Growth of Mantra DAO token

GROWTH OF MANTRA DAO TOKEN

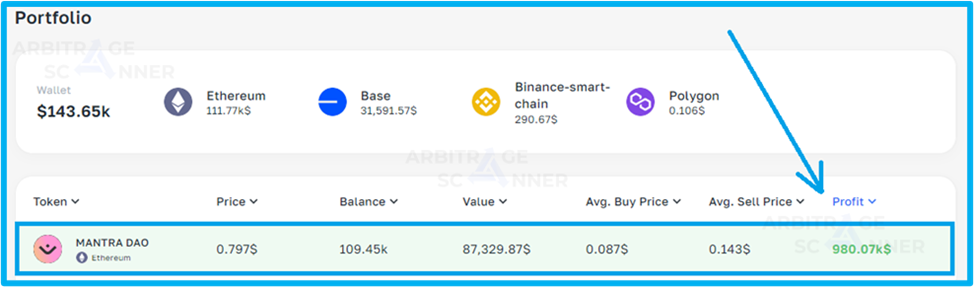

ArbitrageScanner conducted its own investigation into the situation surrounding the Mantra DAO (OM) token, which showed a parabolic growth. We found a wallet that earned $980K on this movement. Using the wide functionality of the service, we discovered that it was linked to market makers GSR Markets and DWF Labs, known for token pumps.

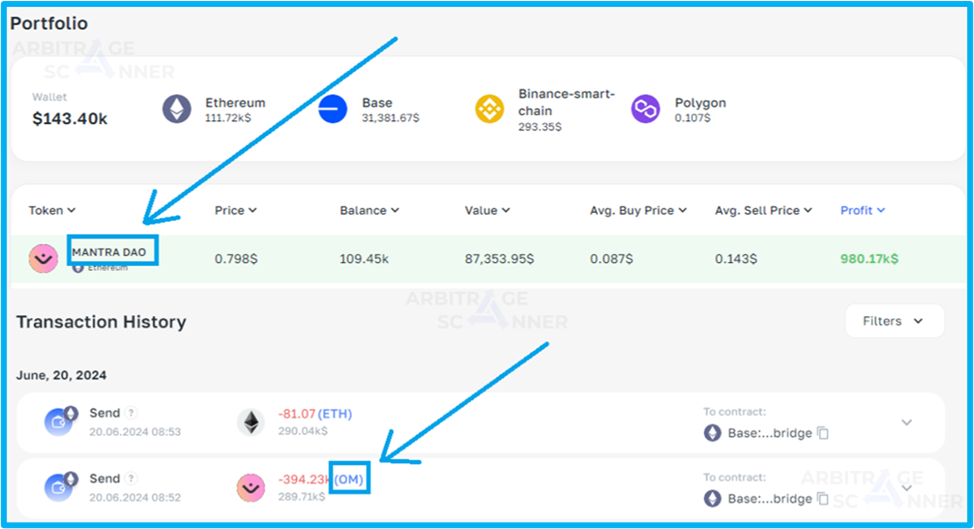

MANTRA DAO TOKEN HOLDER

Fig. 1 - "Early OM Token Holder Wallet by ArbitrageScanner"

Here is the early OM token holder and their wallet, which we found using our products. It caught our attention with its earnings on the Mantra DAO token.

TIP:

Pay attention to the tags under the address statistics. This can give you a minimal understanding of the wallet's entity. For example, whether it is an early holder or a holder of a specific altcoin.

Fig. 2 - "Wallet Earnings on OM Token by ArbitrageScanner"

You can explore the wallet here - here

TIP:

You can sort tokens in the portfolio by parameters by clicking on them. In our example, we used sorting by profit in descending order (from highest to lowest). You can also toggle this parameter to sort the list in ascending order by clicking on it again.

By going to the token's page, you can study its entire activity history.

TIP:

You can go to the asset's separate page by either clicking on the token ticker in the portfolio or clicking on the ticker from the transaction history.

