What is the Fear and Greed Index?

with ArbitrageScanner!

Introduction

Experienced traders and investors always seek additional information to make informed trading decisions. It's important to consider price charts, fundamental aspects of the project, market capitalization, social media, market sentiment, etc. Combining such data can provide an assessment of the level of fear and greed in the market. However, one should not rely entirely on these metrics.

What is the Fear and Greed Index

The Fear and Greed Index is a sentiment indicator that shows the prevalence of either emotion in the market at any given time.

The cryptocurrency Fear and Greed Index was created by Alternative.me based on the traditional index proposed by CNNMoney, adapted to the peculiarities of the cryptocurrency market. It analyzes market indicators on a scale from 0 to 100 to determine the level of fear or greed, where:

- 0 – Extreme fear;

- 50 – Neutral sentiment;

- 100 – Extreme greed.

Extreme fear indicates that cryptocurrencies are undervalued at the moment, which can lead to mass sell-offs and general panic. However, extreme fear does not always mean a bearish trend. It can be related to poor macroeconomic data, major exchange scams, geopolitical tensions, etc.

Extreme fear is a good opportunity to buy.

Neutral sentiment signals stability and the absence of strong emotions of fear or greed, indicating the market is in equilibrium.

At this stage of the market, it makes sense to apply long-term planning and diversify your portfolio.

Extreme greed is the opposite of extreme fear. When market participants, especially beginners, see market growth, they start experiencing FOMO[1] and regret not catching the rally in time. On the other hand, those already in positions want to take even more profit and continue to increase or not realize significant profits.

When investors or traders become extremely greedy, the market may undergo a correction.

!!! NOTE: Always remember, you have profited if you have realized it. Saying "I had 1000% and realized 1000%" are not the same.

How Does the Fear and Greed Index Work?

Fig. 1 – "Fear and Greed Index"

Alternative.me calculates the index daily based on data from Bitcoin and other major cryptocurrencies.

The index scale is divided into:

- 0 – 24: Extreme fear (orange);

- 25 – 49: Fear (yellow);

- 50 – 74: Greed (light green);

- 75 – 100: Extreme greed (green).

The index is calculated based on five factors:

- Volatility (25%): Reflects uncertainty based on the average value of Bitcoin and major cryptocurrencies over the past 30 days and quarter.

- Market momentum/volume (25%): Indicates greed or positive market sentiment if volumes and the number of buyers increase over the past 30 days and quarter.

- Social media (15%): Analyzes hashtag activity on Twitter.

- Bitcoin dominance (10%): Shows interest in buying the main cryptocurrency in the market. An increase in dominance causes fear and uncertainty, as investors see no alternatives. A decrease in dominance increases interest in alternative purchases, thus raising greed.

- Google Trends (10%): Analyzes search queries related to Bitcoin, especially changes in search volumes.

- Survey results (15%): Currently suspended.

Why Measure the Level of Fear and Greed?

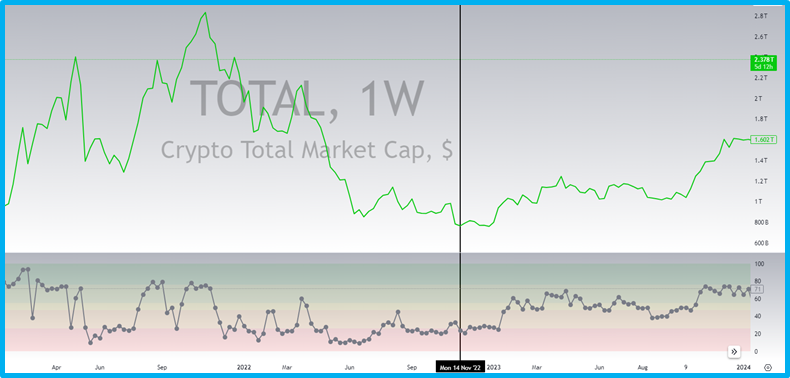

The index helps track market sentiment and identify entry and exit opportunities. For example, in November 2022, the index showed extreme fear, which coincided with an overall decline in the cryptocurrency market capitalization.

