Which Cryptocurrencies Are Venture Funds Investing In?

Which Cryptocurrencies Are Venture Funds Investing In?

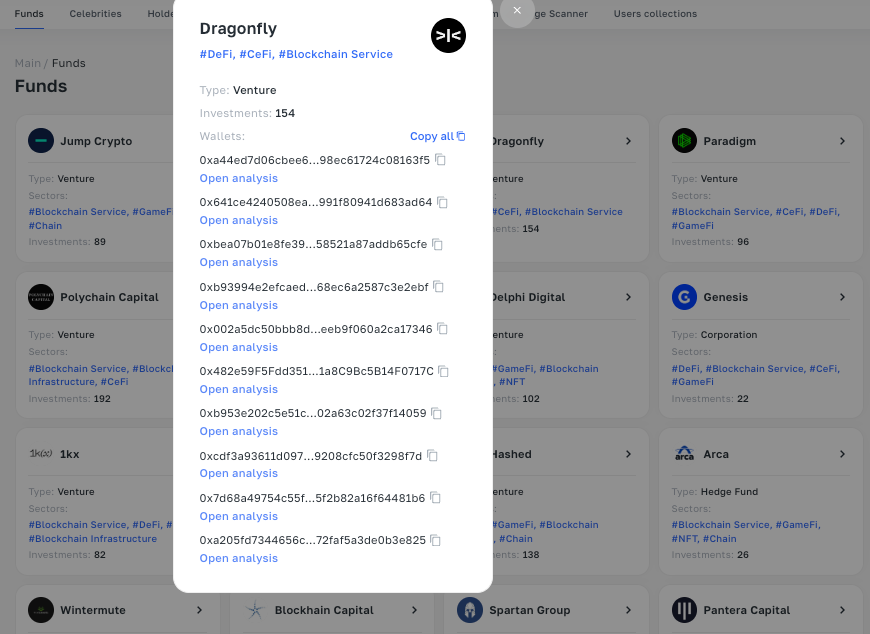

Today, let's talk about Dragonfly Capital, one of the top venture funds actively investing in the world of cryptocurrencies and blockchain technology. The fund focuses on supporting innovative projects and startups, helping them grow and scale. With deep expertise in decentralized finance (DeFi), Web3, and blockchain ecosystems, Dragonfly has been creating new opportunities and trends in the crypto industry for several years.

The total asset valuation of Dragonfly Capital is estimated at around $3 billion. One of the fund's most successful investments, similar to Pantera Capital, was its early investment in Ethereum. Dragonfly Capital also places a significant emphasis on projects working on blockchain scalability and performance improvements. You can read our article on Pantera Capital here.

An example of such an investment is Solana, known for its low fees and high transaction speeds. Today, the SOL token ranks among the top 10 cryptocurrencies by market capitalization. In 2024, Solana gained new momentum due to the rising popularity of meme tokens, which are actively launched on this blockchain platform. Dragonfly invested when the price of SOL was around $0.20 (in 2020), and at its peak, the price reached approximately $260 (at the end of 2021), meaning they could have made about 1300x on this growth. Currently, Solana is trading around $130.

Investments Dragonfly Capital

1) BGB

The native token of the Bitget exchange, known as BGB, is actively used within the platform's ecosystem. It provides users with various benefits such as reduced trading fees, access to exclusive products, participation in token listings, and reward programs.

Upon analysis, we see that their investment in BGB has already grown by more than 600% at its peak, showcasing the strong performance and potential of the token within the Bitget ecosystem.

2) LDO

The native token of the Lido platform, known as LDO, is utilized within the ecosystem that provides cryptocurrency staking services through the liquid staking mechanism

At its peak, their investment in LDO yielded returns of over 100%

3) RBN

A new protocol that helps users access cryptocurrency structured products for DeFi. It combines options, futures and fixed income to improve the risk-return ratio of a portfolio.

At the peak, the investment yielded more than 480%

Some of their successful investments include Avalanche (AVAX), Near Protocol (NEAR), Aptos (APT), Cosmos Hub (ATOM) and Maker (MKR), which have yielded hundreds of percent in venture capital

Study their strategy carefully, follow the projects they invest in, and draw your own conclusions. The world of cryptocurrencies is developing rapidly, and investment opportunities are opening up every day. Study for yourself, analyze trends and make informed decisions

You can view all Dragonfly Capital wallets on the fund collections page - https://arbitragescanner.io/wallets/collections/funds-wallets

Want to learn more about crypto arbitrage?

Get a subscription and access the best tool on the market for arbitrage on Spot, Futures, CEX, and DEX exchanges.