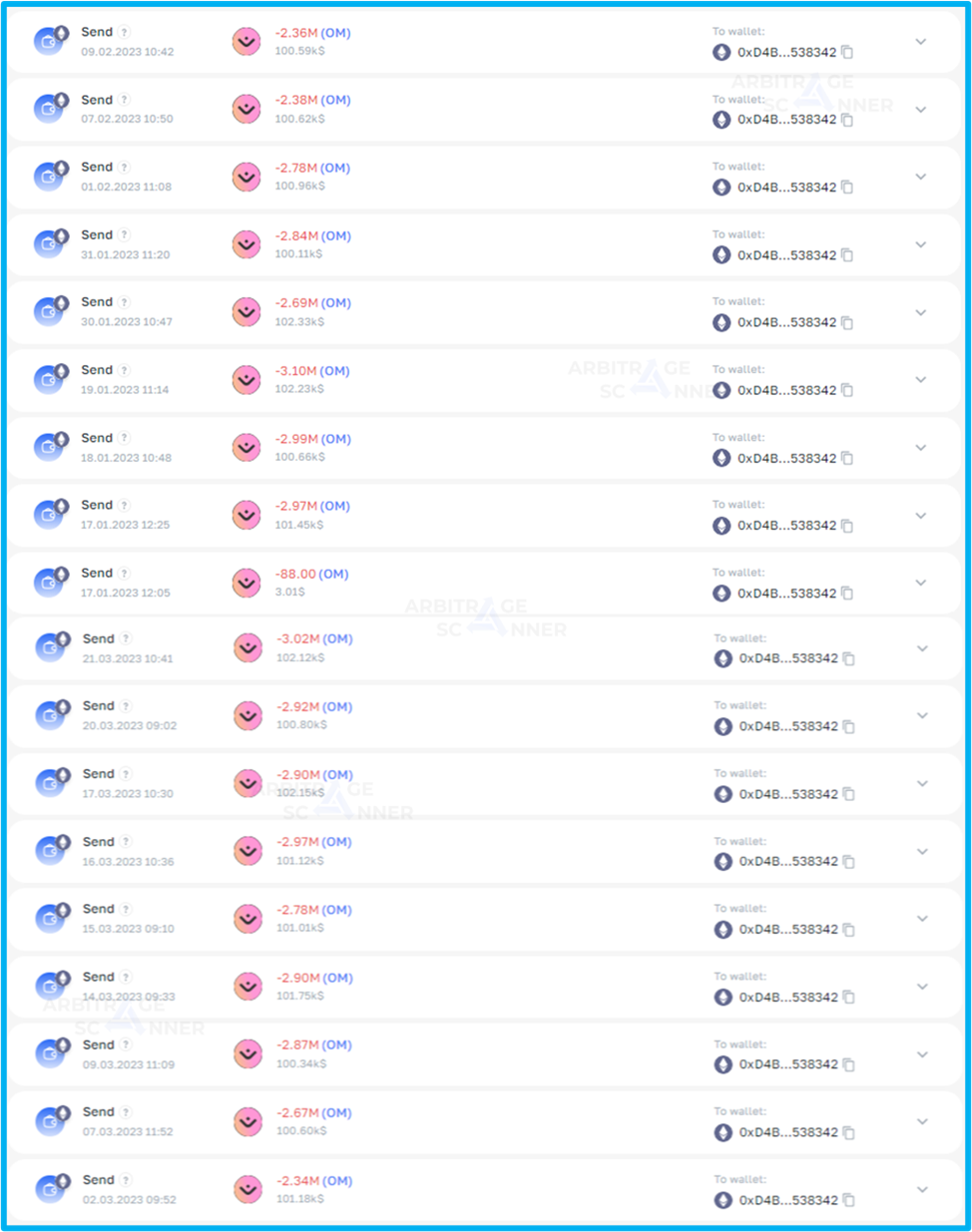

WALLET TRANSACTIONS

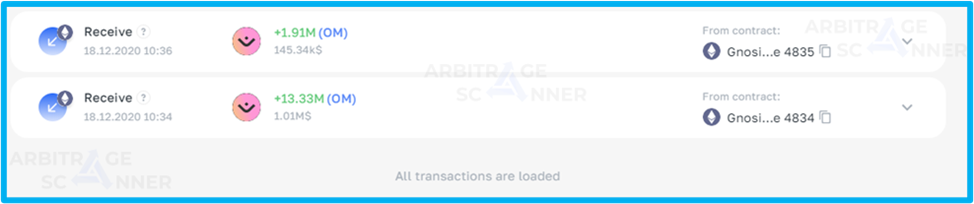

The first transactions of the wallet with the OM token were back in 2020

Fig. 3 - "First Transactions of the Wallet with OM Token by ArbitrageScanner"

