders correctly is the best solution against slippage, but in practice it can be difficult.

For example, if a coin is highly volatile, the price may move away from your intended level and the limit order won’t fill. A similar issue occurs with low-liquidity coins: the order may take a long time to execute. (We do not recommend using very low-liquidity coins for arbitrage.)

In such cases, the second strategy comes in: splitting one large market order into many small market orders.

How it works:

Both makers and takers care not only about order size and price, but also about execution speed. If we hit the book with a large market order, we strongly impact the order book and the coin’s price at that moment. But if we split the large order into several smaller ones, it gives the market time to recover, and we, as a taker, can buy from makers positioned at the best levels of the book.

Combined Strategy

Using an entry format like this:

On one exchange — buy with a limit order

On the second exchange — buy with a market order

How do you know where to use a limit order and where to use a market order?

Watch the order book! On the exchange where fewer coins are available in the book — enter with limit orders. Track how many coins got filled, and then enter on the other exchange with a market order for the same amount, where more coins are available in the order book.

Example:

On Bybit, the first 5 rows of the order book contain liquidity for only 32k coins

While on Gate, the first 5 rows contain 246k

Conclusion: Enter on Bybit using limit orders, splitting the total volume into parts, and enter on Gate with a market order for the volume that was filled by the limit order.

Conclusions

Slippage is a very common pitfall that waits for us every time we buy cryptocurrency.

You can fight it in different ways.

There is no single “best” strategy — each method can perform better or worse depending on the specific coin and exchange.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.