Fig. 2 – "Comparison of the Total chart with the Fear and Greed Index"

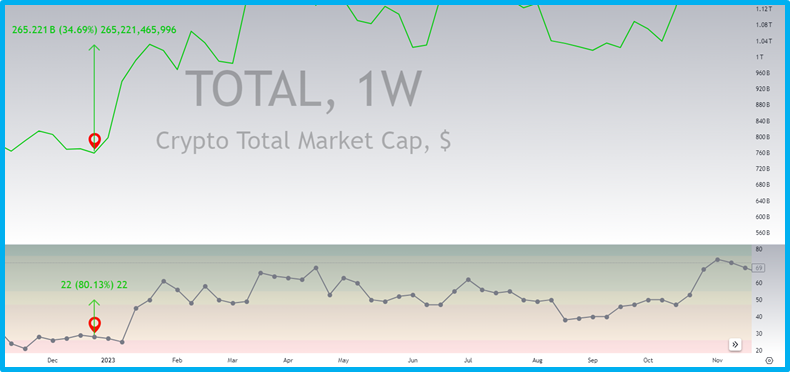

The subsequent decline in fear was accompanied by the growth of the entire cryptocurrency market:

Fig. 3 – "Growth of the Total chart and the Fear and Greed Index"

Thus, from December 26, 2022, to January 23, 2023, the total cryptocurrency market capitalization increased by ~35%. During this time, the Fear and Greed Index reached a mark of 50.

In turn, Bitcoin showed a growth of +42% during this period, followed by Ethereum with +36% (Fig. 4).

Fig. 4 – "Growth of Bitcoin & Ethereum from December 26, 2022, to January 23, 2023"

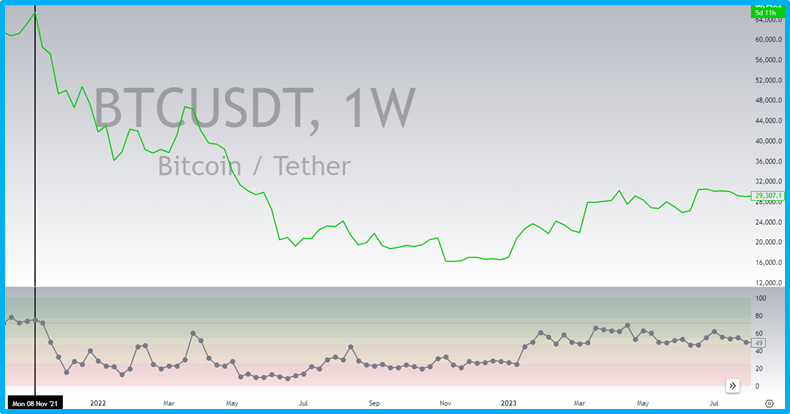

Also, let's refer to the peak of the bull cycle in 2021 for Bitcoin, where its value exceeded $65K. Let's see what levels the Fear and Greed Index was at:

Fig. 5 – "Bitcoin price peak in 2021, along with Fear and Greed Index readings"

The Fear and Greed Index was at the level of extreme greed, predicting a possible correction. Which subsequently occurred.

Thus, the Fear and Greed Index can be a valuable tool for tracking market sentiment changes.

Can This Index Be Used for Long-Term Analysis?

Despite the proven effectiveness of this index, it is suitable for market analysis in both the long-term and medium-term horizons. Referring to other market indicators, including your own analysis (DYOR), before buying is not a mistake.

- In June 2019, when the price of Bitcoin reached $13.9K;

- In February 2021, when the price of Bitcoin soared to $50K;

To the lowest value of 5 points:

- On August 22, 2019, when the price of Bitcoin dropped to $10K.

You can track the index at this resource.

Conclusions

The Fear and Greed Index summarizes various market indicators and sentiments. It should be used together with other metrics for balanced analysis.

!!! NOTE: Always conduct your own research (DYOR) and follow risk management (RM) and money management (MM) principles.

We'd like to conclude this article with a quote from billionaire Warren Buffett:

"Be fearful when others are greedy"

________________________________________________________________________________________

[1] FOMO – Fear Of Missing Out.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.