Explore all transactions of the OM token wallet - here

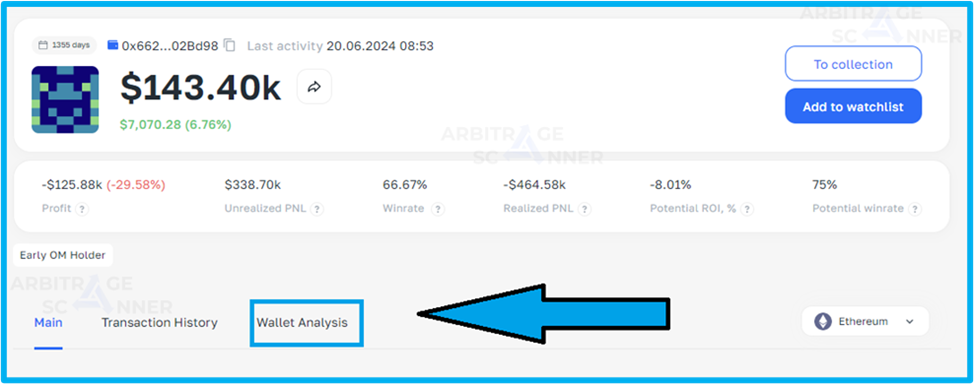

To find addresses that interacted with this wallet, go to the transfers section in the wallet analysis tab.

TIP:

To view outgoing or incoming transfers to the address, you need to go to the wallet analysis tab.

Next, find transfers in the section.

Transfers - list of wallets by transaction type (incoming or outgoing) with which there was interaction.

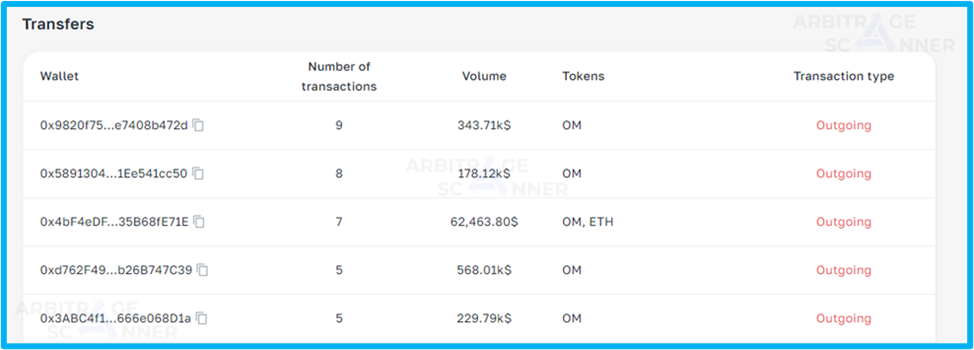

WALLET TRANSFERS

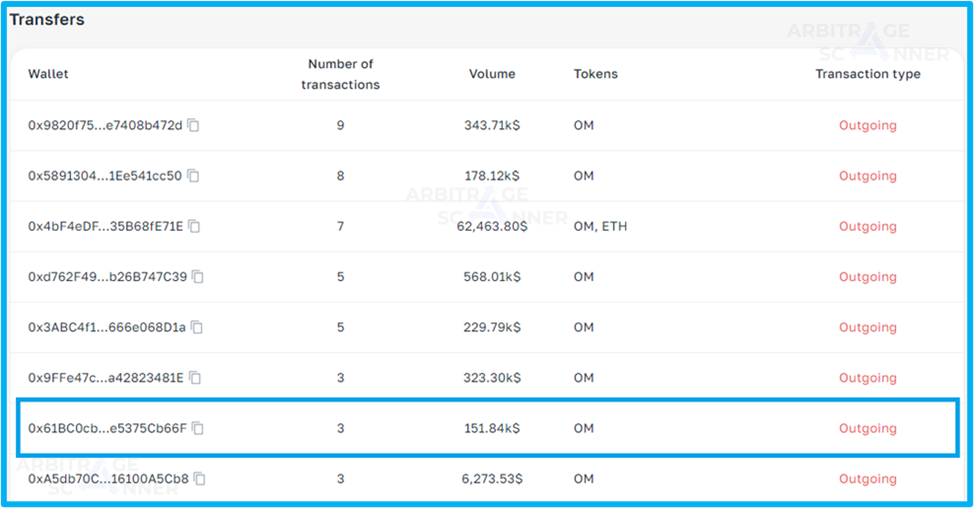

Among all transfers to wallets, we will be interested in the address with which there were three outgoing transactions with the OM token

