What Is a Spread?

What Is a Spread?

Spread is a key concept in arbitrage. Every arbitrage trade is built on spreads, and revenue in any arbitrage situation is generated through them.

A spread is the difference between the buying and selling prices of the same asset within a specific arbitrage setup.

Types of Spread

Spreads can be divided into three types: nominal, actual, and net.

|

Nominal spread |

Actual spread |

Net spread |

|

The spread we calculate at the very beginning, before opening a position. |

The spread that is achieved in reality. It can be either smaller or larger than the nominal one. |

What remains after all costs: fees, slippage, funding, and other expenses. |

Main Factors Affecting the Spread

Important: only net spread is considered in this section.

-

trading volume

-

order book depth

-

volatility

-

market activity

-

network congestion

-

actions of other arbitrage traders

What Usually Causes Spreads

In general, a spread almost always arises due to a sharp price change of a coin on one or several exchanges.

Specific triggers include:

-

Token pumps and dumps

-

News

-

Listings

-

Other factors causing sharp price spikes

In practice, spreads are mainly caused by the exchange audience and the internal “settings” of each exchange. Each exchange has a unique user base, and because of this, every exchange reacts to price changes differently. Some exchanges have a large number of active traders who react quickly to price movements, while others are dominated by long-term holders. As a result, the price of a coin on these exchanges changes differently.

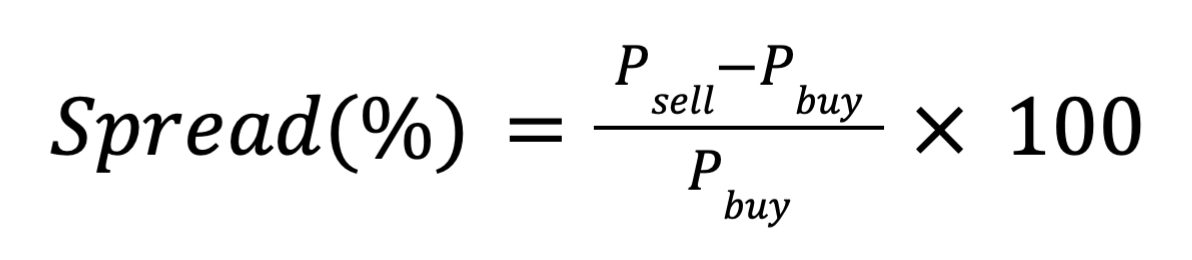

✎ Calculation of nominal and actual spread in arbitrage:

Pbuy — buy price

Psell — sell price

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.