Spot + Futures

Spot + Futures Strategy

Strategy essence: we buy the real asset (Spot) and hedge its price by opening a short position on futures. As a result, it no longer matters where the coin price moves — our profit is locked in the price difference.

Main Difference from “Futures + Futures”

In futures-only strategies, you pay or receive funding fees on both sides. In the “Spot + Futures” strategy, you work with the spot market, where there is no funding.

You simply hold the coin on spot and only need to monitor funding on one side (the exchange where the short is opened).

Where to Get Spot?

-

CEX (Centralized Exchanges). For example: Binance, Bybit, OKX.

-

DEX (Decentralized Exchanges). For example: Uniswap, PancakeSwap, or OKX DEX.

Why is this profitable? On DEXs, sharp price drops or spikes often occur due to lower liquidity. Large exchanges (CEXs) react more slowly, which creates strong arbitrage price differences.

Working with Funding

Funding is a key factor. Since we open a short on futures, it is beneficial for us when the funding rate is positive (in that case, long traders pay us a premium every 8 hours).

What to check before entering:

-

Direction: Ideally, funding is positive. You capture the spread + receive funding payments.

-

Spread Math: If funding is negative (you pay the exchange), your spread profit must be significantly larger than the potential costs.

-

Example: Spread — 2%. Negative funding — 0.01%. Even if you hold the position for 3 days (9 funding payments), you will only pay 0.09%, which barely affects your 2% spread profit.

Real Trade Example

-

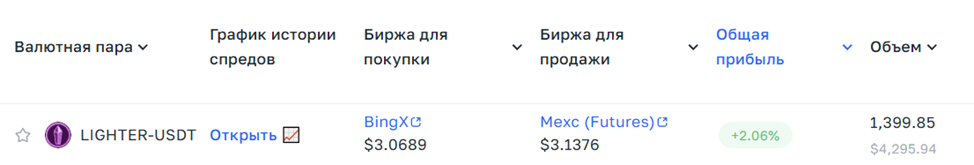

Spot (BingX Exchange): LIGHTER coin price is $3.0689

-

Futures (MEXC Exchange): LIGHTER coin price is $3.1376

1. Trade Entry:

-

Buy 1,400 LIGHTER on BingX for $4,296.46.

-

Enter in parts on both spot and futures (if the trade size is 1,400 coins, execute multiple smaller orders). This protects you from sharp price spikes. In one of our articles, we explained how to strategically open positions. Read more.

-

-

Simultaneously open a short position for 1,400 LIGHTER on MEXC at $3.1376 (also entering in parts).

-

Your locked-in spread: ~$0.07 per coin (around 2% net return on capital).

2. Waiting:

Prices may converge in 5 minutes, or it may take 2 days.

-

If funding on MEXC is positive — you earn additional income while waiting.

-

If funding is negative — you have already calculated that the 2% spread comfortably covers these expenses.

3. Trade Exit:

The prices on both exchanges converge (for example, both become $3.10).

-

Spot: Sell coins at $3.10. Receive $4,340. (Profit +$43.54)

-

Futures: Close the short at $3.10. Since the price dropped from $3.1376 to $3.10, the short profit equals +$52.64.

-

Total: $96.18 profit (price difference), excluding fees and funding.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.