Fig. 4 - "Wallet Transfers to Other Addresses by ArbitrageScanner"

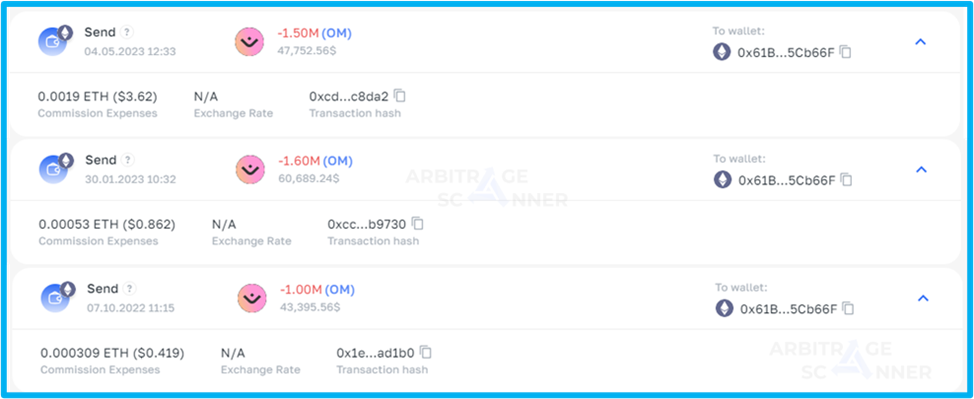

The wallet transactions from Fig. 4 below:

Fig. 5 - "Wallet Transfers to Another Address by ArbitrageScanner"

A total of 4.1M OM tokens were transferred, valued at $151K at the time of transfer.

Next, we will examine the relationship of the wallet from Fig. 4 with other addresses.

RELATED ADDRESSES OF THE EARLY MANTRA DAO HOLDER

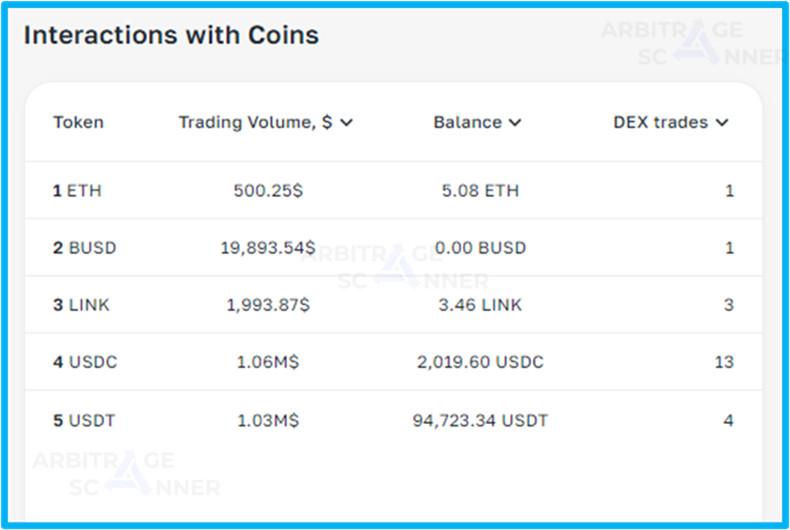

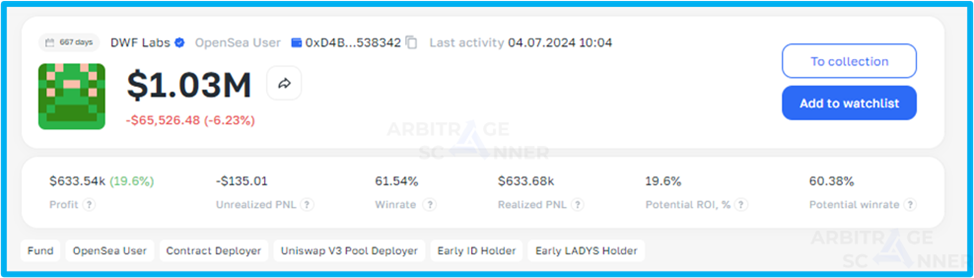

The found wallet (from Fig. 5) has comparatively modest trading statistics

Fig. 6 - "Main Dashboard of the Found Wallet by ArbitrageScanner"

As well as a short list of interactions with tokens on DEX platforms

Fig. 7 - "Token Interaction Table on DEX of the Wallet by ArbitrageScanner"

Explore this wallet here - here

TIP:

Token interactions - list of coins that had deals on DEX.This table is located in the wallet analysis tab. Here you can find the coins that had the most swaps.

This wallet, as mentioned earlier, has a small number of coins traded on DEX, and insignificant trading activity. It was likely used as an address where assets were temporarily placed.

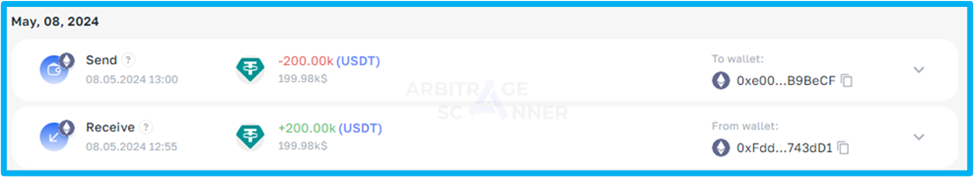

The transactions of this wallet directly indicate this. As soon as the funds were received, they were immediately sent to other addresses.

Fig. 8 – "Example transactions of the found wallet by ArbitrageScanner"

When studying the transfers of this address, we will be interested in the following wallets

Fig. 9 – "Wallet transfers by ArbitrageScanner"

Thus, the wallet transferred OM worth $2.07M to two addresses

All OM transactions to the first wallet from Fig. 9 can be seen below

Fig. 10 – "All transfer type transactions for OM by ArbitrageScanner"

Let's also look at the OM transfers to the other address from Fig. 9:

Fig. 11 – "All transfer type transactions for OM by ArbitrageScanner"

TIP:

To start analyzing the wallet you found, for example, in the transfers, do the following:

- Copy the address

- Press the "F" key

- Enter the address in the search bar

- Press ENTER

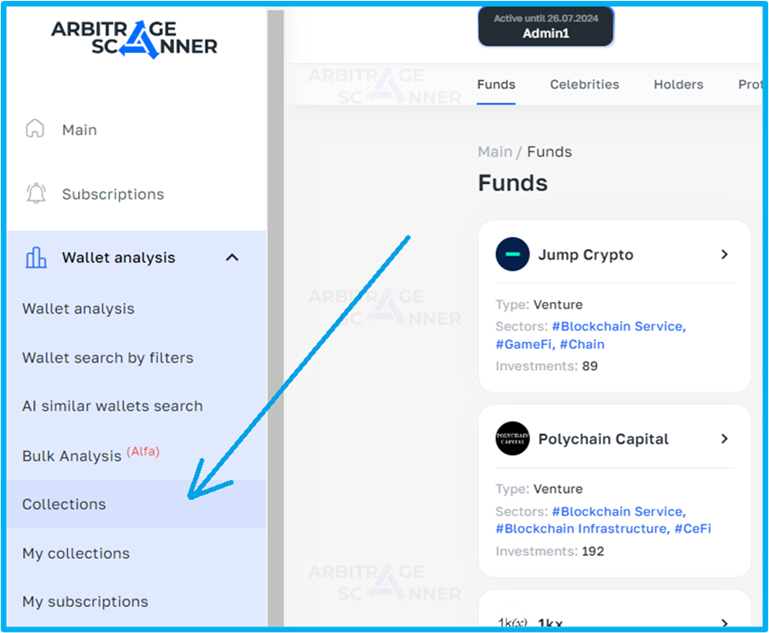

Thanks to ArbitrageScanner's wallet entity identification function, you will easily understand who the owner is.

!!! NOTE: not all wallets have a signed entity. Typically, market maker wallets, funds, and celebrity wallets are already known to the market.

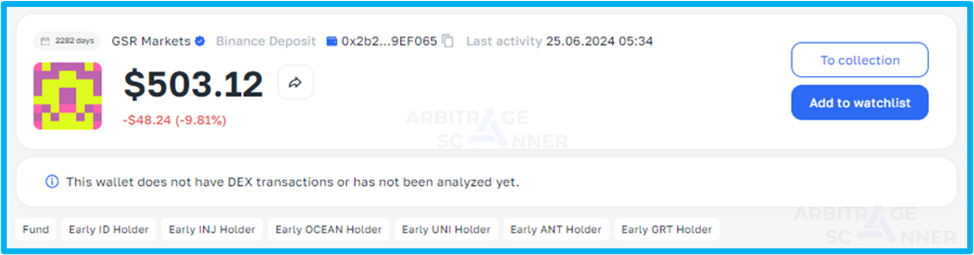

Thus, the wallets from Fig. 9 belong to major market makers.

Fig. 12 – "DWF Labs wallet according to ArbitrageScanner"

You can study the wallet – here

Fig. 13 – "GSR wallet according to ArbitrageScanner"

You can study the wallet – here

TIP:

We have a "Collections" section where we have gathered wallets of famous funds, market makers, top holders, celebrities, and public collections of our users.All the above can be found by going to the corresponding section

Or use this link

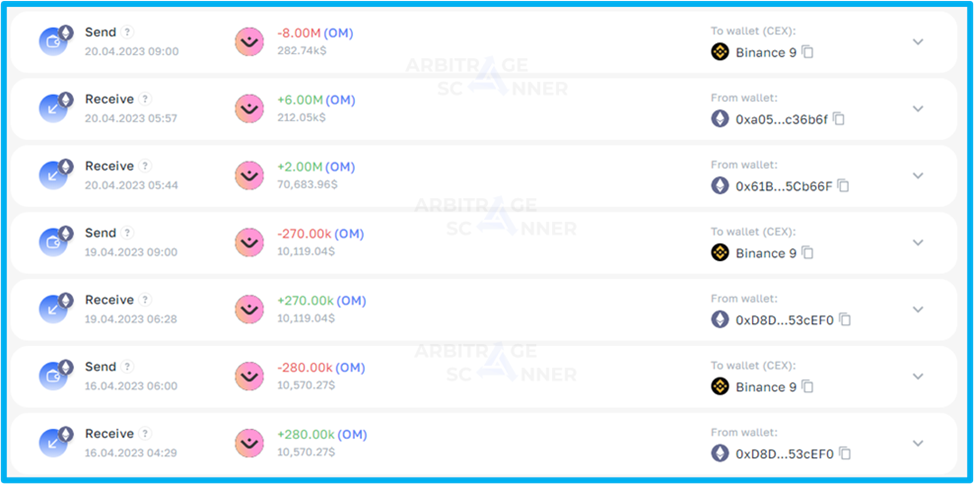

Let's take a closer look at the transactions of market makers.

TRANSACTIONS OF GSR AND DWF LABS MARKET MAKERS

As an example, we will take the GSR Markets wallet

Example of OM receipts to the GSR wallet

Fig. 14 – "OM receipts to the GSR Markets wallet"

You can view the transaction history for the OM token for the market maker – here

As soon as the funds reached the market maker's wallet, they were immediately sent to the exchange Binance.

Fig. 15 – "OM withdrawals to CEX exchange, after being received by GSR Markets market maker from ArbitrageScanner"

From the GSR wallet alone, 61.74M OM or 7% of the maximum volume was transferred to the Binance exchange!

Only from the GSR wallet to the Binance exchange 61.74M OM or 7% of the maximum volume was transferred!

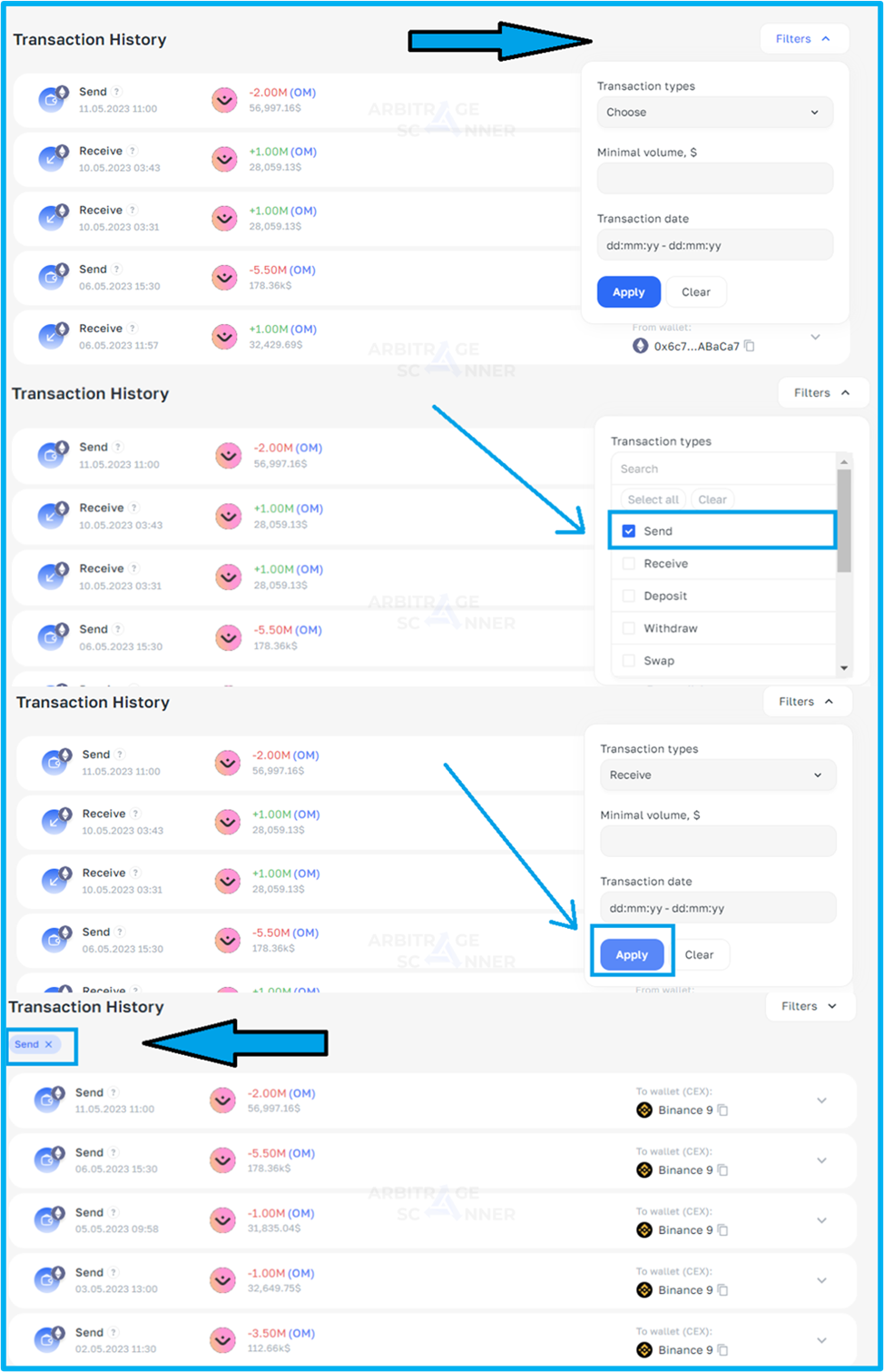

TIP:

In the transaction history, you can apply a filter. For example, we used a filter by transaction type - "Send" to calculate the amount withdrawn.

An example of using search filters is below:

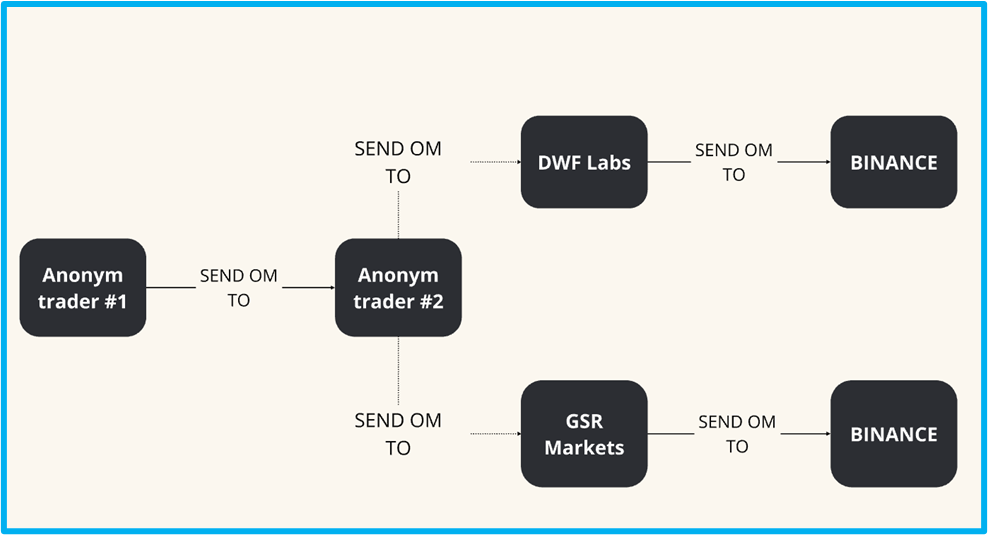

The entire interaction chain of these addresses looked like this:

Fig. 16 – "Wallet Chain for Accumulating MANTRA DAO"

An address interacted with the early holder wallet, which was associated with two market makers.

The received funds were directed by Anonym trader #2 (from Fig. 16) to the GSR Markets and DWF Labs wallets.

Later, the market makers transferred OM to the Binance exchange, accumulating the asset in large volumes.

After a while, the token showed a parabolic growth.

RESULTS

As a result, using wallet analysis, we found out that:

- The early holder of MANTRA DAO interacted with fund wallets.

- The chain of wallets consisted of at least 4 addresses.

- As soon as OM reached the market makers' wallets, it was immediately transferred to the CEX exchange.

- Market makers controlled at least 7% of the maximum token issuance.

- DWF Labs and GSR Markets accumulated MANTRA DAO until the parabolic growth.

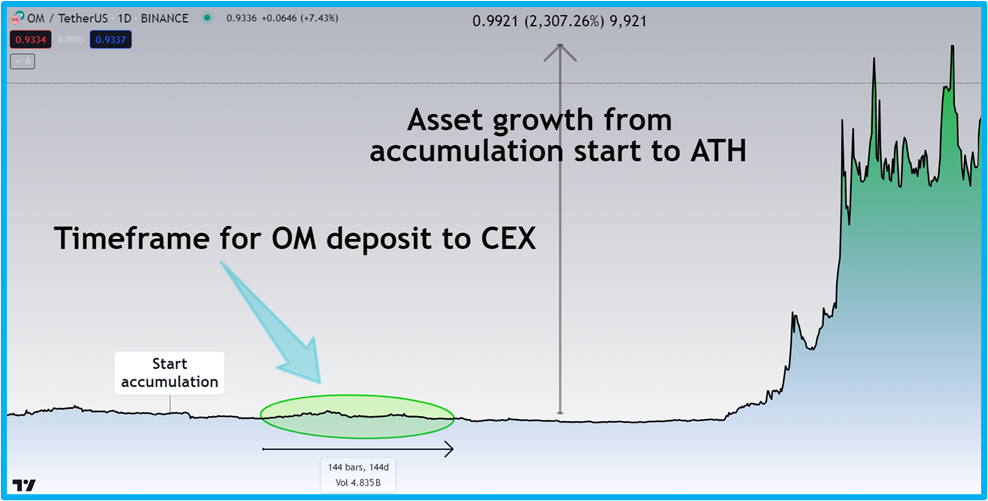

In conclusion, let's look at the MANTRA DAO chart on the Binance exchange, taking into account all the previously mentioned information:

Fig. 17 – "OM 1D Binance Chart"

Thus, we established a connection between market maker addresses that acted together through an early holder wallet.

Long-term accumulation of MANTRA DAO, a large percentage of token control, and of course, transfers to the Binance exchange by market makers eventually led to an asset growth of 2300% or 23 times!

Using products from ArbitrageScanner, you can witness such events and earn along with top market makers.

!!! NOTE: please observe risk and money management.

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.